An October Surprise? Making Sense of the Market Mayhem!

I don't know what it is about October that spooks markets, but it certainly feels like big market corrections happen in the month. As stocks have gone through contortions this month, more down than up, like many of you, I have been looking at my portfolio, wondering whether this is the crash that the market bears have been warning me about since 2012, just a pause in a continuing bull market or perhaps a prognosticator of economic troubles to come. If you are expecting me to give you the answer in this post, I would stop reading, since reading market tea leaves is not my strength. That said, I have been wrestling with what, if anything, I should be doing, as an investor, in response to the market movements. As in previous market crises, I find myself going back to a four-step process that I hope gets me through with my sanity intact.

Step 1: Hit the pause button

The first casualty of crisis is good sense, as I mistake my panic response for instinct, and almost every action that I feel the urge to take in the heat of the moment is driven by fear and greed, not reason. No amount of rational thinking or studying behavioral finance will cure me of this affliction, since it is part of my make up as a human being, but there are three things that I find help me manage my reactions:

Take a breath: When faced with fast-moving markets, I have to force myself to consciously slow down. It helps that I don't work as a trader or a portfolio manager, since part of your job is to look like you are in control, even when you are not.

Turn off the noise: Turn back the clock about four decades and assume that you were a doctor, a lawyer or a factory worker with much of your wealth invested in stocks. If markets were having a bad day, odds were that you would not even have heard about it until you got home and turned on the news, and even then, you would have been fed scraps of information about Dow, perhaps a 2-minute discussion with a market expert, and you would have then turned on your favorite sitcom. Today, not only can you monitor your stocks every moment of your working day, you can trade on your lunch break and stream CNBC on to your desktop. That may make you a more informed investor, or at least an investor with more information, but I am not sure that constant feedback is healthy for your portfolio, especially in periods like this one. I don't have a Bloomberg terminal on my desk, a ticker tape running on my computer or stock apps on my phone, and I am happy that I don't during periods like this month.

Don't play the blame game: Every market correction has its villains, and investors like to tag them. Central banks and governments are always good targets, since they have few defenders and have a history of triggering market meltdowns. The problem that I find with assigning blame to others is that it then relieves me of any responsibility, even for own mistakes, and thus makes it impossible to learn from them and take corrective action.

Step 2: Assess the damage

In an age of instant analysis and expert opinion, it is easy to get a skewed view of not only what is causing the market damage, but also where that damage is greatest. In my (limited) reading of market analyses during the last four weeks, I have seen at least a half a dozen hypotheses about the stock swoon, from it being the Fed's fault (as usual) to a long overdue tech company correction to it being a response to global crises (in Italy and Saudi Arabia). In keeping with the old adage of "trust, but verify", I decided to take a look at the data to see if there are answers in it to these questions.

1.The Fed's fault?

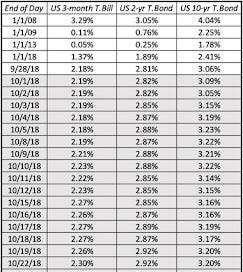

As those of you who read my blog know well, I believe that the Fed has far less power than we think it does to set interest rates, but it is a convenient bogeyman. One explanation for the stock drop that has been making the rounds is that it is fear that Fed will raise rates too quickly in the future, that is causing stocks to swoon. Is that a plausible story? Yes, but if it is the reason for the market decline, you would have a difficult time explaining the movement in interest rates during October 2018:

Source: Federal Reserve (FRED)

As stocks have gone through their pains since October 1, treasury bill and bond rates have remained steady, which would make little sense if the expectation is that they will rise in the near future. After all, if investors expect rates to rise soon, those rates will start going up now and not on cue, when the Fed acts.

There is the possibility that this could be a delayed reaction to rates having gone up over the year already, with the 10-year treasury bond rate moving from 2.41% at the start of the year to 3.06% at the start of October 2018 and to a flattening yield curve (which has historically been a precursor to slower economic growth). Note though, that much of this movement in interest rates happened in the first six months of the year and you would need a reason for why stock prices would be moving four months later.

2. A Tech Meltdown?

My view, based upon what I had been hearing and reading, and before I looked at the data, was that the October 2018 stock drop was being caused by tech companies, in general, and the large tech companies, especially the FANG+Apple combination, specifically. To see if this is true, I looked at the returns on all US stocks, classified by sectors (as defined by S&P), in October, in the year to date and for 1-year and 5-year time periods.

US Sector Market Cap Change. Source: S&P Capital IQ

I know that the S&P sector classifications are imperfect, but my priors seem to be wrong. While information technology, as a group, lost 8.76% of aggregate market capitalization in October 2018, the three worst sectors in the US market were energy, industrials and materials, all of which lost much more, in percentage terms, than technology. In fact, the two sectors that did the best were consumer staples and utilities, with the latter's performance also providing evidence that it is not interest rate fears that are primarily driving this market correction.

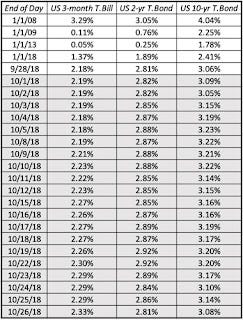

I have argued that, unlike two decades ago, technology companies now are now a diverse group, and many of them don't fit the "high growth, high risk" profile that people seem to still automatically give all tech companies. Using the terminology of corporate life cycles, tech companies run the gamut from old tech to middle-aged tech to young tech, and I have looked at how tech companies in each age grouping in the graph below (age is defined, relative to year of founding):

The median percentage change, in both October 2018 and YTD 2018, in market capitalization was greatest at the youngest tech companies. The median percentage change becomes smaller for older tech companies, in October 2018, but the effect for the four highest age classes is more mixed for the YTD numbers. That said, a much smaller median percentage change at the largest tech companies has a much biggest effect on the market, because of the market capitalization of these companies. That is the reason I look at the FANG stocks and Apple in the table below:

While the percentage change in stock prices at these companies is in line with the market drop, if Apple is included in the mix, the five companies collectively lost a staggering $276 billion in market capitalization between October 1 and October 26. accounting for almost 11.7% of the overall drop in market capitalization of US stocks. While investors in these stocks may feel merited in complaining about their losses, I would draw their attention to the third column, where I look at what these stocks have done since January 1, 2018, with the losses in October incorporated. Collectively, these five companies have added almost $521 billion in market capitalization since the start of the year, and without them, the overall market would have been down substantially.

3. A Correction in Overvalued Stocks?

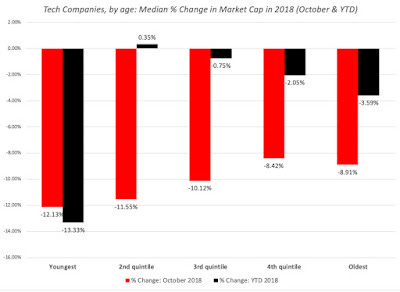

For some value investors who have argued that investors were pushing up some stocks to unsustainable levels, the market correction has been vindication, a sign that the market is correcting its pricing mistakes and marking down the stocks that it had over priced the most. That may be plausible, and to see if it holds, I broke all US stocks, at the start of October, based upon PE ratios into six groupings (low to high PE and a separate one for negative earnings companies):

PE Ratio at start of October 2018, using trailing 12 month earnings

If the selective correction argument is correct, you should expect to see the highest PE ratio and negative earnings companies drop the most in value and the companies with the lowest PE ratios be less affected. While negative earnings stocks have seen the market correction, during October 2018, there is no pattern across the other PE classes. In fact, the lowest PE ratio companies had the second worst record, in terms of price performance, among the groupings.

4. A US Problem?

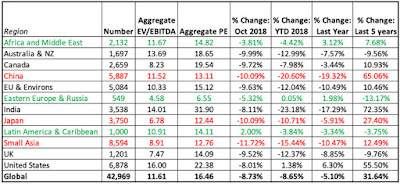

One of the lessons of the last decade is that much as countries would like to disconnect from the rest of the world and chart their own pathway to economic prosperity, they are joined at the hip by globalization, with crisis in one part of the world quickly affecting economies and markets in other parts. In October 2018, we had our share of global shocks, with the standoff between Italy and the EU and Saudi Arabia's Khashoggi problem taking top billing. To see how the market correction has played out in world markets, I broke global markets down into broad regional groupings and arrived at the following:

Source: S&P Capital IQ, based upon headquarters geography

Note that these returns are all in US dollars, reflecting both the performance of the market and the currencies of each region. Asia seems to have been hit the worst this month, with China, Small Asia (South East Asia, Pakistan, Bangladesh) and Japan all seeing double digit declines in aggregate market capitalization. Latin America has had the best performance of the regional groupings, with the election surprise in Brazil driving its markets upwards during the month. The year-to-date numbers do tell a bigger story that has been glossed over in analysis. For much of 2018, the US market & economy has diverged from the rest of the globe, posting solid numbers (prior to October) whereas the rest of the world was struggling. It is possible that we are seeing an end to that divergence, suggesting that the US markets will move more closely with the other global markets going forward.

5. Panic Attack?

One of the more striking features of the markets during October 2018 has been that the stock market retreat, while substantial, has, for the most part, been orderly. In a panic-driven stock market sell off, you usually see a surge in government bond prices (and a drop in rates), a general flight to quality (US $ and safer companies) and a rise in the price of gold. As we noted in the earlier section, the market drop does not seem to be smaller at larger and more profitable companies, and government bond rates have not dropped. In addition, while the US dollar has had a strong year so far, especially against emerging market currencies, it generally did not see a flight to it in October 2018:

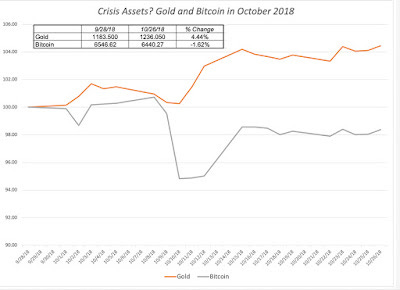

The dollar strengthened mildly against almost every currency during the month, and the only currency where there was a big move was against the Brazilian Reai, where it weakened, again on political news in Brazil. Note again that the market correction may be, at least partly, a delayed reaction to the strength of the US dollar leading into October, but the timing is still difficult to explain. Finally, I looked at gold prices in October 2018, in conjunction with bitcoin, since the latter has been promoted as millennial gold:

It has been a good month for gold, with prices up 4.44%, though there is little sign of panic buying pushing up prices. It may be a little unfair to be passing judgment on Bitcoin, after one crisis, but if it is millennial gold, either millennials are unaware that there is a stock market sell off or they do not care.

Step 3: Review the fundamentals

With the assessment of market pain behind us, we can turn to looking at the fundamentals, again looking for clues in why stocks have had such a tough month. While almost every factor affects stock prices, the effects have to show up in one of four places for fundamental value to change significantly: a shock to base year earnings or cash flows, a change in expected earnings/cash flow growth, a increase in the risk free rate or a change in the price of risk:

Since treasury bond rates have been stable through much of the month, I am going to look at one of the other three variables as the potential culprit.

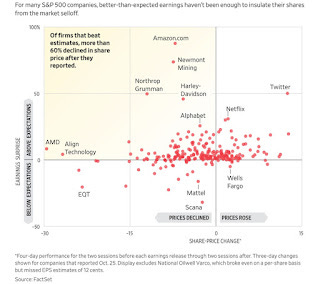

Base Year Earnings/Cashflows: The earnings reports that have come out for companies in diverse sectors in the last two weeks seem to reinforce the strong earnings story. While there were a few like Caterpillar and 3M that reported headwinds from a stronger dollar, both companies also conveyed the message that they were able to pass the higher costs through to the customers.

On the cash flow front, there were no high profile cessations of buybacks or dividends, and all signs point to the market delivering and perhaps beating the earnings and cash flows that we have estimated for 2018.

Earnings Growth: This is a trickier component, since it is driven as much by actual data, as it is by perception. At the start of the year, the expectation that earnings growth would be strong for this year, helped both the tax law changes of last year and a strong economy. That growth has been delivered, but it is possible that investors are now doubtful about the sustainability of that earnings growth. That has not shown up yet in forecasted growth for next year, but it bears watching.

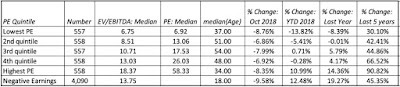

Price of Equity Risk (Equity Risk Premium): If you have been reading my blog for a while, you are probably aware of my implied equity risk premium calculation, one that backs out a price of equity risk (equity risk premium) from the level of the index, expected cash flows and a growth rate. Holding cash flows and growth rate fixed for October, I have computed the implied equity risk premium by day.

End of DayUS 10-yr T.BondS&P 500Implied ERPSpreadsheet9/28/183.06%2913.985.38%Download10/1/183.09%2924.595.36%Download10/2/183.05%2923.435.36%Download10/3/183.15%2925.515.35%Download10/4/183.19%2901.615.39%Download10/5/183.23%2885.575.41%Download10/8/183.22%2884.435.42%Download10/9/183.21%2880.345.43%Download10/10/183.22%2785.685.61%Download10/11/183.14%2728.375.73%Download10/12/183.15%2767.135.65%Download10/15/183.16%2750.795.68%Download10/16/183.16%2809.925.57%Download10/17/183.19%2809.215.56%Download10/18/183.17%2768.785.65%Download10/19/183.20%2767.785.64%Download10/22/183.20%2755.885.67%Download10/23/183.17%2740.695.70%Download10/24/183.10%2656.105.89%Download10/25/183.14%2705.575.78%Download10/26/183.08%2658.695.89%%DownloadIf cash flows and expected growth have not changed over the month, the price of equity risk has jumped from 5.38% at the start of the month to the 5.89% on October 26, putting it at the high end of equity risk premiums in the last decade.

You could attribute the higher equity risk premiums to global crises (in Italy and Saudi Arabia) but that would be a reach since the increase in risk premiums predates both crises. If you do lower expected earnings growth going forward, perhaps reflecting a delayed response to the stronger dollar and higher rates, the equity risk premium will drop. In fact, halving the expected growth rate from 2019 on from the current estimate of 7.29% to 4.71% (the compounded average annual earnings growth rate over the last 10 years) reduces the equity risk premium to 5.28%, but even that number is a healthy one, relative to historic norms. The bottom line is that, at least by my calculations, I am estimating an equity risk premium that seems fair, given macro and micro fundamentals and my risk preferences.

Step 4: Investment Action

One of the biggest perils of being reactive in a crisis is that it can knock you off your investment game and cause you to abandon your core philosophy. I don't believe that there is one investment philosophy that is right for every one, but I do believe that there is one that is right for you, and shifting away from it is a recipe for bad results. I am a “value” investor, though my definition of value is different from old-time value investing in two ways:

Under valued stocks can be found across sectors and the life cycle: I believe that we should try to assess fair value, not a conservative estimate of value, and that the value should include expected value added from future growth. To the critique that this is speculative, my answer is that everything other than cash-in-hand requires making assumptions about the future, and I am willing to go the distance. That is why, at different points in time, you have seen Twitter and Facebook in my portfolio in the past and may well see Netflix and Tesla in the future (just not now).

Intrinsic value can change over time: I believe that intrinsic value is a dynamic number that changes over time, not only because new information may come out about a company. but also because the price of equity risk can change over time. That said, intrinsic values generally change less than market prices do, as mood and momentum shift. This has been a month of significant price drops in many companies, but assuming that they are therefore more likely to be under valued is a mistake, since the intrinsic values of these companies have also changed, because the ERP that I will be using to value the stocks on October 26, 2018, will be 5.89%, much higher than the 5.38% at the start of the month.

Given my philosophy and a reading of the data, here is what I plan to do.

No change in asset allocation: I am not changing my asset allocation mix in significant ways, since I don't see a fundamental reason to do so.

Revisit existing holdings: I normally revalue every company in my portfolio at least once a year, but after a month like this one, I will have to accelerate the process. Put simply, I have to make sure that at the current price for equity risk, and given expected cash flows, that my buys still remain buys and the sells remain sells.

Bonus from short sales: I do have a portion of my portfolio that benefits from a sell off, primarily in short sales and those have provided partial offsets to my losses. I did sell short on Amazon and Apple at the start of the month, and while I would like to claim prescience, it was pure luck on timing, and the market downdraft during the month has helped me.

Check out the biggest market losers: I plan to take a closer look at the stocks that have been pummeled the most during the month, including 3M and Caterpillar, to see if they are cheap at October 26 prices, and using an October 26 ERP in my valuation.

Please note that this is not meant to be investment advice and your path back to investment serenity may be very different from mine!

YouTube Video