I have looked at country risk, in all its dimensions, towards the middle of each year, for the last decade, for many reasons. One is curiosity, as political and economic crises roll through regions of the world, roiling long-held beliefs about safe and risky countries. The other is pragmatic, since it is almost impossible to value a company or business, without a clear sense of how risk exposure varies across the world, since for many companies, either the inputs to or their production processes are in foreign markets or the output is outside domestic markets. Coca Cola is a US company, in terms of history and incorporation, but it generates a significant portion of its revenues from the rest of the world. Royal Dutch may be a UK (or Dutch) company, in terms of incorporation and trading location, but it extracts its oil and gas from some of the riskiest parts of the world. Since country risk is multidimensional and dynamic, my annual country risk update runs to more than a hundred (boring) pages, but I will try to summarize what the last year has brought in this post.

Drivers of Country Risk

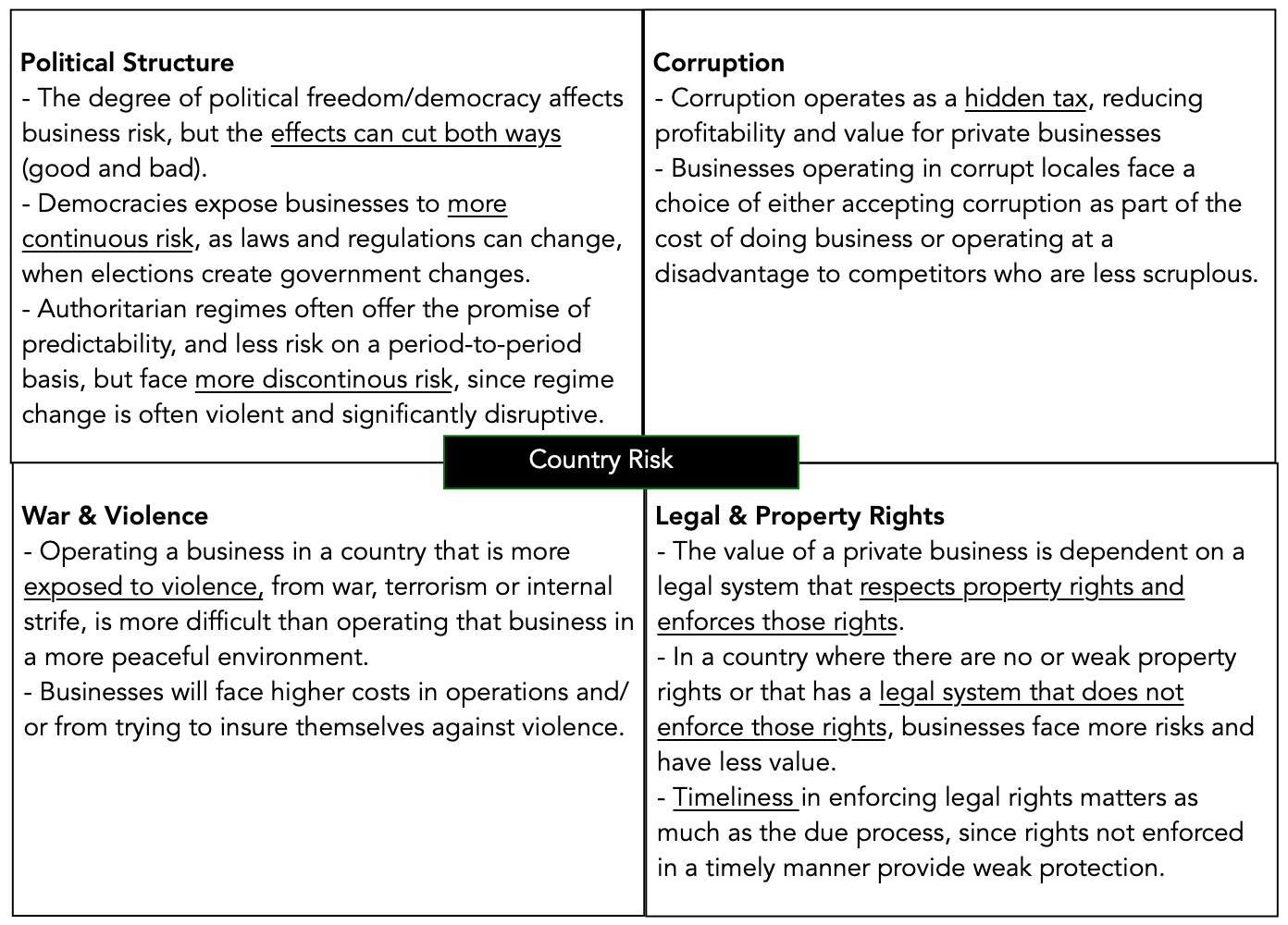

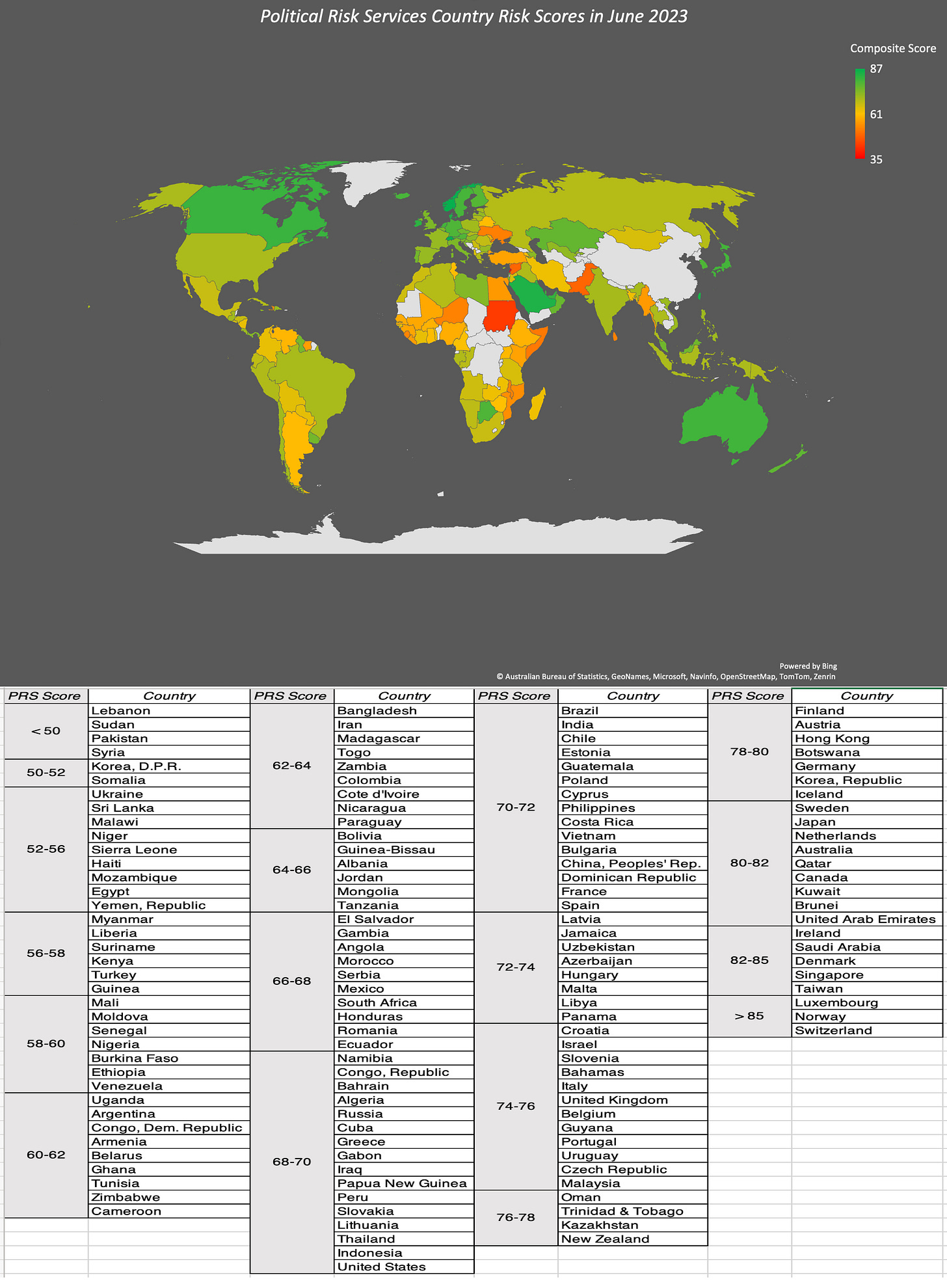

What makes some countries riskier than others to operate a business in? The answer is complicated, because everything has an effect on risk, starting with the political governance system (democracy, dictatorship or something in between), the extent of corruption in the system, the legal system (and its protection for property rights) and the presence or absence of violence in the country (from wars within or without). The table below, which I have used in prior updates, captures the mail drivers of country risk:

Things get even more complicated when you recognize that these drivers are often correlated with, and drive, each other. Thus, a country that is ravaged by war and violence is more likely to have a weak legal system and be corrupt. Furthermore, all of these risk exposures are dynamic, and change over time, as governments change, violence from internal or external forces flares up.

As you assess these factors, you can see very quickly that country risk is a continuum, with some countries exposed less to it than others. It is for that reason that we should be cautious about discrete divides between countries, as is the case when we categorize countries into developed and emerging markets, with the implicit assumption that the former are safe and the latter are risky. To the extent that divide is not just descriptive, but also drives real world investment, both companies and investors may be misallocating their capital, and I will argue for finer delineations of risk.

1. Democracy across the Globe

If your focus stays on economic risk, the question of whether democracies or authoritarian regimes are less risky for businesses to operate in depends in large part on whether these businesses are more unsettled by day-to-day continuous risk, which is often the case with democracies, where the rules can change when new governments gets elected, or by discontinuous risk, which can lie dormant for long periods, but when it does occur, it is larger and sometimes catastrophic, in an authoritarian government. Assessing freedom and democracy in countries is a fraught exercise, with both political and regional biases playing out, and that should be kept in mind when you look at the heat map that shows the results of the Economist's measures of democracy, by country and region, in 2022, as well as trend lines across time:

Source: Economist Intelligence Unit (EIU)

While the global aggregate value for 2022 is very similar to the value in 2021, there has been a significant drop off since 2016, at least according to this measure. In 2022, North America and Western Europe scored highest on the democracy index, and Middle East and Africa scored the lowest.

In my view, the question of whether businesses prefer the continuous change (or, in some cases, chaos) that characterizes democracies or the potential for discontinuous and sometimes jarring change in authoritarian regimes has driven the debate of whether a business should feel more comfortable investing in India, a sometimes chaotic democracy where the rules keep changing, or in China, where Beijing is better positioned to promise continuity. For three decades, China has won this battle, but in 2023, the battleground seems to be shifting in favor of India, but it is still too early to make a judgment on whether this is a long term change, or just a hiccup.

2. Violence across the Globe

When a country is exposed to violence, either from the outside or from within, it not only exposes its citizens to physical risk (of assault or death), but also makes it more difficult to run businesses within its borders. That risk can show up as costs (of buying protection or insurance) or as uninsurable risks that drive up the rates of return investors and businesses need to make, in order to operate. Again, there are subjective judgments at play in these measures, but the map below gives you 2023 scores for peace scores, with lower (higher) scores indicating less (more) exposure to violence.

Iceland and Denmark top the list of most peaceful countries, but in a sign that geography is not destiny, Singapore makes an appearance on that list as well. On the lease peaceful list, it should come as no surprise that Russia and Ukraine are on the list, but Sub-Saharan Africa is disproportionately represented.

3. Corruption across the Globe

Corruption is a social ill that manifests itself as a cost to every business that is exposed to it. As anyone who has ever tried to get anything done in a corrupt setting will attest, corruption adds layers of costs to routine operations, thus become an implicit tax that companies pay, where the payment instead of going to the public exchequer, finds its way into the pockets of intermediaries. Transparency International measures corruption scores, by country, across the world and their 2022 measures are in the map below:

Much of Western Europe, Australia & New Zealand and Canada/United States fall into the least corrupt category, but corruption remains a significant concern in much of the rest of the world. While it easy to attribute the corruption problem to politicians and governments, it is worth noting that once corruption becomes embedded in a system, it is difficult to remove, since the structure evolves to accommodate it. Put simply, a system where the rule-makers, regulators and bureaucrats get paid a pittance (on the assumption that they will be supplement their pay with side payments) to sign off on contracts that are worth billions will inevitably create corruption as a side cost.

4. Legal Protection across the Globe

To operate a business successfully, you need a legal system that enforces contractual obligations and protects property rights, and does so in a timely manner. When a legal system allows contracts and legal agreements to be breached, and property rights to be violated, with no or extremely delayed consequences, the only businesses that survive will be the ones run by lawbreakers, and not surprisingly, violence and corruption become part of the package. The Property Rights Alliance measures the protection offered for property rights (intellectual, physical), with higher (lower) scores going with better (worse) protection, and their most recent update (from 2022) is captured in the picture below:

Source: Property Rights Alliance

By now, you can see the point about the correlation across the various dimensions of country risk, with the parts of the world (North America, Europe, Australia and Japan) that have the most democratic systems and the least corruption scoring highest on the legal protection scores. Conversely, the regions (Africa, large portions of Asia and Latin America) that are least democratic, with the most violence and corruption, have the most porous legal systems.

Measures of Country Risk

With the long lead in on the dimensions of country risk, we can now turn to the more practical question of how to convert these different components of risk into country risk measures. We will start with a limited measure of the risk of default on the part of governments, i.e., sovereign default risk, before expanding that measure to consider other country risks, in political risk scores.

1. Default Risk

Businesses and individuals that borrow money sometimes find themselves unable to meet their contractual obligations, and default, and so too can governments. The difference is that government or sovereign default has much greater spillover effects on all entities that operate within its borders, thus creating business risks. We start with an assessment of sovereign ratings, a widely accessible and hotly contested, of government default risk and then move on to market-based measures of this risk in the form of sovereign default spreads.

a. Sovereign Ratings

The most widely used measures of sovereign default risk come from a familiar source for default risk measures, the ratings agencies. S&P, Moody's and Fitch, in addition to rating companies for default risk, also rate governments, and they rate them both on local currency debt, as well as foreign currency debt. The reason for the differentiation is simple, since countries should be less likely to default, when they borrow in their domestic currencies, than when they borrow in a foreign currency. The table below summaries the sovereign local currency ratings for countries in June 2023, from S&P and Moody's:

Local Currency Ratings for countries (Some UAE emirates have ratings that are independent of the ratings for the UAE, because they issue their own sovereign debt)

The ratings scheme mirrors the one used to rate companies, with the key difference being at the Aaa (AAA) rating, with a sovereign getting that rating viewed as having no default risk, whereas a corporate with that rating still has some. If you are wondering why there should be any default risk when governments borrow in a domestic currency, since these governments should be able to print money to pay off debt, the answer is that money-printing debases a currency and given a choice between currency debasement and default, many countries choose to default. The figure backs up this proposition:

Source: Standard and Poor’s

Note that while countries are less likely to default on local currency than foreign currency bonds, the default rates in the former remain substantial. In addition, the good news, if you are a user of sovereign ratings, is that they clearly are correlated strongly with ratings, with higher default rates for lower-rated sovereigns.

I know that there are many who have issues with the ratings agencies, but I do think that the conflict of interest story, where ratings agencies attach higher ratings to entities, because they get paid to rate them, is overdone, and especially so with sovereign ratings (where the revenue streams are paltry). In my view, the biggest problem with ratings agencies is not that they are biased, but that they take too long to adjust ratings to changes in a country and that they sometimes underrate or overrate regions of the world, because of their histories. Consequently, Latin American countries have to work harder to improve their ratings, or sustain current ratings, than the US or European countries, which get a bye, because they do not have a history of default.

b. Sovereign CDS Spreads

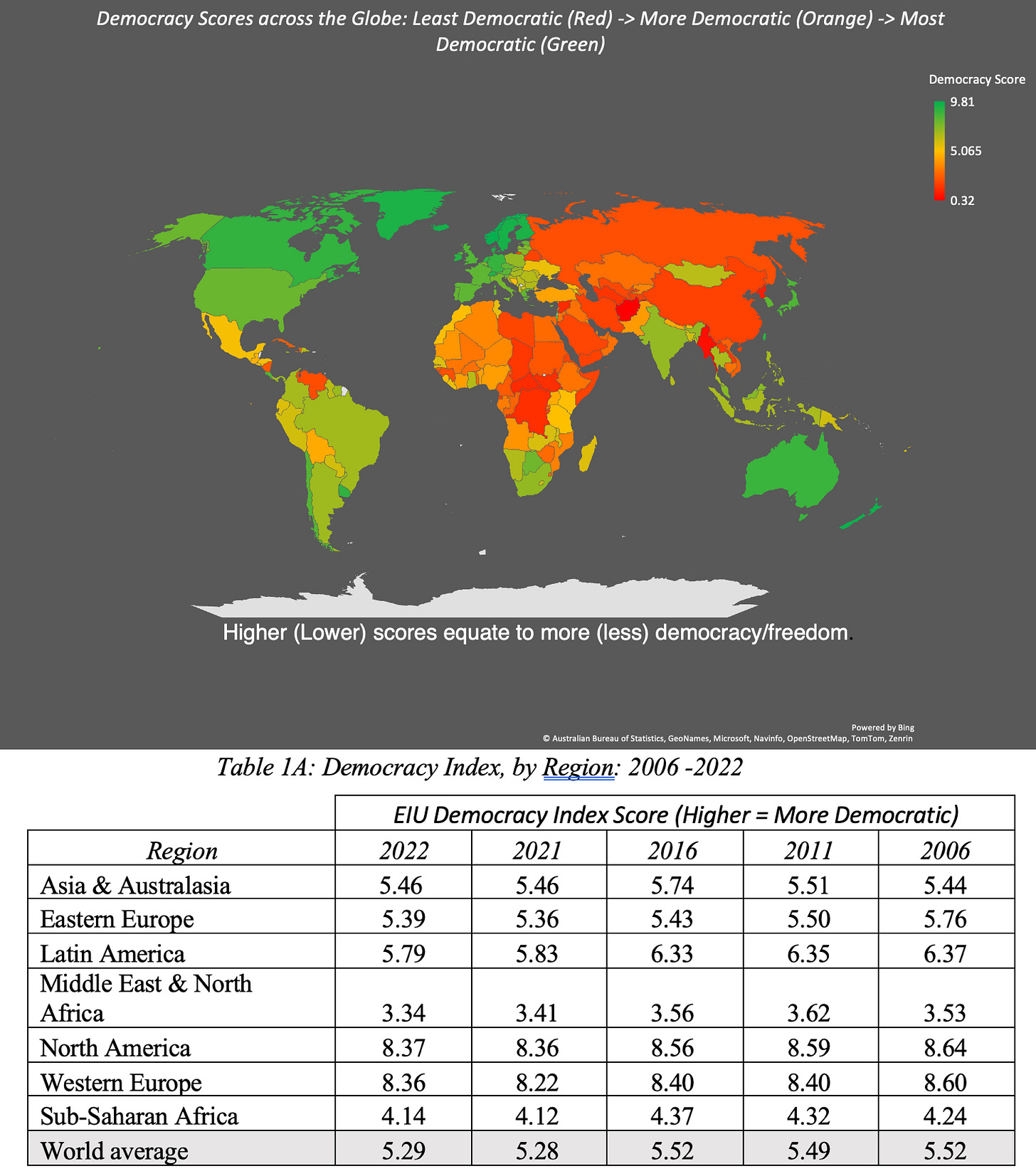

One of the advantages of a market-based measure is that the market price reflects investor perceptions of risk at the moment. Sovereign Credit Default Swaps (CDS) offer a market-based measure of default risk, since investors buy these swaps as protection against default on government bonds. When the sovereign CDS market came into being a few decades ago, there were only a handful of countries that were traded, but the market has expanded, and there are traded credit default swaps on almost 80 countries in June 2023. The graph below shows the sovereign CDS levels, by country:

Source: Bloomberg (July 2023 data)

There are three things to note, as you browse these numbers. The first is that these are dollar spreads (though a Euro CDS market exists as well), and thus are most suited for use with dollar-denominated government bonds. The second is that what comprises default in the sovereign CDS market may not coincide with investor definitions of default , though there are approaches that can be used to back out the likelihood of default from a CDS value. The third is that there are no countries with traded CDS that have zero risk of default, at least according to the sovereign CDS market. Consequently, I have also computed a version of the sovereign CDS spread that is net of the US CDS (on the assumption that default risk is zero in the US, a debatable proposition after the recent debt ceiling debate).

Is a sovereign CDS spread a better measure of default risk than a sovereign rating? The answer is mixed. It is true that a sovereign CDS spread gives you a more updated measure of default risk, since it is market-set, but as with all market-based measures, it comes with far more volatility and overshooting than a ratings-based spread, and it is available for only a subset of countries. My suggestion is that for countries where recent political or economic events would lead you to believe that sovereign rating is dated, you should switch to using sovereign CDS spreads.

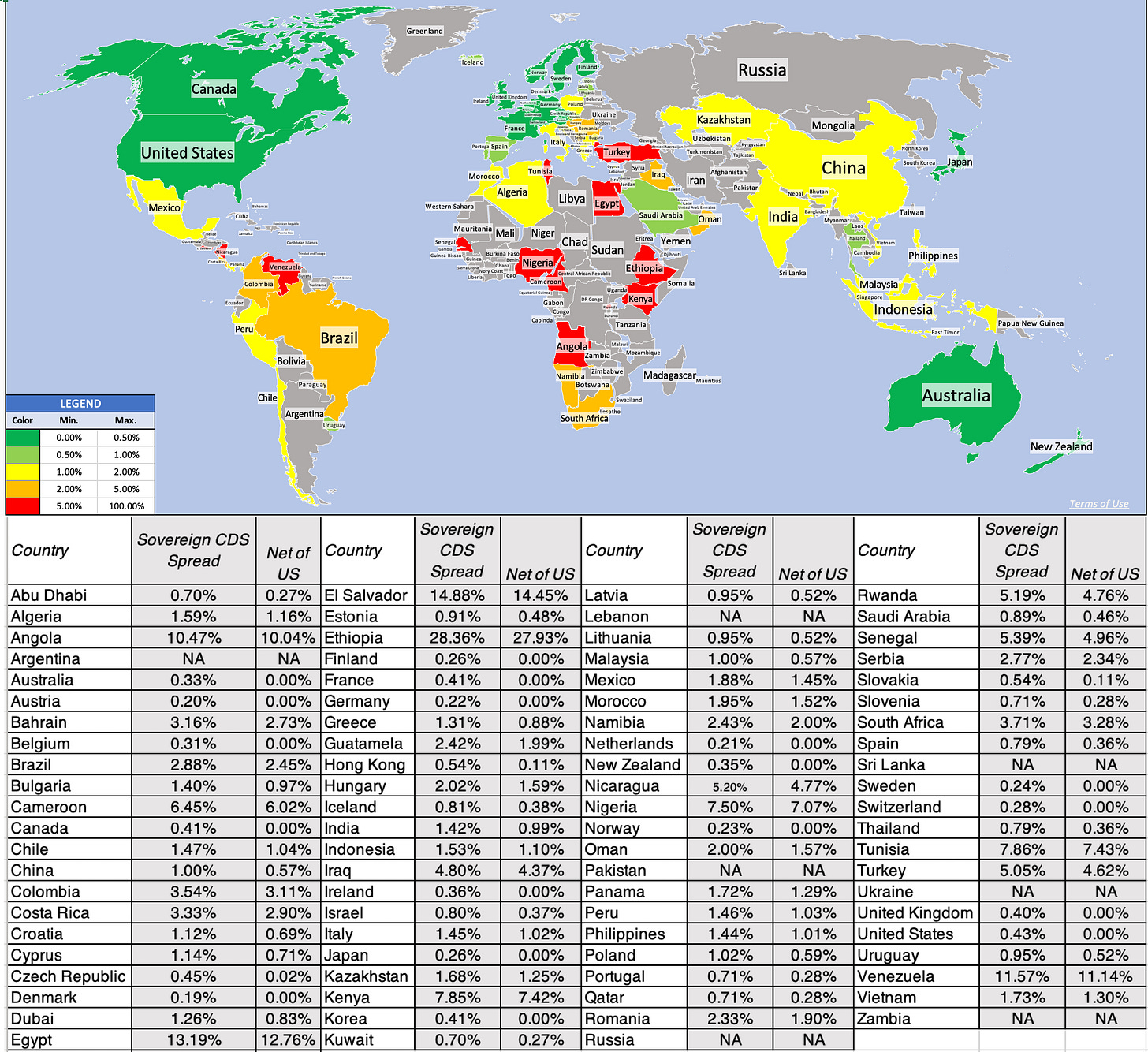

2. Risk Scores

The advantage of default spreads is that they provide an observable measure of risk that can be easily incorporated into discount rates or financial analysis. The disadvantage is that they are focused on just default risk, and do not explicitly factor in the other risks that we enumerated in the last section. Since these other risks are so highly correlated with each other, for most counties, it is true that default risk becomes an reasonable proxy for overall country risk, but there are some countries where this is not the case. Consider portions of the Middle East, and especially Saudi Arabia, where default risk is not significant, since the country borrows very little and has a huge cash cushion from its oil reserves. Investors in Saudi Arabia are still exposed to significant risks from political upheaval or unrest, and may prefer a more comprehensive measure of country risk.

There are many services, including the World Bank and the Economist, who offer comprehensive country risk scores, and the map below includes composite country risk scores from Political Risk Services in June 2023:

The pluses and minuses of comprehensive risk scores are visible in this table. In addition to capturing risks that go beyond default, Political Risk Services also measures risk scores for frontier markets (like Syria, Sudan and North Korea), which have no sovereign ratings. The minuses are that the scores are not standardized; for instance, PRS gives its highest scores to the safest countries, whereas the Economist gives the lowest scores to the safest countries. In addition, the fact that the country risk is measured with scores may lead some to believe that they are objective measures of country risk, when, in fact, they are subjective judgments reflecting what each service factors into the scores, and the weights on these factors. Just to illustrate the contradictions that can result, PRS gives Libya a country risk score that is higher (safer) than the scores it gives United States or France, putting them at odds with most other services that rank Libya among the riskiest countries in the world.

Equity Risk across Countries

Default risk measures how much risk investors are exposed to, when investing in bonds issued by a government, but when you own a business, or the equity in that business, your risk exposure is not just magnified, but also broader. For three decades, I have wrestled with measuring this additional risk exposure and converting that measurement into an equity risk premium, but it remains a work in progress.

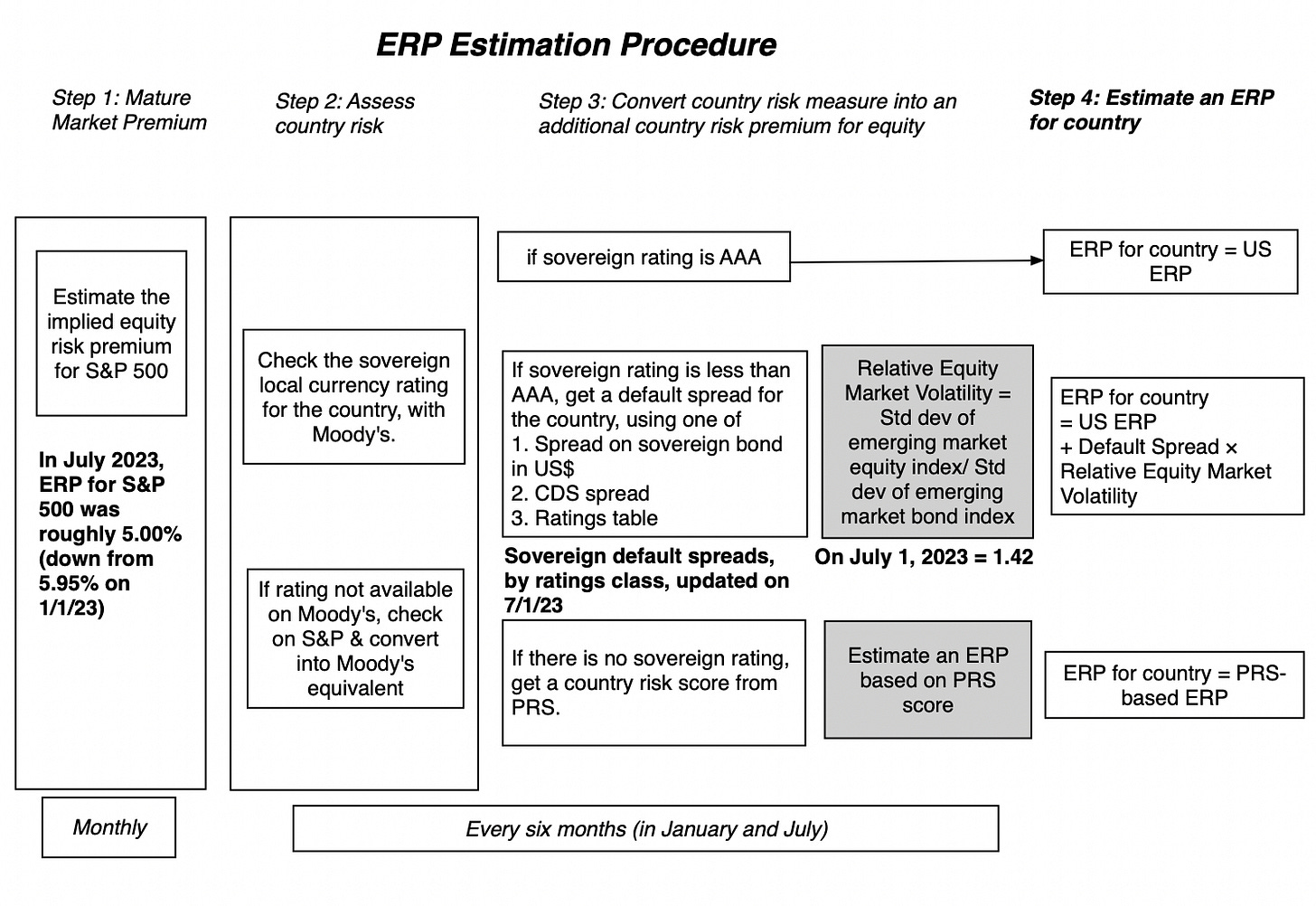

To estimate the equity risk premium, for most countries I start with default spreads, either based on the sovereign ratings assigned by the ratings agencies, or from the market, in the form of sovereign CDS spreads. To account for the fact that equities are riskier than bonds, I scale the standard deviation of an emerging market equity index (S&P Emerging BMI) to an emerging market government bond ETF (iShares JPM USD Emerging Markets Bond ETF), and use this ratio (1.42 in my July 2023 update) and apply this scalar to the default spread, to arrive at a country risk premium. Adding that country risk premium on to the premium that I estimate for the S&P 500 (which was 5.00% at the start of July 2023, and is my measure of a mature market premium), yields the total equity risk premium for a country:

To provide an example, consider India, which with a sovereign rating of Baa3, has a default spread of 2.35% in July 2023. Multiplying this default spread by the scalar (1.42) and adding to the equity risk premium for the S&P 500 results in an equity risk premium of 8.33% for India.

India ERP

= Implied ERP for S&P 500 + Default spread for India * Scalar for Equity Risk

= 5.00% + 2.35% (1.42) = 8.33%

It is worth noting that using the sovereign CDS spread for India of 1.42% would have resulted in a lower equity risk premium for India, at 7.02%.

Using the ratings-based default spreads as starting points, I estimate the equity risk premiums for all countries rated by either S&P and Moody's in the picture below. (For the many people who will point to their country's geographical boundaries being misrepresented on this map, please cut me some slack. This map is purely a device to summarize equity risk premiums, by countries, not arbitrate on where borders should go. Suffice to say that if you are operating a business in a part of the world that is contested by two countries, your risk levels are in the danger zone, no matter where in the world you are.)

Download spreadsheet with data

You will notice that there are countries that are not rated (NR) that have equity risk premiums attached to them. For these frontier markets, I used the PRS score for the country as a starting point, found other (rated) countries with similar PRS scores, and extrapolated an equity risk premium. The caveat, though, is that these equity risk premiums are only as good as the PRS scores that goes into them, and you can see the effect in Libya, which if PRS is right, is a green (low risk) standout in a region (North Africa) of red.

Caveats and Questions

I started publishing equity risk premiums about 30 years ago, and while data sources have become richer and more complete, the core approach that I use for the estimation has remaining stable. That said, there is no intellectual firepower or research behind these numbers, since I am letting the default ratings agencies and risk measurement services carry that weight. I am not a country risk researcher, and I try not to let my personal views alter the numbers that emerge from the analysis, since that would open the door to my biases. I will use three countries in the latest update to illustrate my point:

Saudi Arabia: As I noted earlier, using default spreads as my starting point can result in understating the risk premium for countries like Saudi Arabia, which score low on default risk but high on other risks.

Libya: As indicated in the last section, the equity risk premium for Libya, an unrated country, is entirely based upon the country risk score from PRS. That country risk score is surprisingly high (indicating low risk) and it results in an equity risk premium that is low, relative to other countries in the region.

China: China has a high sovereign rating and a low sovereign CDS spread, indicating that investors in Chinese government bonds don't see much default risk in the country. In the aftermath of a Beijing crackdown on Chinese tech giants and talk of a trade war between China and the US, the perception seems to be that China has become a riskier place to invest. That may or may not be true, but looking at how Chinese equities are priced, trading still at some of the highest multiples of earnings in the world, investors in equity markets don't seem to share that view.

With all three of these countries, I chose not to change the numbers that emerged from the data, but if you have strong views on these countries or others, nothing is stopping you from replacing my numbers with yours.

Company Hurdle Rates

This post has already become much longer than I intended it to be, but I want to end by bringing these equity risk premiums down to the company level, and examining how they play out in hurdle rates, to be used in investment analysis by companies and valuation by investors.

The Currency Question

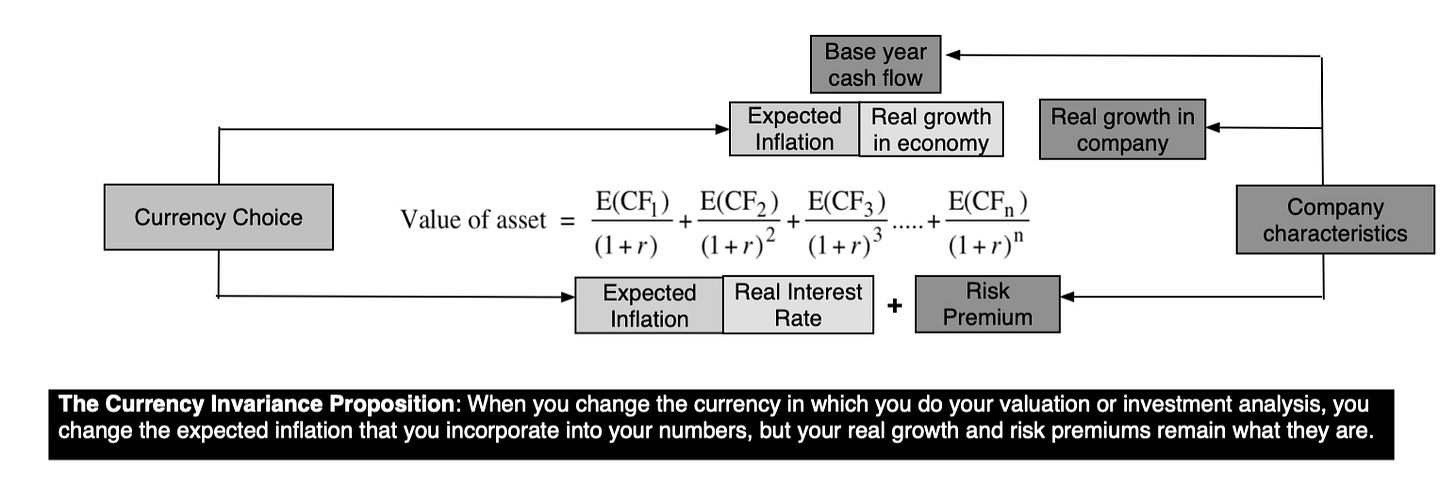

In my discussion so far, you will notice that I have stayed away from talking about currency risk in my equity risk premium discussion and from currency choices in investment analysis. I have my reasons.

I know that the currency choice is the source of angst for many analysts, and I think unnecessarily so. Your choice of currency will affect your cash flows and your discount rates, but only because each currency brings it's own expectations of inflation, with higher inflation currencies leading to higher growth rates for cash flows and higher discount rates

The mechanism that allows for the discount rate adjustment to reflect currency is the risk free rate, with currencies with higher expected inflation carrying higher risk free rates. In a downloadable dataset linked at the end of this post, I estimate riskfree rates in global currencies, based upon the US T.Bond rate as the riskfree rate in US dollars) and differential inflation. To provide an example, using the IMF's estimate of expected inflation for 2023-28 of 3% for the US and 13.50% for Egypt, and building on the US treasury bond rate of 3.80%. the riskfree rate in Egyptian pounds is 14.38%.

Riskfree Rate in EGP = (1+ US T.Bond Rate) (1 + Exp Inflation in Egypt) (1+ Exp Inflation in US) -1 = (1.038)* (1.135/1.03) -1 = .1438 or 14.38%)

To the extent that currency risk adds to the operating risk of a company, it is, in my view, already embedded in the equity risk premiums that I have computed in the last section. After all, countries with unstable governments, plagued by war and corruption, also have the most unstable currencies. The other reason to tread lightly with currency risk is that for investors with global portfolios, it becomes diversifiable risk, as some companies benefit as a currency strengthens or weakened more than expected and others lose for exactly the same reason.

My advice to you when you make a currency choice for your analysis is that you pick a currency that you are comfortable working with, but then make sure that you stay consistent with that currency in all of your estimates. Thus, if you choose to value a Russian company in Euros, rather than rubles, make sure that your growth rates reflect inflation in the Euro zone, but that you risk premiums and real growth reflect its Russian operations.

Exposure to Country Risk

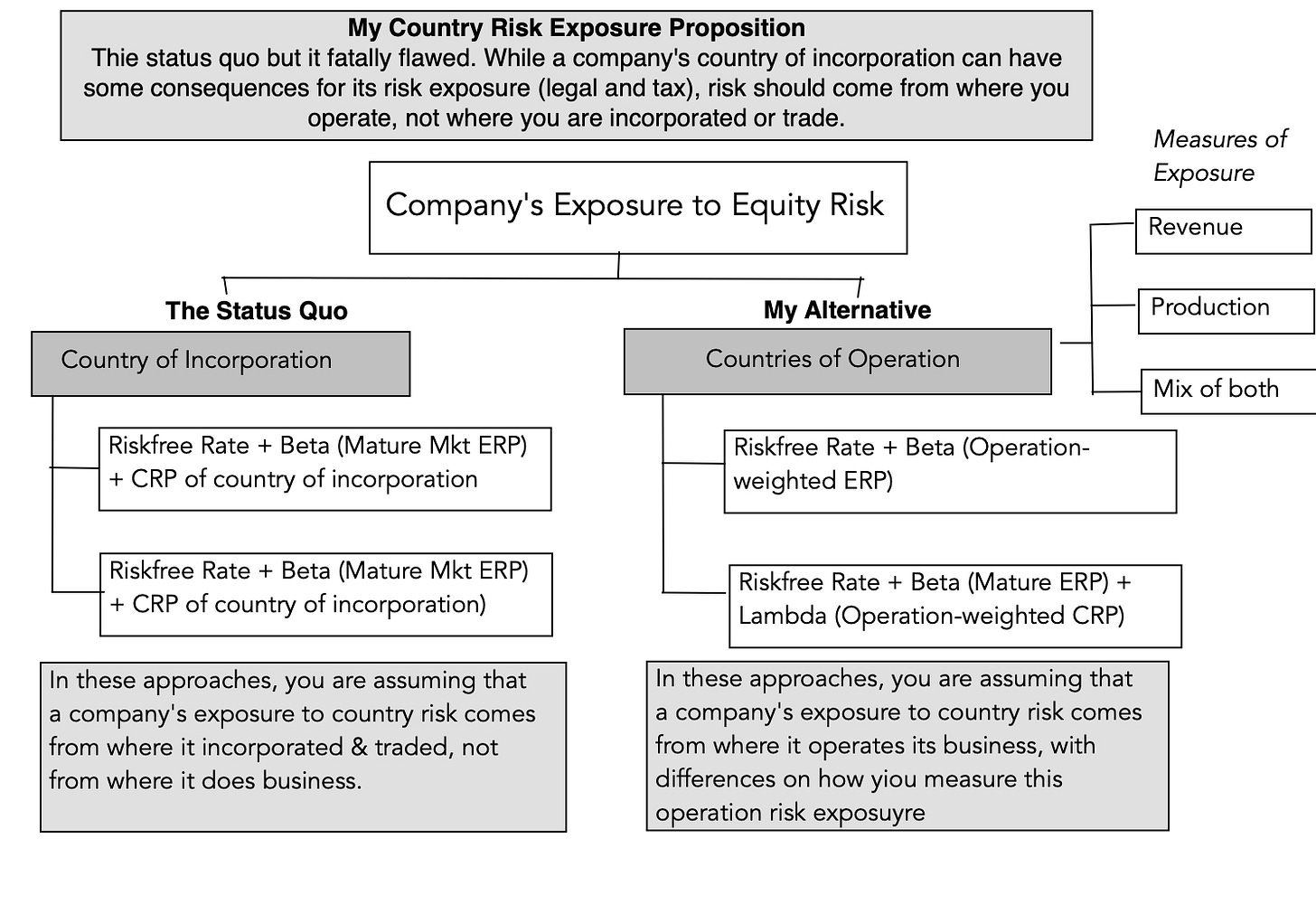

For much of my valuation journey, the status quo in valuation has been to look at where a company is incorporated to determine its risk exposure (and the equity risk premium to use in assessing a hurdle rate). While I understand that where you are incorporated and traded can have an effect on your risk exposure, I think it is dwarfed by the risk exposure from where you operate. A company that is incorporated in Germany that gets all of its revenues in Turkey, is far more exposed to the country risk of Turkey than that of Germany. In the picture below, I contrast the traditional country-of-incorporation based risk measure with my alternative, where equity risk premiums come from where you operate:

We can debate how best to measure operating risk exposure, since it can come from both where you sell your products and services (revenues) as well as where you produce those products and services.

There are implications not just for investors, but for companies. For investors, an operating-risk perspective will mean that there are some emerging market companies that others may perceive as risky, simply because of their country of incorporation, but are much safer, because they get their revenues from much safer parts of the world. Embraer, the Brazilian aerospace company, and Tata Consulting Services, an Indian software company, would be good examples. Conversely, there are developed market companies that are significantly exposed to country risk, either because of where they produce (Royal Dutch) or where they sell their products and services (Coca Cola). For multinational companies, an operating risk perspective will imply that there can be no one hurdle rate across geographies, since a project in Turkey should require a higher equity risk premium (and hurdle rate) than an otherwise similar project in Germany.

Conclusion

It is ironic that a post that was meant to shorten and summarize a long paper has itself stretched to become the equivalent of a long paper, and I apologize. I do hope that you get a chance to read the paper or at least review my country risk measures in this post, since there is significant room for improvement. I don't have all the answers, and I probably never will, but progress is incremental, and each year, I hope that I can add a tweak or a component that will move me in the right direction. Also, please don’t take any of these numbers personally. In short, if you feel that I have overestimated the risk in your country and given it an equity risk premium that you believe is undeservedly high, it is not because I do not like you and your country. It is entirely Moody’s fault for giving your country too low a rating, and you should take it up with them!

YouTube Video

Country Risk Paper

Country Risk Data

Democracy, Violence, Corruption and Legal System Scores, by Country, in July 2023

Sovereign Ratings and CDS Spreads for Countries in July 2023

Currency Data

Very insightful! How one would apply the Country's ERPs to find the cost of equity for a company in a specific country? Simply "MATURE MARKET RISK FREE RATE + COUNTRY's ERP"? And how to account for the (levered) BETA of a specific industry? (1) Multiply the COUNTRY ERP by BETA or (2) the MATURE ERP by BETA, and then add the COUNTRY RISK PREMIUM?

I will include links to your post + paper + video in my links collection post "Emerging Market Links + The Week Ahead (August 31, 2023)" for today. CHECK OUT:

Emerging Market Country Selection in a Multipolar World: Twelve Things to Consider

- Globalization, sovereignty, oil+gas, alt energy, water, industrial minerals, gold+silver (real money), "real" vs. "fake" economy, agriculture, intellectual capital, demographics & climate fanaticism.

https://emergingmarketskeptic.substack.com/p/em-country-selection-multipolar-world