After the 2008 market crisis, I resolved that I would be far more organized in my assessments and updating of equity risk premiums, in the United States and abroad, as I looked at the damage that can be inflicted on intrinsic value by significant shifts in risk premiums, i.e., my definition of a crisis. That precipitated my practice of estimating implied equity risk premiums for the S&P 500, at the start of every month, and following up of using those estimated premiums when valuing companies during that month. The 2008 crisis also gave rise to two risk premium papers that I have updated each year: the first looks at equity risk premiums, what they measure, how they vary across time and how best to estimate them, with the last update in March 2024. The second focuses on country risk and how it varies across geographies, with the focus again on determinants, measures and estimation, which I update mid-year each year. This post reflects my most recent update from July 2024 of country risk, and while you can read the entire paper here, I thought I would give you a mildly abridged version in this post.

Country Risk: Determinants

At the risk of stating the obvious, investing and operating in some countries is much riskier than investing and operating in others, with variations in risk on multiple dimensions. In the section below, I highlight the differences on four major dimensions - political structure, exposure to war/violence, extent of corruption and protections for legal and property rights, with the focus firmly on the economic risks rather than on social consequences.

a. Political Structure

Would you rather invest/operate in a democracy than in an autocracy? From a business risk perspective, I would argue that there is a trade off, sometimes making the former more risky than the latter, and sometimes less so. The nature of a democracy is that a government will be less able to promise or deliver long term predictable/stable tax and regulatory law, since losing an election can cause shifts in policy. Consequently, operating and investing in a democratic country will generally come with more risk on a continuous basis, with the risk increasing with partisanship in the country. Autocratic governments are in a better position to promise and deliver stable and predictable business environments, with two caveats. The first is that when change comes in autocracies, it will be both unexpected and large, with wrenching and discontinuous shifts in economic policy. The second is that the absence of checks and balance (legal, legislative, public opinion) will also mean that policy changes can be capricious, often driven by factors that have little to do with business or public welfare.

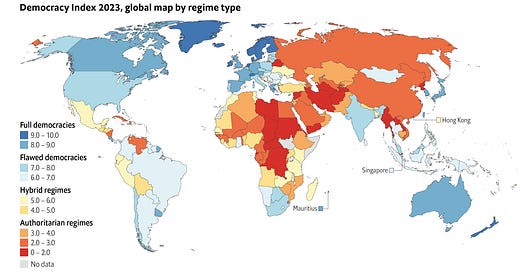

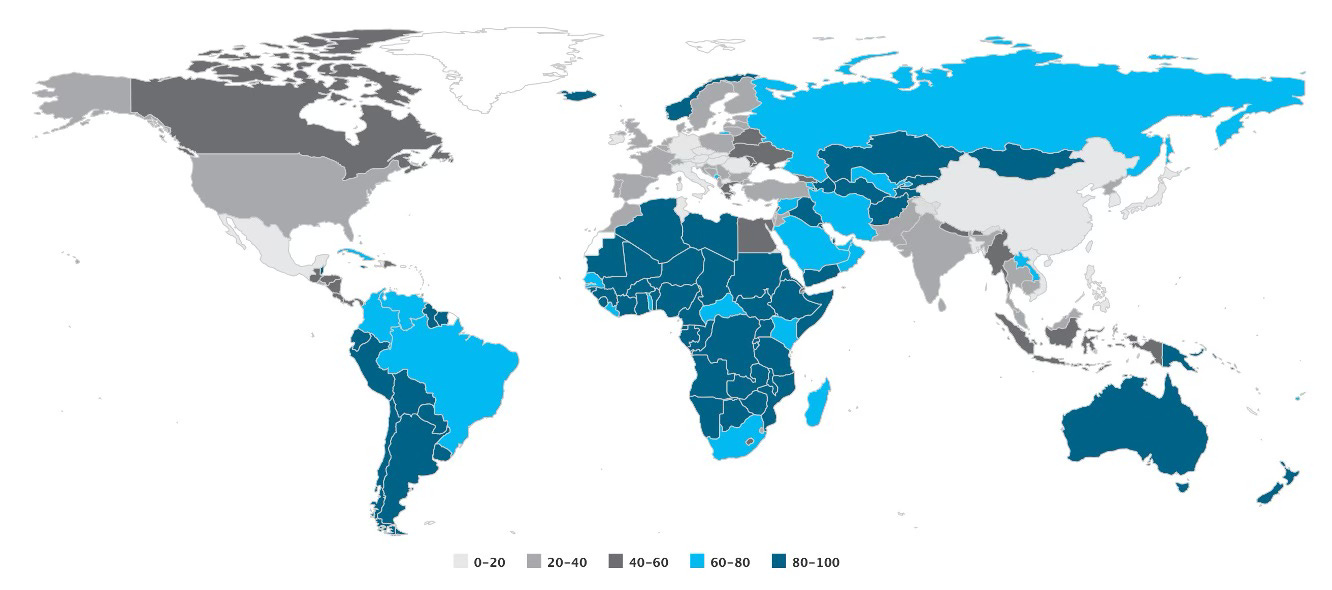

Any attempt to measure political freedom comes with qualifiers, since the biases of the measuring service on what freedoms to elevate and which ones to ignore will play a role, but in the figure below, I report the Economist's Democracy Index, which is based upon five measures - electoral process and pluralism, government functioning, political participation, democratic social culture and civil liberties:

Democracy Index in 2023: Source: The Economist

Based upon the Economist's democracy measures, much of the world remains skewed towards authoritarianism, changing the risk exposures that investors and businesses face when operating in those parts of the world.

b. War and Violence

Operating a business becomes much more difficult, when surrounded by war and violence, from both within and outside the country. That difficulty also translates into higher costs, with those businesses that can buy protection or insurance doing so, and those that cannot suffering from damage and lost revenues. Drawing again on an external service, the Institute for Economics and Peace measures exposure to war and violence with a global peace index (with higher scores indicating more propensity towards violence)

:

Global Peace Index 2024: Source: Institute for Economics & Peace

While Africa and large swaths of Asia are exposed to violence, and Northern Europe and Canada remain peaceful, businesses in much of the world (including the United States) remain exposed to violence, at least according to this measure.

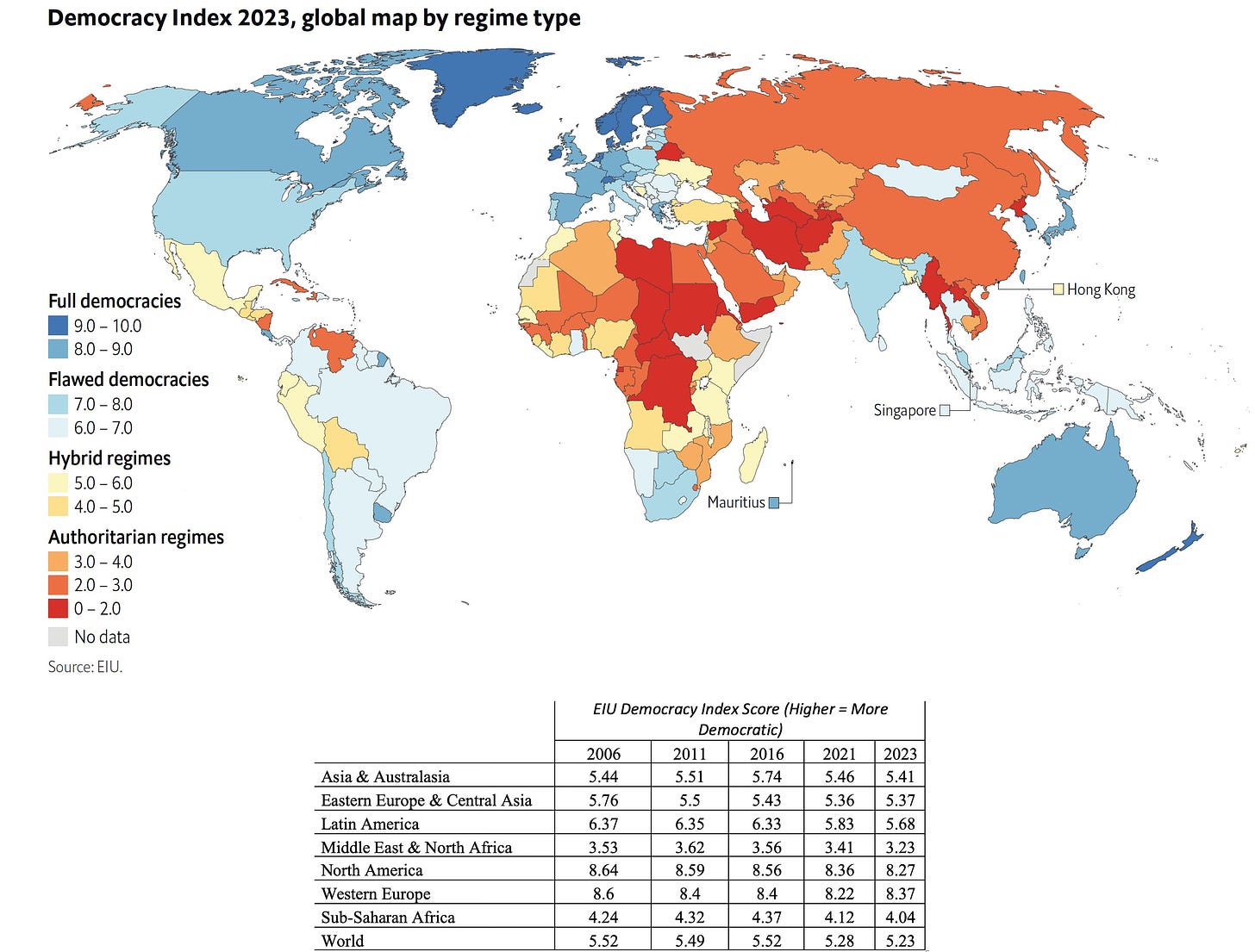

c. Corruption

As I have argued in prior posts, corruption operates as an implicit tax on businesses, with the tax revenues accruing to middlemen or third parties, rather than the government.

Corruption Index 2023: Source: Transparency International

Again, while you can argue with the scores and the rankings, it remains undeniable that businesses in much of the world face corruption (and its associated costs). While there are some who attribute it to culture, I believe that the overriding reasons for corruption are systems that are built around licensing and regulatory constraints, with poorly paid bureaucrats operating as the overseers

There are other insidious consequences to corruption. First, as corruption becomes brazen, as it is in some parts of the world, there is evidence that companies operating in those settings are more likely to evade paying taxes to the government, thus redirecting tax revenues from the government to private players. Second, companies that are able and willing to play the corruption game will be put at an advantage over companies that are unable or unwilling to do so, creating a version of Gresham's law in businesses, where the least honorable businesses win out at the expense of the most honorable and honest ones.

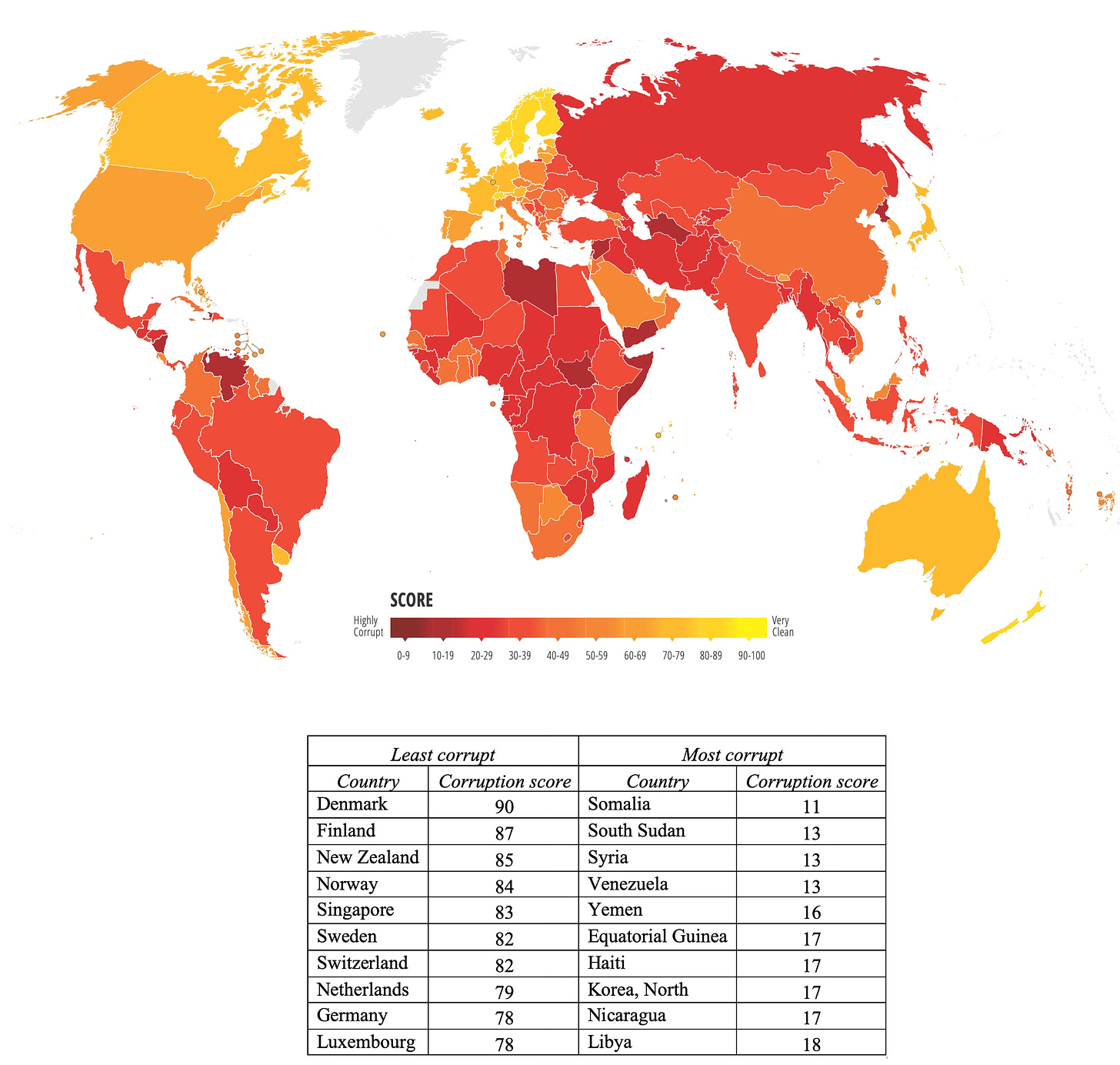

d. Legal and Property Rights

When operating a business or making an investment, you are reliant on a legal system to back up your ownership rights, and to the extent that it does not do so, your business and investment will be worth less. The Property Rights Alliance, an entity that attempts to measure the strength of property rights, by country, measured property rights (physical and intellectual) around the world, to come up with a composite measure of these rights, with higher values translating into more rights. Their most recent update, from 2023, is captured in the picture below

:

Property Rights Index 2023: Source: The Property Rights Alliance

Again, there are wide differences in property rights across the world; they are strongest in the North America and Europe and weakest in Africa and Latin America. Within each of these regions, though, there are variations across countries; within Latin America, Chile and Uruguay rank in the top quartile of countries with stronger property rights, but Venezuela and Bolivia are towards the bottom of the list. In assessing protections of property rights, it is worth noting that it is not only the laws that protect them that need to be looked at, but also the timeliness of legal action. A court that takes decades to act on violations of property rights is almost as bad as a court that does not enforce those rights at all.

One manifestation of property right violation is nationalization, and here again there remain parts of the world, especially with natural resource businesses, where the risks of expropriation have increased. A Sustainalytics report that looked at metal miners documented 165 incidents of resources nationalization between 2017 and 2021, impacting 87 mining companies, with 22 extreme cases, where local governments ending contracts with foreign miners. Maplecroft, a risk management company, mapped out the trendline on nationalization risk in natural resources in the figure below

:

National security is the reason that some governments use to justify public ownership of key resources. For instance, in 2022, Mexico created a state-owned company, Litio Para Mexico, to have a monopoly on lithium mining in the country, and announced a plan to renegotiate previously granted concessions to private companies to extract the resource.

Country Risk: External factors

Looking at the last section, you would not be faulted for believing that country risk exposure is self-determined, and that countries can become less risky by working on reducing corruption, increasing legal protections for property rights, making themselves safer and working on more predictable economic policies. That is true, but there are three factors that are largely out of their control that can still drive country risk upwards.

1. Commodity Dependence

Some countries are dependent upon a specific commodity, product or service for their economic success. That dependence can create additional risk for investors and businesses, since a drop in the commodity’s price or demand for the product/service can create severe economic pain that spreads well beyond the companies immediately affected. Thus, if a country derives 50% of its economic output from iron ore, a drop in the price of iron ore will cause pain not only for mining companies but also for retailers, restaurants and consumer product companies in the country. The United Nations Conference on Trade and Development (UNCTAD) measures the degree to which a country is dependent on commodities, by looking at the percentage of its export revenues come from a commodities, and the figure below captures their findings:

Proportion of revenues from commodities- 2019-2021; Source: UNCTAD

Why don’t countries that derive a disproportionate amount of their economy from a single source diversify their economies? That is easier said than done, for two reasons. First, while it is feasible for larger countries like Brazil, India, and China to try to broaden their economic bases, it is much more difficult for small countries like Peru or Angola to do the same. Like small companies, these small countries have to find a niche where they can specialize, and by definition, niches will lead to over dependence upon one or a few sources. Second, and this is especially the case with natural resource dependent countries, the wealth that can be created by exploiting the natural resource will usually be far greater than using resources elsewhere in the economy, which may explain the inability of economies in the Middle East to wean itself away from oil.

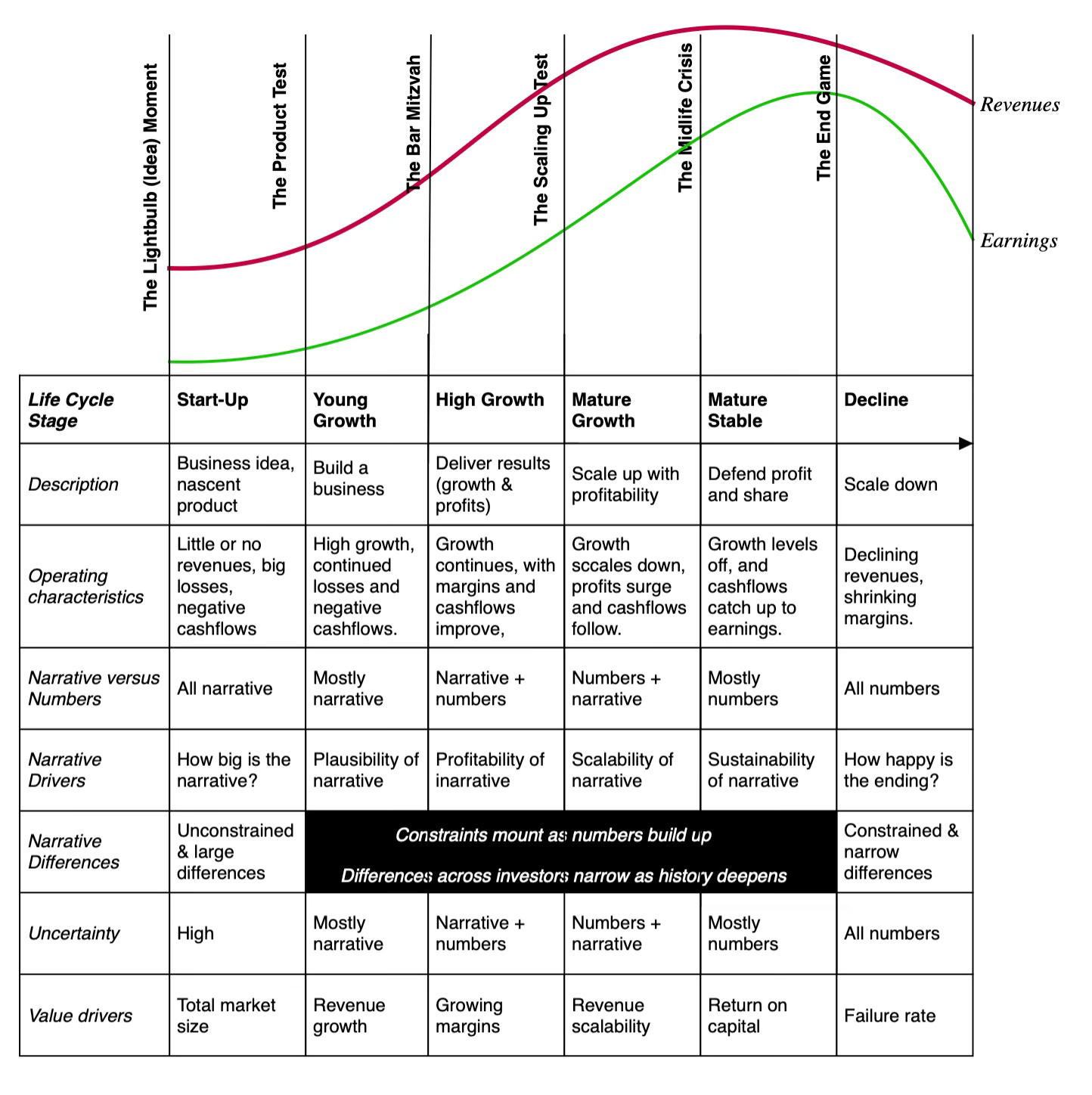

II. Life Cycle dynamics

As readers of this blog should be aware, I am fond of using the corporate life cycle structure to explain why companies behave (or misbehave) and how investment philosophies vary. At the risk of pushing that structure to its limits, I believe that countries also go through a life cycle, with different challenges and risks at each stage:

The link between life cycle and economic risk is worth emphasizing because it illustrates the limitations on the powers that countries have over their exposure to risk. A country that is still in the early stages of economic growth will generally have more risk exposure than a mature country, even if it is well governed and has a solid legal system. The old investment saying that gain usually comes with pain, also applies to operating and investing across the globe. While your risk averse side may lead you to direct your investments and operations to the safest parts of the world (say, Canada and Northern Europe), the highest growth is generally in the riskiest parts of the world.

3. Climate Change

The globe is warming up, and no matter where you fall on the human versus nature debate, on causation, some countries are more exposed to global warming than others. That risk is not just to the health and wellbeing of those who live within the borders of these countries, but represents economic risks, manifesting as higher costs of maintaining day-to-day activity or less economic production. To measure climate change, we turned to ResourceWatch, a global partnership of public, private and civil society organizations convened by the World Resources Institute. This institute measure climate change exposure with a climate risk index (CRI), measuring the extent to which countries have been affected by extreme weather events (meteorological, hydrological, and climatological), and their most recent measures (from 2021, with an update expected late in 2024) of global exposure to climate risk is in the figure below:

Climate Risk Index (CRI) in 2021: ResourceWatch

Note that higher scores on the index indicate more exposure to country risk, and much of Africa, Latin America and Asia are exposed. In fact, since this map was last updated in 2021, it is conceivable that climate risk exposure has increased across the globe and that even the green regions are at risk of slipping away into dangerous territory.

Country Life Cycle - Measures

With that long lead in on the determinants of country risk, and the forces that can leave risk elevated, let us look at how best to measure country risk exposure. We will start with sovereign ratings, which are focused on country default risk, because they are the most widely used country risk proxies, before moving on to country risk scores, from public and private services, and closing with measures of risk premiums that equity investors in these countries should charge.

1. Sovereign Default Risk

The ratings agencies that rate corporate bonds for default risk also rate countries, with sovereign ratings, with countries with higher (lower) perceived default risk receiving lower (higher) ratings. I know that ratings agencies are viewed with skepticism, and much of that skepticism is deserved, but it is undeniable that ratings and default risk are closely tied, especially over longer periods. The figure below summarizes sovereign ratings from Moody's in July 2024

:

Moody's Sovereign Ratings in July 2024; Source: Moody's

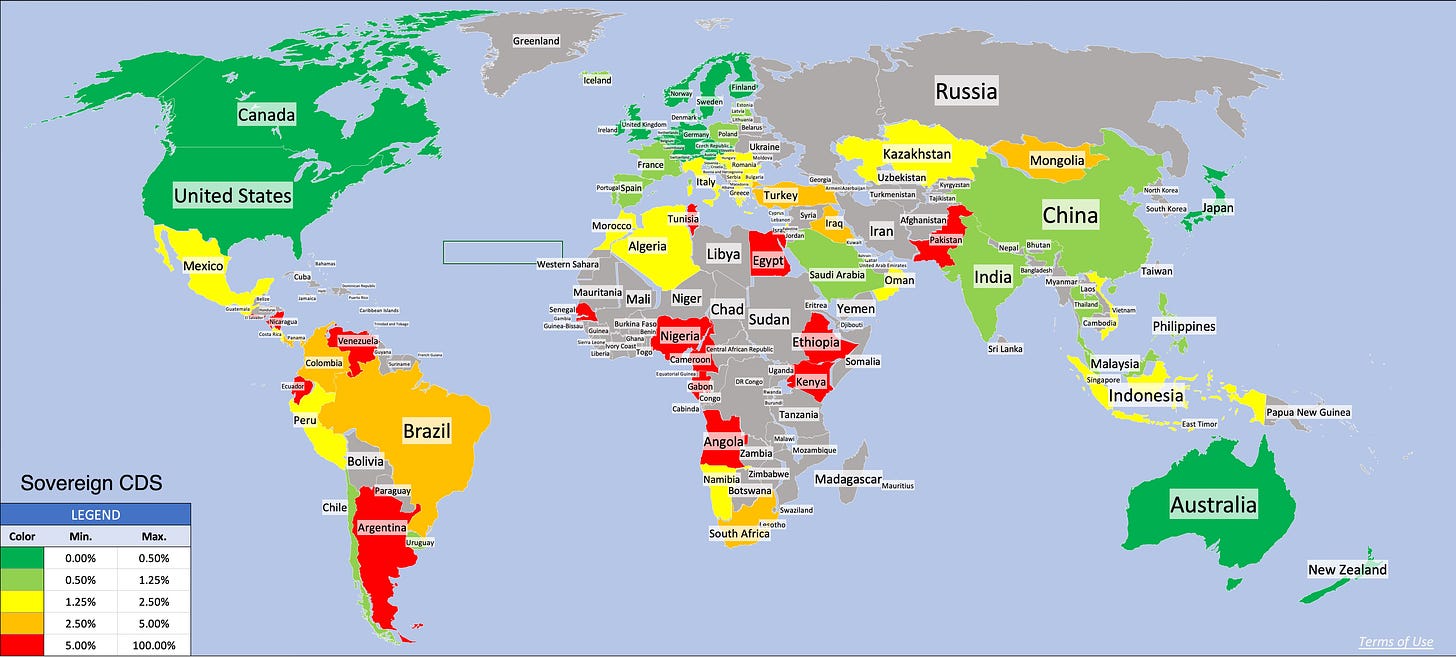

If you compare these ratings to those that I reported in my last update, a year ago, you will notice that the ratings are stagnant for most countries, and when there is change, it is small. That remains my pet peeve with the rating agencies, which is not that they are biased or even wrong, but that they are slow to react to changes on the ground. For those searching for an alternative, there is the sovereign credit default swap (CDS) market, where you can market assessments of default risk. The figure below summarizes the spreads for the roughly 80 countries, where they are available

:

Sovereign CDS Spreads on June 30, 2024: Source: Bloomberg

Sovereign CDS spreads reflect the pluses and minuses of a market-based measure, adjusting quickly to changes on the ground in a country, but sometimes overshooting as markets overreact. As you can see, the sovereign CDS market views India as safer than suggested by the ratings agencies, and for the first time, in my tracking, as safer than China (Sovereign CDS for India is 0.83% and for China is 1.05%, as of June 30, 2024).

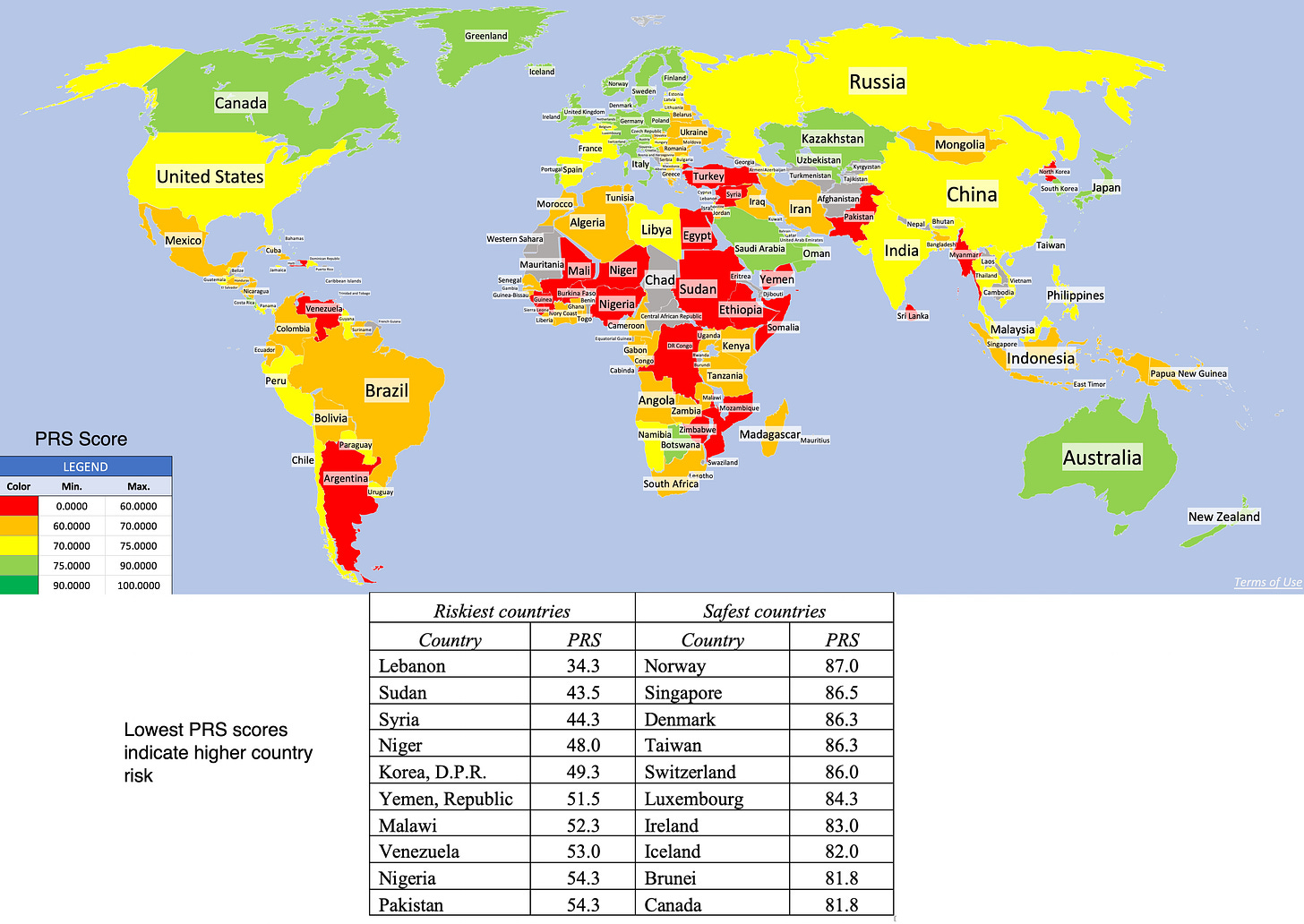

2. Country Risk Scores

Ubiquitous as sovereign ratings are, they represent a narrow measure of country risk, focused entirely on default risk. Thus, much of the Middle East looks safe, from a default risk perspective, but there are clearly political and economic risks that are not being captured. One antidote is to use a risk score that brings in these missed risks, and while there are many services that provide these scores, I use the ones supplied by Political Risk Services (PRS). PRS uses twenty two variables to measure country risk, whey then capture with a country risk score, from 0 to 100, with the riskiest countries having the lowest scores and the safest countries, the highest

:

Country risk scores in July 2024: Political Risk Services

While I appreciate the effort that goes into these scores, I have issues with some of the scoring, as I am sure that you do. For instance, I find it incomprehensible that Libya and the United States share roughly the same PRS score, and that Saudi Arabia is safer than much of Europe. That said, I have tried other country risk scoring services (the Economist, The World Bank) and I find myself disagreeing with individual country scoring there as well.

3. Equity Risk Premiums

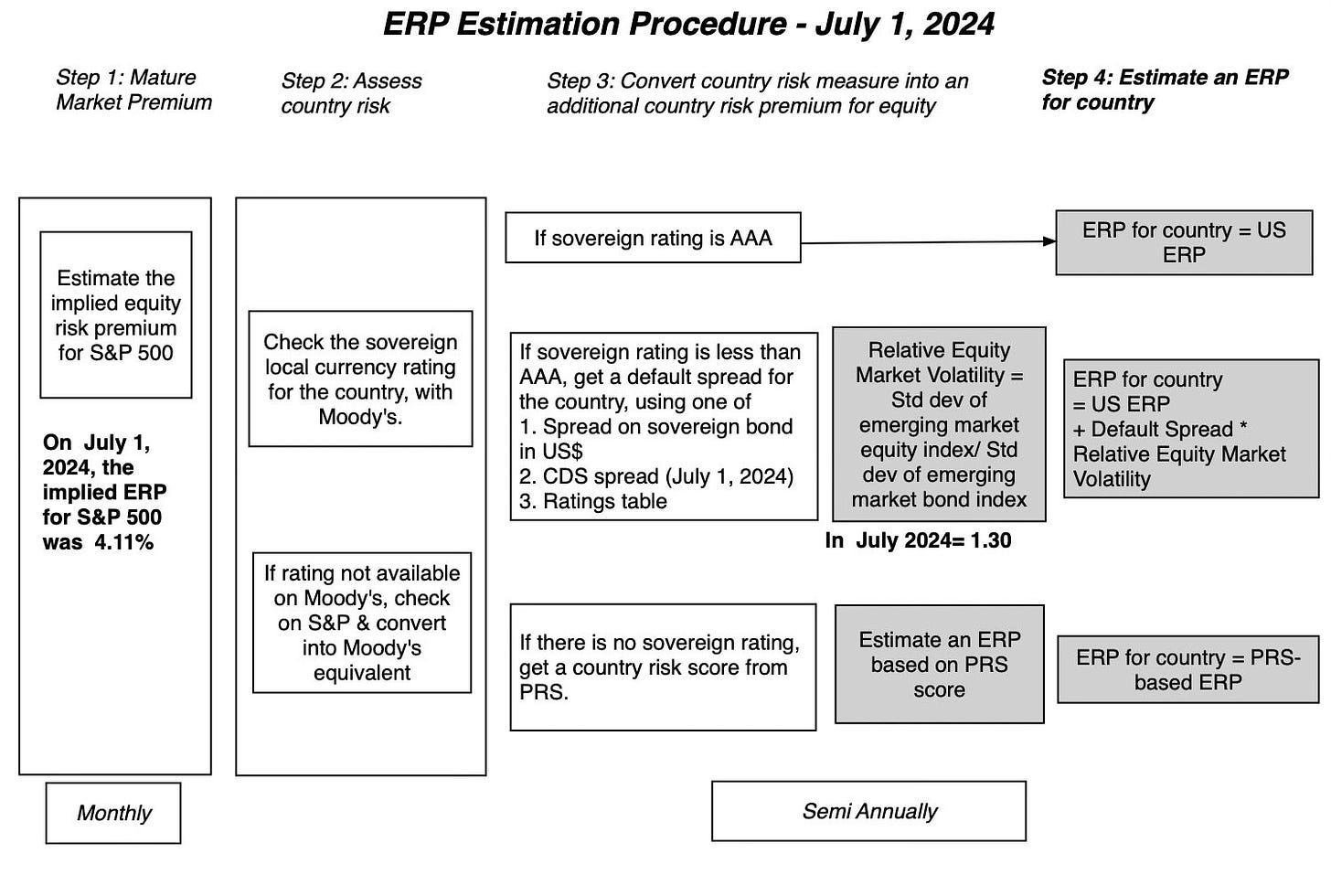

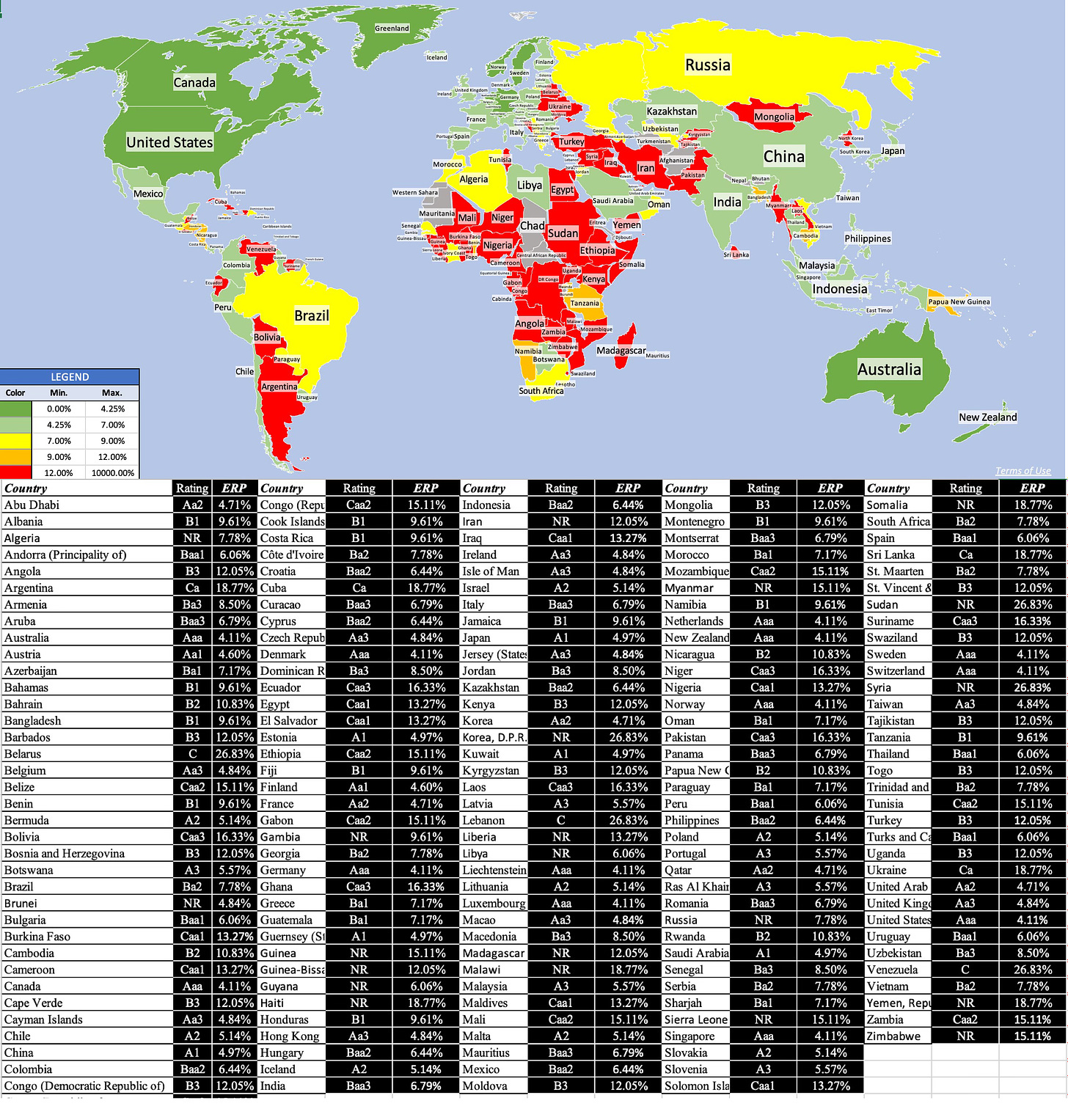

Looking at operations and investing, through the eyes of equity investors, the risk that you care about is the equity risk premium, a composite measure that you then incorporate into expected returns. I don't claim to have prescience or even the best approach for estimating these equity risk premiums, but I have consistently followed the same approach for the last three decades. I start with the sovereign ratings, if available, and estimate default spreads based upon these ratings, and I then scale up these ratings for the fact that equities are riskier than government bonds. I then add these country risk premiums to my estimate of the implied equity risk premium for the S&P 500, to arrive at equity risk premiums, by country.

For countries which have no sovereign ratings, I start with the country risk score from PRS for that country, find other (rated) countries with similar PRS scores, and extrapolate their ratings-based equity risk premiums. The final picture, at least as I see it in 2024, for equity risk premiums is below:

You will undoubtedly disagree with the equity risk premiums that I attach to at least some of the countries on this list, and perhaps strongly disagree with my estimate for your native country, but you should perhaps take issue with Moody's or PRS, if that is so.

Country Risk in Decision Making

At this point, your reaction to this discussion might be "so what?", since you may see little use for these concepts in practice, either as a business or as an investor. In this section, I will argue that understanding equity risk premiums, and how they vary across geographies, can be critical in both business and personal investing.

Country Risk in Business

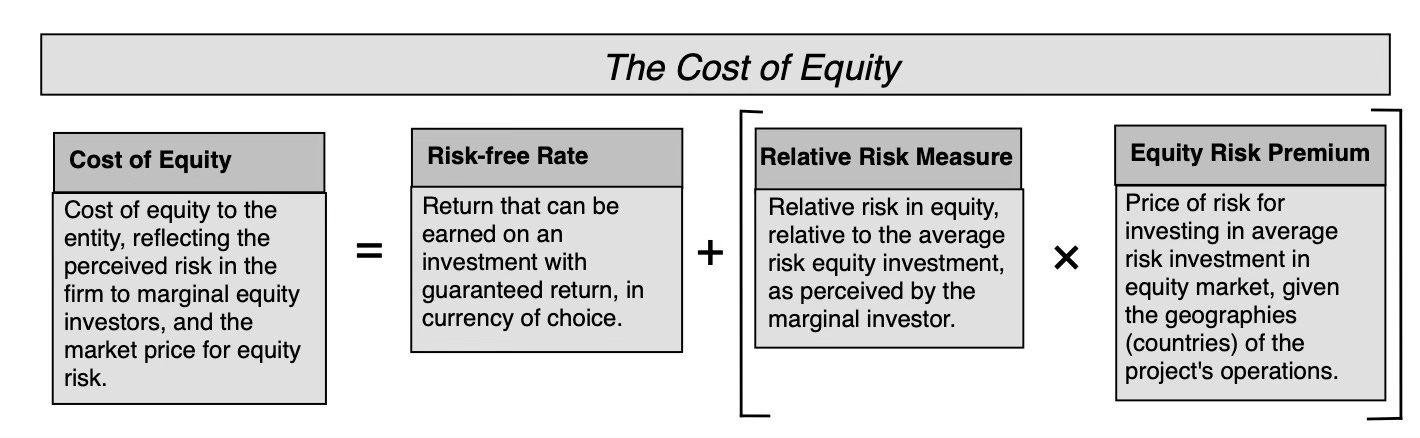

Most corporate finance classes and textbooks leave students with the proposition that the right hurdle rate to use in assessing business investments is the cost of capital, but create a host of confusion about what exactly that cost of capital measures. Contrary to popular wisdom, the cost of capital to use when assessing investment quality has little to do with the cost of raising financing for a company and more to do with coming up with an opportunity cost, i.e., a rate of return that the company can generate on investments of equivalent risk. Thus defined, you can see that the cost of capital that a company uses for an investment should reflect both the business risk as well as where in the world that investment is located. For a multinational consumer product company, such as Coca Cola, the cost of capital used to assess the quality of a Brazilian beverage project should be very different from the cost of capital estimated for a German beverage project, even if both are estimated in US dollars. The picture below captures the ingredients that go into a hurdle rate

:

Thus, in computing costs of equity and capital for its Brazil and German projects, Coca Cola will be drawing on the equity risk premiums for Brazil (7.87%) and Germany (4.11%), leading to higher hurdle rates for the former.

The implications for multi-business, multi-national companies is that there is no one corporate cost of capital that can be used in assessing investments, since it will vary both across businesses and across geographies. A company in five businesses and ten geographies, with have fifty different costs of capital, and while you complaint may that this is too complicated, ignoring it and using one corporate cost of capital will lead you to cross subsidization, with the safest businesses and geographies subsidizing the riskiest.

Country Risk in Investing

As investors, we invest in companies, not projects, with those companies often having exposures in many countries. While it is possible to value a company in pieces, by valuing each its operations in each country, the absence of information at the country level often leads us to valuing the entire company, and when doing so, the risk exposure for that company comes from where it operates, not where it does business. Thus, when computing its cost of equity, you should look not only at its businesss risk, but what parts of the world it operates in:

In intrinsic valuation, this will imply that a company with more of its operations in risky countries will be worth less than a company with equivalent earnings, growth and cash flows with operations in safer countries. Thus, rather than look at where a company is incorporated and traded, we should be looking at where it operates, both in terms of production and revenues; Nvidia is a company incorporated and traded in the United States, but as a chip designed almost entirely dependent on TSMC for its chip manufacture, it is exposed to China risk.

It is true that most investors price companies, rather than value them, and use pricing metrics (PE ratios, EV to EBITDA) to judge cheap or expensive. If our assessment of country risk hold, we should expect to see variations in these pricing metrics across geographies. I computed EV to EBITDA multiples, based upon aggregate enterprise value and EBITDA, by country, in July 2024, and the results are captured in the figure below

:

Source: Raw data from S&P Capital IQ

The results are mixed. While some of the riskiest parts of the world trade at low multiples of EBITDA, a significant part of Europe also does, including France and Norway. In fact, India trades at the highest multiple of EBITDA of any country in the world, representing how growth expectations can trump risk concerns.

Currency Effects

You may find it odd that I have spent so much of this post talking about country risk, without bringing up currencies, but that was not an oversight. It is true that riskier countries often have more volatile currencies that depreciate over time, but this more a symptom of country risk, than a cause. As I will argue in this section, currency choice affects your growth, cash flow and discount rate estimates, but ultimately should have no effect on intrinsic value.

If you value a company in US dollars, rather than Indian rupees, should the numbers in your valuation be different? Of course, but the reason for the differences lies in the fact that different currencies bring different inflation expectations with them, and the key is to stay consistent:

If expected inflation is lower in US dollars than in rupees, the cost of capital that you should obtain for a company in US dollars will be lower than the cost of capital in rupees, with the difference reflecting the expected inflation differential. However, since your cash flows will also then have to be in US dollars, the expected growth that you should use should reflect the lower inflation rate in dollars, and if you stay consistent in your inflation estimates, the effects should cancel out. This is not just theory, but common sense. Currency is a measurement mechanism, and to claim that a company is undervalued in one currency (say, the rupee) while claiming that it is overvalued at the same time in another currency (say, the US dollar) makes no sense. To practitioners who will counter with examples, where the value is different, when you switch currencies, my response is that there is a currency view (that the rupee is under or over priced relative to the dollar) in your valuation in your valuation, and that view should not be bundled together with your company story in a valuation.

As we noted in the last section, the place that currency enters your valuation is in the riskfree rate, and if my assertion about expected inflation is right, variations in riskfree rates can be attributed entirely to difference in expected inflation. At the start of July 2024, for instance, I estimated the riskfree rates in every currency, using the US treasury bond rate as my dollar riskfree rate, and the differential inflation between the currency in question and the US dollar:

My estimates are in the appendix to this post. In the same vein, inflation also enters into expected exchange rate calculations:

This is, of course, the purchasing power parity theorem, and while currencies can deviate from this in the short term, it remains the best way to ensure that your currency views do not hijack your valuation.

YouTube Video

My Country risk premium paper

My Data Links

Equity risk premiums, by country - July 2024 (also includes ratings, PRS scores and sovereign CDS)

Riskfree rates in currencies, based upon differential inflation - July 2024

External Data Links

Thanks for sharing, always appreciated

I included your post in my links Monday compilation post: Emerging Market Links + The Week Ahead (August 19, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-august-19-2024 ... HOWEVER, some of the charts come from sources that are almost pure Western propaganda e.g. the so-called Democracy Index - The EU is more and more authoritarian while alot of people who don't read the Economist don't think a "full democracy" is a country where a political party (that the elites hate) can get 4 million votes and only 4 seats in parliament while a party getting less than that number of votes gets several dozen seats etc...

I ALSO WROTE THIS PIECE SOME TIME AGO:

Emerging Market Country Selection in a Multipolar World: Twelve Things to Consider

Globalization, sovereignty, oil+gas, alt energy, water, industrial minerals, gold+silver (real money), "real" vs. "fake" economy, agriculture, intellectual capital, demographics & climate fanaticism.