Data Update 3 for 2021: Currencies, Commodities, Collectibles and Cryptos

In my last post, I described the wild ride that the price of risk took in 2020, with equity risk premiums and default spreads initially sky rocketing, as the virus led to global economic shutdowns, and then just as abruptly dropping back to pre-crisis levels over the course of the year. As stock and bond markets went through these gyrations, it should come as no surprise that the same forces were playing out in other markets as well. In this post, I will take a look at these other markets, starting with a way of dividing investments into assets, commodities, currencies and collectibles that I find useful in thinking about what I can (and cannot) do in those markets, and then reviewing how these markets performed during 2020. As I do this, there is no way that I can evade discussing Bitcoin and other crypto assets, which continued to draw disproportionate (relative to their actual standing in markets) attention during the year, and talking about what 2020 taught us about them.

Investments: Classifications and Consequences

In a 2017 post, focused on bitcoin, I argued that all investments can be categorized into one of four groups, assets, commodities, currencies and collectibles, and the differences across these group are central to understanding why pricing is different from value, and what sets investing apart from trading.

The Divide: Assets, Commodities, Currencies and Collectibles

If you define an investment as anything that you can buy and hold, with the intent of making money, every investment has to fall into at least one of these groupings:

Assets: An asset has expected cash flows that can either be contractually set (as they are with loans or bonds), residual (as is the case with an equity investment in a business or shares in a publicly traded company) or even conditional on an event occurring (options and warrants).

Commodities: A commodity derives its value from being an input into a process to produce a item (product or service) that consumers need or want. Thus, agricultural products like wheat and soybeans are commodities, as are industrial commodities like iron ore and copper, and energy-linked commodities like oil and natural gas.

Currencies: A currency serves three functions. It is a measure of value (used to tell you how much a product or service costs), a medium of exchange (facilitating the buying and selling of products and services) and a store of value (allowing people to save to meet future needs). While we tend to think of fiat currencies like this Euro, the US dollar or the Indian rupee, the use of currency pre-dates governments, and human beings have used everything from seashells to rocks as currency.

Collectibles: A collectible's pricing comes from the perception that it has value, driven by tastes (artwork) and/or scarcity (rare items). There are a range of items that fall into this grouping from fine art to sports memorabilia to precious metals.

While most investments fall into one of these buckets, there are some that can span two or more, and you have to decide which one dominates. Take gold, for instance, whose ductility and malleability makes it a prized commodity to jewelers and electronics makers, but whose scarcity and indestructibility (almost) make it even more attractive as a currency or a collectible, With bitcoin, even its most ardent promoters seem to be divided on whether the end game is to create a currency or a collectible, a debate that we will revisit at the end of this post.

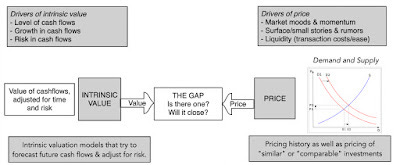

Price versus Value

The classification of investments is key to understanding a second divide, one that I have repeatedly returned to in my posts, between value and price.

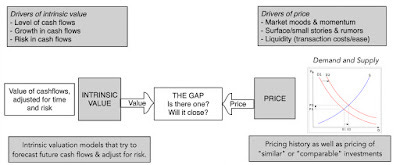

If the value of an investment is a function of its cashflows and the risk in those cash flows, it follows that only assets can be valued. Though commodities can sometimes be roughly valued with macro estimates of demand and supply, they are far more likely to be priced. Currencies and collectible can only be priced, and the determinants of their pricing will vary:

Commodity Pricing: With commodities, the pricing will be determined by two factors. The first is the demand for and supply of the commodity, given its usage, with shocks to either causing price to change. Thus, it should come as no surprise that the oil embargo in the 1970s caused oil prices to surge and freezing weather in Florida resulted in higher prices for orange juice. The second is storability, with storage costs ranging from minimal with some commodities to prohibitive for others. In general, storable commodities provide buyers with the option of buying when prices are low, and storing the commodity, and for that reason, futures prices of storable commodities are tied to spot prices and storage costs.

Currency Pricing: Currencies are priced against each other, with the prices taking the form of "exchange rates". In the long term, that pricing will be a function of how good a currency is as a medium of exchange and a store of value, with better performing currencies gaining at the expense of worse performing ones. On the first dimension (medium of exchange) currencies that are freely exchangeable (or even usable) anywhere in the world (like the US dollar, the Euro and the Yen) will be priced higher than currencies that do not have that reach (like the Indian rupee or the Peruvian Sul). On the second (store of value), it is inflation that separates good from bad currencies, with currencies with low inflation (like the Swiss franc) gaining at the expense of currencies with higher inflation (like the Zambian kwacha).

Collectible Pricing: Most collectibles are pure plays on demand and supply, with no fundamentals driving the price, other than scarcity and desirability, real or perceived. Paintings by Picasso, Monet or Van Gogh are bought and sold for millions, because there are collectors and art lovers who see them as special works of art, and their supply is limited. Adding to the allure (and pricing) of collectibles is their longevity, reflected in their continuous hold on investor consciousness. It should come as no surprise that gold's, because it brings together all three characteristics; it's scarcity comes from nature, its desirability comes from in many forms and it has been used and valued for thousands of years.

I capture these differences in the table below:

In short, assets can be both priced and value, commodities can be roughly valued but are mostly priced and currencies and collectibles can only be priced.

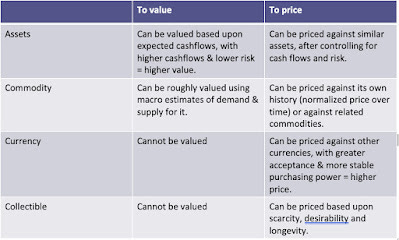

Investing versus Trading

The essence of investing is assessing value, and buying assets that trade at prices below that value, and selling assets that trade at more. Trading is far simpler and less pretentious, where successful trading requires one thing and one thing only, buying at a low price and selling at a higher one. If you agree with those definitions, it then follows that you can invest only in assets (stocks, bonds, businesses, rental properties) and that you can only trade commodities, currencies and collectibles. Drawing on a table that I have used in prior posts (and I apologize for reusing it), here is my contrast between investing and trading:

Note that I am not passing judgment on either, since your end game is to make money, whether you are an investor or a trader, and the fact that you made money following the precepts of value investing and did fundamental analysis does not make you better or more worthy than your neighbor who made the same amount of money, buying and selling based upon price and volume indicators.

Commodities

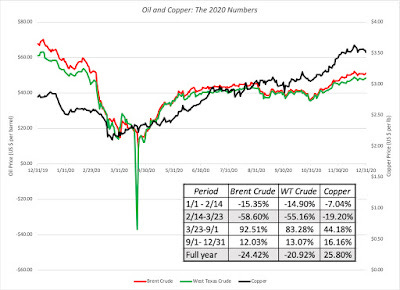

With that lengthly lead in, let's look at what 2020 brought as surprises to the commodity market. As the virus caused a global economic shut down, there were severe disruptions to the demand for some commodities, as usage decreased, and to the supply of others, as production facilities and supply chains broke down. During the course of 2020, I kept track continuously of two commodities, copper and oil, both economically sensitive, and widely traded.

Federal Reserve Database (FRED)

Note that the ups and downs of oil and copper not only follow the same time pattern, but closely resemble what stocks were doing over the same periods, but the changes are more exaggerated (up and down) with oil than with copper. Both oil and copper dropped during the peak crisis weeks (February 14 through March 23, 2020), but while copper not only recouped its losses and was up almost 26% over the course of the year, oil remains more than 20% below the start-of-the-year numbers. Note also the odd phenomenon on April 20, where West Texas crude prices dropped below zero, as traders panicked about running out of storage space for oil in the US.

Expanding more broadly and looking at a basket of commodities, we can trace out the same effects. In the graph below, I look at three commodity indices, the S&P World Commodity Index (WCI), which is a production-weighted index of commodity futures, the S&P GSCI Index, an investable version that includes the most liquid commodity futures, and the S&P GSCI Agricultural Index, a weighted average of agricultural commodity futures.

The broad commodity indices (WCI and GSCI) saw significant drops between February 14 and March 23, and recoveries in the months after, mirroring the oil and copper price movements. Agricultural commodity futures were far less affected by the crisis, with only a small drop during the crisis weeks, and delivered the best overall performance for the year.

Currencies

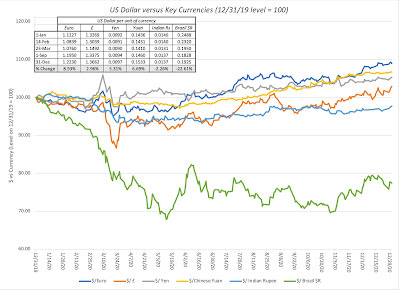

In a year during which financial markets had wild swings, and commodity prices followed, it should come as no surprise that currency markets also went through turbulence. In the graph below, I look at the movements of a select set of currencies over 2020, all scaled to the US dollar to allow for comparability:

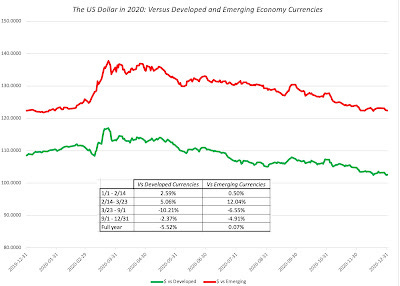

The dollar strengthened against all of the currencies between February 14 and March 23, but over the course of the year, it depreciated against the Euro, Yen and the Yuan, was mostly flat against the British pound and Indian rupee and gained significantly against the Brazilian Real. Looking at the US dollar’s movements more broadly, you can see the effects of 2020 by looking at the Us movement relative to developed market and emerging market currencies in the graph below:

In the crisis weeks (2/14 to 3/23), the US dollar gained against other currencies, but more so against emerging market currencies than developed markets ones. In the months afterwards, it gave back those gains to end the year flat against emerging market currencies and down about 5.5% against developed market currencies.

Collectibles

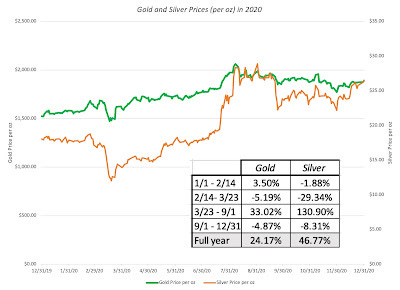

During crises, collectibles often see increased demand, as fear about the future and a loss of faith in institutions (central banks, governments) leads people to see refuge in investments that they believe will outlast the crisis. Given the history of gold and silver as crisis assets, I start by looking at gold and silver prices in 2020;

Both gold and silver had strong years, with gold up 24.17% and silver up 46.77% during the year, but gold played the role of crisis asset better, with its price dropping only 5.19% in the crisis weeks from February 14 to March 23, beating out almost every other asset class in performance during the period. Silver dropped by 29.34% during that same period, but while its subsequent rise more than made up for that drop, on the narrow measure of crisis asset, it did not perform as well as gold.

The year (2020) had mixed effects on other collectible markets. Fine art, for itself, built around in-person auctions of expensive art works saw sales plummet in the early months of 2020, as shutdowns kicked in, but saw a surge of online auctions towards the end of the year. Notwithstanding this development, overall sales of art dropped in 2020, and transactions decreased, especially in the highest-priced segments.

Cryptos

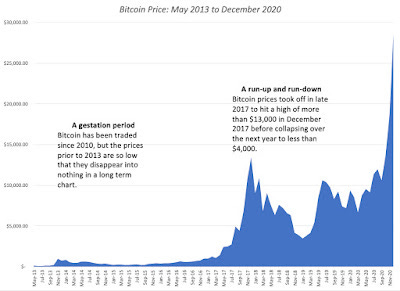

It would be impossible to complete this post without talking about bitcoin, which as it has for much of the decade, continued to dominate discussions of markets and investments. Looking at this graph of bitcoin since its inception, you can see its meteoric rise:

There are clearly many who have been enriched during this rise, and quite a few who have lost their shirts, but any discussion of bitcoin evokes more passion than reason. There are some who believe so intensely in bitcoin that any critique or viewpoint that is contrary to theirs evokes an almost hysterical overreaction. On the other hand, there are others who view bitcoin as speculation run amok, with the end game destined to be painful. At the risk of provoking both sides, I want to start with a fundamental question of whether bitcoin is an asset, a commodity, a currency or a collectible. Even among its strongest supporters, there seems to be no consensus, with the biggest split being between those who argue that it will become a dominant currency, replacing fiat currencies in some markets, and supplementing them in others, and those who claim that it is a gold-like collectible, deriving its pricing from crises and loss of faith in fiat currencies. You could argue that this divide has existed from its creation in 2008, both in terminology (you mine for bitcoin, just as you do for gold) and in its design (an absolute limit on its numbers, creating scarcity). There are even some who believe that the block chain technology that is at the heart of bitcoin can make it a commodity, with the price rising, as block chains find their place in different parts of the economy. Here is my personal take:

Bitcoin is not an asset. I know that you can create securities denominated in bitcoin that have contractual or residual cash flows, but if you do so, it is not bitcoin that is the asset, but the underlying contractual claim. Put simply, when you buy a dollar or euro denominated bond, it is the bond that is the asset, not the currency of denomination.

Bitcoin is not a commodity. It is true that block chains are finding their way into different segments of the economy and that the demand for block chains may grow exponentially, but bitcoin does not have a proprietary claim to block chain technology. In fact, you can utilize block chains with fiat currencies or other crypto currencies, and many do. There are some cryptos, like ethereum, that are designed to work much better with block chains, and with those crypto currencies, there is a commodity argument that can be made.

Bitcoin is a currency, but it is not a very good one (at least at the moment): Every year, since its inception, we have been told that Bitcoin is on the verge of a breakthrough, where sellers of products and services will accept it as payment for goods and services, but twelve years after its creation, its acceptance remains narrow and limited. There are simple reasons why it has not acquired wider acceptance. First, if the essence of a currency is that you want transactions to occur quickly and at low cost, bitcoin is inefficient, with transactions times and costs remaining high. Second, the wild volatility that makes it such a desirable target for speculative trading makes both buyers and sellers more reluctant to use it in transactions, the former because they are afraid that they will miss out on a price run up and the latter because they may be accepting it, just before a price drop. Third, a currency with an absolute limit in numbers is one that is destined for deflation in steady state, in economies with real growth. I know that stories about the Silk Road have enshrined the mythology of bitcoin being the currency of choice for illegal activities, but a currency designed purely for evasion (of crime and taxes) is destined to be a niche currency that will be under assault from governments and law enforcement.

Bitcoin is a collectible, but with a question mark on longevity: I have described Bitcoin as millennial gold, and you could argue that, at least for some young people, holding bitcoin resonates more than holding gold. They may be right in their choice, but there are two issues that they need to confront. The first is that while bitcoin’s allure is that it has limits on quantity, that assumes that it has no substitutes. If other cryptos can operate as substitutes, even imperfect ones, there is no limit on quantity, since you can keep creating new variants. The second is whether the desirability of bitcoin will endure, since much of that desirability right now is built on its past price performance. In other words, if traders move on from bitcoin to some other speculative investment, and bitcoin prices stagnate or drop, will traders continue to hold it? In Bitcoin's favor, it has been able to make it through prior downturns, and not only survive but come back stronger, but the question still remains.

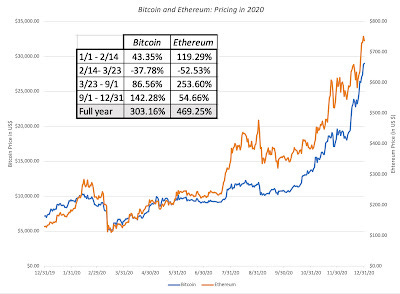

Looking at how Bitcoin did in 2020 can give us insight into its future. In the graph below, I look at Bitcoin and Ethereum prices through the year:

Yahoo! Finance

Both Bitcoin and Ethereum delivered spellbinding returns in 2020, with Bitcoin up more than 300% and Ethereum up 469%. It may seem odd to take issue with either investment after a year like this one, but there are two components to the year's performance that should give pause to proponents. The first is that during the crisis weeks (2/14 - 3/23) and the months afterwards (3/23 - 9/1), Bitcoin and Ethereum both behaved more like very risky stocks than crisis assets, undercutting the argument that investors will gravitate to them during crises. The second is that there were no significant developments that I know off, during the last few months of 2020, that advanced the cause of Bitcoin as a currency or Ethereum as a commodity, which leaves us with momentum as the dominant variable explaining the price run up.

Does that mean that we are headed for a correction in one or both of these cryptos? Not necessarily, since momentum is a dominant force, and while momentum can and will break, the catalysts for that to happen are not obvious in either Bitcoin or Ethereum, precisely because they are unformed. Since the end game (currency or collectible) is still being hashed out, there are no markers against which progress is being measured, and thus, no disappointments or surprises that will lead to a reassessment. Put simply, if you don't know where Bitcoin is going, how would you know if it is getting there? Let me suggest that this confusion serves the interests of bitcoin traders, keeping its prices volatile, but it comes at the expense of bitcoin’s long term potential as a currency or collectible, which require more stability.

The Investment Lessons

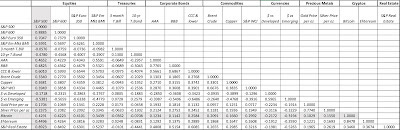

Every investing class starts with a discourse on diversification, an age-old lesson of not putting your eggs in one basket, and spreading your bets. In the last few decades, a combination of modern portfolio theory and data access has quantified this search for stability into a search for uncorrelated investments. When I was learning investments, admittedly a lifetime ago, I was told to expand my stock holdings to foreign markets and real estate, because their movements were driven by different forces than my domestic stockholdings. That was sensible advice, but as we (collectively as investors) piled into foreign stock funds and securitized real estate, we created an unwanted, but predictable consequence. The correlations across markets rose, reducing the benefits of diversification, and particularly so, during periods of crisis. The co-movement of markets during the 2008 crisis has been well chronicled, and I was curious about how 2020 played out across markets, and to capture the co-movement, I computed correlations using daily returns in 2020, across markets:

Download correlations, with raw data to back them up

If you are rusty on statistics, this table can look intimidating, but it is a fairly easy one to read. To see the story behind the numbers, remember that a correlation of one reflects perfect co-movement, plus one, if in the same direction, and minus one, if in opposite directions, and a number close to zero indicates that there is no co-movement. Here is what I see:

Equities moved together across markets, with correlations of 0.89 between US large cap and small cap, 0.70 between US large cap and European equities and 0.60 between US large cap and emerging market equities. Put simply, having a globally diversified stock portfolio would have helped you only marginally on the diversification front, during 2020.

The US dollar moved inversely with equities, gaining strength when stocks were weak and losing strength when they were strong, and the movements were greater against emerging economy currencies ((-0.54) than against developed economy currencies (-0.17). That may have offset some or much of the diversification benefits of holding emerging market stocks.

Treasury bond prices moved inversely with stock prices, at least during 2020. That can be seen in the negative correlations between the S&P 500 and 3-month T.Bills (-.06) and 10-year T.Bonds (-0.48). In other words, on days in 2020, when interest rates rose (fell) strongly, causing T.Bond prices to drop (rise), stock prices were more likely to go up (down). (I computed daily returns on treasury bonds, including the price change effect of interest rates changing.)

With corporate bonds, the relationship with stock prices was positive, with lower-grade and high yield bonds moving much more with stocks (S&P 500 correlation with CCC & lower rated bonds was 0.60), than higher grade bonds (S&P 500 correlation with CCC & lower rated bonds was 0.47).

In 2020, at least, commodity prices moved with stock prices, with the correlations being strongly positive not just for oil and copper, but with the broader commodity index.

The S&P real estate index moved strongly with stocks, but a caveat is in order, since this index measures securitized real estate. Most of real estate is still held in private hands, and the prices on real estate can deviate from securitized real estate prices. The Case-Shiller index measures actual transactions, but it is not updated daily, and thus does not lend itself to this table.

Gold and silver provided partial hedges against financial assets (stocks and bonds), but the correlation was not negative, as it was in the 1970s. During 2020, gold and silver both posted positive correlations with the S&P 500, 0.17 for the former and 0.24 for the latter.

Cryptos moved more with stocks than gold, with bitcoin exhibiting a correlation of 0.43 with the S&P 500 and ethereum correlated 0.45 against the same index. Interesting the correlation between cryptos and gold is low; the correlation is 0.10 between bitcoin and gold and 0.12 between ethereum and gold.

I know that this is all from one year, and that these correlations are unstable, but it is crisis years like 2008 and 2020 that we should be looking at, to make judgments about the relationship between investments and risk. The bottom line is that diversification today is a lot more difficult than it was a few decades ago, and staying with the old playbook of hold more foreign stocks and some real estate will no longer do the trick.

YouTube Video

Spreadsheets

Data Updates for 2021