Wednesday, February 15, 2023

Data Update 5 for 2023: The Earnings Test

As I have argued in all four of my posts, so far, about 2022, it was year when we saw a return to normalcy on many fronts, as treasury rates reverted back to pre-2008 levels, and risk capital discovered that risk has a downside. During the course of the year, investors also rediscovered that the essence of business is not growing revenues or adding users, but making profits from that growth. In this post, I will focus on trend lines in profitability at companies in 2022, with the intent of addressing multiple questions. The first is to see how the increase in inflation in 2021 and 2021 has played out in profitability for companies, since inflation can increase profits for some firms, and lower them for others. The second is on whether these profit effects vary across geographies and sectors, by estimating profitability measures across regions and industries. The third is to revisit the link between profitability and value at companies, since making money is a first step for any business to survive, but making enough money to create value in business is a much more stringent test for businesses, and one that many fail.

Profits: Levels and Trends

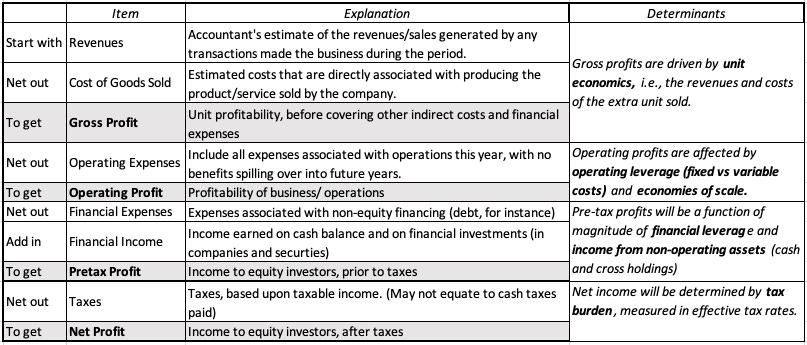

The end game for any business, no matter how noble its mission and how much good its products and services do, is to make money, since without profits, the business will soon run out of capital and sink into oblivion. That said, if you own the business, you may decide to accept less profits in return for social good, as you pursue your business, but you may not get the same degrees of freedom, if you are a manager at a publicly traded company, since you will now be doing good, with other people's money. Even in these cases, where you constrain your profits for the greater good, you still cannot stay on an endless path of losses. That said, there is surprising confusion about what it means for a company to make money, with different measures of profit used by investors, analysts and companies to bolster their priors about companies. To set the stage, I will start by laying out the differences measure of earnings that reported on an income statement:

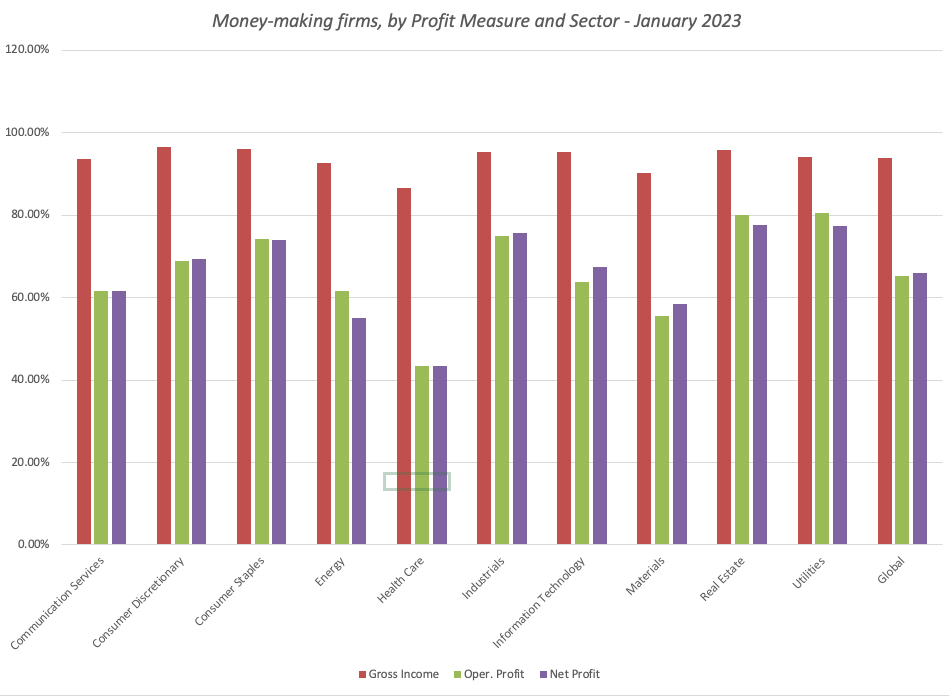

At the top of the profit ladder is gross income, the earnings left over after a company has covered the direct cost of producing whatever it sells. Netting out other operating expenses, not directly related to units sold but still an integral part of operating a business (like selling and G&A expenses) yields operating income. Subtracting out interest expenses, and adding interest income and income from non-operating assets results in taxable income or pre-tax profit, and after taxes, you have the proverbial bottom line, the net income. Not surprising, there is many a cost between the gross and the net versions of earnings, and while there remain a few firms, especially young and start-up, with negative gross income, the likelihood of losses gets progressively greater as you move down the income statement. In the graph below, I look at all publicly traded firms, listed globally at the start of 2023, and at the percent of firms, within each sector, that have positive earnings using gross, pre-tax operating and net income:

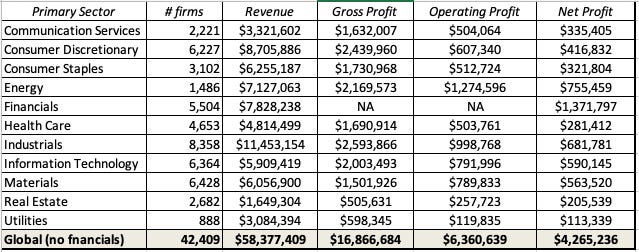

Not surprisingly, while more than 85-90% of all firms report positive gross income, that number drops down to just about 60%, with net income. All of the sectors are subject to the same phenomenon, but there are outliers in both directions, with health care have the highest drop off in money makers, as you go from gross to net income, and real estate and utilities having the smallest. Finally, I look at the aggregated values across all companies on all three income measures, across all global companies, again broken down by sector:

Collectively, global companies reported $16.9 billion in gross profit in the last twelve months leading into 2023, but operating income drops off to $6.4 billion and need income is only $4.3 billion. With financial service firms, where gross and operating income are meaningless, we report only net income, and the sector remains the largest contributor to net income across companies.

Profit Margins

While absolute profits are a useful measure of profitability, you have to scale profits to a common scaling variable, to compare companies of different scale. One common scaling measure is revenues, and that scaling, of course, yields profit margins. The graph below draws a distinction between a medley of margins that are in use:

In addition to scaling gross, operating and net profits to revenues, to get to gross, operating and net margins, I have also added two variants. One is to compute the taxes you would have paid on operating income, if it had been fully taxable, to get after-tax operating income and margin, and the other is to add back depreciation to operating income to get EBITDA and EBITDA margin.

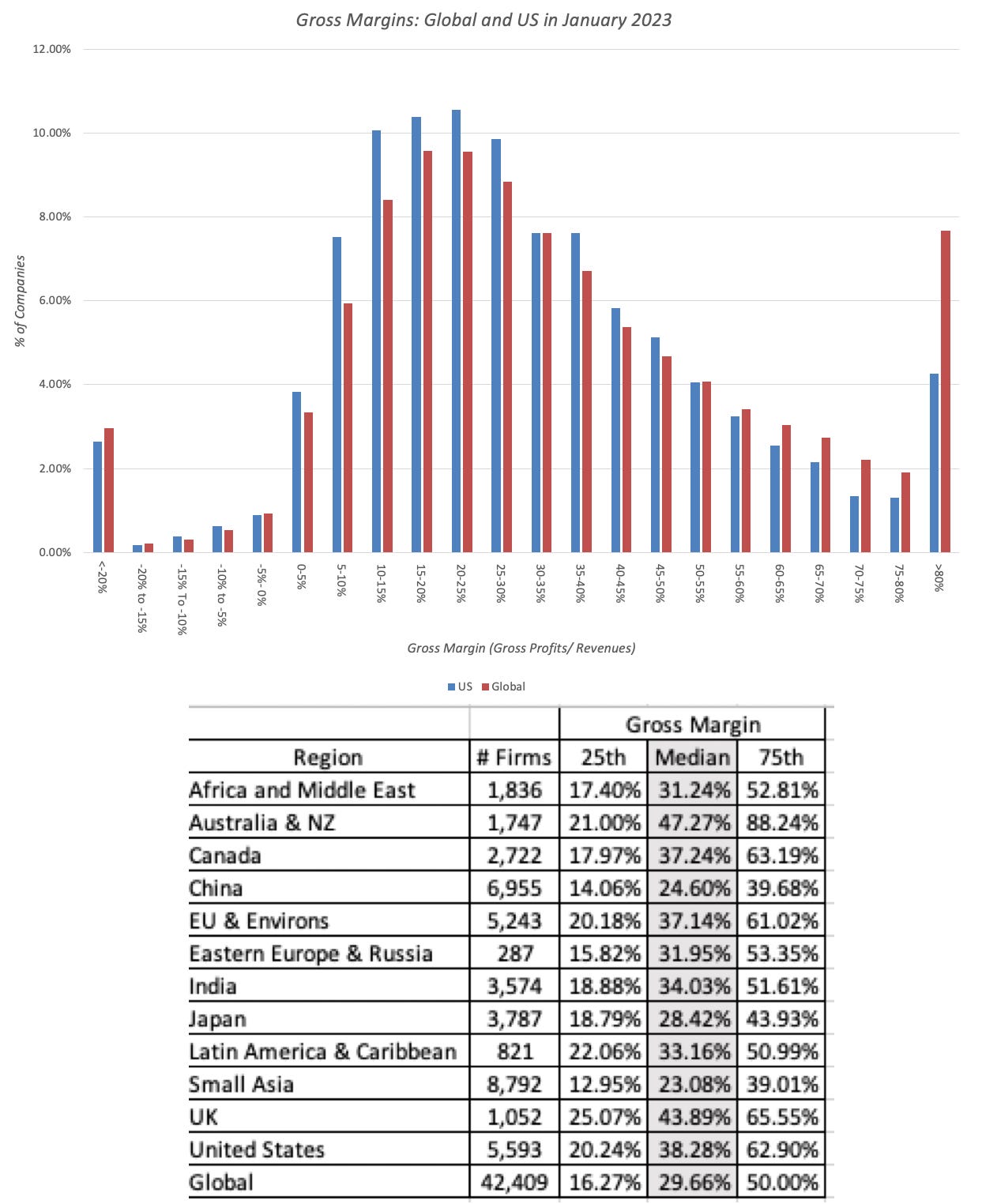

Starting with gross margins, and computing the number for all non-financial service firms, we report the distribution of gross margins across publicly traded companies at the start of 2023, again based upon gross income and sales in the most recent twelve months:

While the median gross margin across all publicly traded global firms is about 30%., there are variations across the globe, with Chinese companies reporting the lowest gross margins and Australian companies having the highest. Some of that variation can be attributed to different mixes of businesses in different regions, since unit economics will result in higher gross margins for technology companies and commodity companies, in years when commodity prices are high, and lower gross margins for heavy manufacturing and retail businesses.

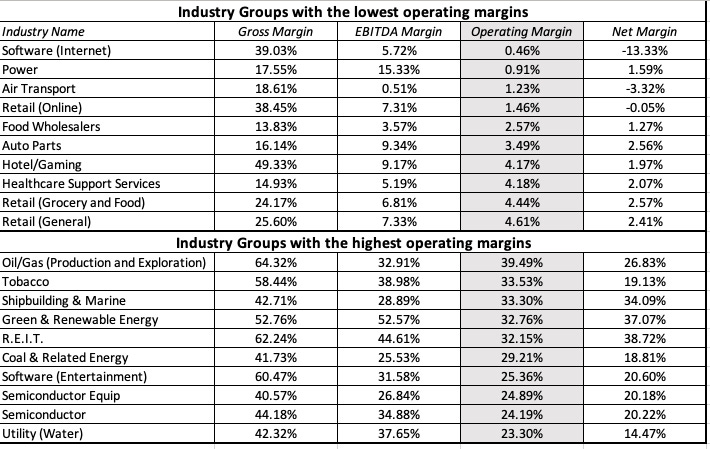

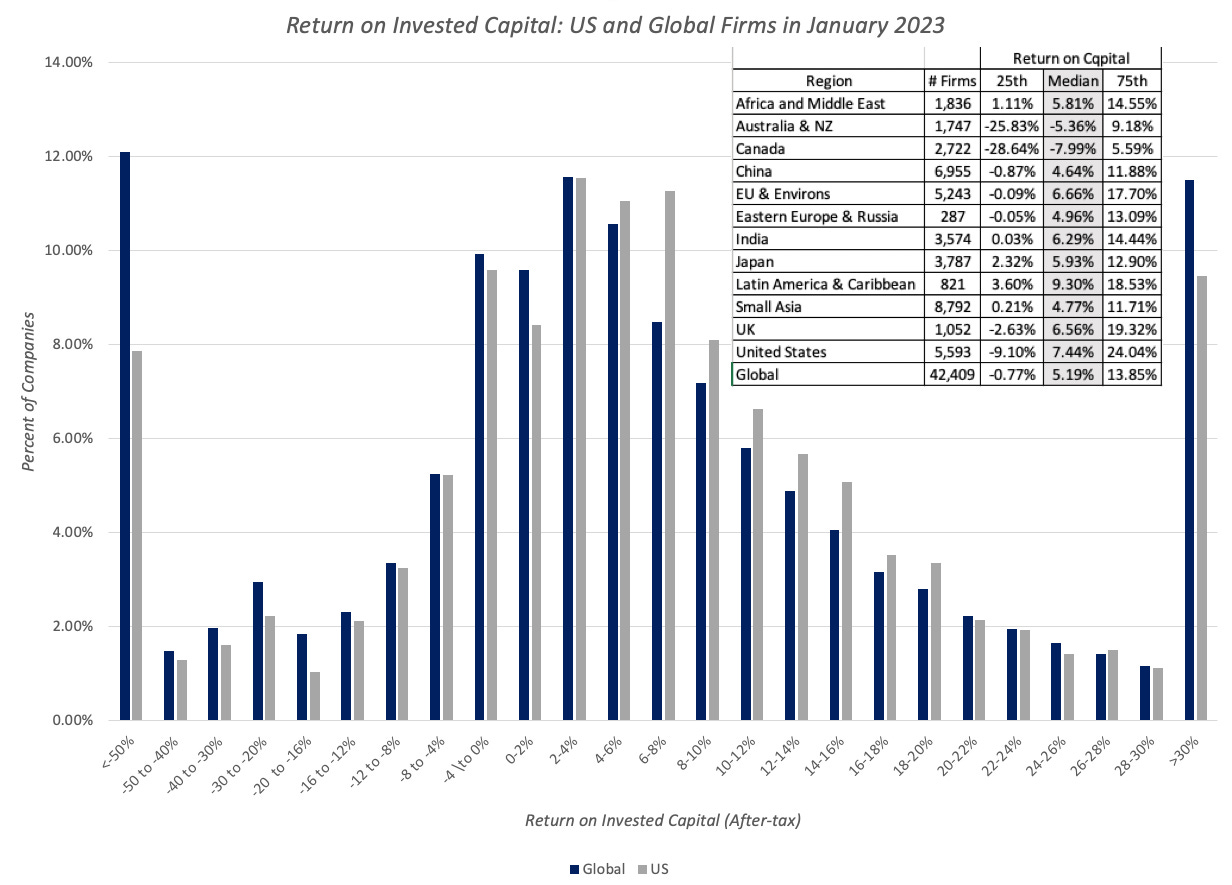

To explore differences in profit margins across industry groups, I broke stocks down into 94 industry groups, and sorted industries, based upon operating margin, from highest to lowest. In the table below, I list the ten industry groups with the lowest margins in the twelve months leading into 2023 and the ten industry groups with the highest:

Source: Profit Margins, by industry group (full list)

The money-losers include four industry group from the retail space, a business with a history of low operating margins, a young industry in online software, a couple of industries in long-term trouble in airlines and hotel/gaming. The money makers include a large number of energy groupings, reflecting oil prices being elevated through much of the reporting period (October 2021-September 2022), a few technology groupings (software and semiconductors) and a declining, but high-profit business in tobacco.

Accounting Returns

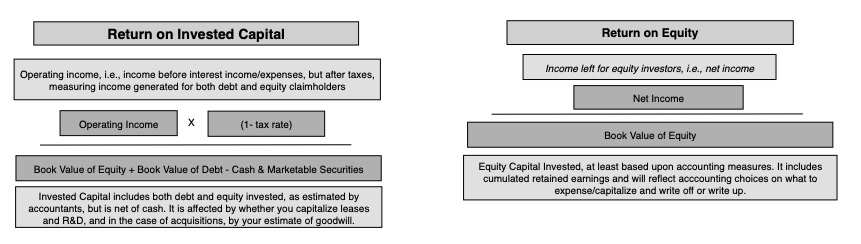

While profit margins tell a part of the profitability story, a high margin, by itself, may be insufficient to make a judgment on whether a business is a good one, i.e,, a business that consistently generates returns that exceed the cost of funding it. It is to remedy this defect that analysts scale profits to invested capital, with equity and capital variants:

In the equity version, you divide net income by book equity to estimate a return on equity, a measure of what equity investors are generating on the capital they have invested in a company. In the firm version, you divide after-tax operating income, again acting like the entire operating income would have been taxable, by total invested capital, the sum of book equity and book debt, with cash netted out, to obtain return on capital. The latter has several different names (return on capital employed, return on invested capital) with some mild variants on calculation, but all sharing the same end game. Both accounting returns are computed based upon book value, not because we have suddenly developed trust in accounting, but because the objective is to estimate what investors have earned on what they originally invested in a company, rather than an updated or a marked-to market value. I know that ROIC has acquired a loyal, perhaps even fanatical, following among financial analysts, and there are a few like Michael Mauboussin who use it to extract valuable insights about business economics and value creation, but I find that many analysts who use the measure are unaware, or unwilling, to learn about the limits of accounting returns. I have a long and extremely boring paper on the fixes that you need to make to the computation, especially with older companies and companies where accounting is inconsistent in its classification of expenses.

Notwithstanding its many limits, I do think there is value in knowing what return on invested capital a company is generating, and I do compute the return on invested capital for every publicly traded non-financial firm in the world, and the calculation details are below:

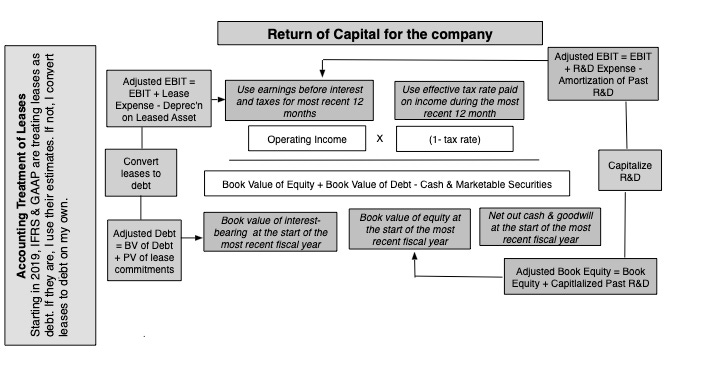

The distribution of resulting returns on capital for the 42,000 publicly traded, non-financial firms are shown below:

The after-tax returns on capital, at least in the aggregate, are unimpressive, with the median return on capital of a US (global) firm being 7.44% (5.19%). There are a significant number of outliers in both directions, with about 10% of all firms having returns on capital that exceed 50% and 10% of all firms delivering returns that are worse than -50%.

Excess Returns

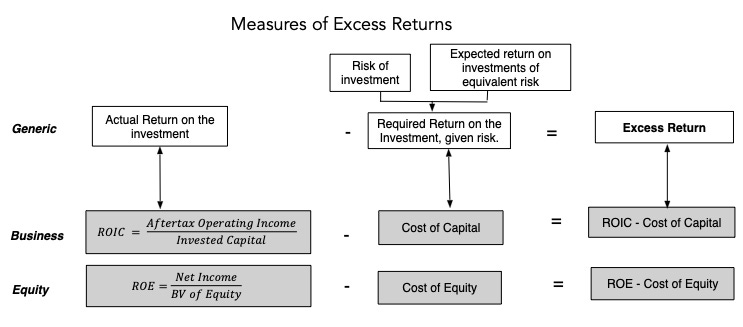

If your reaction to the median return on capital being 7.44% for US companies and 5.19% for global companies is that they are making money, you are right, but when you invest capital in risky businesses you need to not just make money, but make enough to cover what you could have earned on investments of equivalent risk. It was in attempting to estimate the latter that I computed the costs of equity in my second post and costs of capital in my third. In fact, comparing the accounting returns from the last section to the costs of equity and capital that we computed earlier allows us to compute excess returns to equity and the firm:

Put simply, value creation comes from delivering returns on equity and capital that are higher than the costs of equity and capital, and while you can take issue with using accounting returns from the most twelve months as a proxy for long term returns, the comparison is still a useful one to make:

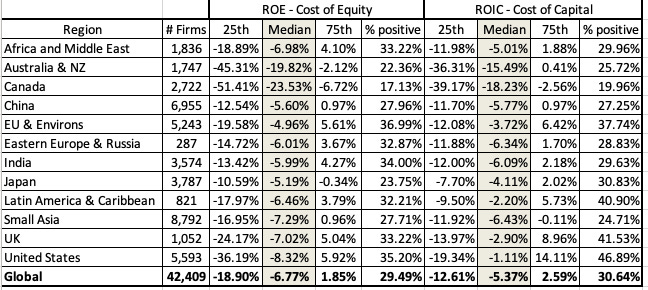

As you can see in this table, almost 70% of all listed companies earned accounting returns that were lower than their costs of equity or capital. On a regional basis, US companies have the highest percent of companies that earn more than the cost of capital, but still falling short of 50%, and Canadian companies performed the worst, with more than 80% of companies delivering returns that were lower than the cost of capital.

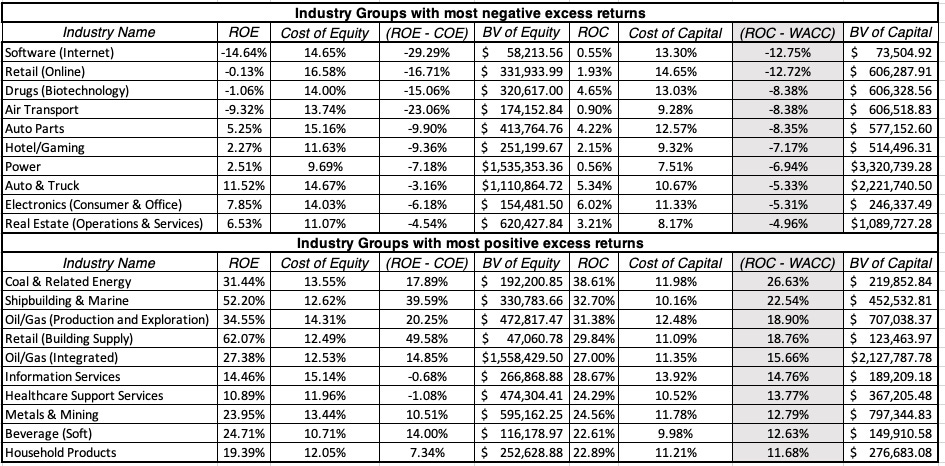

It is certainly true that while the typical company had trouble making its costs of equity or capital, there are industry groups that generate returns that significantly exceed their costs, just as there are industry groups that operate as drags on the market. I look at the ten industry groups with the most positive and the most negative excess returns in the table below:

Download spreadsheet with excess returns for all industry groups

The rankings are similar to those that we got with margins, but it is clearly an ESG advocate's nightmare, as the list of companies that deliver the most positive excess returns are a who's who of companies that would be classified as bad, with tobacco, oil and mining dominating the list.

Conclusion

If 2022 was a reminder to investors that the end game for every business is to not just generate profits, but to generate enough profits to cover its opportunity costs, i.e, the returns you can make on investments of equivalent risk, and that game became a lot more difficult to win in 2022. As I noted in my second and third posts, a combination of rising risk free rates and surging risk premiums (equity risk premiums and default spreads) has conspired to push the cost of capital of both US and global companies more than any year in my recorded history (which goes back to 1960). A company generating a 7.44% return on capital (the median value at the start of 2023) in the US, would have comfortably cleared the 5.60% cost of capital that prevailed at the start of 2022, but not the 9.63% cost of capital at the start of 2023. There will be, and has already been, investor remorse about investments taken a year or more ago, but hoping that the cost of capital will come back to 2021 levels is not the solution. While there is little that can be done about past mistakes, we can at least stop adding to those mistakes, and one place to start is by updating hurdle rates, as investors and businesses, to reflect the world we live in, rather than some normalized past version of it.

YouTube Video

Data Links

Profit Margins (US, Emerging Markets, Europe, Japan, Global)

Excess Returns (US, Emerging Markets, Europe, Japan, Global)

Papers

I see the profit margins for latam before deducting the cost of capital are good. Makes me think that there is strong potential for unlocking value if the region works to reduce its risk profile since much of it might come from the geopolitical and fiscal policy side. But I wonder of higher spread of ROIC-WACC/ ROE-RE its a predictor of higher equity returns...

Hello Sir

I wanted to Thank you for posting regularly over the last 14 years. I have learnt a lot and I am not sure I can repay you in kind. I hope you keep posting and I hope that I will be able to complete both of your courses and read all of your books in the coming years.

Thanks and Regards

Sanjeev