In my last post, I looked at banking as a business, and used a simple banking framework to advance the notion that the key ingredient tying together the banks that have failed so far in 2023 is an absence of stickiness in deposits, created partially by depositor and deposit characteristics (older are stickier than younger) and partly by growth in deposits (high growth increases stickiness). I also used the banking framework to argue that good banks have stickier deposits, with a higher precent of these deposits being non-interest bearing, that they invest in loans and investment securities on which they earn interest rates that cover and exceed the default risk in these investments. While differentiating between good and bad banks can be straightforward, it does not follow that buying good banks and selling bad banks is a good investment strategy, since its success depends entirely on what the market is incorporating into stock prices. An investor who buys a good bank at too high a price, given its goodness, will underperform one who buys a bad bank at too low a price, given its badness. In this post, I will begin by looking at how to value banks and follow up with an examination of investor views of banking have changed, by looking at pricing, before examining divergences in how banks are priced in the market today.

The Intrinsic Value of Bank Equity

I am a dabbler in all things valuation-related, and I find the process fascinating, as stories about businesses get translated into valuation inputs, and finally into value. I enjoy challenging valuations, but banks remain, at least for me, the last frontier in valuation, simply because so much of what we do in conventional valuation does not work with banks, and a crisis or panic can upend even the most carefully done bank valuation.

All Equity, All the time!

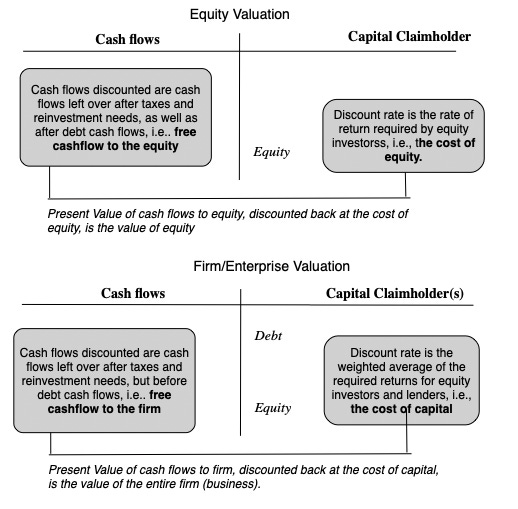

With most non-financial service businesses, you face a choice in how you approach valuation. You can value the enterprise or the entire business, focusing on valuing the operations or assets of the business, and consider capital as inclusive of both debt and equity. Alternatively, you can value just the equity in the business, focusing on cash flows left over after debt payments and discounting back at a rate of return that reflects the risk that equity investors face:

With banks, this choice does not exist, since debt to a bank can be expansively defined to include deposits as well, making it effectively raw material for the bank's operations, where the objective is borrow money (from depositors and lenders) at a low rate and lend it out or invest it at a higher rate. Consequently, you can only value the equity in a bank, and by extension, the only pricing multiples you can use to price banks are equity multiples (PE, Price to Book etc.). The notion of computing a cost of capital for a bank is fanciful and fruitless, and any attempt to compute an enterprise value for a bank is destined to end in failure.

Equity Valuation 101 and Dividend Discount Model

Staying on equity valuation, the intrinsic value of equity can be written as a function of the cash flows left for equity investors, after reinvestment and taxes, and after all other claim holders have been paid, and the cost of equity:

Over the decades, analysts trying to put this model into practice with banks have run into trouble estimating cash flows for banks, using the traditional structure, since items like capital expenditures and working capital are impossible to measure at banks. It should come as no surprise that, at least with banks, analysts fell back on the only observable cash flows to equity, i.e., dividends;

It is this line of reasoning, i.e., that it is difficult, if not impossible, to estimate banking free cashflows to equity, that I used prior to 2008, when I argued for the use of the dividend discount model to value banks In using the dividend discount model, I was making two implicit assumptions. The first was that banks were run by sensible people, who paid out what they could afford to in dividends, neither holding back on paying dividends nor paying too much in dividends. The other was that the bank regulatory framework operated effectively, preventing banks from overreaching on risk or being under capitalized.

A Bank FCFE Model

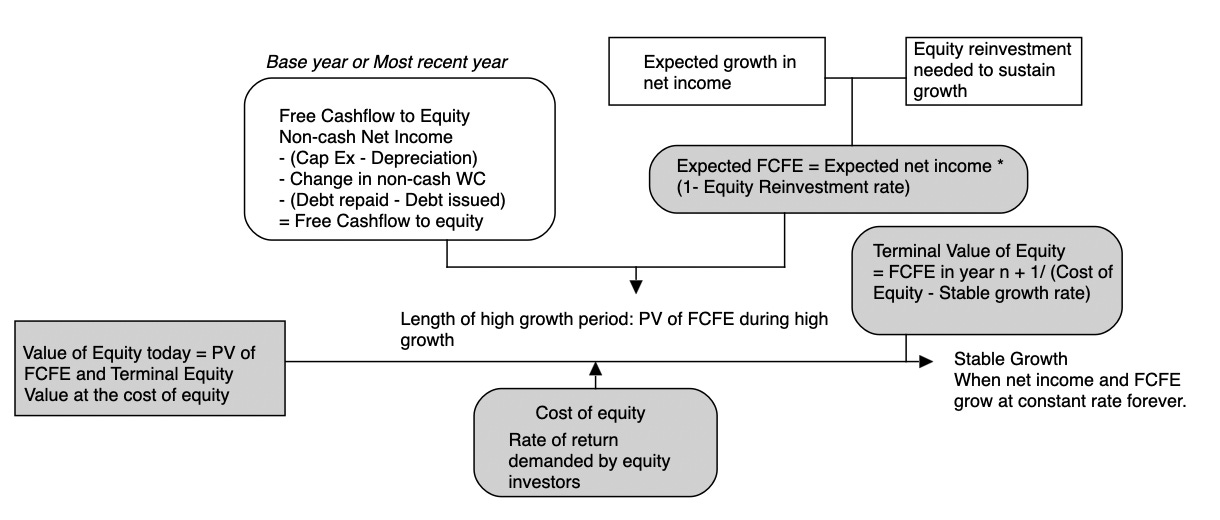

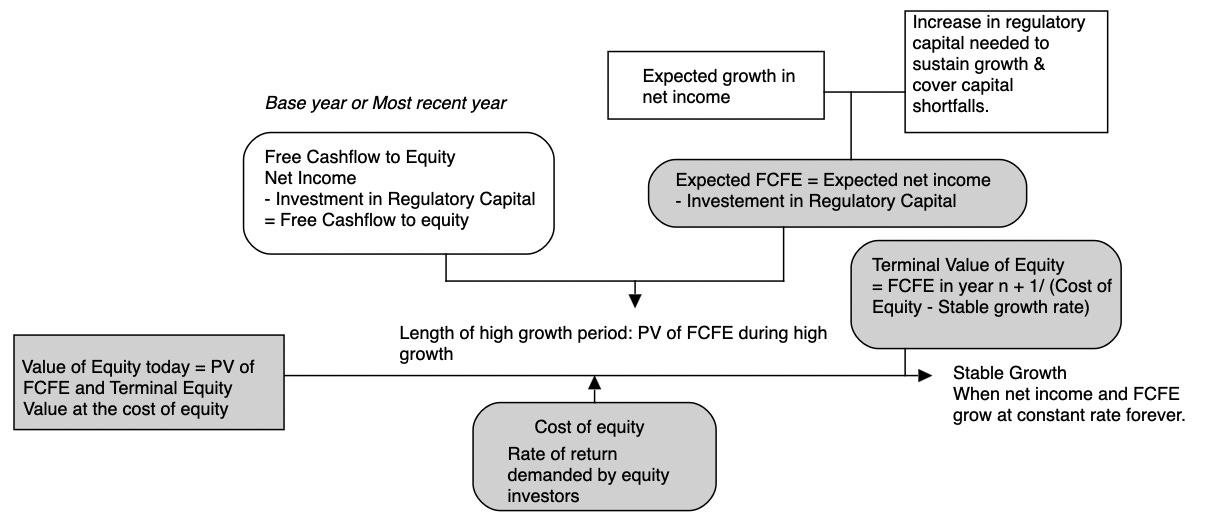

The events of 2008 dispelled me of both delusions that allowed for the use of the dividend discount model, as it became clear that the managers of banks were anything but sensible and the regulatory framework had large holes in it that were exploited. In the years after, I have replaced dividends with a variant on free cash flow to equity, defined through the lens of a banking business, discounted back at a cost of equity reflecting banking risks (duration mismatches, low regulatory capital and riskiness of loan/investment portfolios).

Note the differences between the bank FCFE and bank dividend discount models.

The first is that unlike dividends, which are floored at zero, the free cash flow to equity for a growing or severely undercapitalized bank can be negative, reflecting the need to raise fresh equity to survive.

The other is that by tying cashflows to capitalization, it allows us to bring in that same factor into risk and costs of equity, with under capitalized banks have higher costs of equity.

As a final component of bank equity value, and 2023 has brought this home to us is the reality that even a healthy, profitable bank can see its value melt away in days, if its depositors decide, for good, bad or no reasons at all, to withdraw their deposits and put the bank into the death spiral from which recovery can be close to impossible. Since this risk is existential, it is almost impossible to build into a discounted cash flow model, which is for a going-concern, and has to be incorporated as a risk of failure.

In short, the banking version of a FCFE model gives us access to levers that allow us to differentiate across banks and bring in the elements that make some banks better than others.

Valuing Citi

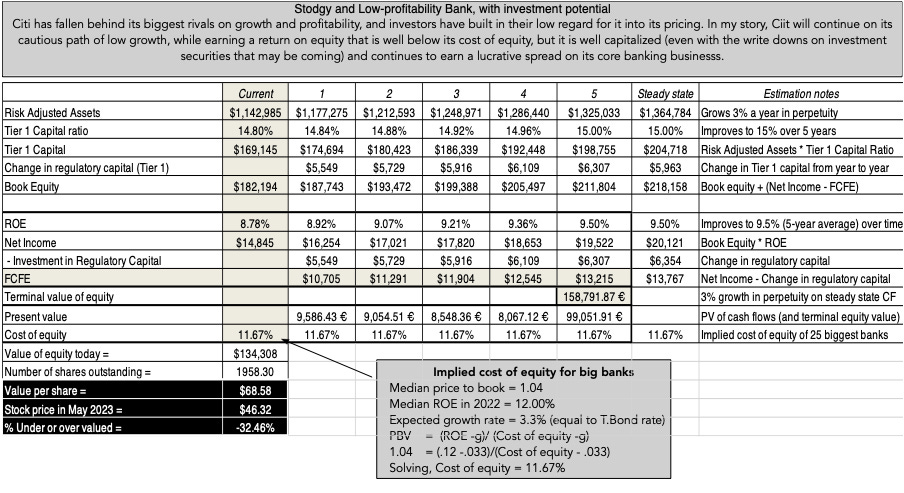

Intrinsic valuation models connect only when applied to real companies, and in the table below, I used the Bank FCFE model described above in my valuation of Citi (a choice that may strike you as odd, but which you will understand if you read the rest of my post). To set the table, in the battle of big banks for investor acclaim, Citi has clearly lost the battle not only against JP Morgan Chase, but against most of the other big US banks. It has delivered low growth and subpar profitability, but it has built up buffers in its capital ratios and still has a banking model that delivers a lucrative interest rate spread.

In my valuation, I will assume that Citi will continue on its cautious, low-growth path, growing its risk-adjusted assets at 3% a year in perpetuity, a little lower than its 3.74% growth rate over the last 5 years. Over time, I expect some improvement in the return on equity, which was 8.78% in 2022, to its five-year average of 9.50%, which is still lower than the cost of equity of 11.67% that I am using for large commercial banks (see picture below for how I am computing an implied cost of equity for the 25 largest banks). Finally, I will assume that the bank will continue to marginally improve its Tier 1 capital ratio, currently at 14.80% to reach a target of 15.00%, in five years:

Download spreadsheet to value Citi (or any bank)

Note that the combination of low growth and a healthy, current regulatory capital ratio keep the needs for reinvesting in regulatory capital low, allowing for large potential dividends. Those high cash flows, even though they are delivered by a bank that earns and expects to continue to earn an ROE less than its cost of equity translate into a value of equity for Citi of about $69, making it about 32% under valued auto the stock price of $46.32, at close of trading on May 5, 2023. Obviously, you will have very different views about Citi than I do, and you are welcome to download the spreadsheet and input your numbers not just for Citi, but for any bank.

The Pricing of Bank Equity

You have heard me say this before, but I don't think there is any harm in repeating this. Value and price are words that are often used interchangeably, but they come from different processes and can yield different numbers for the same asset or company.

Since pricing requires comparison across companies, often with different units (numbers of shares outstanding), we generally convert market values into pricing multiples, to allow for this comparison. As we noted in the last section, the pricing multiples that we use to compare banks have to be equity multiples, with price earnings rations and price to book ratios being the most common choices.

Price to Book Ratio: Choice and Drivers

There is no sector where price to book ratios get used more than in banking and financial services, for two reasons. The first is that the book value of equity for a bank, by becoming the basis for regulatory capital, has operating consequences, since actions or events that lower than book value of equity (an unexpected loss, a regulatory fine, a trading shortfall) can cause a bank to become undercapitalized and go out of business. The other is that marking to market is more common in banks than at other sectors, the hold-to-maturity loophole notwithstanding, and that should make book value of equity a more meaningful figure than book value of equity at a software or a consumer product company.

To use the price to book ratio to price banks, I begin by identifying its drivers, and that is simple to do, if you start with an intrinsic equity valuation model. In fact, using the simplest equity valuation model that I can think of, which is a stable growth dividend discount model, we get:

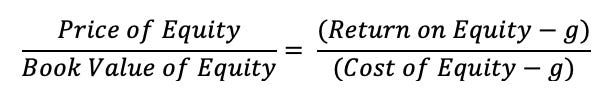

Dividing both sides by book value of equity, and setting growth rate = (1- Payout ratio) ROE, we can simplify this equation:

This equation, in its simple, stable growth form, suggests that whether a bank trades at below or above its book value of equity will be driven by whether investors expect banks to earn more than their cost of equity (price to book>1), roughly the cost of equity (price to book = 1) or less than the cost of equity (price to book <1).

Price to Book for Banks: Over time

To get a measure of how banks are being priced today, it is worth getting perspective as to how investor views on bank profitability and risk have changed over time. To gain this perspective, I looked at the aggregated price to book ratio of all US banks, obtained by first aggregating the market capitalizations of all banks and dividing by the aggregated book equity from 2004 to 2022, at the end of each year, and in May 2023:

If there is a lesson in the graph, it is that the 2008 crisis has left a lasting impression, as US banks have struggled since that crisis to elevate price to book ratios. Even as returns on equity have slowly recovered close to pre-2008 levels, the price to book ratios have not recovered, even as the rest of the market has seen rising price to book ratios, due to lower interest rates. In fact, the 2023 crisis has reduced the aggregate price to book ratio for US banks to close to one, the Maginot line below which investors are assuming that banks will generate return on equity roughly equal to their cost of equity in the long term.

For some, this drop in price to book ratios over time is a sign of market overreaction, and there are some value investors who have overweighted their bank holdings as a consequence. That may very well be the case, but I think it is prudent to see if there are fundamental reasons for the shift:

Higher Risk: One explanation is that investors perceive banks to be riskier than they were prior to 2008, and at first sight, that seems puzzling since banks have become better capitalized over the last decade, as the regulatory authorities have reacted to the 2008 crisis by tightening safety capital requirements:

As you can see the Tier 1 capital at US banks collectively has risen to 13-14% from 10-11% in the years leading into the 2008 crisis and after. It is true, though, that equity as a percent of total assets dipped especially in 2020 and 2021, before bouncing back, but even that statistic has shown little change over the decade.

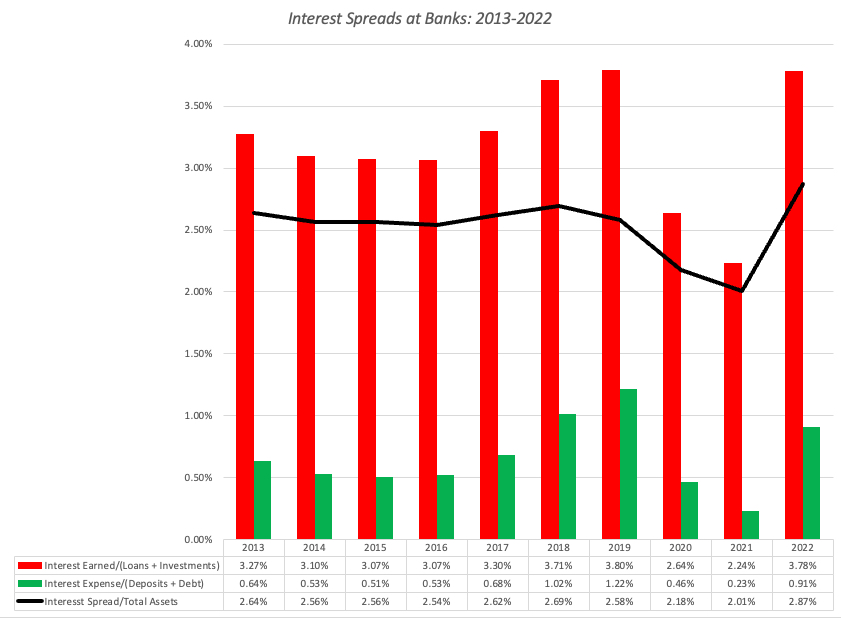

Lower Profitability: Another is that investors don't trust net income reported by banks as final numbers, given the propensity of some banks to surprise them with after-the fact and unexpected losses (from trading mistakes and asset write-downs) or believe that banks are becoming less profitable over time. To see if this is the case, I looked at the interest income and expenses over time at banks:

Like the book equity, the spread dropped in 2020 and 2021, with 2022 showing a recovery. However, as interest rates have risen, it is likely that rates on deposits will rise faster than rates earned on loans and investments in the near term, perhaps a source of concern for investors.

Business Economics; If banks are not more risky, at least collectively, and interest spreads have held their own, the only remaining explanation is that investors believe that the banking business is much less likely to be value-adding now than two decades ago. Almost every aspect of banking is under stress, with deposits becoming less sticky, increased competition for the loan business from fintech and other disruptors and increased risks of contagion and crisis, and while banks remain profitable on the surface, investors have good reason to wonder whether the good times will last.

I know that a contrarian take, especially after the last few months, would suggest investing in banking as a sector, but I believe that the long term trends for the business are negative.

The Pricing of Banks - Across Banks

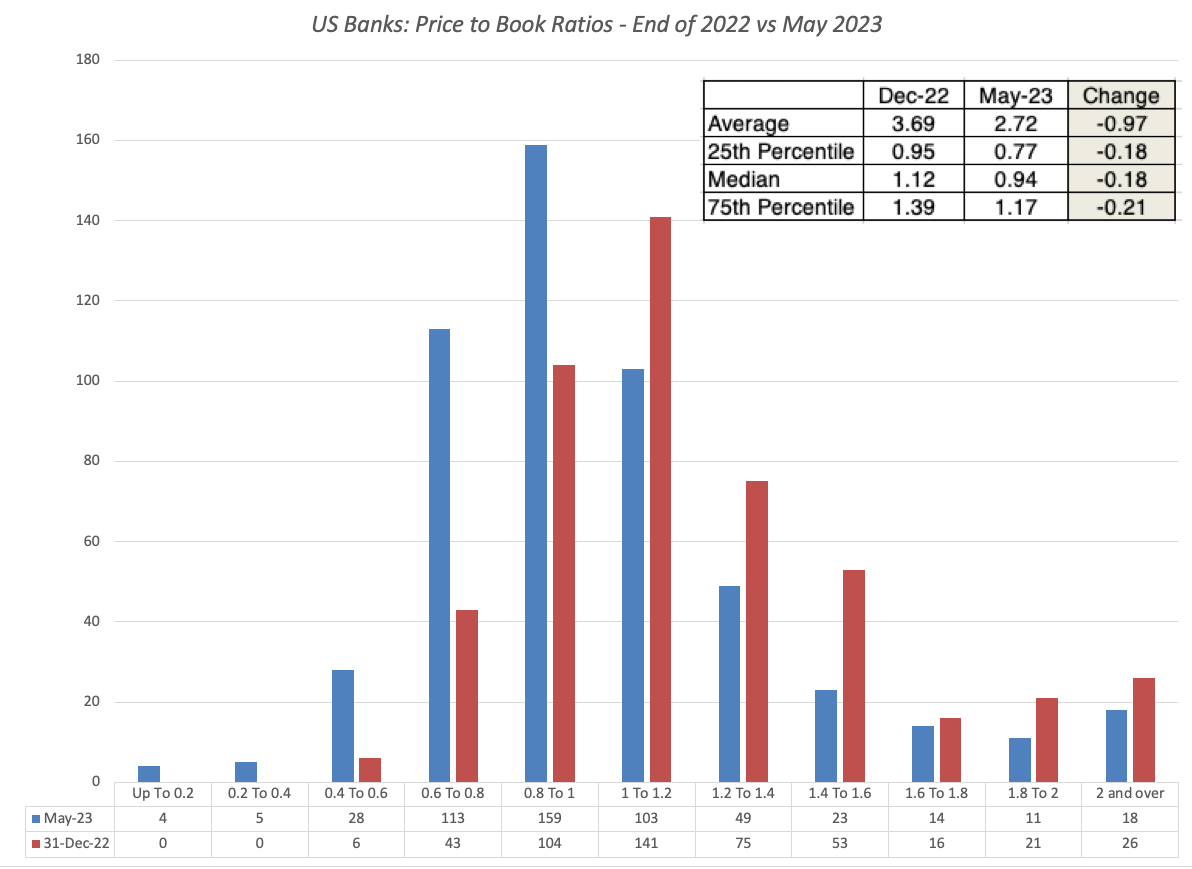

Even though I would not make a collective bet on banks collectively, I do believe that, as in any crisis, individual banks are getting mis-placed. Thus, as investors panic and sell regional banks, it is likely that good regional banks and lumped in bad ones, in the sell off, and if that money is being redirected to the bigger banks, some of those banks may not merit the price increases. Staying with price to book as my pricing metric for banks, I looked at the distribution of price to book ratios across banks, both at the end of 2022, and in May 2023, as the banking crisis has unfolded:

As you can see, the crisis has lowered price to book ratios across the board, with the median price to book ratio dropping from 1.12 at the end of 2022 to 0.94 in May 2022. That decline is almost entirely the result of a decline in market capitalization, since the book values of equity for banks were little changed between the third quarter of 2022 (used for the end of 2022 calculation) and the end of 2022 (used for the May 2023 calculation).

Since the key driver of price to book ratio is the return on equity, I looked at the distribution of returns on equity at US banks in 2021 and 2022:

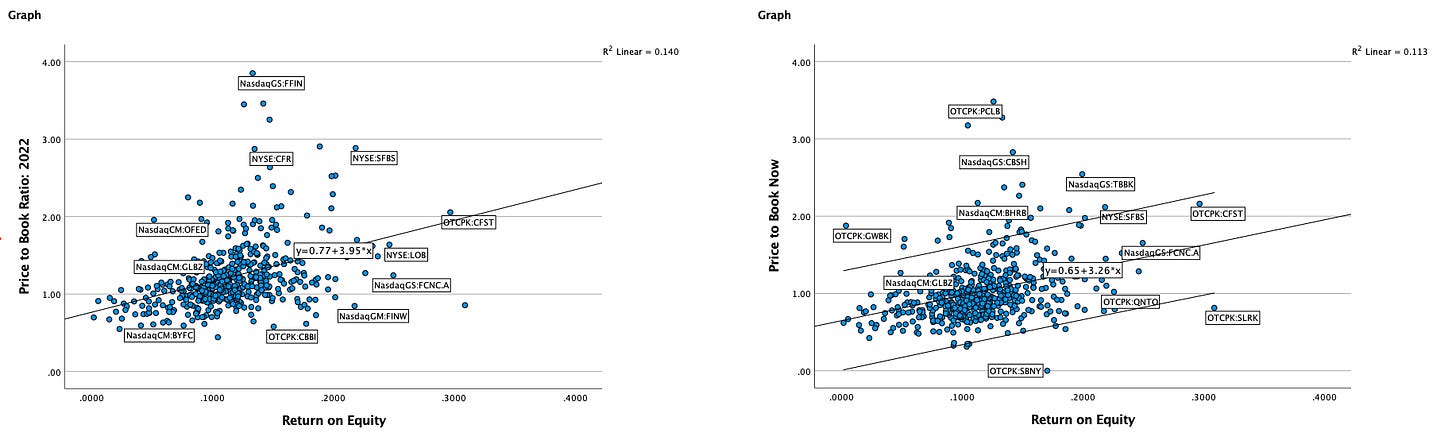

Unlike companies in other sectors, where there are wide variations across companies, the returns on equity at banks is tightly clustered, with 50% of banks having 9.38% (9.24%) and 14.80% (13.75%) in 2021 (2022). However, there are clearly banks that generate higher returns on equity than other banks, and that should play a role in explaining differences in price to book ratios. To check how closely price to book ratios at banks hew to the returns on equities generated by banks, I did a scatter plot of price to book against ROE, both at the end of 2022 and again in May 2023:

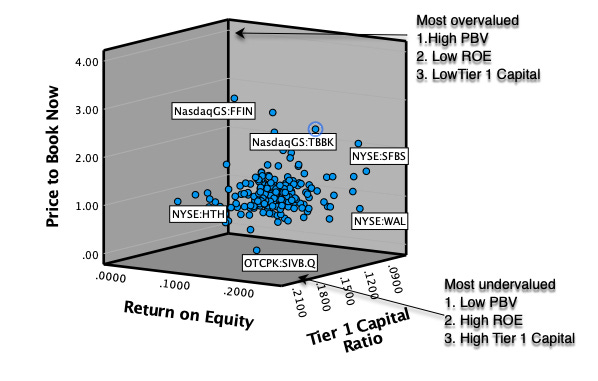

While banks with higher ROE generally trade at higher price to book ratios, there is significant noise in the relationship, though more in May 2023 (with an R squared just above 11%) than in December 2022 (with an R squared just above 14%). In a final visual display, I looked a 3D scatter plot, of PBV against ROE and Tier 1 capital ratios:

I have highlighted the combination that characterizes the most under valued banks (low price to book, high ROE and a high Tier 1 capital ratio) as well as the combination for the most over valued banks (high price to book, low ROE and low Tier 1 capital

The Biggest Banks- Trawling for Bargains!

One of the exercises that I find useful, when pricing, is to look for the perfect underpriced stock, one that looks cheap with no good reason for why it is so cheap. Applying that practice to banks, here is what you would want to see in your underpriced bank:

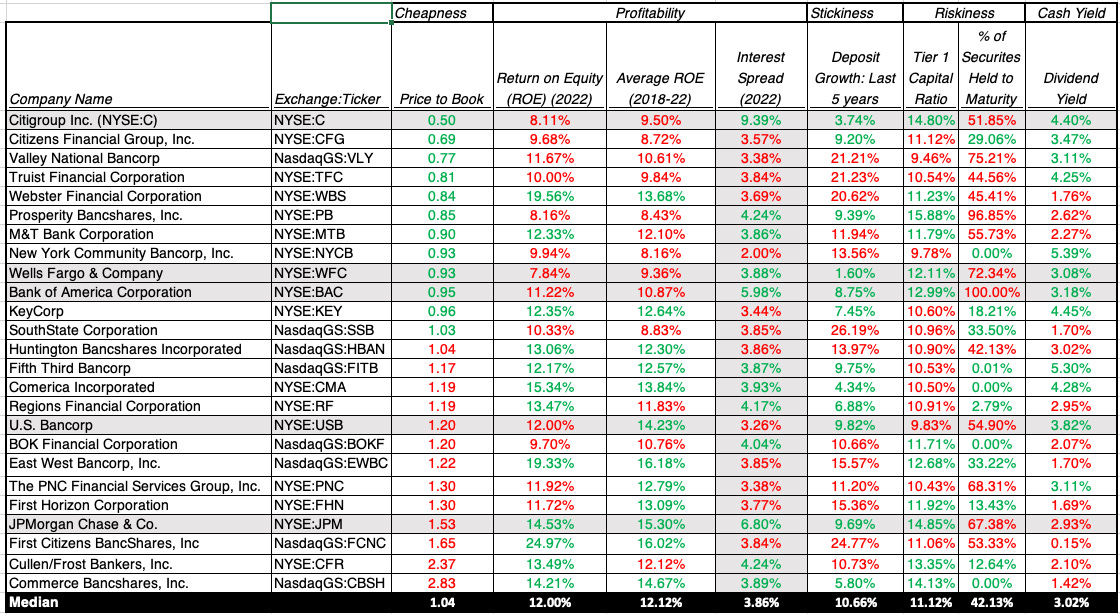

Applying this approach to the 25 largest banks, for instance, I computed the median values for each of these variables for the 25 largest US banks, in terms of market cap, and used it as the dividing line for good and bad on each of the variables. Thus, a return on equity higher than the median of 12% is considered a good (and in green) and less than 12% is considered bad (and in red).

Source: S&P Capital IQ

Put simply, you are looking for a preponderance of green numbers for your under priced banks, and while there no all green banks, Citi comes closest to meeting the tests, scoring well on risk (with a higher than median Tier 1 capital ratio and a lower percent of securities held to maturity among the five biggest banks), deposit stickiness (with low deposit growth) and trades at half of book value (the lowest price to book ratio). Its weakest link is a return on equity of 8.11% (in 2022) and 9.50% (average from 2018-2022), lower than the median for US banks, and while that would suggest a lower than median price to book ratio, the discount at Citi exceeds that expectation. Citi's banking business, though slow growing, remains lucrative with the higher interest rate spread in this sample. I will be adding Citi to my portfolio, since it offers the best mix of cheapness and low risk, and hope that it can at least maintain its profitability, though an increase would be icing on the cake. It is a slow-growth, stodgy bank that seems to be priced on the presumption that it will not only never earn a ROE even close to its cost of equity, and that makes it a good investment.

At the other end of the expectation scales, JP Morgan Chase scores well on operating metrics, with a high ROE, low deposit growth and a high Tier 1 capital ratio, but it trades at a much higher price to book ratio than the other banks, and iwith a lower dividend yield. I have owned JPM Chase for close to a decade in my portfolio, and I don't see anything in this table that would lead me to sell, though I would not be in a hurry to buy either, at today's prices, if I did not own it.

As a value investor, I would be uncomfortable making an investment in Citi, purely based upon this pricing analysis, and it is for that reason that I retraced my steps to do the intrinsic valuation of the bank that you saw in the last section. That reinforces a more general point that even investors who are true believers in valuation can benefit from understanding and using pricing, just as traders, who play the pricing game, can benefit from an understanding of the core principles of intrinsic valuation.

Wrapping up

In my last post, my focus was on the qualities that made for the distinction between good and bad banks, and those qualities includes deposit stickiness, a low interest rate on deposits combined with a high interest rate (given default risk) on loans and investments and a big buffer against shocks (with high book equity and Tier 1 capital ratios). In this post, I shifted attention to the investing side of the picture, and that puts the price you pay to acquire banks on center stage. Acquiring a good bank, while paying too high a price, will make for a bad investment, just as acquiring a bad bank, at a bargain price, will be a good investment. On the contest of banking quality, JP Morgan Chase would beat Citi handily, with a high return on equity and continued growth, combined with safety, but in the contest for investing dollars, Citi is the better priced bank. Since I will have both stocks in my portfolio starting tomorrow, I will have a ringside seat to watch this contest play out over the next few years.

YouTube Video

Iirc Sandy Chen had a book on an ROIC methodology for bank - sensible framework i seem to recall.

Nice post! When reading '(high growth increases stickiness)' at the top i intuitively believed it was a typo and the reverse holds true and further down zou seem to agree referring to Citi's low deposit growth. Could you confirm? Thx!