High and higher: The Money in Marijuana!

In 1992, when Bill Clinton was running for president of the United States, and was asked whether he had ever smoked marijuana, he responded that he had, but that he did not inhale, reflecting the fear that being viewed as a weed-smoker would lay low his presidential ambitions. How times have changed! Today, smoking marijuana recreationally is legal in nine states, and medical marijuana in twenty nine states, in the United States. Outside the United States, much of Europe has always taken a much more sanguine view of cannabis, and on October 17, 2018, Canada will become the second country (after Uruguay) in the world to legalize the recreational use of the product. In conjunction with this development, new companies are entering the market, hoping to take advantage of what they see as a “big” market, and excited investors are rewarding them with large market capitalizations. I have never smoked marijuana, but on my daily walks on the boardwalks of San Diego, I have been inhaling a lot of second-hand smoke, leaving me a little light headed as I write this post. So, read on at your own risk!

The Macro Big Picture

While there is much to debate about how this market will evolve over time, and whether investors and businesses can make money of that evolution, there is one fact that is not debatable. The cannabis market will be a big one, in terms of users and revenues, drawing in large numbers of the population. To get a sense of the growth in this business, consider some nascent statistics from the soon-to-be legalized Canadian recreational market:

Lots of people smoke weed: According to the Canadian national census, 42.5% of Canadians have tried Marijuana and about 16% had used it in the recent past (last 3 months), with the percentages climbing among younger Canadians, where one in three being recent users.

And spend money to do so: The total revenues from recreational marijuana sales in Canada alone is expected to be $7-8 billion in 2020 and grow at a healthy rate after that. Some of this will represent a shifting from the illegal market (estimated at close to $5 billion in 2017) and some of it will represent new users drawn in its legal status.

There is also information that can be gleaned about the future of this business from the states in the United States that have legalized marijuana.

In California, where legalization occurred at the start of 2018, revenues from cannabis are expected to be about $3.4 billion in 2018, but that is not a huge jump from the $3 billion in revenues in the illegal market in 2017. One reason, at least in California, is that legal marijuana, with testing, regulation and taxes, is much more expensive than that obtained in the illegal markets that existed pre-legalization.

In Colorado, where recreational marijuana use has been legal since 2014, the revenues from selling marijuana have increased from $996 million in 2015 to $1,25 billion in 2016 to $1,47 billion in 2017, representing solid, but not spectacular, growth. Marijuana-related businesses in Colorado have benefited from the revenue growth but have, for the most part, been unable to convert that growth into solid profits, partly because of the regulatory and tax overlay that they have had to navigate.

With the limited data that we have from both Canada and the US states that have legalized marijuana, here are some general conclusions that come to mind.

The illegal marijuana market will persist after legalization: The illegal weed business will continue, even after legalization, for many reasons. One is that legalization brings costs, regulations and taxes, which make the cost of legal weed higher than its illegal counterpart. The other is cultural, where a segment of long-time weed smokers will be reluctant to give up their traditional ways of acquiring and using weed. From a business standpoint, this will mean that the legal weed businesses will have to share the market with unregulated and untaxed competitors, reducing both revenues and profitability.

There will be growth in recreational marijuana sales, but it will not be exponential: For those who are expecting a sudden surge of new users, as a result of legalization, the results from the parts of the world that have legalized should be sobering. In most of these parts, to the extent that society and law enforcement had already turned a blind eye to enforcing marijuana laws before legalization, there was no sea change in legal consequences from weed smoking.

The medical marijuana market growth will be driven more by research indicating its value in health care than by popularity contests. The bad news is that this will require navigating the time-consuming and cash-burning FDA regulatory approval process but the good news is that once approved, there is less likely to be pushback, cultural or legal, against its use. It is a safe prediction that medical marijuana will be legal in all of the United States far sooner than recreational marijuana.

Federal laws matter: If you are a company in the weed business in one of the nine states that has legalized recreational marijuana, you still face a quandary. While your operations may be legal in the state that you operate in, you are at risk any time your operations require you to cross state lines and as we noted with Colorado businesses, when you pay federal taxes. Since most financial service firms operate across state borders and are regulated by Federal entities, it has also meant that even legal businesses in this space have had trouble raising funding or borrowing money from banks.

In spite of all of these caveats, there is optimism about growth in this market, with the more conservative forecasters predicting that global revenues from marijuana sales will increase to $70 billion in 2024, triple the sales today, and the more daring ones predicting close to $150 billion in sales.

The Business Question

If the marijuana market is likely to grow strongly, it should be a good market to operate a business in, right? Not all big businesses are profitable or value creating, since for a big business to be value creating, it has to come with competitive advantages or barriers to entry. If you are an investor in this space, you also have to start thinking about how companies will set themselves apart from each other, once the business matures. To see how companies in this business will evolve, it is important that you separate the recreational from the medical cannabis businesses, since each will face different challenges.

I. Recreational Cannabis

Like tobacco and alcohol, the recreational marijuana business will grow with a wink and a nod towards its side costs, and potential to be a gateway to more potent and addictive substances. Like tobacco and alcohol, marijuana will face both constraints on who it can be sold to, as well as lawsuits down the road. Before you take issue with me for taking a negative view of marijuana, note that this is not a bad path to follow, given that tobacco and alcohol have been solid money-makers for decades. The question then becomes whether, like alcohol and tobacco, cannabis will become a brand-name driven business, where having a stronger brand name allows the winners to charge higher prices and earn better margins, or whether it devolves into a commodity business, where there is little to differentiate between the offerings of different companies, leading to commoditization and low margins. If it is the former, the most successful businesses in the space will bring marketing and branding skills to the table and if it is the latter, it will be economies of scale, and low-cost production that will be the differentiator.

II. Medical Cannabis

The medical marijuana business will more closely resemble the pharmaceutical business, where you will have to work with health care regulations and economics. Success in this business will come from finding a blockbuster cannabis-based drug that can then be sold at premium prices. If our experience with young pharmaceutical and biotech companies is an indicator, this would suggest that to succeed in this business, a company will need continued access to capital from investors with patience, a strong research presence and an understanding of the regulatory approval process. The company will also generate more value in health care systems where drug companies have pricing power, making the US market a much more lucrative one than the Canadian one. The differences between the two businesses are stark enough that you can argue that it will be difficult for a company to operate in both businesses without running into problems, sooner or later.

Investment considerations

So, should you invest in this business or stay away until it becomes more mature? While there is an argument for waiting, if you are risk averse, it will also mean that you will lose out on the biggest rewards. If you are exploring your options today, you have to start by assessing your investment choices and pick the one that you are most comfortable with.

The Investment Landscape

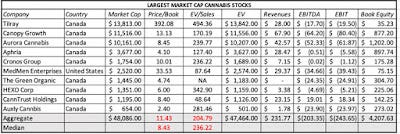

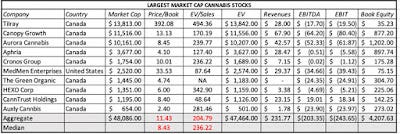

This is a young and evolving business, with the Canadian legalization drawing more firms into the market. Not only are the companies on the list of public companies in the sector recent listings, but almost all of them have small revenues and big losses. While that, by itself, is likely to drive away old time value investors, it is worth noting that at a this early stage in the business life cycle, these losses are a feature, not a bug. Looking at just the top 10 companies, in terms of market cap, on the cannabis business, here is what I see:

Largest Publicly Traded Cannabis Companies- October 2018 Note that the biggest company on the list is Tilray, a company that went publicly only a few months ago, with revenues that barely register ($28 million) and operating losses. Tilray made the news right after its IPO, with its stock price increasing ten-fold in the weeks after, before losing almost half of its value in the weeks after. Canopy Growth, the largest and most established company on this list, has the highest revenues at $68 million. More generally, Canadian companies dominate the list and all of them trade at astronomical multiples of book value.

As new companies flock into the market, the list of publicly traded companies is only going to get longer, and at least for the foreseeable future, most of them will continue to lose money. Adding to the chaos, existing companies that have logical reasons to enter this business (tobacco & alcohol in the recreational and pharmaceuticals in the medical) but have held back will enter, as the stigma of being in the business fades, and with it, the federal handicaps imposed for being in the business. Put simply, this business, like many other young and potentially big markets, seems to be in the throes of what I called the big market delusion in a post that I had about online advertising companies a few years ago.

Trading and Investing

Like all young businesses, this segment is currently dominated by trading and pricing, not investing and valuation. Put differently, companies are being priced based upon the size of the potential market and incremental information. Put simply, small and seemingly insignificant news stories will cause big swings in stock prices. Thus, there is no fundamental rationale you can give for why Tilray’s stock has behaved the way it has since it's IPO. It is driven by mood and momentum. If you are a good trader, this is a great time to play the game, since you can use your skills at detecting momentum shifts to make money as the stock goes up and again as it goes down. Since I am a terrible trader, I will leave it up to to you to decide whether you want to play the game.

If you are an investor, you want to invest on the expectation that there is more value in these companies than you are paying up front, for your equity stake. As I see it, here are your choices:

The Concentrated Pick: Pick a stock or two that you believe is most suited to succeed in the business, as it matures. Thus, if you believe that the business is going to get commoditized and that the winner will be the one with the lowest costs, you should target a company like Canopy Growth, a company that seems to be pushing towards making itself the low-cost leader in the growth end of the business. If, in contrast, you believe that this is a business where branding and marketing will set you apart, you should focus on a company that is building itself up through marketing and celebrity endorsements. To succeed at this strategy, you have to be right on both your macro assessment and your company pick, but if you are, this approach has the potential to have the biggest payoff.

Spread your bets: If your views about how the business will evolve are diffuse, but you do believe that there will be strong overall revenue growth and ultimate profitability, you can buy a portfolio of marijuana stocks. In fact, there is an ETF (MJ) composed primarily of cannabis-related stocks, with a modest expense ratio; its ten biggest holdings are all marijuana stocks, comprising 62% of the portfolio. The upside is that you just have to be right, on average, for this strategy to pay off, but the downside is that these companies are all richly priced, given the overall optimism about the market today. You also have to worry that the ultimate winner may not be on the list of stocks that are listed today, but a new entrant who has not shown up yet. If you are willing to wait for a correction, and there will be one, you may be able to get into the ETF at a much more reasonable price.

The Indirect Play: Watch for established players to also jump in, with tobacco and alcohol stocks entering the recreational weed business, and pharmaceutical companies the medical weed business. You may get a better payoff investing in these established companies, many of which are priced for low growth and declining margins. One example is Scott’s Miracle-Gro, for instance, which has a growing weed subsidiary called Hawthorne Gardening. Another is GW Pharmaceuticals that has cannabis-based drugs in production for epilepsy and MS.

It may be indication of my age, but I really don’t have a strong enough handle on this market and what makes it tick to make an early bet on competitive advantages. So, I will pass on picking the one or two winners in the market. Given how euphoric investors have been since the legalization of weed in Canada in pushing up cannabis stock prices, I think this is the wrong time to buy the ETF, especially since sector is going to draw in new players. That leaves me with the third and final choice, which is to invest in a company that is not viewed as being in the business but has a significant stake in it nevertheless. At current stock prices, neither Scott Miracle-Gro nor GW Pharmaceuticals looks like a good bet (I valued Scott Miracle-Gro at about $55, below its current stock price of $70.), but I think that my choices will get richer in the years to come. I can wait, and while I do, I think I will take another walk on the boardwalk!

YouTube Video