Inflation and Investing: False Alarm or Fair Warning?

As we approach the mid point of 2021, financial markets, for the most part, have had a good year so far. Looking at US equities, the S&P 500 is up about 11% and the NASDAQ about 5%, from start of the year levels, and the underperformance of the latter has led to a wave of stories about whether this is start of the long awaited comeback of value stocks, after a decade of lagging growth stocks. Along the way, it has been a bumpy ride, as the market wrestles with two competing forces, with an economy growing faster than expected, acting as a positive, and worries that this growth will bring with it higher inflation and interest rates, as a negative. As inflation makes its way back into market consciousness, there are debates raging from whether the higher inflation numbers that we are seeing are transitory or permanent, and if it is the latter, how they will play out in financial markets.

Inflation: Measures and Drivers

For those who are under the age of forty and have grown up in the United States or Europe, inflation is an abstraction, a number that governments report on and experts talk about, but not something that is central to their investing or regular lives. For those who are older or grew up in countries with high inflation, inflation is far more than a number, wreaking havoc on savings and exposing fault lines in economies and societies.

What is inflation?

Put simply, inflation is a measure of the change in purchasing power in a given currency over time. Implicit in this definition are two key components of inflation.

The first is that to define purchasing power, you have to start with a definition of what you are purchasing, and this detail, as we will see, can lead to differences in inflation measured over a given period, across measures/services.

The second is that inflation is tied to currencies, and different currencies can be exposed to different levels of inflation over the same period. Understanding these differences is key to understanding why interest rates vary across currencies and changes in exchange rates over time.

With that definition in place, a loss of purchasing power over time is inflation, and an increase in purchasing power over time is deflation. If there is inflation in a currency, and the loss of purchasing power over a period is acute, you have hyper inflation, though the exact cut off that leads to that label is subject to debate and disagreement. Thus, while everyone agrees that inflation in the thousands of percent, as seen in Germany in the 1920s, Brazil in the 1990s, Zimbabwe in the last decade, or Venezuela today is hyperinflation, the cut off point in terms of inflation rates that qualifies is unclear.

How do you measure inflation?

In inflation is the change in purchasing power, in a currency, over time, how do you measure inflation? Most inflation indices start by defining a bundle of goods and services to use in measuring inflation and a process for collecting the price levels of those goods and services, to come up with a measure of inflation. Consider the consumer price index (CPI) in the United States, perhaps the most widely reported inflation measure. It starts by creating a basket of goods and services for the average urban US consumer, with weights for each item based upon how much is spent by the consumer on the item, and then reestimate the price of the good/service in a subsequent period. The percentage change in the weighted-average price of all of the goods and services in the basket is the inflation rate for the period. Almost every country measures inflation within its borders using a variant of this approach, and you can see that inflation measures can be affected by three choices:

Consumption basket is misspecified: While inflation-measuring services try their best to get the basket of goods and services right, there are two fundamental problems that they all face. The first is that within a country, the consumption basket varies widely across consumers, and identifying the representative consumer is inherently subjective. In the US, consumption patterns vary across income levels, regionally and age, and inflation can be different, even over the same period, for different consumers. The second is that the basket is not stable over time, as consumers adjust to changing tastes and prices to alter what and how much they consume of different goods and services. You can find the most recent breakdown, for the US CPI, by going to the source at the Bureau of Labor Statistics.

Prices of goods and services are wrong/biased: Even if you had consensus on the consumption basket, the prices for goods and services still have to be estimated each period. While services use sampling techniques to obtain prices of goods and service from sellers, and often double check them against consumer expenditures, there is no practical way that you can survey every retailer and consumer. The sampling used to arrive at the final numbers can create error in the final estimate. In some countries, especially when high inflation has political consequences, the measurement services may use prices that do not reflect what consumers actually pay, to arrive at measured inflation rates that are much lower than the true inflation rates.

Prices of goods and services have seasonal patterns and/or volatility: There are some goods and service, where there are seasonal patterns in prices, and services sometimes try to control for the seasonality, when measuring changes in pricing power. With other items, where prices can be volatile over short period, like gasoline, services often measure inflation with and without these items to reduce the effect of volatility.

All of these measures, no matter how carefully designed, give a measure of inflation in the past, and markets are ultimately concerned more with inflation in the future. To get measures of expected inflation, there are three approaches that can be used:

Inflation surveys: There are measures of expected inflation, obtained by surveying economic experts or consumers. The IMF has expected inflation rates, by country, that it updates every year that you can find here. In the United States, the University of Michigan has been surveying consumers about their inflation expectations for decades, and reports those survey numbers every month. That said, inflation surveys suffer from two limitations. The first is that survey projections are heavily influenced by past inflation, thus rendering them less useful, when there are structural changes leading to changing inflation. The second is that words are cheap, and those providing the surveyed numbers have no money riding on their own predictions.

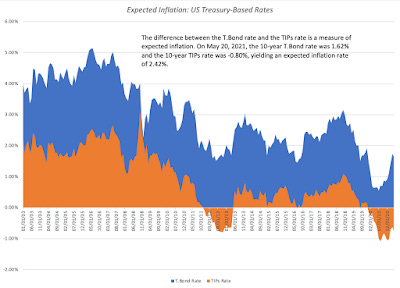

Interest rates: To understand the link between expected inflation and interest rates, consider the Fisher equation, where a nominal riskfree interest rate (which is what treasury bond rates) can be broken down into expected inflation and expected real interest rate components. Put simply, if you expect the annual inflation rate to be 2% in the future, you would need to set the interest rate on a bond above 2% to earn a real return. With the addition of inflation-protected treasuries, you now have the ingredients to compute expected inflation rate as the difference between the nominal riskfree rate and a inflation-protected rate of equal maturity. Thus, if the 10-year T.Bond rate is 3% and the TIPs rate is 1.25%, the expected inflation rate is approximately 1.75%. In the graph below, I look at the 10-year US T.Bond rate and the 10-year TIPs rate on a monthly basis, going back to the start of 2003, when TIPs started trading:

The advantage of using interest rates to forecast inflation is that it not only is constantly updated to reflect real world events, but also because there is money riding on these bets. The graph below contrasts the expected inflation rates from the Michigan survey with the expected inflation rate from the treasury markets.

Source Data

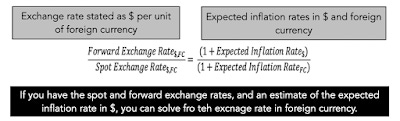

The two estimates move together much of the time, but the consumer expectations are consistently higher, and at the end of April 2021, the consumer survey was forecasting inflation of 3.2%, about 1.1% higher than a year earlier, and the treasury markets were signaling a 2.42% expected inflation, about 1.35% higher than a year earlier.Exchange rates: The third approach to estimating inflation rates is to use forward exchange rate, in conjunction with spot rates, to back out expected inflation in a currency. To use this approach, you need to have a base currency, where you can estimate expected inflation, say the US dollar and forward exchange rates in the currency in which you want to estimate inflation. The calculation is below:

Note that you are assuming purchasing power parity is the sole or at least the most critical determinant of changes in exchange rates over time, when you use this approach.

There is one final way to link actual to expected inflation. In any period, the actual inflation rate can be higher or lower than what was expected during that period. That difference is unexpected inflation, a positive number when inflation is greater than expected, and negative when it is lower than expected.

Unexpected inflation in period t = Actual inflation in period t - Expected inflation in period t

Later in this post, I will argue that expected and unexpected inflation play different roles in affecting the values of assets, and that while one can be protected against, the other cannot.

What causes inflation?

Inflation, at its core, is a monetary phenomenon, created by too much money chasing too few goods. For pure monetarists, all else is noise, and expansive money supply will see inflation in the aftermath. That said, it is true that in the near term (which can extend to years), inflation is affected by other forces as well.

Economic slack: When an economy has employment and production slack, as is the case after recessions or economic crises, you could see inflation stay subdued, even in the presence of fiscal and monetary stimuli, as it grows back to fill in capacity. This is the rationale that Keynesians would adopt to argue that central bankers need to ease monetary policy, in the face of economic slowdowns.

Structural Changes: There are times when structural changes in the economy, arising as it transitions from a manufacturing to a service economy, or from one that is domestically focused to one that is export-oriented, can create periods where inflation stays subdued in the face of monetary expansion.

Consumer/investor behavior: Consumers are the wild card in this process, as changes in demographics and behavior can have consequences for inflation. For instance, as consumers age and/or save more, relative to the past, you can see decreases in inflation or even deflation in economies.

Size of the economy: It is not fair, but larger economies with currencies that are used globally, also have the capacity to absorb monetary stimuli that would put a lesser economy into an inflationary spiral. Thus, the EU and the United States have more degrees of freedom to set monetary policy than does Brazil or Chile.

You can see why forecasting inflation can be tricky, especially at times like now. As the economy climbs back from the shutdown in 2020, there are some who argue that the monetary and fiscal stimuli of the last year, unprecedented though they may be in size and scale, will not cause inflation because the economy has substantial excess capacity. There are a few arguing that the shift to a technology-based economy has removed inflationary pressures permanently, pointing to the last decade where inflation fears never came to fruition. On the other side of the debate, there are investors and economists who believe that adding trillions of dollars to an economy that is already recovering strongly will overheat it, leading to a return of inflation. In a sign of how volatile inflation expectations have been over the last year, I looked at the probabilities that the Federal Reserve Bank of St. Louis estimates for inflation rates exceeding 2.5% and for deflation on a monthly basis:

Source Data Note that these probabilities are estimated from statistical models (PROBIT) that uses both real inflation data and survey expectations. The probability of inflation exceeding 2.5%, which was 0.11% in May 2020, soared to 60.86% in April 2021, whereas the probability of deflation, which was 76.63% in May 2020, dropped to 0.01% in April 2021.

Currency and Inflation

The best counter to those who somehow believe that inflation has been conquered forever is the response that inflation is currency-specific. Thus, even in this new technology-driven global economy, there remain some currencies where inflation rates are high, and others where inflation rates are not just low, but negative (deflation). In the table below, I use IMF forecasts of inflation from 2021 to 2026 to generate a geographical heat map and to find the ten countries with the highest expected inflation and the ten with the lowest expected inflation, from 2021-26:

Drawing on my earlier point that interest rates convey inflation expectations, I would argue that the biggest, though not the only, reason for differences in riskless rates across currencies is differences in expected inflation:

It should come as no surprise that the currencies with the highest expected inflation also have the highest riskfree rates, that currencies with lower expected inflation has lower riskfree rates and currencies where deflation is expected could have negative riskfree rates. Those inflation differences also explain currency appreciation/depreciation, over time, with high inflation currencies losing value, relative to low inflation currencies, in the long term.

A History of Inflation in the United States

As I noted in the earlier section on measuring inflation, different inflation measures can yield different values, even over the same period, largely as a consequence of whose perspective (consumer, producer) is taken, how the basket of goods and services is defined and how prices are collected and aggregated. In the graph below, I look at four measures of US inflation. The first two measures are urban consumer price indices, one without seasonal adjustments that has been reported since 1913, and the other with seasonal adjustments, available since 1948. The third is a producer price index, where price changes are measured at the producer level, for goods and services that they consume. The final measure is the GDP price deflator, computed from the BEA’s estimates of nominal and real GDP, and designed to capture the price change in goods and services produced in the United States, including exports.

As you can see, the four inflation measures are highly correlated, and there is no indication, at least historically, that one measure delivers higher or lower values than the others systematically. The PPI does show a lot more volatility than the other price indices, but there is also no indication that it or any of the other measures leads the others. Over the seven decades for which we have data on all four measures, there are two standout periods. Inflation was highest in the 1970s and it spilled into the first few years of the 1980s; that was the closest the US has come to being confronted with runaway inflation, and we will look at how investments behaved during the period. Inflation was lowest in the last decase (2010-19), and that low inflation continued in 2020.

Inflation and Value

Having spent a substantial portion of this post talking about the mechanics of inflation and how it is measured, I would like to turn to the focus of this post, which is the effect inflation has on asset value. I will start with fixed income securities, and trace out the effect of expected and unexpected inflation on value, and then move on to the more complicated case of equities, and how they are affected by the same forces.

Inflation and Fixed Income Securities

To understand how inflation affects the value of a fixed income bond, let's start with the recognition that in a fixed income security, the buyer has a contractual claim to a pre-specified cash flow and that cash flow is in nominal terms. Thus, expected inflation and unexpected inflation affect bond buyers in very different ways:

Expected Inflation: At the time that the bond contract is initiated, the buyer of a bond takes into account the expected inflation, at that time, when deciding the coupon rate for the bond. Thus, if expected inflation is 5%, a rational bond buyer will demand a much higher interest rate than when expected inflation is 3%.

Unexpected Inflation: Subsequent to the contract being created, and the bond being issued, both the bond buyer and seller are exposed to actual inflation, which can be higher or lower than the inflation that was expected at the time the bond was issued. If actual inflation is lower than expected inflation, the bond interest rate will drop and the bond price will increase. Alternatively, if actual inflation is higher than expected, interest rates will rise and the bond price will decrease.

The return that the bond buyer will earn on the bond has two components, a coupon portion that incorporates the expected inflation at the time the bond was issued, and a price appreciation portion that will move inversely with unexpected inflation.

Inflation value proposition 1: In periods when inflation is lower than expected, treasury bond returns will be boosted by price appreciation and in periods when inflation is higher than expected, treasury bond returns will be dragged down by price depreciation.

With corporate bonds, inflation will have the same direct consequences as they would on default-free or treasury bonds, with an added factor at play. As inflation comes in above expectation, corporate borrowing rates will go up, and those higher interest rates can increase the risk of default across all corporate borrowers. This higher risk may manifest itself as higher default spreads for bonds, pushing down corporate bond prices, creating additional pain for corporate bondholders.

Inflation value proposition 2: In periods when inflation is higher (lower) than expected, corporate default risk can increase (decrease), leading to corporate bond returns lagging (leading) treasury bond returns.

Inflation and Equities

To understand how inflation affects equity value, I will draw on a picture that I have used many times before, where I look at the drivers of value for a business.

Embedded in this picture are the multiple pathways that inflation, expected and unexpected, can affect the the values of businesses.

Interest Rates: The most direct link between inflation and equity value is through the risk free rate (interest rate) that forms the base for the expected returns that investors demand for investing in a company's equity, and for lending it money. If inflation is higher than expected, you can expect interest rates to rise, pushing up the returns that both equity investors and lenders demand.

Risk Premiums and Failure Risk: By itself, inflation has no direct effect on equity risk premiums, but it remains true that higher levels of inflation are associated with more uncertainty about future inflation. Consequently, as inflation increases, equity risk premiums will tend to increase. The effect of higher-than-expected inflation on default spreads is more intuitive and reflects the reality that interest expenses will be higher when inflation rises, and interest rates go up, and those larger interest expenses may create a higher risk of default.

Revenue Growth Rates: As inflation rises, all companies will have more freedom to raise prices, but companies with pricing power, coming from stronger competitive positions, will be able to do so more easily than companies without that pricing power, operating in businesses where customers are resistant to price increases. Consequently, when inflation rises, the former will be able to raise prices more than the inflation rate, while price rises will lag inflation for the latter group.

Operating Margins: If revenues and costs both rise at the inflation rate, margins should be unaffected by changes in inflation, but it is a rare company where this is true. For companies that have costs that are sensitive to higher inflation and revenues that are less so, margins will decrease as inflation rises. Conversely, for companies where costs are slow to adjust to inflation, but revenues that can quickly margins will increase as inflation rises.

Taxes: In much of the world, the tax code is written in nominal terms, and when inflation rises, the effective tax rate paid by companies can change. To see why, consider one aspect of the tax code, where companies are allowed to depreciate their investments in building and equipment over time, but only based upon what was originally invested in those assets. As inflation rises, the tax benefits from this depreciation will decrease, effectively raising the tax rate.

The bottom line is that inflation that is higher than expected will have disparate effects across companies, with some benefiting, some unaffected and some losing value.

Inflation value proposition 3: In periods when inflation is higher (lower) than expected, individual companies can benefit, be left unaffected or be hurt by inflation, depending on whether the benefits of inflation (higher revenue growth and margins) are greater than, equal to or less than the costs of unexpected inflation (higher risk free rates, higher risk premiums, higher default spreads and higher taxes).

While individual companies may benefit from higher inflation, the question of how higher inflation affects equities in the aggregate is an open one. Even if you assume that companies are able, in the aggregate to deliver high enough revenue growth to match the increase in the riskfree rate, and premiums remain unchanged, you still have the drag in value caused by higher risk premiums, failure risk and effective tax rates. The only scenario where higher-than-expected inflation can be good for stocks in the aggregate, is if the increase in inflation is accompanied by extraordinary growth in aggregate earnings that more than offsets the inflation effect.

Inflation value proposition 4: Unexpectedly high inflation will generally be a net minus for markets, at least until expectations are reset, as investors struggle to reassess risk premiums and companies try to adjust their product pricing and cost structures to deal with the higher inflation.

Inflation and Investments

In theory, and intuitively, higher than expected inflation should be bad for treasury bonds, worse for corporate bonds and good, bad or neutral for individual equities. The acid test, though, is in the numbers, and in this section, I will look at almost a 100 years of history to look at the actual performance of asset classes in response to both expected and unexpected inflation.

Inflation, Stock and Bond Returns

To assess how stocks and bonds have been affected by inflation, I started with a historical data series of returns on stocks (with the S&P 500 as proxy), treasury bonds (with the 10-year constant maturity bond standing in) and corporate bonds (with the Baa 10-year Corporate bond as its representative. For measuring inflation, I used the CPI, unadjusted for seasonal factors, since it is the only inflation series available for the entire time period, and to estimate unexpected inflation, I used a simplistic proxy:

Unexpected Inflation = Inflation in year t - Average inflation in years t-1 to t-10

I would have rather used one of the expected inflation measures that I described in the last section, but neither the Michigan survey nor the treasury rate go back in time for that long. I bring these series all together in the graph below:

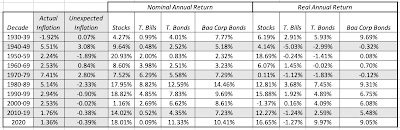

Since it is almost impossible to detect patterns in this graph, I broke my data down by decade and looked at annual nominal and real returns on stock, treasury bond and corporate bonds, by decade:

Looking at annual real returns, the worst decade for stocks in this time period was 2000-2009, with the 2008 banking crisis melting the gains for the entire decade, but the second worst decade for stocks was 1970-79, the period with the highest unexpected inflation. For treasury bonds, the two worst decades were the 1940s and the 1970s, both decades with the highest unexpected inflation, and the best decade was the 1980s. For corporate bonds, the only decade with negative real returns was the 1970s, and you can see the influences of both treasury bonds and stocks on performance.

Taking a deeper look at stocks, and specifically at two widely reported phenomena of the 20th century, the outperformance of small cap stocks, relative to large cap ones, and the superior returns earned by low price to book stocks, relative to high price to book stocks, through the lens of inflation (and I am in debt to Ken French who maintains these datasets on his online data page):

Small is the bottom decile and large is the top decile in market cap, of US stocks

Value is the bottom decline and growth is the top decile in price to book ratios, of US stocks.

There is a risk of reading too much into the data in this table, but the three best decades for low price to book stocks were 1940-49, 1970-79 and 1980-89, the three decades when inflation was high, and in two of those decades, inflation was much higher than expected. Conversely, the decades where value underperformed growth were 1990-99 and 2010-19, when inflation was much lower than expected. There is no detectable pattern with the small cap premium that can be related to inflation, in either expected or unexpected forms. Put simply, for those value investors who have been wandering in the investment wilderness for the last decade, the silver lining in a return to higher inflation may be a tilt back towards low PE and PBV stocks.

Inflation, Gold and Real Estate

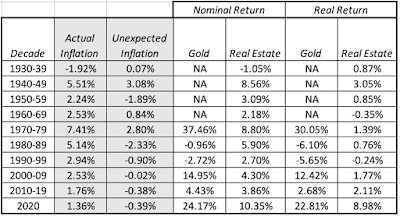

It is part of investing lore that gold is the ultimate hedge against inflation. Harvey and Erb note that over very long time periods (hundreds of years), gold preserves its purchasing power, effectively growing at the inflation rate. It is also part of investing lore that no asset class holds up better to inflationary swings than real estate. To examine the data behind the lore, I looked at the returns on gold (using gold prices, London fixing) and on real estate (using Robert Shiller's database on home prices) as a function of inflation. Note that gold prices are available only since 1970, with the effective abandonment of the gold standard.

While you can see the spike in gold prices in the 1970s and link it to the high inflation of the period, I looked at nominal and real returns on gold and real estate, by decade, just as I did with stocks:

Gold clearly had a winning decade in the 1970s, but it also did well in the 2000-09 time period, when stocks were under siege and in 2020, when it played its role as a crisis asset. Real estate had solid nominal returns in the 1970s and delivered returns that meet and beat inflation, during that decade, but is best decade in both nominal and real terms was 2000-09, albeit with a housing crash at the end of the decade wiping out much of the compounded gains.

Inflation, Collectibles and Cryptos

For investors fearful of meltdowns in financial assets, there have been relatively few hiding places, but over time, some have sought refuge in fine art and collectibles, arguing that a Picasso is more likely to protect you against inflation than a stock. In the last decade, younger investors have also sought out crypto currencies, arguing that their design, with hard limits on quantity, should make them better stores of value. It is for that reason that there are some who consider Bitcoin to be Millennial Gold, but the jury is still out on whether it will serve that role well.

If the role that gold has played historically have been as a refuge from high inflation and market crisis, the question becomes whether Bitcoin can also play that role. Last year, I did check to see how Bitcoin and Ether behaved during the course of the year, and concluded that at least in 2020, Bitcoin and ether behaved less like collectibles, and more like risky stock.

Clearly, that is a single period of history, and it is possible that Bitcoin and Ether will behave better in future crises. On the question of how unexpectedly high inflation will affect crypto currencies, the fact that they have been in existence only for a little more than a dozen years, during which period inflation was at historic lows, makes it difficult to draw a conclusion.

Hiding from Inflation?

Having looked at how stocks, bonds, real estate and gold have moved with expected and unexpected inflation in the past, I used the year by year data on these asset classes to estimate the correlation with both expected and unexpected inflation.

This table tells the composite story about inflation and asset returns well. The only two asset classes that have moved with inflation, both in expected and unexpected forms, are gold and real estate, though a fair portion of that co-movement can be explained by the 1970s. While real estate has been a better hedge against expected inflation, gold has done much better at protecting against unexpected inflation. The asset classes that are worst affected by inflation are treasury and corporate bonds, but the damage is from unexpected inflation is much greater than from expected inflation. Stocks and expected inflation are close to uncorrelated, but the correlation of stocks with unexpected inflation is negative, albeit weaker and less statistically significant than that exhibited by bonds. Finally, while the value premium is greater when inflation is higher, the results are not statistically significant, suggesting that other forces are playing a much stronger role in the disappearance of that premium.

Are there some sectors that offer better protection against inflation than others? To examine that question, I looked at broad industry categorizations, and estimated annual returns across the decades, in conjunction with inflation numbers:

Source Data (Industry annual returns, from Ken French)

The only sector that seems to have a link to inflation is energy, an outperformer not just in the 1970s, as oil prices surged, but also in the 1940s, another high inflation decade, while underperforming between 2010 and 2019, as inflation fell to historic lows. Since inflation is currency-specific, there is another pathway to protection, but it is viable only if inflation is restricted just to the United States. If inflation remains lower in other countries, either because they have more prudent central bankers or because their economies stay weaker, you would expect their currencies to appreciate, relative to the dollar, and their equity and bond markets to behave badly. Given that central bankers around the world seem to have drunk the same Koolaid, I am not sure that I would bet on this possibility.

What now?

This post has stretched for too long, and I will let you draw your own conclusions, but here is a summary of where we stand:

Inflation is back: There is no question that we are seeing higher inflation now than we have seen in a decade, in reported numbers (CPI, PPI and GDP deflators), in expectations (from the treasury markets and surveys) and in commodity markets.

Unclear whether it is transitory or permanent: The debate, both among investors and at central banks, is whether this surge in inflation reflects a return from an economic shutdown, which will burn out once things settle down, or a sign of a permanent increase from the abnormally low inflation that we witnessed all of the last decade. While economists and investors continue to look at the tea leaves to try to decipher the answer, I am afraid that only time can answer that question. If as the economy strengthens this summer, inflation continues to beat expectations, I think that the answer will be in front of us.

Return to normal: If some or all of the inflation increase is permanent, and we are reverting back to more normal inflation levels (2-3%), there will be an adjustment, perhaps even painful, as interest rates rise and stock prices recalibrate. You can still find stock sectors that are better positioned to deal with higher inflation, with commodity companies and companies with significant pricing power (consumer brand names) holding value better than the rest of the market.

With a non-trivial chance of a breakout: If it is permanent, and we see inflation rise to levels not seen since the 1970s and 1980s (>5%), stocks and bonds will have to be repriced significantly. Not only will investors need to move money out of financial into real assets and collectibles, but companies and individuals that have chosen to borrow to capacity, based upon current low rates, will face a default risk reckoning.

And the Fed has to be ready: It behooves the Fed to get ahead of the inflation game. Since the probability of inflation rising to dangerous levels is non-trivial, in my view, the Fed should stop its happy talk about inflation being under control and interest rates staying low, no matter what. In fact, central bankers around the world would be well served reverting back to an old rule book of being seen very little and speaking even less, and letting their actions speak for themselves.

For those who are quick to dismiss inflation, it is worth remembering that it is insidious and sneaky, benign when it is under control, but a destructive force, when it is not, a genie that should be kept in the bottle.

YouTube Video

Data