January 2016 Data Update 1: The US Equity Markets

Like most of you, I start every new year with optimism and hopeful resolutions, but the first week each year for the last two decades has been what I term my “Moneyball” week. During the week, I download the raw data on every publicly traded company that is listed globally, and work at converting that data into the industry averages that you see on my website. I do the analyses to keep myself grounded, since it is so easy to form preconceptions about market and corporate behavior that have no basis in reality. As I update the data, I will be doing a series of posts on how the numbers have or have not changed during the course of the last year. In this, the first of the series, I will start by looking at US equity markets, as we start the new year.

Looking Back

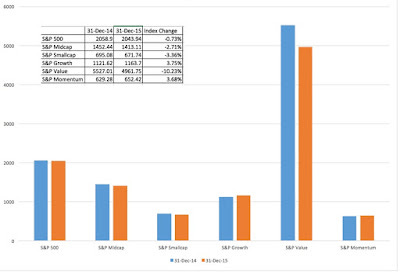

It was not a good year for US equity markets, but given circumstances, it could have been a lot worse. The S&P 500 was almost unchanged during the course of the year, though indices of some subsets of the market did worse:

Source: Standard and Poor's

During 2015, large cap stocks did better than small cap stocks, growth outperformed value and momentum investing provided a positive payoff.

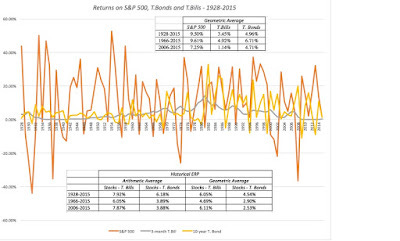

If there is a word that I would use to describe US equity markets in 2015, it is “resilient”, since they had to weather two significant crises. During the summer, China, the engine for global economic growth for much of the last decade, had a market meltdown, triggered by an economic slowdown. (Take a look at the post that I did at the height of the crisis in late August). The commodity markets, which collapsed in 2014, continued their decline in 2015, albeit at a slower pace. Notwithstanding these developments, the S&P 500 ended 2015, with a return of 1.36%, if you count in dividends, higher than the returns you would have generated on T.Bills (0.21%) or T.Bonds (1.28%) for the year. Incorporating the returns from 2015 into the historical data, the compounded annual returns on stocks, T.Bonds and T.Bills are shown below for periods going back as far as 1928:

Source: Damodaran Online

The historical premium earned by stocks, relative to treasury bonds, inched down to 4.54% for the 1928-2015 time period, from 4.60% for the 1928-2014 time period.

Looking forward

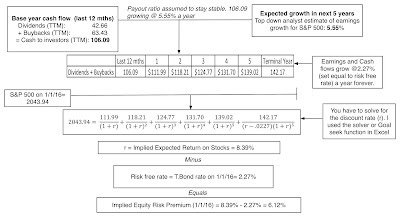

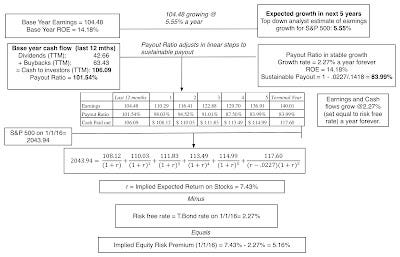

The equity risk premium is the extra return that investors demand for investing in stocks as opposed to putting their money in a riskless asset, and it is the composite statistic that best captures how stocks are priced in the aggregate. It is also a number that I have posted on extensively, that I update at the start of every month on my website, and write an extended update about, each year. My preferred approach for estimating the premium is to start with current stock prices, estimate expected cash flows from owning stocks and to solve for the discount rate (expected return or internal rate of return). At the start of 2016, using the S&P 500 as the market index, the collective cash flow from dividends and buybacks as the cash flow from stocks and a top down estimate of growth in earnings for the index as the growth rate in the cash flows, I obtain an equity risk premium (ERP) of 6.12%:

This equity risk premium serves two purposes. First, it is a key input in valuing individual companies, becoming a part of the costs of equity and capital of all companies; a higher ERP translates into higher discount rates and lower values. Second, by comparing the current ERP to what you believe a fair ERP should be (perhaps by looking at historical averages), you can make a judgment on whether you think the market is under or over valued. If the current premium is higher (lower) than what you think is fair, stocks are under (over) valued.

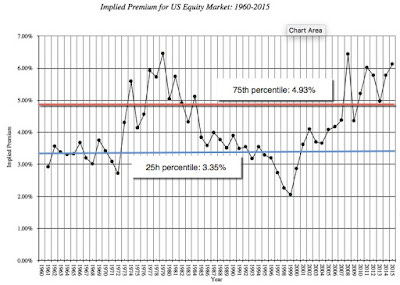

Source: Damodaran Online

On that comparison, the high ERP on US stocks (or at least those in the S&P 500) is reason for optimism.

Cautionary Notes

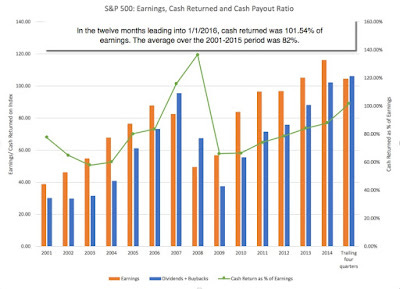

The optimism emanating from the high current ERP should be tempered, though, since the drivers of that premium are much softer than they were a year ago, when the ERP was 5.78%. Largely as a consequence of the commodity price decline, base year earnings for the S&P 500 companies dropped almost 10% in 2015. In fact, the ERP at the start of 2016 is being elevated by two forces, the first is that the T.Bond rate continues to be low (by historic standards) and the second is that cash returned (about 60% in buybacks) by US companies rose last year by 4% during the year. The net result of the declining earnings and increasing buybacks is that the cash returned last year was 101.54% of earnings, unsustainable over time.

To correct for this, I reestimated the ERP, adjusting the cash return down to a more sustainable number over the long term. In effect, I lower the cash return ratio each year over the next five years to reach about 84% of earnings in year 5:

The resulting ERP is 5.16%, still higher than the 75th percentile (4.93%) for the 1960-2015 period, but the margin for error is much smaller than it was last year. If the continued drop in commodity prices in the last quarter of 2015 affects earnings for the index in 2016 and/or T.Bond rates rise sharply, the ERP will decline. This year, I plan to monitor (and report) this buyback-adjusted ERP , in addition to my unadjusted estimates, more closely than in prior years.

Bottom Line

I am more wary about equities going into 2016 than I was entering 2015, but my feelings about the market have never been a reliable predictor of what stocks actually do during the year. Thus, I will do what I always do at the start of every year, invest on the presumption that I am not market timer and that I am better off investing in individual companies that I think are under valued. My faith in intrinsic value will be tested by price movements in the wrong direction and I hope that I will not be found wanting.

Data

Spreadsheets

Data Update Posts