January 2016 Data Update 6: Debt, the double edged sword!

In corporate finance, the decision on whether to borrow money, and if so, how much has divided both practitioners and theorists for as long as the question has been debated. Corporate finance, as a discipline, had its beginnings in Merton Miller and Franco Modigliani's classic paper on the irrelevance of capital structure. Since then, theorists have finessed the model, added real life concerns and come to the unsurprising conclusion that there is no one optimal solution that holds across companies. At the same time, practitioners have also diverged, with the more conservative ones (managers and investors) arguing that debt brings more pain than gain and that you should therefore borrow as little as possible, and the most aggressive players positing that you cannot borrow too much.

The Trade off on debt

The benefits of debt, for better or worse, are embedded in the tax code, which in much of the world favors borrowers. Specifically, a company that borrows money is allowed to deduct interest expenses before paying taxes, whereas one that is equity funded has to pay dividends out of after-tax earnings. This, of course, makes it hypocritical of politicians to lecture any one on too much debt, but then again, hypocrisy is par for the course in politics. A secondary benefit of debt is that it can make managers in mature, cash-rich companies a little more disciplined in their project choices, since taking bad projects, when you have debt, creates more pain (for the managers) than taking that same projects, when you are an all equity funded company.

On the other side of the ledger, debt does come with costs. The first and most obvious one is that it increases the chance of default, as failure to make debt payments can lead to financial distress and bankruptcy. The other is that borrowing money does create the potential for conflict between stockholders (who seek upside) and lenders (who want to avoid downside), which leads to the latter trying to protect themselves by writing in covenants and/or charging higher interest rates.

Pluses of DebtMinuses of Debt1. Tax Benefit: Interest expenses on debt are tax deductible but cash flows to equity are generally not. The implication is that the higher the marginal tax rate, the greater the benefits of debt.1. Expected Bankruptcy Cost: The expected cost of going bankrupt is a product of the probability of going bankrupt and the cost of going bankrupt. The latter includes both direct and indirect costs. The probability of going bankrupt will be higher in businesses with more volatile earnings and the cost of bankruptcy will also vary across businesses.2. Added Discipline: Borrowing money may force managers to think about the consequences of the investment decisions a little more carefully and reduce bad investments. The greater the separation between managers and stockholders, the greater the benefits of using debt.2. Agency Costs: Actions that benefit equity investors may hurt lenders. The greater the potential for this conflict of interest, the greater the cost borne by the borrower (as higher interest rates or more covenants). Businesses where lenders can monitor/control how their money is being used can borrow more than businesses where this is difficult to do.

In the Miller-Modigliani world, which is one without taxes, bankruptcies or agency problems (managers do what's best for stockholders and equity investors are honest with lenders), debt has no costs and benefits, and is thus irrelevant. In the world that I live in, and I think you do too, where taxes not only exist but often drive big decisions, default is a clear and ever-present danger and conflicts of interests (between managers and stockholders, stockholders and lenders) abound, some companies borrow too much and some borrow too little.

The Cross Sectional Differences

Looking at the trade off, it is clear that 2015 tilted more towards the minus side than plus side of the equation for debt, as the Chinese slowdown and the commodity price meltdown created both geographic and sector hot spots of default risk. As in prior years, I started by looking at the distribution of debt ratios across global companies, in both book and market terms:Debt to capital (book) = Total Debt/ (Total Debt + Book Equity)Debt to capital (market) = Total Debt/ (Total Debt + Market Equity)In keeping with my argument that all lease commitments should be considered debt, notwithstanding accounting foot dragging on the topic, I include the present value of lease commitments as debt, though I am hamstrung by the absence of information in some markets. I also compute net debt ratios, where I net cash out against debt, for all companies:

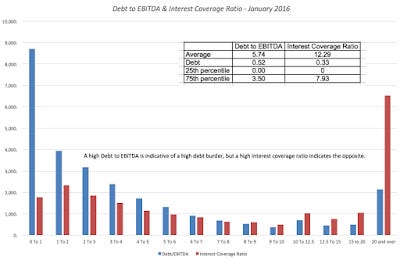

Damodaran OnlineWhile debt ratios provide one measure of the debt burden at companies, there are two other measures that are more closely tied to companies getting into financial trouble. The first is the multiple of debt to EBITDA, with higher values indicative of a high debt burden and the other is the multiple of operating income to interest expenses (interest coverage ratio), with lower values indicating high debt loads. In 2015, the distribution of global companies on each of these measures is shown below:

By itself, there is little that you can read into this graph, other than the fact that there are some companies that are in danger, with earnings and cash flows stretched to make debt payments, but that is a conclusion you would make in any year.

The Industry DivideTo dig a little deeper into where the biggest clusters of companies over burdened with debt are, I broke companies down by industry and computed debt ratios (debt to capital and debt to EBITDA) by sector. You can download the entire industry data set by clicking here, but here are the 15 sectors with the most debt (not counting financial service firms), in January 2016.

Damodaran Online, January 2016There is a preponderance of real estate businesses on this list, reflecting the history of highly levered games played in that sector. There are quite a few heavy investment businesses, including steel, autos, construction shipbuilding, on this list. Surprisingly, there are only two commodity groups (oil and coal) on this section, oil/gas distribution, but it is likely that as 2016 rolls on, there will be more commodity sectors show up, as earnings lag commodity price drops.

In contrast, the following are the most lightly levered sectors as of January 2016.

Damodaran Online, January 2016The debt trade off that I described in the first section provides some insight into why companies in these sectors borrow less. Notice that the technology-related sectors dominate this list, reflecting the higher uncertainty they face about future earnings. There are a few surprises, including shoes, household products and perhaps even pharmaceutical companies, but at least with drug companies, I would not be surprised to see debt ratios push up in the future, as they face a changed landscape.

The Regional DividesIf the China slow-down and the commodity pricing collapse were the big negative news stories of 2015, it stands to reason that the regions most exposed to these risks should also have the most companies in debt trouble. The regional averages as of January 2016 are listed below:

Damodaran Online, Data Update of 41,889 companies in January 2016The measure that is most closely tied to the debt burden is the Debt to EBITDA number and that is what I will focus on in my comparisons. Not surprisingly, Australia, a country with a disproportionately large number of natural resource companies, tops the list and it is followed closely by the EU and the UK. Canada has the highest percentage of money-losing companies in the world, again due to its natural resource exposure. The companies listed in Eastern Europe and Russia have the least debt, though that may be due as much to the inability to access debt markets as it is to uncertainty about the future. With Chinese companies, there is a stark divide between mainland Chinese companies that borrow almost 2.5 times more than their Hong Kong counterparts. If you are interested in debt ratios in individual countries, you can see my global heat map below or download the datasets with the numbers.

via chartsbin.com

If the biggest reason for companies sliding into trouble in 2015 were China and Commodities, the first three weeks of 2016 have clearly made the dangers ever more present. As oil prices continue to drop, with no bottom in sight, and the bad news on the Chinese economy continue to come out in dribs and drabs, the regions and sectors most exposed to these risks will continue to see defaults and bankruptcies. These, in turn, will create ripples that initially affect the banks that have lent money to these companies but will also continue to push up default spreads (and costs of debt) for all firms.

The Bottom LineDebt is a double edged sword, where as you, as the borrower, wield one edge against the tax code and slice your taxes, the other edge, just as sharp, is turned against you and can hurt you, in the event of a downturn. In good times, companies that borrow reap the benefits of debt, slashing taxes paid and getting rewarded with high values by investors, who are just as caught up in the mood of the moment. In bad times, which inevitably follow, that debt turns against companies, pushing them into financial distress and perhaps putting an end to their existence as ongoing businesses. One constraint that I will bring into my own investments decisions in 2016 is a greater awareness of financial leverage, where in addition to valuing businesses as going concerns, I will also look at how much debt they owe. I will not reflexively avoid companies that have borrowed substantial amounts, but I will have to realistically assess how much this debt exposes them to failure risk, before I pull the "buy" trigger.

Datasets

Data Update Posts