January 2018 Data Update 10: The Price is Right!

In my first nine posts on my data update for 2018, I focused on the costs that companies face in raising equity and debt, and their investment, financing and dividend decisions. In assessing those decisions, though, I looked at their actions through the lens of value creation, arguing that investing in projects that earn less than their cost of capital is not a good use of shareholder capital. While this may seem like a reasonable conclusion, it is built on the implicit assumption that financial markets reward value creation and punish value destruction. As any market observer will tell you, markets have minds of their own, sometimes rewarding companies for bad behavior and punishing companies that take the right actions. In this post, I look at market pricing around the world, and point to potential inconsistencies with the fundamentals.

Value vs Price

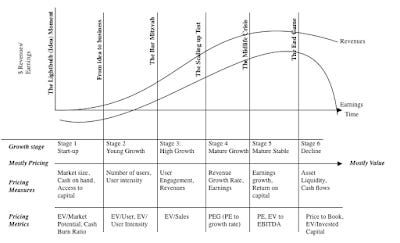

In multiple posts on this blog, I have argued that we need to stop using the words, value and price, interchangeably, that they not only can be very different for the same asset, at any point in time, but that they are driven by different forces, require different mindsets to understand, and give rise to different investment philosophies. The picture below summarizes the key distinctions:

Understanding the difference between value and price, at least for me, is freeing, because it not only makes me aware of the assumptions that I, as an investor who believes in value and convergence, am making, but also makes me respect and recognize those who might have a different perspective. The bottom line, though, is that the pricing process can sometimes reward firms that take actions that no tonly have no effect on value, but may actually destroy value, and punish firms that are following financial first principles. Even though I believe that value ultimately prevails, it behooves to me to try to understand how the market is pricing stocks, since it will help me be a better investor.

The Pricing Process

I will begin with what sounds like a over-the-top assertion. Much of what we see foisted on us as valuation, including those that you see backing up IPOs, acquisitions or big investment decisions, are really pricing models, masquerading as valuations. In many cases, bankers and analysts use the front of estimating cash flows for a discounted cashflow valuation, while slipping in a multiple to estimate the biggest cash flow (the terminal value) in what I call Trojan Horse DCFs. I am not surprised that pricing is the name of the game in banks and equity research, but I am puzzled at why so much time is wasted on the DCF misdirection play. There are four steps to pricing an asset or company well, and done well, there is no reason to be ashamed of a pricing.

1. Similar, Traded Assets

To price an asset, you have to find "similar" assets that are traded in the market. Note the quote marks around similar, because with publicly traded stocks, you will be required to make judgment calls on what you view as similar. The conventional practice in pricing seems to be country and sector focused, where an Indian food processing company is compared to other food processing companies in India, on the implicit assumption that these are the most comparable companies. That practice, though, can not only lead to very small samples in some countries, but also can yield companies that have very different fundamentals from the company that you are valuing.

1.1: With equities, there are no perfect matches: If you are valuing a collectible (Tiffany lamp or baseball card), you might be able to find identical assets that have been bought and sold recently. With stocks, there are no identical stocks, since even with companies that are close matches, differences will persist.

1.2: Small, more similar, sample or large, more diverse, sample: Given that there are no stocks identical to the one that you are trying to value in the market, you will be faced with two choices. One is to define "similar" narrowly, looking for companies that are listed on the same market as yours, of similar size and serving the same market. The other is to define "similar" more broadly, bringing in companies in other markets and perhaps with different business models. The former will give you more focus and perhaps fewer differences to worry about and the latter a much larger sample, with more tools to control for differences.

2. Pricing Metric

To compare pricing across companies, you have to pick a pricing metric and broadly speaking, you have three choices:

The market capitalization is the value of equity in a business, the enterprise value is the market value of the operating assets of the firm and the firm value is the market value of the entire firm, including any cash and non-operating assets. While firm value is lightly used, because non-operating assets and cash can skew it, both enterprise value and equity value are both widely used. In computing these metrics, there are three issues that do complicate measurement. One is that market capitalization (market value of equity) is constantly updated, but debt and cash numbers come from the most recent balance sheets, creating a timing mismatch. The second is that the market value of equity is easily observable for publicly traded companies, but debt is often not traded (if bank debt) and book debt is used as a stand in for market debt. Finally, non-operating assets often take the form of holdings in other companies, many of which are private, and the values that you have for them are book values.

2.1: When leverage is different across companies, go with enterprise value: When comparing pricing across companies, it is better to focus on enterprise value, when debt ratios vary widely across the companies, because equity value at highly levered companies is much smaller and more volatile and cannot be easily compared to equity value at lightly levered companies.

2.2: With financial service companies, stick with equity: As I have argued in my other posts, debt to a bank, investment bank or insurance company is more raw material than source of capital and defining debt becomes almost impossible to do at financial service firms. Rather than wrestle with his estimation problem, my suggestion is that you stick with equity multiples.

3. Scaling Variable

When pricing assets that come in standardized units, you can compare prices directly, but that is never the case with equities, for a simple reason. The number of shares that a company chooses to have will determine the price per share, and arguing that Facebook is more expensive than Twitter because it trades at a higher price per share makes no sense. It is to combat this that we scale prices to a common variable, whether it be earnings, cash flows, book value, revenues or a driver of revenues (users, riders, subscribers etc.).

3.1: Be internally consistent: If your pricing metric is an equity value, your scaling variable has to be an equity value (net income, book value of equity). If your pricing metric is enterprise value, your scaling variable has to be an operating variable (revenues, EBITDA or book value of invested capital).

3.2: Life cycle matters: The multiple that you use to judge pricing will change, as a company moves through the life cycle.

Early in the life cycle, the focus will be on potential market size or revenue drivers, since the company's own revenues are small or non-existent and it is losing money. As it grows and matures, you will see a shift to equity earnings first, since growth companies are mostly equity funded, and then to operating earnings and EBITDA, as mature companies use debt, ending with a focus on book value as a proxy for liquidation value, in decline.

4. Control for differences

As we noted, when discussing similar companies, no matter how carefully you pick comparable firms, there will be differences that persist between the company that you are trying to value and the comparable firms. The test of good pricing is whether you detect the variables that cause differences in pricing and how well you control for the differences. In much of equity research, the preferred mode for dealing with these differences is to spin them to justify whatever pre-conceptions you have about a stock.

4.1: Check the fundamentals: In intrinsic value, we argued that the value of a company is a function of its cash flows, growth and risk. If you believe that the fundamentals ultimately prevail in markets, you should tie the multiples you use to these fundamentals, and using algebra and a basic discounted cash flow model will lead you to fundamentals drivers of any multiple.

4.2: Let the market tell you what matters: If you are a pure trader, who has little faith that the fundamentals will prevail, you can can take a different path. You can look at other data, related to the companies that you are pricing, and look for correlation. Put simply, you are trying to use the data to back out what variables best explain differences in market pricing, and using those variables to price your company.

To illustrate the differences between the two approaches, take a look at my pricing of Severstal, where I used fundamentals to conclude that it was under priced, and my pricing of Twitter, at the time of its IPO, where I backed out the number of users as the key variable driving the market pricing of social media companies and priced Twitter accordingly.

Pricing around the Globe

Assuming that you have had the patience to get to this part of the post, let's look at the pricing numbers at the start of 2018, around the world, starting with earnings multiples (PE and EV/EBITDA), moving on to book value multiples (Price to Book, EV to Invested Capital) and ending with revenue multiples (EV/Sales).

1. Earnings Multiples

Earnings multiples have the deepest roots in pricing, with the PE ratio still remaining the most used multiple in the world. In the last two to three decades, there has been a decided shift towards enterprise value multiples, with EV/EBITDA leading the way. While I am skeptical of EBITDA as a measure of accessible cash flow, since it is before taxes and capital expenditures, I understand its pull, especially in aging companies with significant depreciation charges. If you assume that depreciation will need to go back into capital expenditures, there is an intermediate measure of pricing, EV to EBIT.

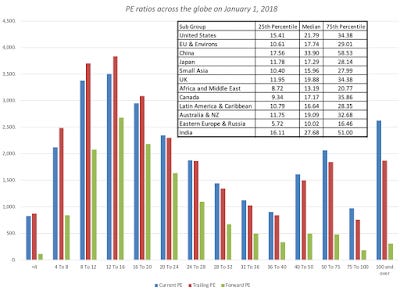

In the chart below, I look at the distribution of PE ratios globally, and report on the PE ratio distributions, broken down region, at the start of 2018.

I know that it is dangerous to base investment judgments on simple comparisons of pricing multiples, but at the start of 2018, the most expensive market in the world on a PE ratio basis, is China, followed by India, and the cheapest market is Eastern Europe and Russia. If you would like to see the values for earnings multiples, by country, please click at this link.

If you are more interested in operating earnings multiples, the chart below has the distribution of EV/EBIT and EV/EBITDA multiples:

China again tops the scale, with the highest EV/EBITDA multiples, and Eastern Europe and Russia have the lowest EV/EBITDA multiples. Earnings multiples also vary across sectors, with some of the variation attributable to fundamentals (differences in growth, risk and cash flows) and some of it to misplacing. The sectors that trade at the highest and lowest PE ratios are identified below:

You can download the full list of earnings multiples for all of the sectors, by clicking on this link.

2. Book Value Multiples

The delusion of fair value accounting is that balance sheets will one day provide better estimates of how much a business in worth than markets, and while I believe that day will never come, even accountants are entitled to their dreams. That said, there are investors who still put their faith in book value and compare market prices to book value, either in equity terms or operating asset terms:

Price to Book Equity = Market Value of Equity / Book Value of Equity

EV to Invested Capital = (Market Value of Equity + Market value of Debt - Cash)/ (Book value of equity + Book value of Debt - Cash)

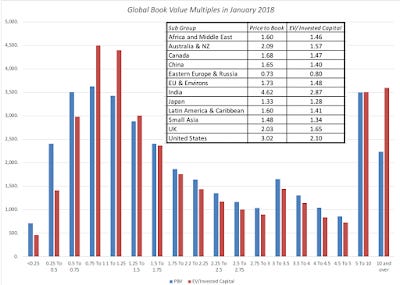

In the table below, I report on price to book and enterprise value to invested capital ratios, by sub-region of the world:

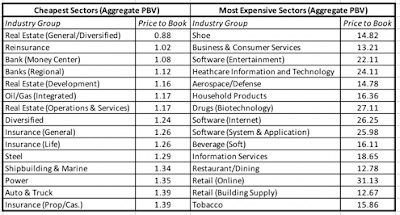

The most expensive sub-region of the world is India, on both a price to book and EV/Invested capital basis, and the lowest priced stocks are again in Eastern Europe and Russia. If you would like to see book value multiples, by country, click at this link. With book value multiples, the differences you observe across sectors not only reflect differences in fundamentals and pricing errors, but also accounting inconsistencies on how capital expenditures in non-manufacturing companies are dealt with, as opposed to manufacturing firms. I tried to correct for these inconsistencies, by capitalizing R&D at all firms, but that correction goes only part way and the most expensive and cheapest sectors, with my corrected book values, are listed below:

Download industry PBV spreadsheet

You can download the book value multiple data, by sector, by clicking here.

3. Revenue Multiples

To the question of why investors and analysts look at multiples of revenues, my one word answer is "desperation". When every other number in your income statement is negative, you have to keep climbing the statement until you hit a positive value. That said, there is value in focusing on a variable that accountants have the least influence over, and the heat map below captures differences in the enterprise value to sales ratios across the globe.

Unlike earnings and book value multiples, which have a pronounced peak in the middle of the distribution, revenue multiples are more evenly distributed, with quite a few firms trading at more than ten times revenues. As with earnings and book value multiples, I report revenue multiples, by country at this link and by sector at this link. Note that there no revenue multiples reported for financial service firms, where neither enterprise value nor revenues can be meaningfully measured or estimated.

Conclusion

I am an investor, who believes in value, but it would be foolhardy on my part to ignore the pricing game, since I am dependent upon it ultimately to cash out on my value gains. In this post, I have looked at the pricing differences around the globe, at least based upon market prices at the start of 2018. Of all of my data posts, this is the one that is the most dynamic and likely to change over short periods, since markets can react to change far more quickly than companies can.

YouTube Video

Datasets

1. Multiples, by Sector, in January 2018

2. Multiples, by Country, in January 2018

Data Update Posts