January 2019 Data Update 7: Debt, neither poison nor nectar!

Debt is a hot button issue, viewed as destructive to businesses by some at one end of the spectrum and an easy value creator by some at the other. The truth, as is usually the case, falls in the middle. In this post, I will look not only at how debt loads vary across companies, regions and industries, but also at how they have changed over the last year. That is because last year should have been a consequential one for financial leverage, especially for US companies, since the corporate tax rate was reduced from close to 40% to approximately 25%. I will also put leases under the microscope, converting lease commitments to debt, as I have been doing for close to two decades, and look at the effect on profit margins and returns, offering a precursor to changes in 2019, when both IFRS and GAAP will finally do the right thing, and start treating leases as debt.

The Debt Trade Off

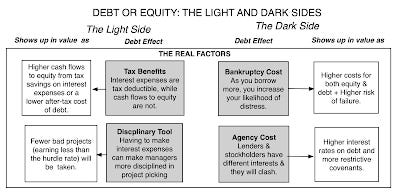

Debt is neither an unmixed good nor an unmitigated disaster. In fact, there are good and bad reasons for companies to borrow money, to fund operations, and in this section, I will look at the trade off, and look at the implications for what types of businesses should be the biggest users of debt, and which ones, the smallest.

The Pluses and Minuses

There are only two ways you can raise capital to fund a business. One is to use owner funds, which can of course range from personal savings in a small start up to issuing shares to the market, for a public company. The other is to borrow money, again ranging from a loan from a family member or friend to bank debt to corporate bonds. The debt equity trade off then boils down to what debt brings to the process, relative to equity, in both good and bad ways.

The two big elements driving whether a company should borrow money are the tax code, and how heavily it is tilted towards debt, on the good side and the increased exposure to default and distress, that it also creates, on the bad side. Simply put, companies with stable and predictable earnings streams operating in countries, with high corporate tax rates should borrow more money than companies with unstable earnings or which operate in countries that either have low tax rates or do not allow for interest tax deductions. For financial service firms, the decision on debt is more complex, since debt is less source of capital and more raw material to a bank. As a consequence, I will look at only non-financial service firms in this post, but I plan to do a post dedicate to just financial service firms.

US Tax Reform - Effect on Debt

If one of the key drivers of how much you borrow is the corporate tax code, last year was an opportunity to see this force in action, at least in the US. At the start of 2018, the US tax code was changed in two ways that should have affected the tax benefits of debt:

The federal corporate tax rate was lowered from 35% to 21%. Adding state and local taxes to this, the overall corporate tax rate dropped from close to 40% to about 25%.

Restrictions were put on the deductibility of interest expenses, with amounts exceeding 30% of taxable income no longer receiving the tax benefit.

Since there were no significant changes to bankruptcy laws or costs, these tax code changes make debt less attractive, relative to equity, for all US companies. In fact, as I argued in this post at the start of 2018, if US companies are weighing the pros and cons correctly, they should have reduced their debt exposure during the course of 2018.

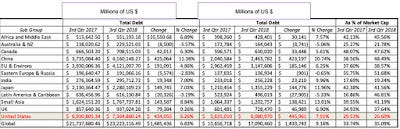

While I have data only through through the end of the third quarter of 2018, I look at the change in total debt, both gross and net, at non-financial service US companies, over the year (by comparing to the debt at the end of the third quarter of 2017).

Download debt change, by industry

In the aggregate, US non-financial service companies did not reduce debt, but instead added $434 billion to their debt load, increasing their total debt from $6,931 billion to $7,365 billion between September 2017 and September 2018. That represented only a 6.26% increase over the year, and was accompanied by a decline in debt as a percent of market capitalization, but that increase is still surprising, given the drop in the marginal tax rate and the ensuing loss of tax benefits from borrowing. There are three possible explanations:

Inertia: One of the strongest forces in corporate finance is inertia, where companies continue to do what they have always done, even when the reasons for doing so have long since disappeared. It is possible that it will be years before companies wake up to the changed tax environment and start borrowing less.

Uncertainty about future tax rates: It is also possible that companies view the current tax code as a temporary phase and that the drop in corporate tax rates will be reversed by future administrations.

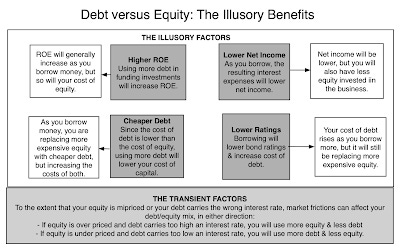

Illusory and Transient Benefits: Many companies perceive benefits in debt that I term illusory, because they create value, only if you ignore the full consequences of borrowing. I have captured these illusory benefits in the table below: Put simply, the notion that debt will lower your cost of capital, just because it is lower than your cost of equity, is widely held, but just not true, and while using debt will generally increase your return on equity, it will also proportionately increase your cost of equity.

I will continue tracking debt levels through the coming years, and assuming no bounce back in corporate tax rates, we should get confirmation as to whether the tax hypothesis holds.

Debt: Definition

The tax law changed the dynamics of the debt/equity tradeoff, but there is an accounting change coming this year, which will have a significant impact on the debt that you see reported on corporate balance sheets around the world, and since this is the debt that most companies and data services use in measuring financial leverage. Specifically, accountants and their rule writers are finally going to come to their senses and plan to start treating lease commitments as debt, plugging what I have always believed is the biggest source of off balance sheet debt.

Debt: Definition

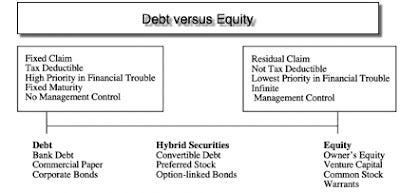

In my financing construct for a business, I argue that there are two ways that a business, debt (bank loans, corporate bonds) and equity (owner's funds), but to get a sense of how the two sources of capital vary, I looked at the differences:

Specifically, there are two characteristics that set debt apart from equity. The first is that debt creates a contractual or fixed claim that the firm is obligated to meet, in good and bad times, whereas equity gives rise to a residual claim, where the firm has the flexibility not to make any payments, in bad times. The second is that with debt, a failure to meet a contractual commitment, will lead to a loss of control of the firm and perhaps default, whereas with equity, a failure to meet an expected commitment (like paying dividends) can lead to a drop in market value but not to distress. Finally, in liquidation, debt holders get first claim on the assets and equity gets whatever, if any, is left over. Using this definition of debt, we can navigate through a balance sheet and work out what should be included in debt and what should not. If the defining features for debt are contractual commitments, with a loss of control and default flowing from a failure to meet them, it follows that all interest bearing debt, short term as well as long term, bank loans and corporate bonds, are debt. Staying on the balance sheet, though, there are items that fall in a gray area:

Accounts Payable and Supplier Credit: There can be no denying that a company has to pay back supplier credit and honor its accounts payable, to be a continuing business, but these liabilities often have no explicit interest costs. That said, the notion that they are free is misplaced, since they come with an implicit cost. To make use of supplier credit, for instance, you have to give up discounts that you could have obtained if you paid on delivery. The bottom line in valuation and corporate finance is simple. If you can estimate these implicit expenses (discounts lost) and treat them as actual interest expenses, thus altering your operating income and net income, you can treat these items as debt. If you find that task impossible or onerous, since it is often difficult to back out of financial reports, you should not consider these items debt, but instead include them as working capital (which affects cash flows).

Underfunded Pension and Health Care Obligations: Accounting rules around the world have moved towards requiring companies to report whether their defined-benefit pension plans or health care obligations are underfunded, and to show that underfunding as a liability on balance sheets. In some countries, this disclosure comes with legal consequences, where the company has to set aside funds to cover these obligations, akin to debt payments, and if this is the case, they should be treated as debt. In much of the world, including the United States, the disclosure is more for informational purposes and while companies are encouraged to cover them, there is no legal obligation that follows. In these cases, you should not consider these underfunded obligations to be debt, though you may still net them out of firm value to get to equity value.

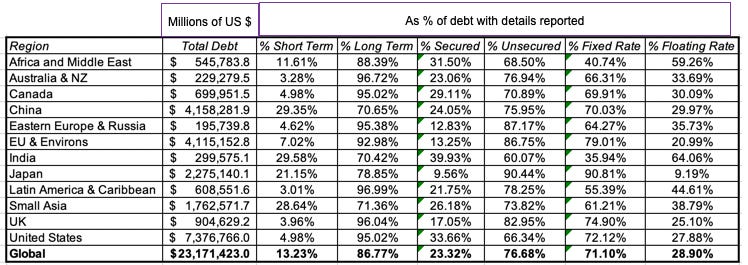

The table below provides the breakdown of debt for non-financial service companies around the world.

Debt Details, by Industry (US)

As you browse this table, please keep in mind that disclosure on the details of debt varies widely across companies, and this table cannot plug in holes created by non-disclosure. To the extent that company disclosures are complete, you can see that there are differences in debt type across regions, with a greater reliance on short term debt in Asia, a higher percent of unsecured and fixed rate debt in Japan and more variable rate, secured debt in Africa, India and Latin America than in Europe or the US. You can get the debt details, by industry, for regional breakdowns at the link at the end of this post.

Debt Load: Balance Sheet Debt

Using all interest bearing debt as debt in looking at companies, we can raise and answer fundamental questions about leverage at companies. Broadly speaking, the debt load at a company can be scaled to either the value of the company or to its earnings and cash flows. Both measures are useful, though they measure different aspects of debt load:

a. Debt and Value

Earlier, I noted that there are two ways you can fund a business, debt and equity, and a logical measure of financial leverage that follows is to look at how much debt a firm uses, relative to its equity. That said, there are two competing measures of value, and especially for equity, the divergence can be wide.

The first is the book value, which is the accountant's estimate of how much a business and its equity are worth. While value investors attach significant weight to this number, it reflects all of the weaknesses that accounting brings to the table, a failure to adjust for time value of money, an unwillingness to consider the value for current market conditions and an inability to deal with investments in intangible assets.

The second is market value, which is the market's estimate, with all of the pluses and minuses that go with that value. It is updated constantly, with no artificial lines drawn between tangible and intangible assets, but it is also volatile, and reflects the pricing game that sometimes can lead prices away from intrinsic value.

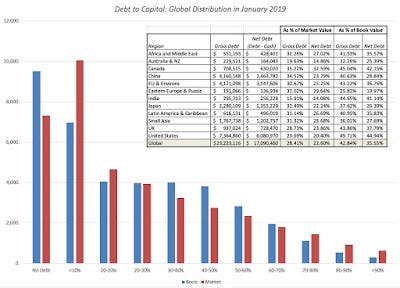

In the graph below, I look at debt as a percent of capital, first using book values for debt and equity, and next using market value.

In the table below, I break out debt as a percent of overall value (debt + equity) using both book value and market value numbers, and look at the distribution of these ratios globally:

Embedded in the chart is a regional breakdown of debt ratios, and even with these simple measures of debt loads, you can see how someone with a strong prior point of view on debt, pro or con, can find a number to back that view. Thus, if you want to argue as some have that the Fed (which is blamed for almost everything that happens under the sun), low interest rates and stock buybacks have led US companies to become over levered, you will undoubtedly point to book debt ratios to make your case. In contrast, if you have a more sanguine view of financial leverage in the US, you will point to market debt ratios and perhaps to the earnings and cash flow ratios that I will report in the next section. On this debate, at least, I think that those who use book value ratios to make their case hold a weak hand, since book values, at least in the US and for almost every sector other than financial, have lost relevance as measures of anything, other than accounting ineptitude.

b. Debt and Earnings/Cashflows

Debt creates contractual obligations in the form of interest and principal payments, and these payments have to be covered by earnings and cash flows. Thus, it is sensible to measure how much buffer, or how little, a firm has by scaling debt payments to earnings and cash flows, and here are two measures:

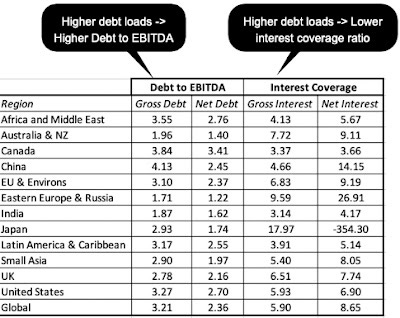

Debt to EBITDA: It is true that EBITDA is an intermediate cash flow, not a final one, since you still have to pay taxes and invest in growth, before you get a residual cash flow. That said, it is a proxy for how much cash flow is being generated by existing investments, and dividing the total debt by EBITDA is a measure of overall debt load, with lower numbers translating into less onerous loads.

Interest Coverage Ratio: Dividing the operating income (EBIT) by interest expenses, gives us a different measure of safety, one that is more immediately tied to default risk and cost of debt than debt to EBITDA. Firms that generate substantial operating income, relative to interest expenses, are safer, other things remaining equal, than firms that operate with lower interest coverage ratios.

In the table below, I look at the distributions of both these numbers, again broken down by region of the world:

Debt ratios, by industry (US)Again, the story you tell can be very different, based upon which number you look at. Chinese companies have the most debt in the world, if you define debt as gross debt, but look close to average, when you look at net debt. Indian companies look lightly levered, if you look at Debt to EBITDA multiples, but have the most exposure to debt, if you use interest coverage ratios to measure debt load.

Operating Leases: The Accounting Netherworld

Going back to the definition of debt as financing that comes with contractually set obligations, where failure to meet these obligations can lead to loss of control and default, it is clear that focusing on only the balance sheet (as we have so far) is dangerous, since there are other claims that companies create that meet these conditions. Consider lease agreements, where a retailer or a restaurant business enters into a multi-year agreement to make lease payments, in return for using a store front or building. The lease payments are clearly set out by contract, and failing to make these payments will lead to loss of that site, and the income from it. You can argue that leases providing more flexibility that a bank loan and that defaulting on a lease is less onerous, because the claims are against a specific location and not the business, but those are arguments about whether leases are more like unsecured debt than secured debt, and not whether leases should be treated as debt. For much of accounting history, though, accountants have followed a different path, treating only a small subset of leases as debt and bringing them on to the balance sheet as capital leases, while allowing the bulk of lease expenses as operating expenses and ignoring future lease commitments on balance sheets. The only consolation prize is that both IFRS and GAAP have required companies to show these lease commitments as footnotes to balance sheets.

In my experience, waiting for accountants to do the right thing will leave you twisting in the wind, since it seems to take decades for common sense to prevail. Consequently, I have been treating leases as debt for more than three decades in valuation, and the process for doing so is neither complicated nor novel. In fact, it is the same process that accountants use right now with capital leases and it involves the following steps:

Estimate a current cost of borrowing or pre-tax cost of debt for the company today, given its default risk and current interest rates (and default spreads).

Starting with the lease commitment table that is included in the footnotes today, discount each lease commitment back to today, using the pre-tax cost of debt as your discount rate (since the lease commitments are pre-tax). Most companies provide only a lump-sum value for commitments after year 5, and while you can act as if this entire amount will come due in year 6, it makes more sense to convert it into an annuity, before discounting.

The sum total of the present value of lease commitments will be the lease debt that will now show up on your balance sheet, but to keep the balance sheet balanced, you will have to create a counter asset.

To the extent that the accounting has treated the current year's lease expense as an operating expense, you have to recompute the operating income, reflecting your treatment of leases as debt:

Adjusted Operating Income = Stated Operating Income + Current year's lease expense - Depreciation on the leased asset

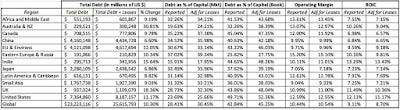

Capitalizing leases will have large consequences for not just debt ratios at companies (pushing them for companies with significant lease commitments) but also for operating profitability measures (like operating margin) and returns on invested capital (since both operating income and invested capital will be changed). The effects on net margin and return on equity should either be much smaller or non-existent, because equity income is after both operating and capital expenses, and moving leases from one grouping to another has muted consequences. In the table below, I report on debt ratio, operating margin and return on capital. before and after the lease adjustment :

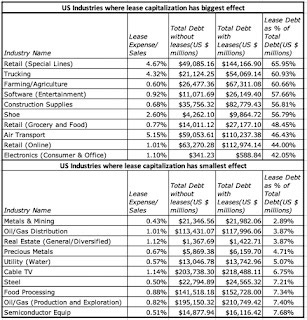

Lease Effect, by Industry, for USYou can download the effects, by industry, for different regions, by using the links at the bottom of this post. Keep in mind, though, that there are parts of the world where lease commitments, though they exist, are not disclosed in financial statements, and as a consequence, I will understate the else effect, While the effect is modest across all companies, the lease effect is larger in sectors that use leases liberally in operations, and to see which sectors are most and least affected, I looked at the ten sectors, among US companies, and not counting financial service firms, that saw the biggest percentage increases in debt ratios and the ten sectors that saw the smallest in the table below:

Lease Effect, by Industry, for USNote that there are a large number of retail groupings that rank among the most affected sectors, though a few technology companies also make the cut. As I noted at the start of this post, this year will be a consequential one, since both GAAP and IFRS will start requiring companies to capitalize leases and showing them as debt. While I applaud the dawning of sanity, there are many investors (and equity research analysts) who are convinced that this step will be catastrophic for companies in lease-heavy sectors, since it will be uncover how levered they are. I am less concerned, because markets, unlike accountants, have not been in denial for decades and market prices, for the most part and for most companies, already reflect the reality that leases are debt.

Debt: Final Thoughts

One of the biggest impediments to any rational discussion of debt's place in capital is the emotional baggage that we bring to that discussion. Debt is neither poison, as some detractors claim it to be, nor is a nectar, as its biggest promoters describe it. It is a source of capital that comes with fixed commitments and the risk of default, good for some companies and bad for others, and when it does create value, it is because the tax code it tilted towards it. It is true that some companies and investors, especially those playing the leverage game, over estimate its benefits and under estimate its side costs, but they will learn their lessons the hard way. It is also true that other companies and investors, in the name of prudence, think that less debt is always better than more debt, and no debt is optimal, and they too are leaving money on the table, by being too conservative.

YouTube Video

Datasets

Debt Details, by Industry Group in 2019 for US, Europe, Emerging Markets, Japan, Australia & Canada, India and China

Debt Ratios, by Industry Group in 2019 for US, Europe, Emerging Markets, Japan, Australia & Canada, India and China

Lease Capitalization Effects, by Industry Group in 2019 for US, Europe, Emerging Markets, Japan, Australia & Canada, India and China

Papers

January 2019 Data Updates