I have spent the last week reading "Shoe Dog", Phil Knight's memoir of how a runner on the Oregon University track team built one of the great shoe companies in the world, in Nike. In addition to its entertainment value, and it is a fun book to read, I read it for two storylines. The first is the time, effort and grit that it took to build a business, in a world where risk capital was more difficult to access than it has been in this century, and in a business where scaling up posed significant challenges. The second is the building of a brand name, with a mix of happy accidents (from the naming of the company to the creation of the swoosh as the company's symbol to its choice of slogan), good timing and great merchandising all playing a role in creating one of the great brand names in apparel and footwear. The latter assessment led a more general consideration of what constitutes a brand name, what makes a brand name valuable and what causes brand name values to deplete and disappear. Of course, since my attention was drawn to Nike in the first place, because of a change at the top the company and talk of brand name malaise, I tried my hand at valuing Nike in 2024, along the way.

Brand Name - What is it?

The broadest definition of a brand name is that it is recognized (by employees, consumers and the market) and remembered, either because of familiarity (because of brand name longevity) or association (with advertising or a celebrity). That definition, though, is not particularly useful since remembering or recognizing a brand, by itself, tells you nothing about its value. After all, almost everyone has heard or recognizes AT&T as a brand/corporate name, but as someone who is a cell service and internet customer of AT&T, I can assure you that neither of those choices were driven by brand name. The essence of brand name value is that the recognition or remembrance of a brand name changes how people behave in its presence. With customers, brand name recognition can manifest itself in buying choices (affecting revenues and revenue growth) or willingness to pay a higher price (higher profit margins). With capital providers, it may allow for lower funding costs, with equity investors pricing equity higher and lenders accepting lower interest rates and/or fewer lending covenants. For the moment, this may seem abstract and subjective, but in the next section, we will flesh out brand name effects on operating metrics and value more explicitly.

Corporate, Product and Personal Brand Names

Brand names can attach to entire companies, to particular products or brands, or even to personnel and people. With a company like Coca Cola, it is the corporate brand name that has the most power, but the soft drink beverages marketed by the company (Coca Cola, Fanta, Sprite, Dasani etc.) each have their own brand names. With companies like Unilever, the corporate brand name takes a back seat to the brands names of the dozens of products controlled by the company, which include Dove (soap), Axe (deodorant), Hellman's (mayonnaise) and Close-up (toothpaste), just to name a few. There are clearly cases of people with significant brand name value, in sports (Ohtani in baseball, Messi in soccer, Kohli in cricket) and entertainment (Taylor Swift, Beyonce), with a spill over to the entities that attach themselves to these people. In fact, a critical component of Nike's brand name was put in place in 1984, when the company signed on Michael Jordan, in his rookie season as a basketball player, and reaped benefits as he became the sport's biggest star over the next decade.

Brand names and other Competitive Advantages

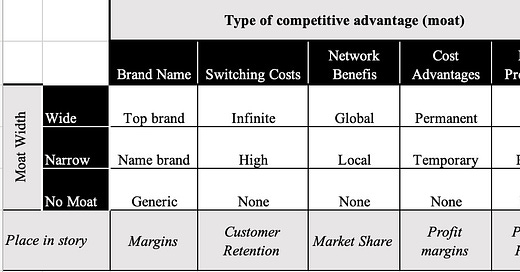

One reason that brand name discussions often lose their focus is that companies are quick to bundle a host of competitive advantages, each of which may be valuable, in the brand name grouping. The table below, where I have loosely borrowed from Morningstar and Michael Porter is one way to think about both the types and sustainability of competitive advantages:

Companies like Walmart and Aramco have significant competitive advantages, but I don't think brand name is on the top five list. Walmart's strengths come from immense economies of scale and bargaining power with suppliers, and Aramco's value derives from massive oil reserves, with far lower costs of extraction, than any of its competitors. Google and Facebook control the advertising business, because they have huge networking benefits, i.e., they become more attractive destinations for advertisers as they get bigger, explaining why they were so quick to change their corporate names, and why it has had so little effect on value. The pharmaceutical companies have some brand name value, but a bigger portion of their value added comes from the protection against competition they get from owning patents. While this may seem like splitting hairs, since all competitive advantages find their way into the bottom line (higher earnings or lower risk), a company that mistakes where its competitive advantages come from risks losing those advantages.

Brand Name Value

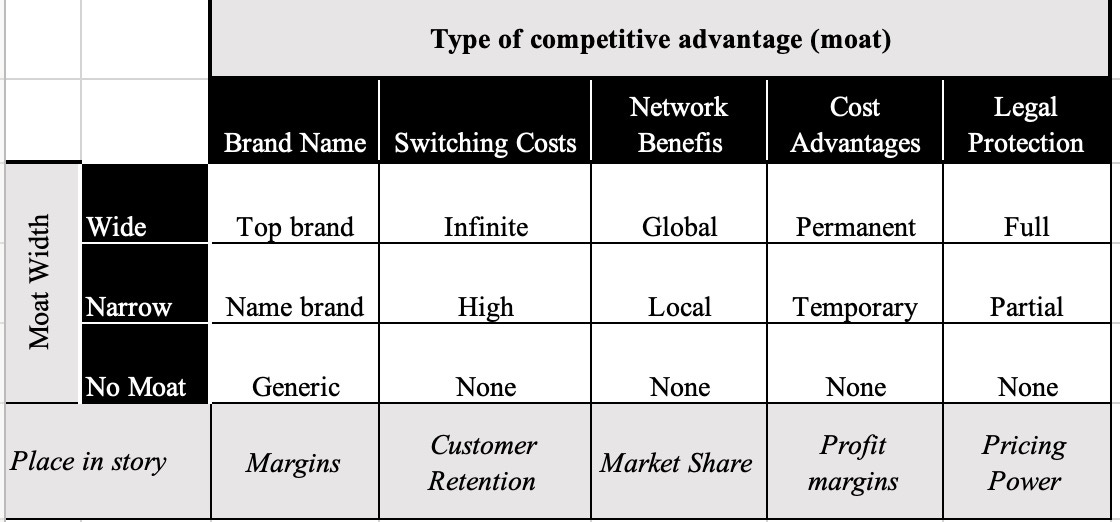

At the risk of drawing backlash from marketing experts and brand name consultants, I will start with my "narrow" definition of brand name. In arriving at this definition, I will fall back on a structure where I connect the value of a business to key drivers, and look at how brand name will affect these drivers:

Put simply, brand name value can show up in almost every input, with a more recognizable (and respected) brand name leading to more sales (higher revenues and revenue growth), more pricing power (higher margins), and perhaps even less reinvestment and less risk (lower costs of capital and failure risk). That said, the strongest impact of brand name is on pricing power, with brand name in its purest form allowing it's owner to charge a higher price for a product or service than a competitor could charge for an identical offering. To illustrate, I walked over to my neighborhood pharmacy, and compared the prices of an over-the-counter pain killer (acetaminophen), in its branded form (Tylenol) and its generic version (CVS) :

The ingredients, in case you are wondering, are exactly the same, leading to the interesting question, more psychological than financial, of why anyone would pay an extra $2.50 for a product with no differentiating features. If you are wondering how this plays out at the business level, the operating margins of pharmaceutical companies that own the "brand names" are significantly higher than the brand names of companies that make just the generic substitutes.

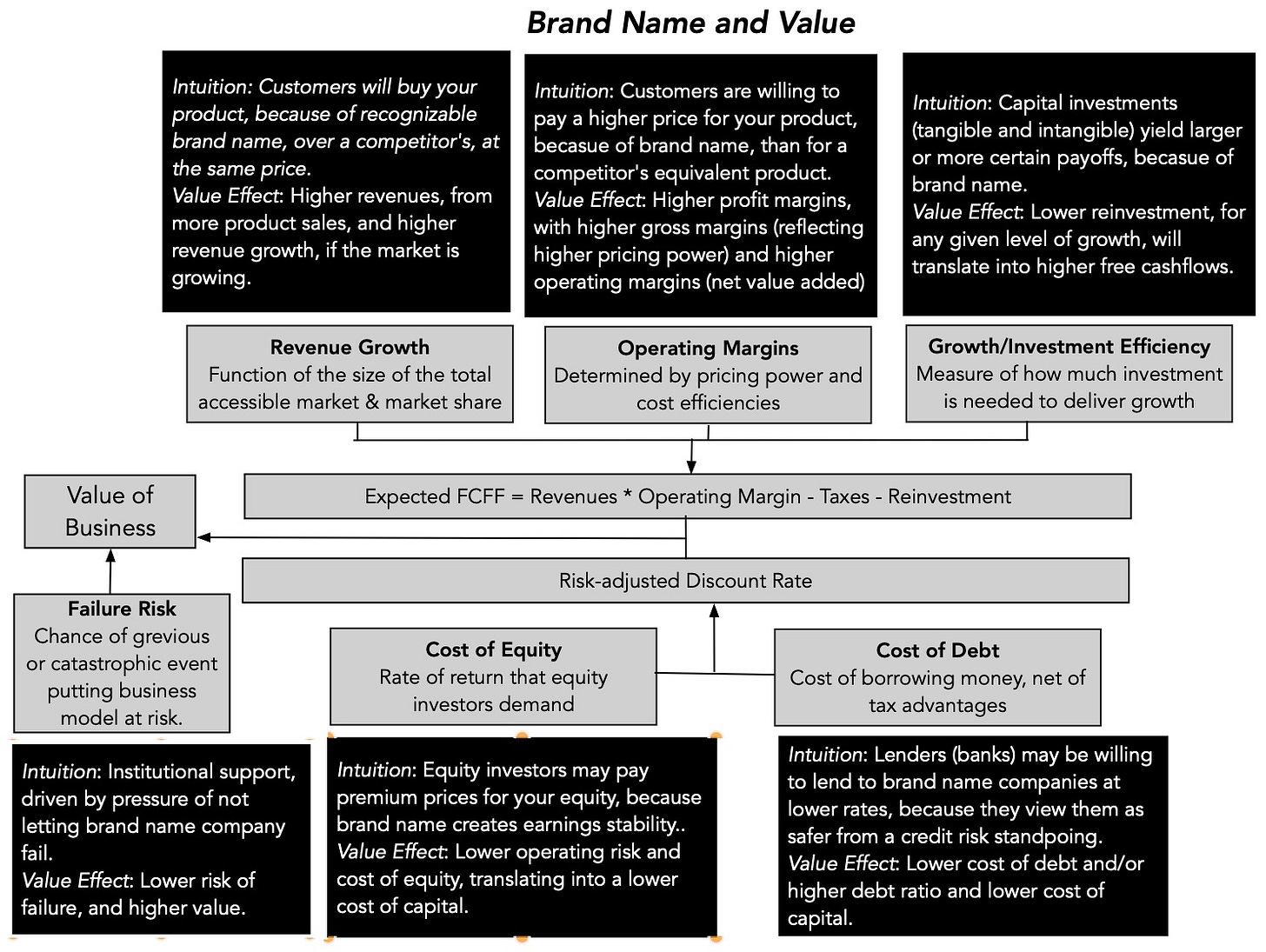

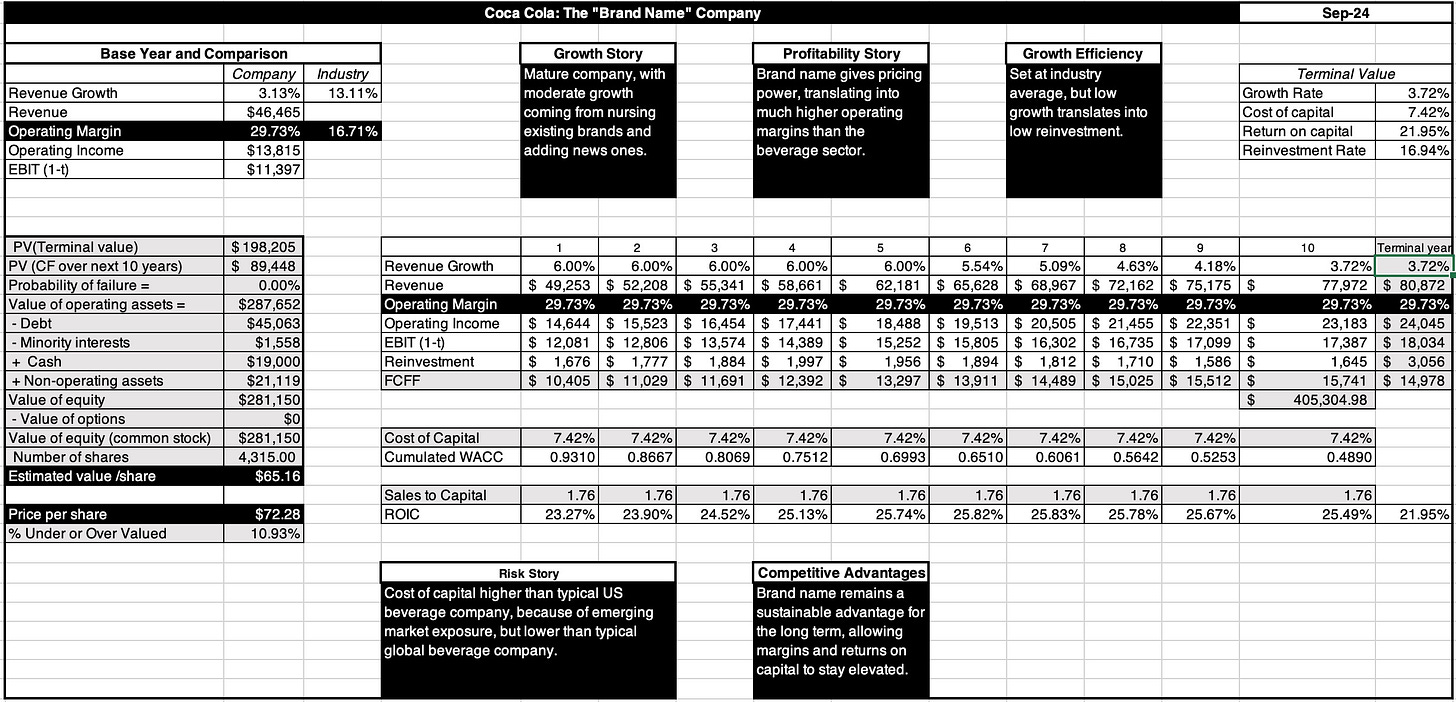

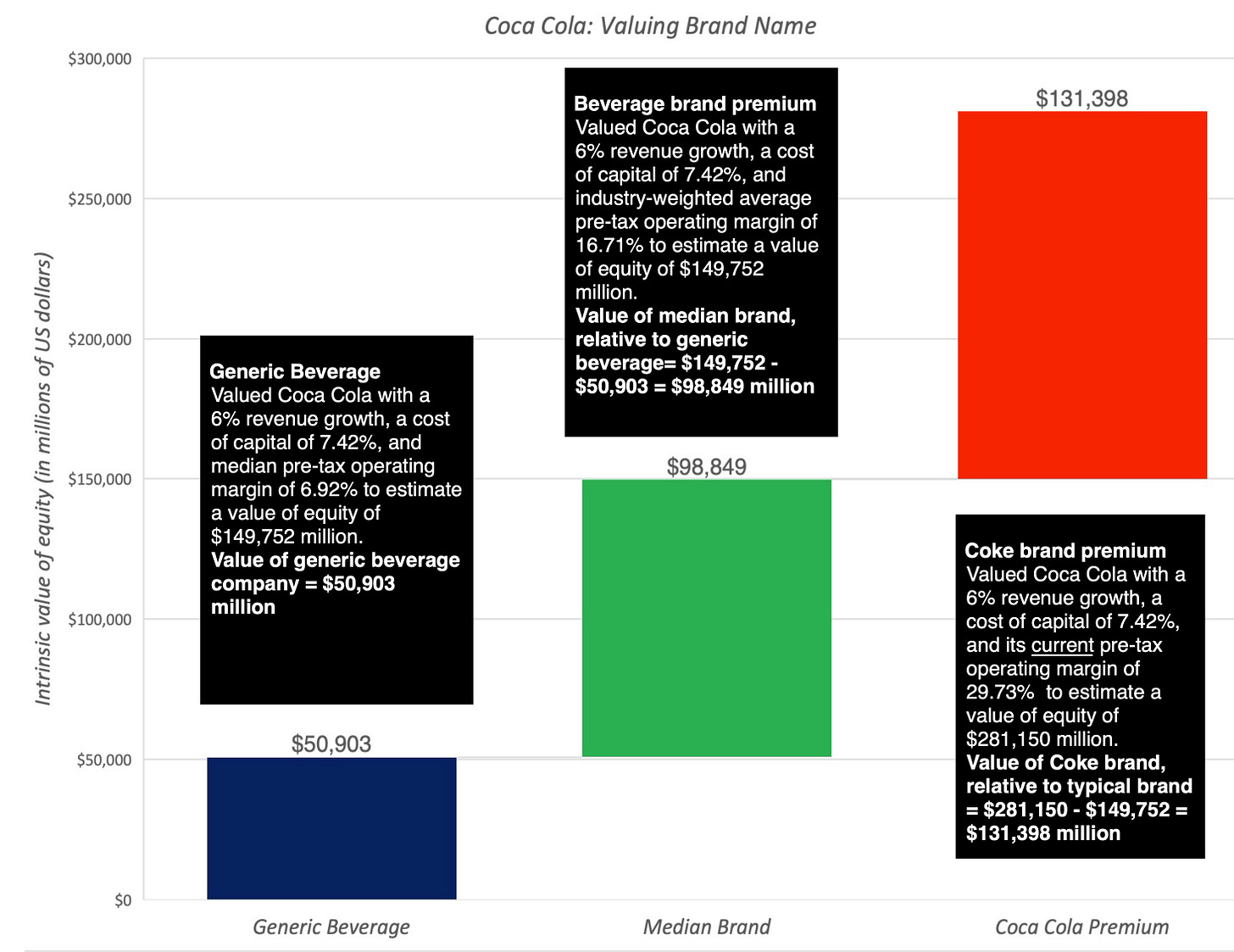

The Tylenol example also serves to illustrate when it is easiest to value brand name, i.e., when it is the only competitive advantage, and when it will become difficult to do, i.e., when it has many competitive advantages. It is for that reason that valuing brand name is easier to do at a beverage or cereal company, such as Coca Cola or Kellogg's, where there is little to differentiate across products other than brand name, and you can attribute the higher margins almost entirely to brand name. It is at the basis for my valuation of Coca Cola's brand name in the picture below, where I value the company with its current operating margin:

Note that while the company comes in as slightly overvalued, it is still given a value of $281.15 billion, with much of that value coming fromits pre-tax operating margin of 29.73%. We estimate the value of Coca Cola's brand name in two steps, first comparing to aweighted average margin off 16.75%for soft-drink beverage companies, where many of the largest companies are themselves branded (Pepsi, Dr. Pepper etc.), albeit with less pricing power than Coca Coal and then comparing to themedian operating margin of 6.92%, skewed towards smaller and generic beverage companies listed globally:

This is undoubtedly simplistic, since it assumes that the brand name value shows up entirely in the margin, and it likely understates the value of Coca Cola's brand name. That said, valuing Coca Cola at the median beverage company margin yields a value of $51 billion, suggesting that 82% of the company's intrinsic value comes from its brand name. Comparing to other beverage company and valuing at the weighted average operating margin still yields a differential brand value of $131.4 billion for Coca Cola, indicating that having a premium brand name has significant value.

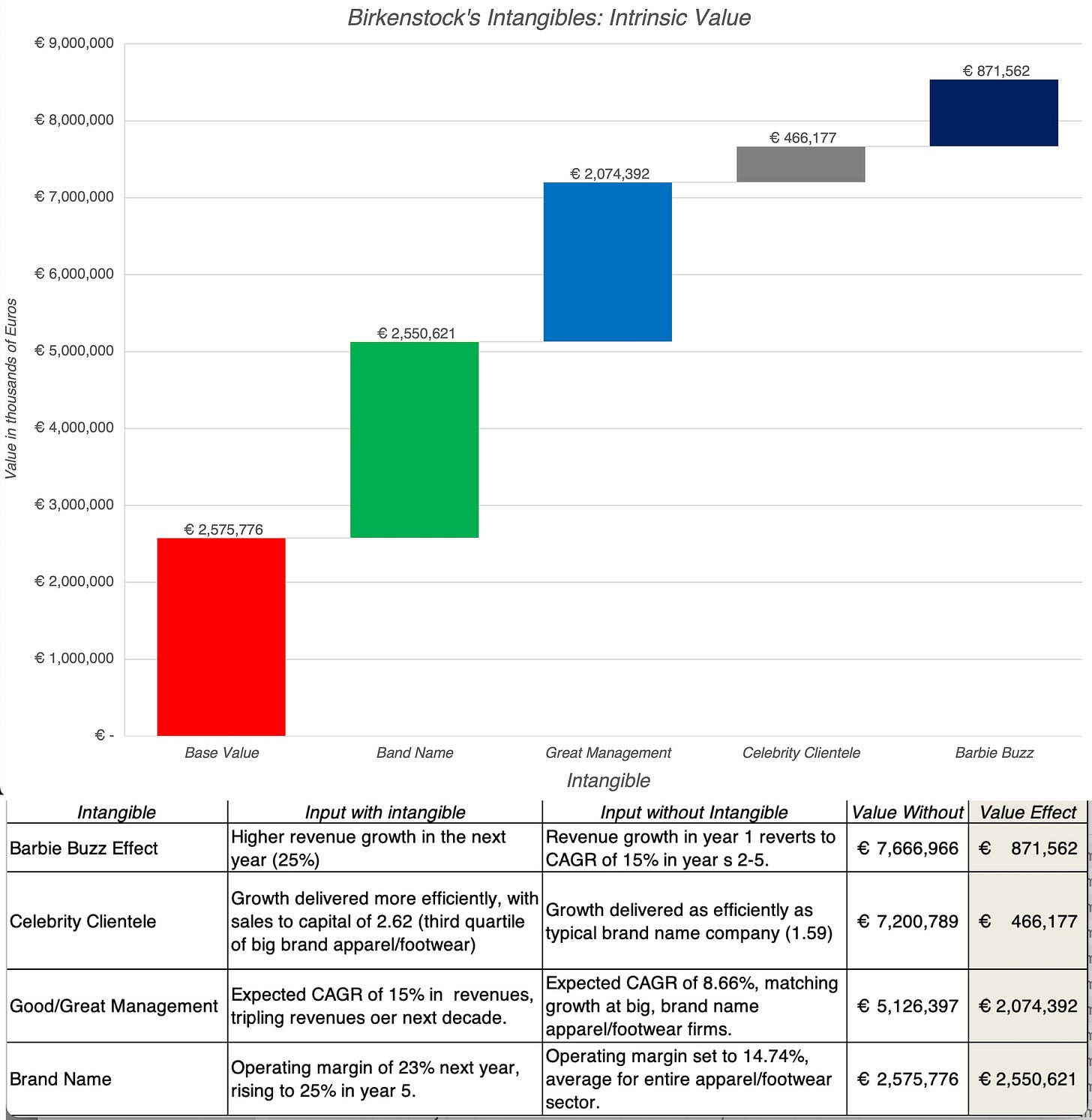

Brand names become more difficult to isolate and value, when a company has multiple competitive advantages, since the higher margins or growth or returns on capital will reflect the composite effect of all of the advantages. With companies like Apple, where brand name is a factor, as is a proprietary operating system, a superior styling and a unique app ecosystem, the higher margin can be attributed to a multitude of factors, making it more difficult, perhaps even impossible, to isolate the brand name value. When valuing Birkenstock, at the time of its IPO, I wrestled with this problem, and with the help of a series of assumptions along the way, did find a way to break the value of the four intangibles that I saw in the company: a world-recognized brand name, a quality management team, free celebrity advertising and the buzz created by Margot Robbie wearing pink Birkenstock in the Barbie movie.

Download Birkenstock valuation at the time of IPO

The pricing premium effect of brand name also becomes an effective device to strip companies that hold on to the delusion that their brand name values have value, long after they have lost their shine. If a company has margins that trail that of other companies in its industry grouping, it has lost brand name bragging rights (and value), and it is time to either accept that reality or rebrand to acquire pricing power again. Applying this test, you will find that nine out of ten companies that claim to have brand values have really nothing to show for that claim.

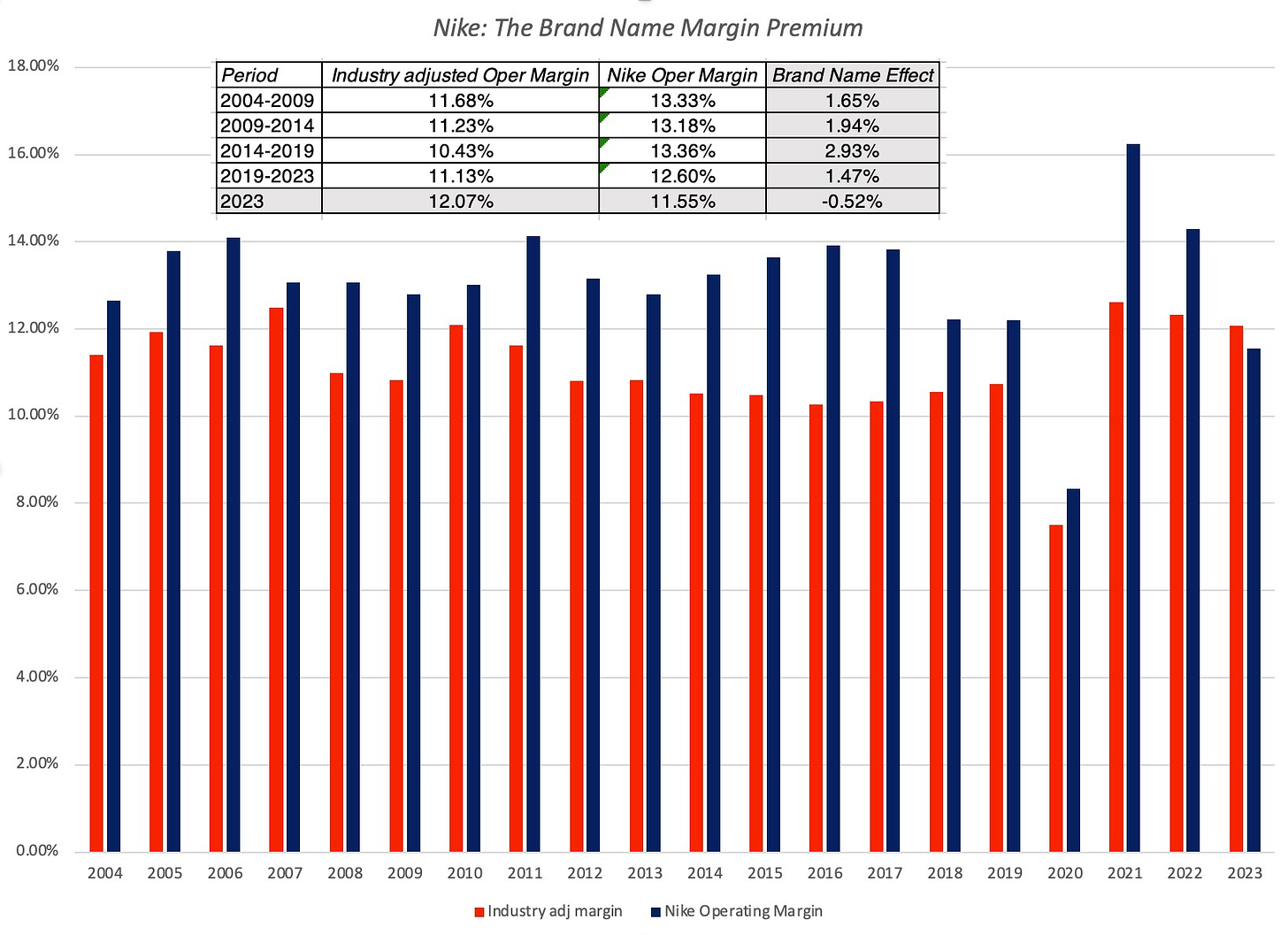

Nike, in my view, falls somewhere between the two extremes. It is not as pure a brand play as Coca Cola, since athletic footwear, in particular, has physical differentiation that may lead some to prefer one brand over another. At the same time, it is not as complex as Apple, insofar as even a Nike aficionado can find a relatively close substitute in another brand. To measure how Nike's brand name has played out in its operating metrics, we compared the company's operating margins to the weighted operating margin of the two businesses (two thirds footwear and one third apparel) that Nike has operated in for much of the last two decades:

Other than 2023, Nike has consistently earned a higher operating margin (1.5% to 3% higher) than the rest of the industry, and since much of this industry is composed of brand name companies, it would suggest that Nike has a premium brand name, not surprisingly. If you are a Nike-pessimist, though, the drop off in the margin differential in the last five years is troubling, but almost all of that drop can be attributed to the company's troubles in 2023. Clearly, the company is taking the decline seriously, bringing back a Nike employee of long standing in Elliott Hill to replace John Donahoe, who cut his teeth in tech companies (ServiceNow, eBay and PayPal).

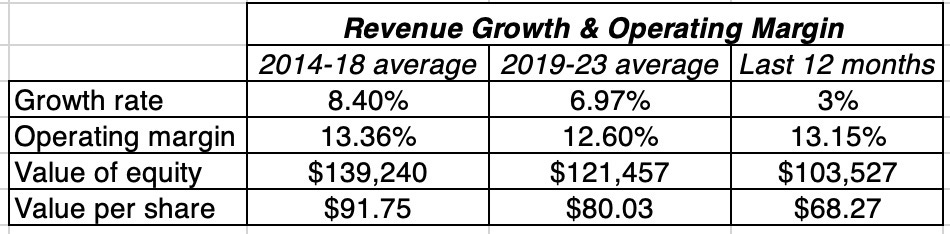

I valued Nike, using its compounded annual growth rate and average operating margin over three period - 2014-2108, 2019-2023 and just the last twelve months:

You can see why Nike acted swiftly to change its CEO, since its value will dip substantially, if its growth stays down and margins do not bounce back. At the $71 stock price that the stock was trading at, just six weeks ago, the investing odds would have been in your favor, but the bounce back in the stock price to $88, after the new CEO hire, suggests that the market is pricing in the expectation that the company will bounce back to higher growth and better margins.

Brand Name Creation

Brand name does add value, if it gives the company that owns it pricing power, but how does a company end up with a valuable brand name? There are facile answers and they include longevity, with long-lived companies having more recognizable brand names, and advertising, where more spending is assumed to result in a more valuable brand name. To see why I attach the "facile" prefix to these answers, consider again the example of AT&T, a company that has been around for more than a century and remains one of the ten largest spenders on advertising in the United States. None of that spending has translated into a significant brand name value, thought there may other benefits that the company accrues.

I am sure that someone who immerses themselves in in this topic, perhaps in marketing and advertising, may be able to provide a deeper answer, but here is what I see as ingredients that go into developing a valuable brand name:

Attachment to an emotional factor/need: As marketing has recognized through the ages, the key to a powerful brand name is a tie to a human emotion. Rational or not, consumers may reach for a branded product, because they associate the product with freedom, reliability, happiness, patriotism or aspiration, if that association exists in their minds. The challenge, of course, is to find an emotion that attaches well to your product, either because of its history or its make-up, but the association, once made, can be powerful and long-lasting.

Celebrity connection: Earlier, we talked about personal brand names, and argued that Nike benefited from its association with Michael Jordan, in building its brand name. In fact, Apple (in its streaming service) and Major League Soccer benefited mightily from Lionel Messi playing Inter Miami, with the former adding hundreds of thousands of subscribers to it soccer streaming service, and the latter increasing attendance in stadiums around the country. Here again, there are perils, since attaching a brand name to a person also exposes the company to the failings and foibles of that person, as Nike found out in its associations with both Tiger Woods and Colin Kaepernick.

Fortuitous events/ choices: There is a third factor that is not covered in most brand name management classes, and for good reason, and that is the effect of luck. In an alternate universe, Phil Knight might have stayed with Dimension Six, his initial choice for the company name, picked a different symbol than the swoosh (for which Nike paid $35 to the designer) and even a different slogan ( than the "Just do it" picked by the advertising team), and the end result could have been very different.

Advertising: While there may be little or no link between overall advertising spending and brand name, it is undeniable that there are ads that catch people's attention and alter perceptions of a product. I was an Apple user already in 1984, when it ran its famous 1984 ad during the Super Bowl, setting itself apart from the PC makers, and while that ad yielded little monetary benefit to Apple in the immediate aftermath, it contributed to creating the brand name that now allows the company to charge $1600 for a new smart phone. Nike has had its share of iconic commercials, and I still remember this Nike ad, with Michael Jordan, from 1997, showing how long the shelf life can be for a great ad.

If asked to advice a company that was intent on creating a brand name, my suggestion would be to start with a product or service that is differentiated from the competition, and to give the brand name time to build around that differentiation. That may require sacrifices on scaling up (accepting less growth to preserve the product differential), a higher cost structure (if it is a quality difference) and perhaps even more reinvestment, but trade offs are inherent to almost everything of value in business. If the expected costs of building a brand name exceed its benefits, though, it may be worth asking whether brand name is the competitive advantage that the company should be aspiring for, since there are other competitive advantages that can add as much or much more value in the business the company operates in.

Brand Name Destruction

The benefit of building a strong brand name is that it remains one of the most sustainable competitive advantages in business, with the advantages often lasting decades. However, even brand names eventually lose their luster, but the reasons they do so vary:

Aging brand/consumer base: In my posts and book on corporate life cycle, I talk about how and why companies age, and how aging is inevitable. The same can be said of brand names, since even the most highly regarded brand names eventually age, and no matter how much managers try to resurrect them, they never recover their mojo. When valuing Kraft Heinz in 2015, when the most venerable name in value investing (Warren Buffett) teamed up with one of the shrewdest players in private equity (3G Capital) to buy the company because it was under valued, I wondered whether the reason the market was turning down on the company was because the portion of the population that were drawn to the company's products (fifty seven types of ketchup, all of which taste bad, and cheese that stays liquid through a nuclear winter) to be tasty was getting smaller and older. In hindsight, it is clear that Kraft Heinz will not reclaim its former glory, because its products and customer base have aged.

Benign neglect: Brand names may provide sustainable competitive advantages, but only if they are cared for and maintained. There are legendary brand names that have been neglected, treated as cash cows with no new investment or sprucing up needed, and have faded in value. Quaker Oats, a longstanding mainstay of the US cereal business, not only allowed itself to pushed to the sidelines by aggressive cereal companies, but failed to take advantage of the rise in demand for oatmeal as a heart-healthy substitute.

Cultural changes: There are products and services that have lost their allure over time, because the cultural mores or social norms of the consumers have changed. If you binge watch Mad Men, the television series about advertising in the 1960s, you should not be surprised to see ads for products and services that you would now view in a very different light.

Changing tastes: There are some businesses, where the demand for products is transient and fad-driven, and new brands replace old ones, as tastes shift. This has generally been the case with apparel retail in the United States, with the Gap's reign at the top lasting about a decade, with newer and cooler retail brands like Abercrombie and Fitch and Tommy Hilfiger replacing them, and then were themselves being displaced by H&M and Uniqlo.

Toxic connections: A brand name that is built up over time can sometimes very quickly fall back to earth, if the company or its personnel bring toxic connections. Abercrombie and Fitch, for instance, which became a hot destination for the young in the first decade of this century, found its brand name devastated by accusations of racism and sexism in its ranks.

Brand overreach: There are cases where a company with a valuable brand name may dilute or even destroy that brand name by overreaching, and putting it on products that cut agains the brand name narrative. A good argument can be made that Disney, usually masterful at managing its brands, diluted the value of both its Avengers and Star Wars franchises by rushing headlong into the streaming business, with new series.

While all of these forces can cause a once valuable brand name to lose its value, it is worth noting that there are companies that have redeemed brand name value, sometimes by remaking the product or service, sometimes by repackaging it and sometimes by repositioning it. Crocs, whose brand name soared in the 2000s, but crashed by the end of the decade, repackaged itself around celebrity endorsements to become a successful brand again. Lego, a venerable brand name in the toy business, sold off its theme parks, and refocused attention on its core product, while redirecting its offerings to adults. In general, though, reincarnating a brand becomes easier for niche brands than for mass market ones, for product brands than for company brands, and for younger brands than for older ones.

I believe that 2023 was a wake up call for Nike, as it awoke multiple disruptions. First, in the post-COVID years, Nike moved from store sales to digital sales, with Nike Digital, accounting for almost 43% of revenues in 2022. While that shift does reflect a change in consumer preferences towards shopping online, there is a question of whether bypassing shoe stores, which over the decades have contributed to the Nike brand, by highlighting their most iconic shoes, has undercut the brand. Second, while the footwear business has been more resistant to fads than the apparel business, Nike;'s mass market strategy of being all things to all people is exposing it to disruption. The company is losing market share, especially among younger customers, to newcomers in the space like On and Hoka, and among runners (Nike's original core market) to older companies like New Balance that have rediscovered their mojo. Third, in an age where celebrities come with problems, and politics divides us on even the most trivial of issues, Nike's celebrity-driven advertising campaigns may hurt more than help the company. In short, Nike's new CEO has his work cut out for him!

YouTube Video

Links

Great article as usual, Professor. Younger readers might enjoy Munger's reverse-engineered or "inverted" brand analysis of Coke.

https://fs.blog/turning-2-million-into-2-trillion/

Loved the connection of brand name to actual numbers such as revenue growth, operating margins, cost of equity/cost of debt. Thank you as always I learn so much from you