As we enter the last quarter of 2023, it has been a roller coaster of a year. We started the year with significant uncertainty about whether the surge in inflation seen in 2022 would persist as well as about whether the economy was headed into a recession. In the first half of the year, we had positive surprises on both fronts, as inflation dropped after than expected and the economy stayed resilient, allowing for a comeback on stocks, which I wrote about in a post in July 2023. That recovery notwithstanding, uncertainties about inflation and the economy remained unresolved, and those uncertainties became part of the market story in the third quarter of 2023. In July and the first half of August of 2023, it looked like the market consensus was solidifying around a soft-landing story, with no recession and inflation under control, but that narrative developed cracks in the second half of the quarter, with markets giving back gains. In this post, I will look at how markets did during the third quarter of 2023, and use that performance as the basis for examining risk capital's presence (or absence) in markets.

The Markets in the Third Quarter

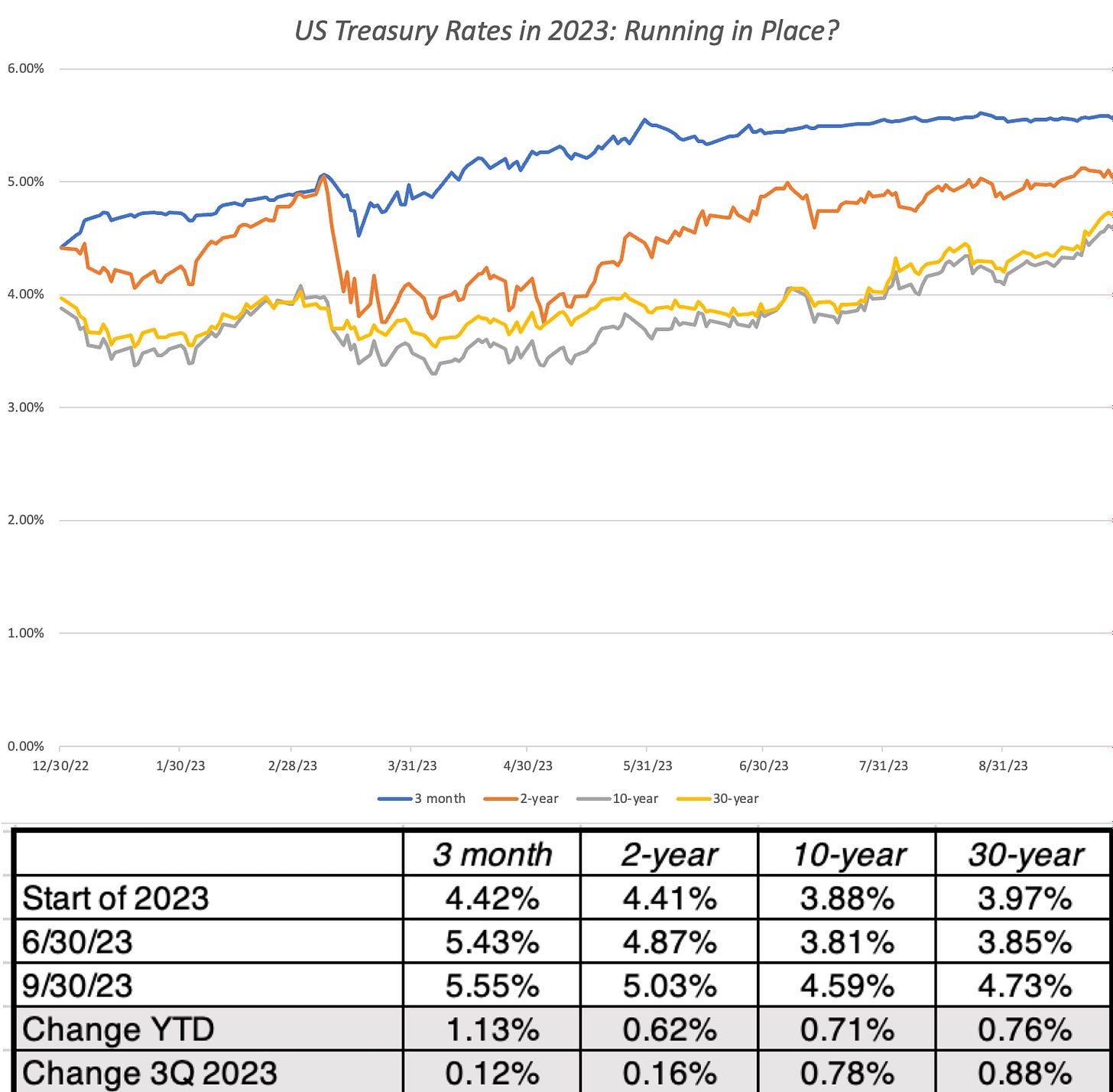

Coming off a year of rising rates in 2022, interest rates have continued to command center stage in 2023. While the rise in treasury rates has been less dramatic this year, rates have continued to rise across the term structure:

Source: US Treasury

While short term rates rose sharply in the first half of the year, and long term rates stabilized, the third quarter has sen a reversal, with short term rates now stabilizing and long term rates rising. At the start of October, the ten-year and thirty-year rates were both approaching 15-year highs, with the 10-year treasury at 4.59% and the 30-year treasury rate at 4.73%. As a consequence, the yield curve which has been downward sloping for all of the last year, became less so, which may have significance for those who view this metric as an impeccable predictor of recessions, but I am not one of those.

Moving on to stocks, the strength that stocks exhibited in the first half of this year, continued for the first few weeks of the third quarter, with stocks peaking in mid-August, but giving back all of those gains and more in the last few weeks of the third quarter of 2023:

As you can see, it has been a divergent market, looking at performance during 2023. In spite of losing 3.65% of their value in the third quarter of 2023, large cap stocks are still ahead 12.13% for the year, but small cap stocks are now back to where they were at the start of 2023. The NASDAQ also gave back gains in the third quarter, but is up 27.27% for the year, but those gaudy numbers obscure a sobering reality. Seven companies (NVIDIA, Apple, Microsoft, Alphabet, Meta, Amazon and Tesla) account for $3.7 trillion of the increase in market cap in 2023, and removing them from the S&P 500 and NASDAQ removes much of the increase in value you see in both indices.

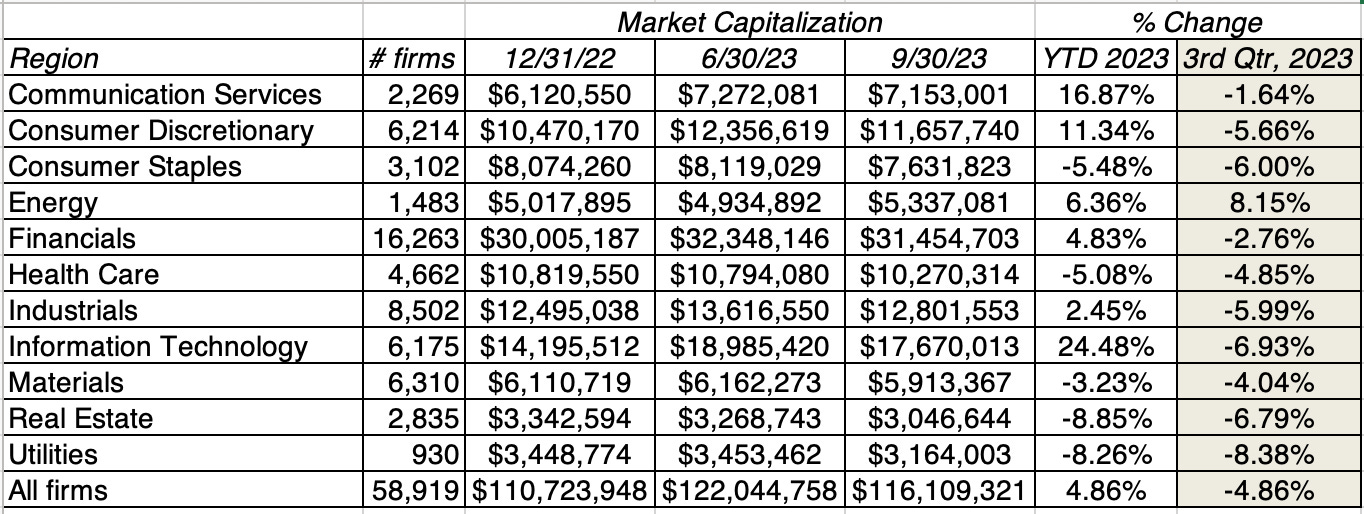

Breaking global equities down by sector, and looking at the changes in 2023, both for the entire year as well as just the third quarter, we arrive at the following:

In keeping with our findings from contrasting the NASDAQ to other US indices, technology has been the best performing sector for 2023, followed by consumer discretionary and communication services. However, also in keeping with our findings on divergence across stocks, five of the eleven sectors have decreased in value in 2023, with real estate and utilities the worst performing sectors. Some of these differences across sectors reflect reversals from the damage done in 2022, but some of it is reflective of the disparate impact of inflation and higher rates across companies

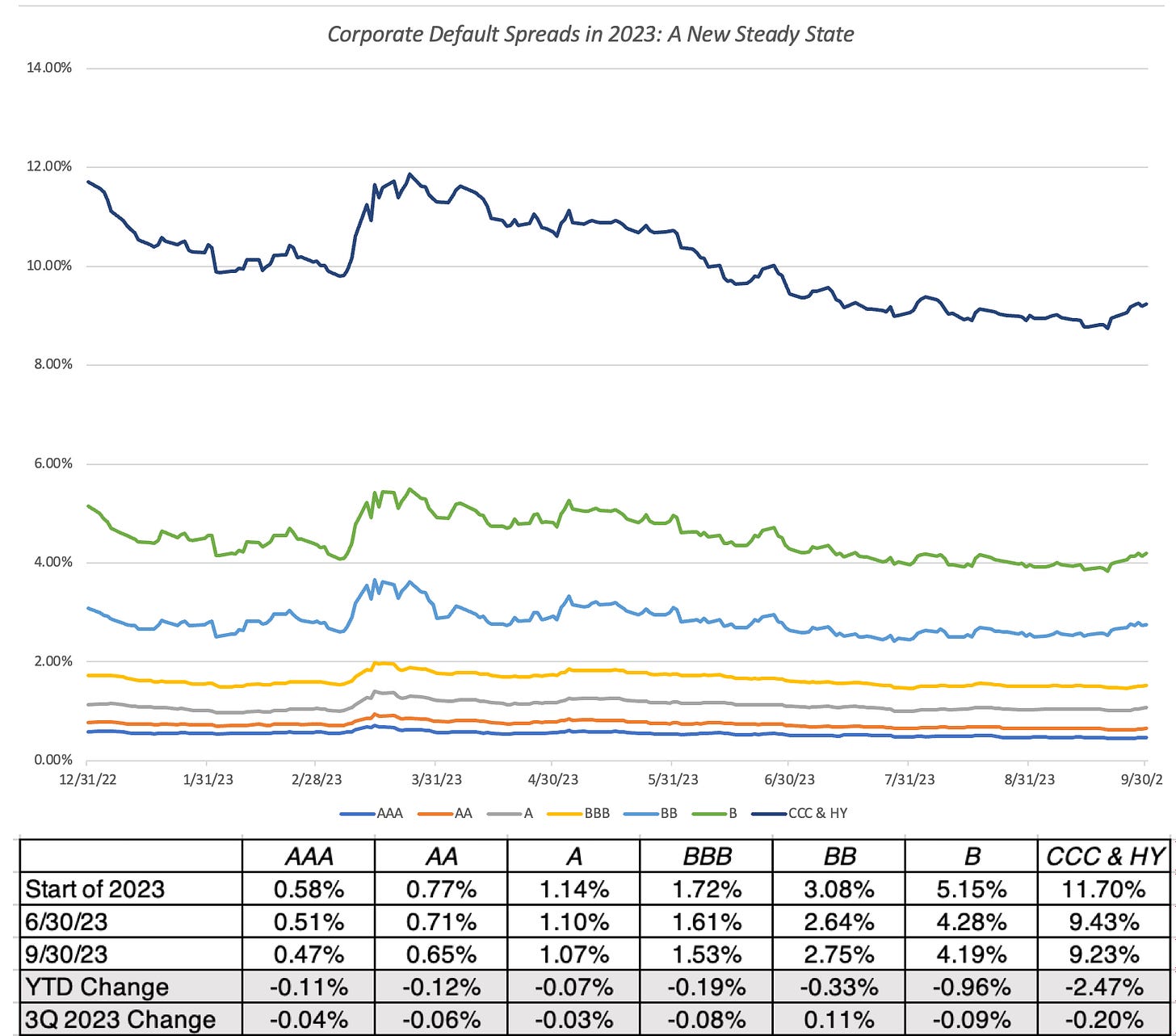

Finally. I looked at global equities, broken down by region of the world, and in US dollars, to allow for direct comparison:

India is the only part of the world to post positive returns, in US dollar terms, in the third quarter,and is the best performing market of the year, running just ahead of the US; note again that of the $5.2 trillion increase in value US equities, the seven companies that we listed earlier accounted for $3.7 billion. Latin America had a brutal third quarter, and is the worst performing region in the world, for the year-to-date, followed by China. If you are an equity investor, your portfolio standing at this point of 2023 and your returns for the year will be largely determined by whether you had any money invested in the "soaring seven" stocks, as well as the sector and regional skews in your investments.

Price of Risk

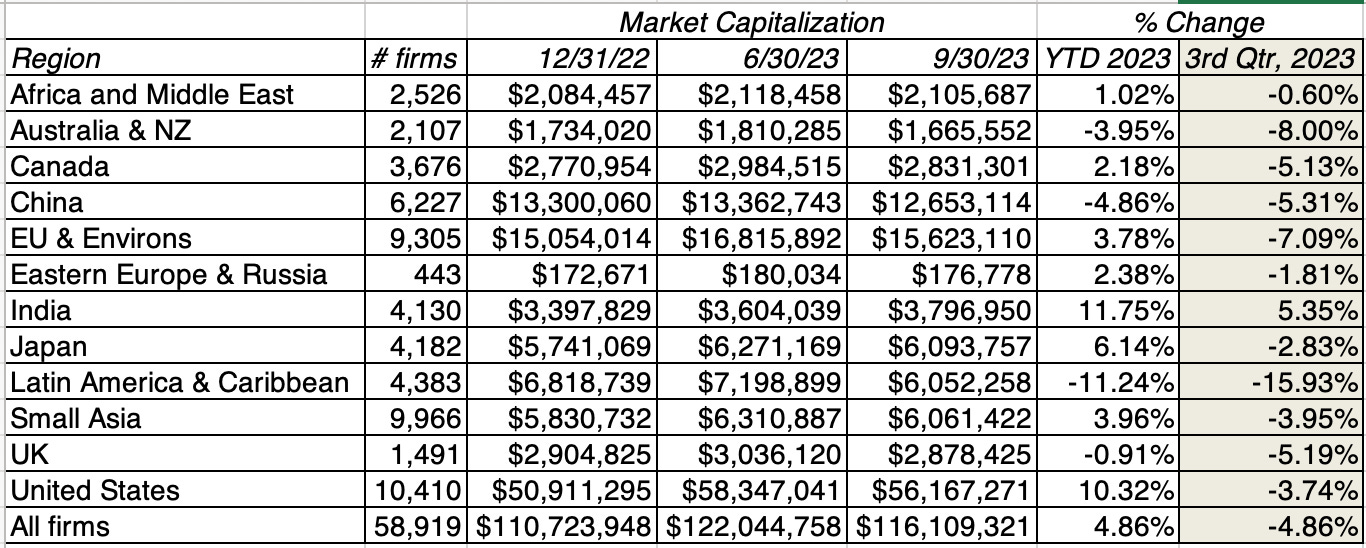

The drop in stock and bond prices in the third quarter of 2023 can partly be attributed to rising interest rates, but how much of that drop is due to the price of risk changing? Put simply, higher risk premiums translate into lower asset prices, and it is conceivable that political and macroeconomic factors have contributed to more risk in markets. To answer this question, I started with the corporate bond market, where default spreads capture the price of risk, and looked at the movement of default spreads across ratings classes in 2023:

As you can see, bond default spreads, after surging in 2022, had a quiet third quarter, decreasing slightly across all ratings classes. Looking across the year to date, there has been little movement in the higher ratings classes, but default spreads have dropped substantially during2023, for lower rated bonds.

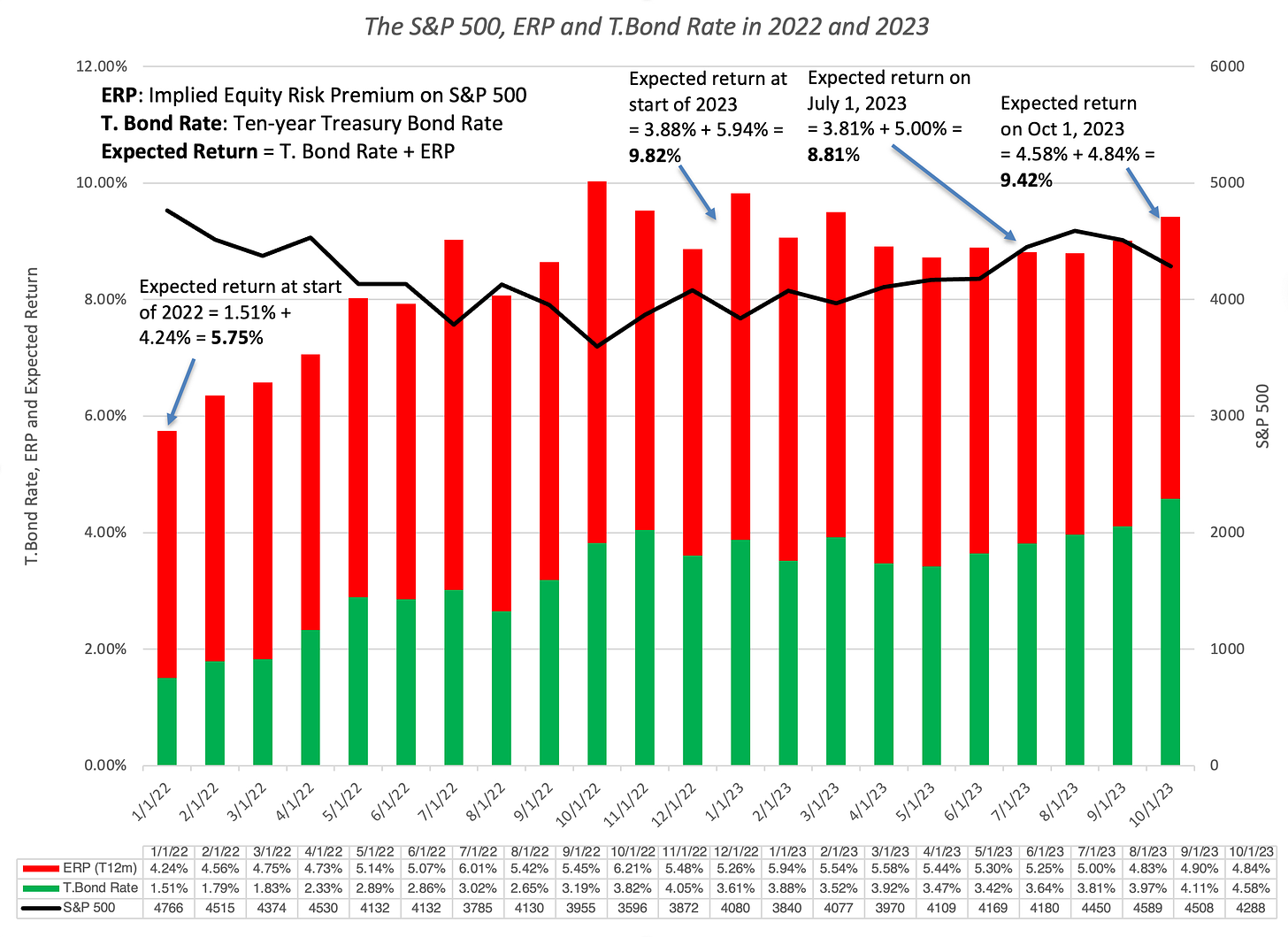

In the equity market, I fall back on my estimates of implied equity risk premiums, which I report at the start of every month on my website, and you can see the path that these premiums have taken during the course of the last two years below:

The equity risk premium declined in the first half of the year, from 5.94% on January 1, 2023, to 5.00% on July 1, 2023, but have been relatively stable in the third quarter, albeit on top of higher risk free rates. Thus, the equity risk premium of 4.84% on October 1, 2023, when added to the ten-year T.Bond rate of 4.58% on that day yields an expected return on equity of 9.42%, up from 8.81% on July 1, 2023. Put simply, notwithstanding the ups and downs in stock prices and interest rates in the third quarter of 2023, there is little evidence that changes in the pricing of risk had much to do with the volatility. Much of the change in stock and corporate bond prices in the third quarter has come from rising interest rates, not a heightened fear factor.

Risk Capital

In a post in the middle of 2022, I noted a dramatic shift in risk capital, i.e., the capital invested in the riskiest investments in every asset class - young, money-losing stocks in equities, high-yield bonds in the corporate bond market and seed capital, in venture capital. After a decade of excess, where risk capital was not just abundant, but overly so, risk capital retreated to the sidelines, creating ripple effects in private and public equity markets. In making that case, I drew on three metrics for measuring risk capital - the number of initial public offerings, the amount of venture capital investment and original issuances of high yield bonds, and I decided that it is time to revisit those metrics, to see if risk capital is finding its way back into markets.

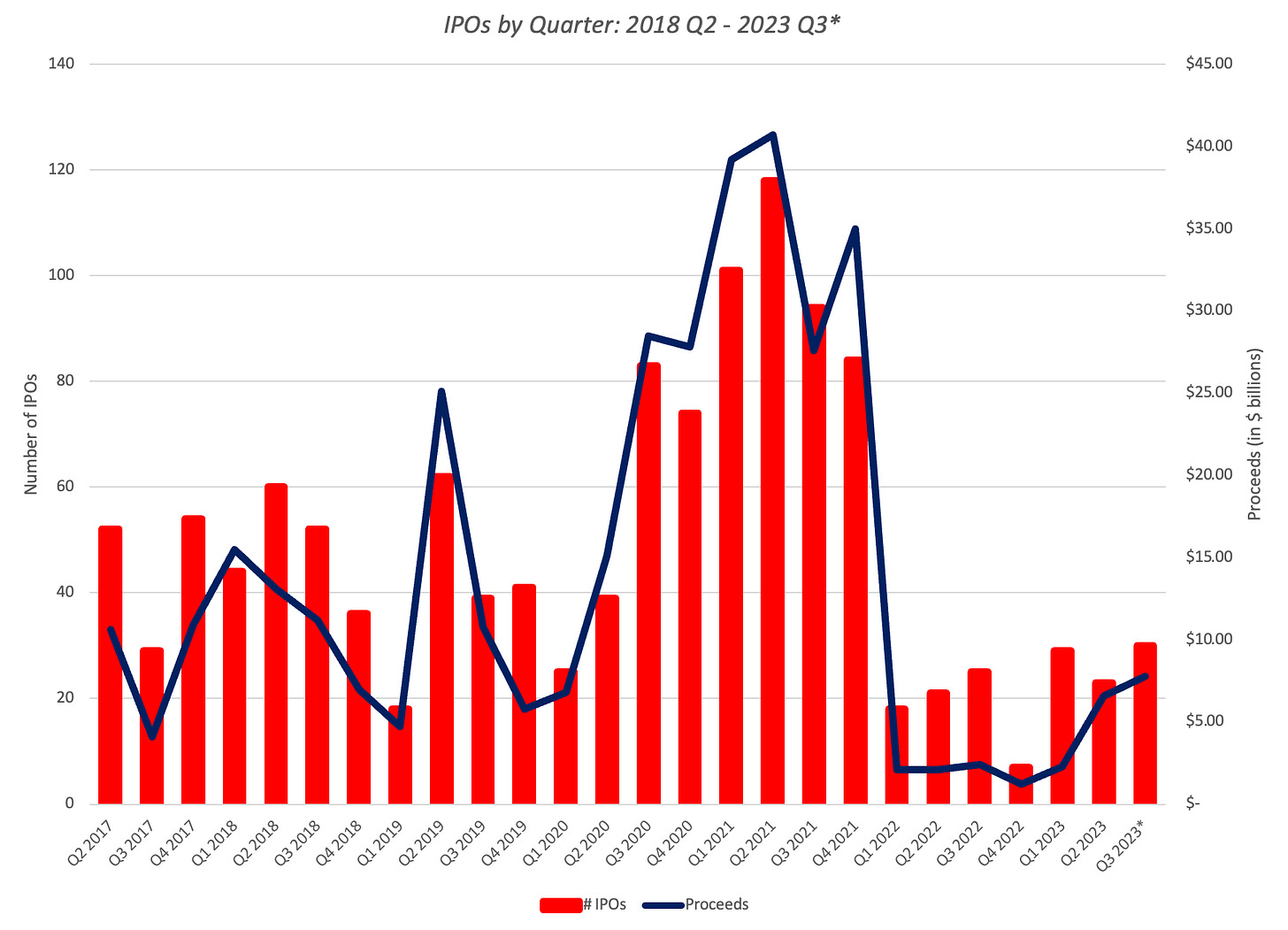

With IPOs, there have been positive developments in recent weeks, with a few high-profile IPOs (Instacart, ARM and Klaviyo) hitting the market, suggesting a loosening up of risk capital. To get a broader perspective, though, I took a look a the number of IPOs, as well as proceeds raised, in 2023, with the intent of detecting shifts:

The good news is that there has been some recovery from the last quarter of 2022, where there were almost no IPOs, but the bad news (for those in the IPO ecosystem) is that this is still a stilted recovery, with numbers well below what we observed for much of the last decade. In addition, it should be noted that the companies that have gone public in the last few weeks have had rough going, post-issuance, in spite of being priced conservatively (relative to what they would have been priced at two years ago).

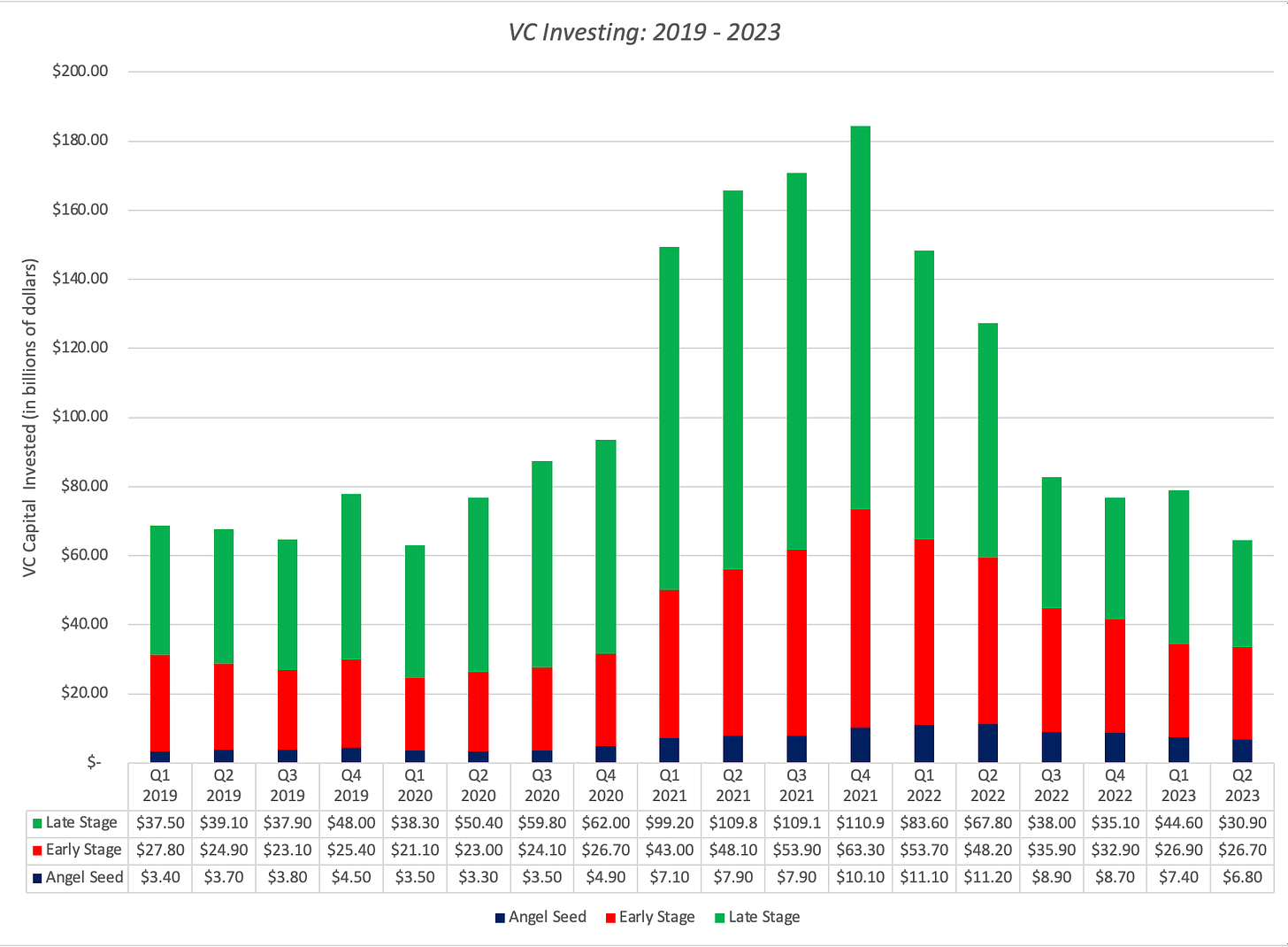

Turning to venture capital financing, we look at both the dollar value of venture capital investing, as well as the breakdown into angel, early stage and late stage funding:

The drop off in venture capital investing that we saw in the second half of 2022 has clearly continued into 2023, with the second quarter funding down from the first. I have long argued that venture capital pricing is tied to IPO and young company pricing in public markets, and given that those are still languishing, venture capital is holding back. In short, if you are a venture capitalist or a company founder, battered by down rounds and withheld capital, the end is not in sight yet.

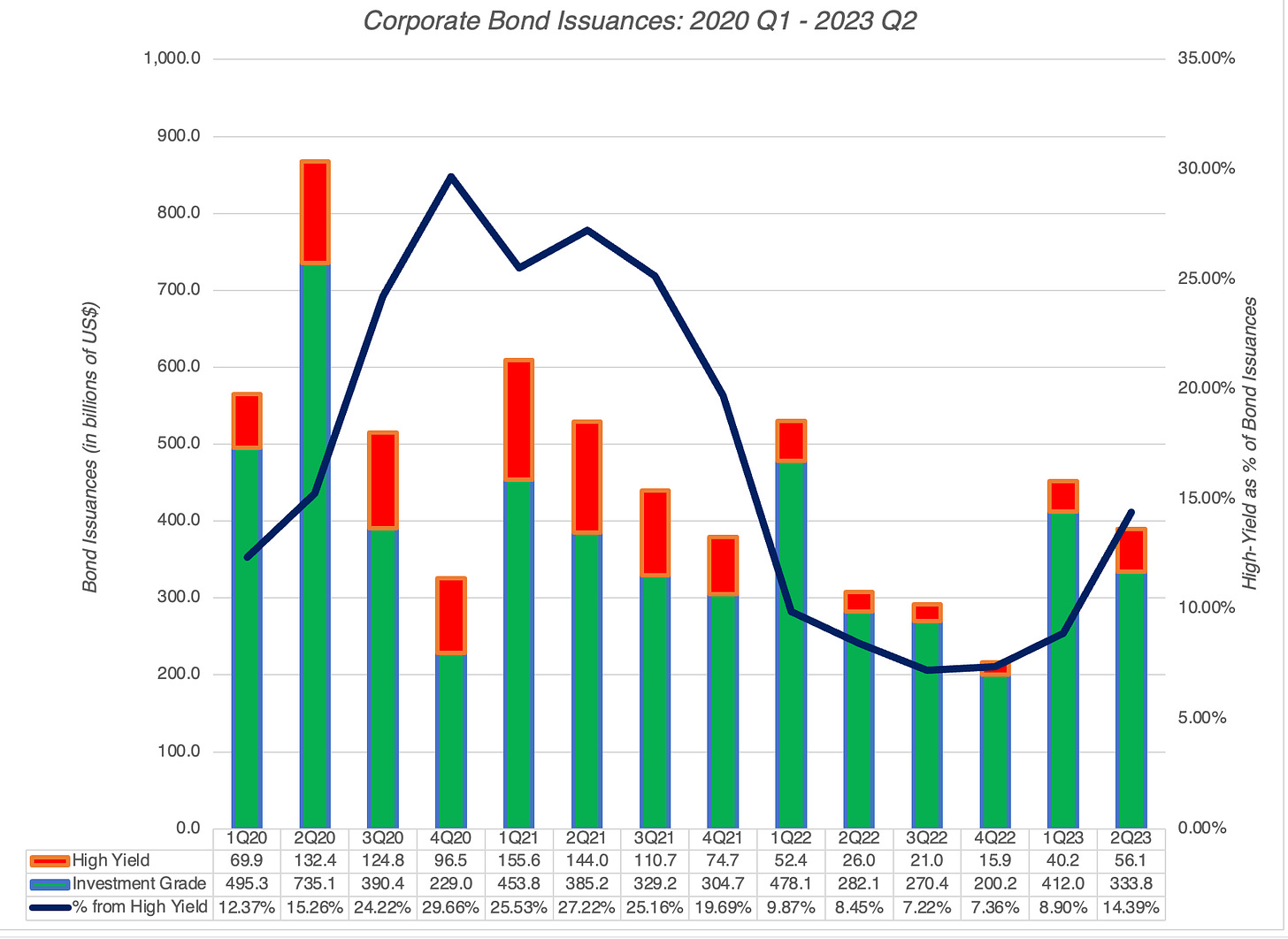

Finally, companies that have ratings below investment grade need access to risk capital, to make original issuances of bonds. In the chart below, I look at corporate bond issuances in 2023:

The good news is that corporations are back to issuing bonds, perhaps recognizing that waiting for rates to come down is futile. However, the portion of these issuances that are high-yield bonds has stayed low for the last six quarters, suggesting that the market for these bonds is still sluggish.

Looking across the risk capital metrics, notwithstanding the recovery we have seen in equities this year, it looks like risk capital is still on the side lines, perhaps because that recovery is concentrated in large and money-making companies. Until you start see stock market gains widen and include smaller, money-losing companies, it is unlikely that we will see bounce backs in the venture capital and high-yield bond markets. Even when that recovery comes, I believe that we will not return to the excesses of the last decade, and that is, in my view, a good development.

What now?

Entering the last quarter of 2023, it is striking how little the terrain has shifted over the last nine months. The two big uncertainties that I highlighted at the start of the year - whether inflation would persist or subside and whether there would be a recession - remain unresolved. If anything, the failed prognostications of economists and market gurus on both of these macro questions has left us with even less faith in their forecasts, and more adrift about what's coming down the pike. On the economy, the consensus view at the start of 2023 was that we were heading into a recession, with the only questions being when it would kick in, and how deep it would be. One reason for market outperformance this year has been the performance of the economy, which has managed to not only avoid a recession but also deliver strong employment numbers:

It is true that if you squint at this graph long enough, you may see signs of slowing down, but there are few indicators of a recession. This data may explain why economists have become more optimistic about the future, over the course of 2023, as can be seen in their estimates of the probability of a recession:

The economists polled in this survey have reduced their likelihood of a recession from more than 60% to about 40%, with the steepest drop off occurring in the last two months.

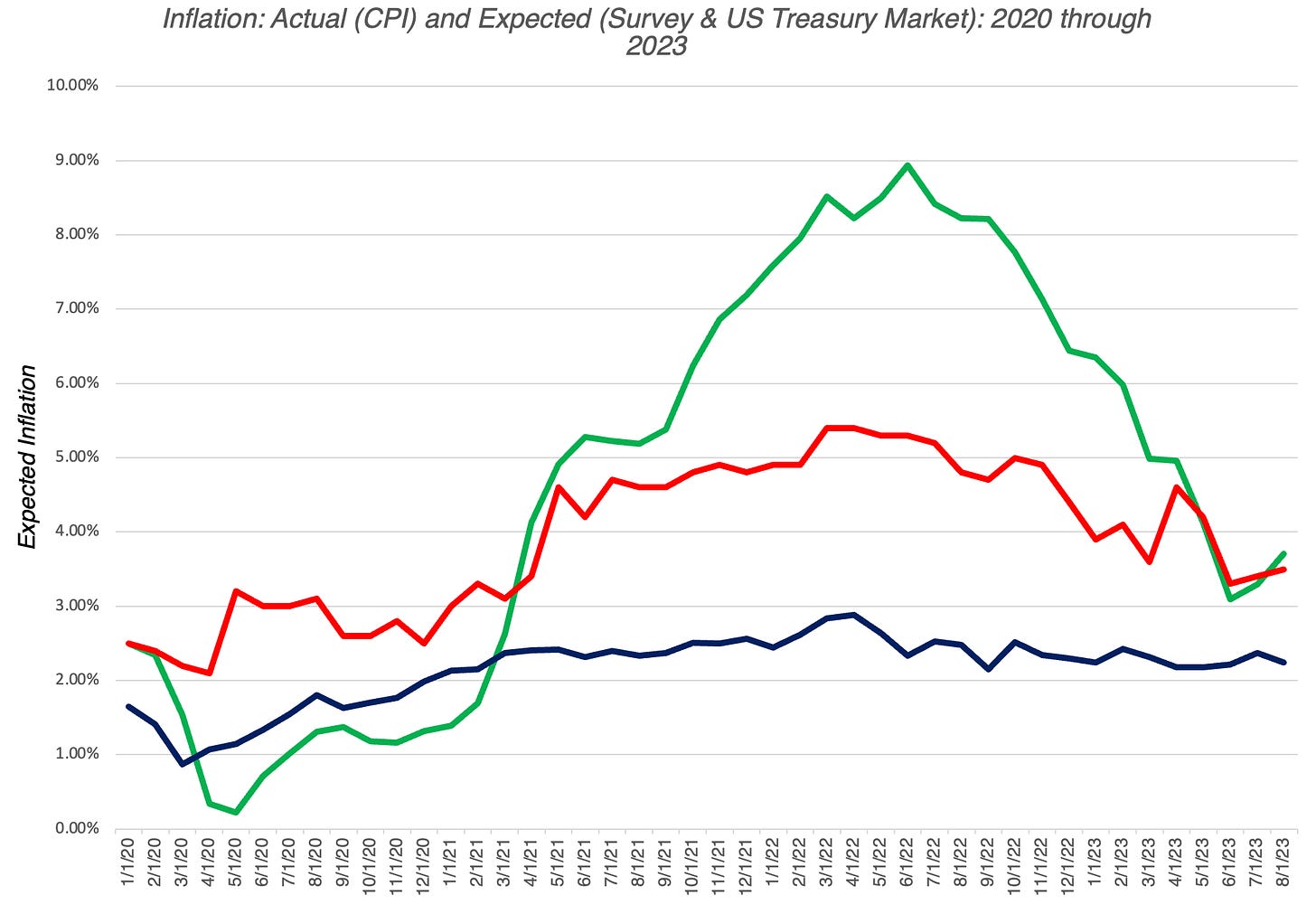

On inflation, we started the year with the consensus view that inflation would come down, but only because of economic weakness. The positive surprise for markets in 2023 is that inflation has come down, without a recession yet in sight:

The drop off in inflation in the first half of 2023 was steep, both in actual numbers (CPI and PPI) and in expectations (from surveys of consumers and the treasury market). While the third quarter saw of leveling off in those gains, it is clear that inflation has dropped over the course of the year, albeit to levels that still remain about Fed targets. If you are one of those who argued that inflation was transitory, this year is not a vindication, since prices, even if they level off, will be about 20% higher than they were two years ago. There is work to be done on the inflation front, and declaring premature victory can be dangerous.

Valuing Equities

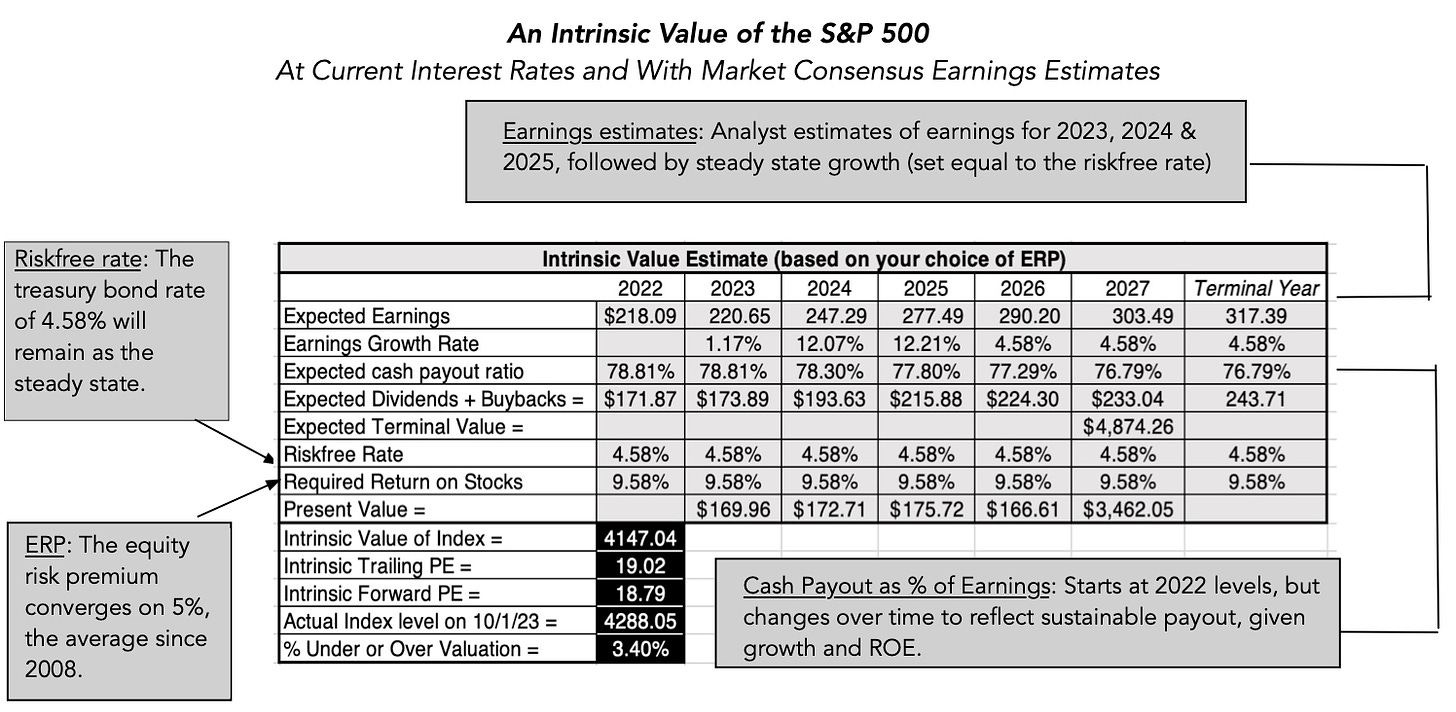

In response to what this means for the market, I have to start with a confession, which is that I am not a market timer, making it very unlikely that I will find the market to be mis-valued by a large magnitude. In keeping with a practice that I have used before (see my start-of-the year and mid-year valuations), I valued the S&P 500, given current market interest rates and consensus estimates of earnings for the future:

Download valuation spreadsheet

As you can see, with the 10-year treasury bond rate at 4.58% and the earnings estimates from analysts for 2023, 2024 and 2025, I estimate an intrinsic value of the index of 4147, about 3.4% below the actual index level of 4288, making it close to fairly valued.

My assessment is a bit of a cop-out, since they are built on current interest rate levels and consensus earnings estimates. To the extent that your views about inflation and the economy diverge from that consensus can cause you to arrive at a different value. I have tried to capture four scenarios in the picture below, with a contrast to the market consensus scenario above, and computed intrinsic value under each one:

As you can see, your views on inflation (stubborn or subsides) and the economy (soft landing or recession) will lead you to very different estimates of intrinsic value, and judgments about under or over valuation.

Since I am incapable of forecasting inflation and economic growth, I fall back on another tool in my arsenal, a Monte Carlo simulation, where I allow three key variables (risk free rate, equity risk premium, earnings in 2024 & 2025) to vary, and estimate the effect on index value:

The median value across 10,000 simulations is 4199. 2.1% below the index value of 4288, confirming my base case conclusion. If there is a concern here for equity investors, it is that there is more downside than upside, across the simulation, and that should be a factor in asset allocation decisions. It can also explain not only why there is reluctance on the part of investors to jump on the bandwagon, but also the presence of high-profile investors, short selling the entire equity market.

Conclusion

As I was writing this post, I am reminded of one of my favorite movies, Groundhog Day, where Bill Murray is a weatherman who wakes up and relives the same day over and over again. We started the year, talking about inflation and a possible recession, and we keep returning to that conversation repeatedly. You may want to move on, but it is unlikely that either uncertainty will be resolved in the near future. In the meantime, the market will continue swinging between wild optimism (where inflation is no longer viewed as a threat and the economy has a soft landing) and extreme pessimism (where inflation comes back with a bang and the economy falls into a recession). The truth, as is often the case, will fall somewhere in the middle, but it will not be easy to find.

YouTube Video

Spreadsheets

great coverage as always, thank you, appreciate!

Thanks for the great post, Professor 🙏