Market Resilience or Investors in Denial: The Market at Mid-Year 2023

Fear, greed and confusion!

I am not a market prognosticator for a simple reason. I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis. At the start of the year, the consensus of market experts was that this would be a difficult year for markets, given the macro worries about inflation and an impending recession, and adding in the fear of the Fed raising rates to this mix made bullishness a rare commodity on Wall Street. Markets, as is their wont, live to surprise, and the first six months of 2023 has wrong-footed the experts (again).

The Start of the Year Blues: Leading into 2023

As we enjoy the moment, with markets buoyant and economists assuring us that the worst is behind us, both in terms of inflation and the economy, it is worth recalling what the conventional wisdom was, coming into 2023. After a bruising year for every asset class, with the riskiest segments in each asset class being damaged the most, there were fears that inflation would not just stay high, but go higher, and that the economy would go into a tailspin. While this may seem perverse, the first step in understanding and assessing where we are in markets now is to go back and examine where things stood then.

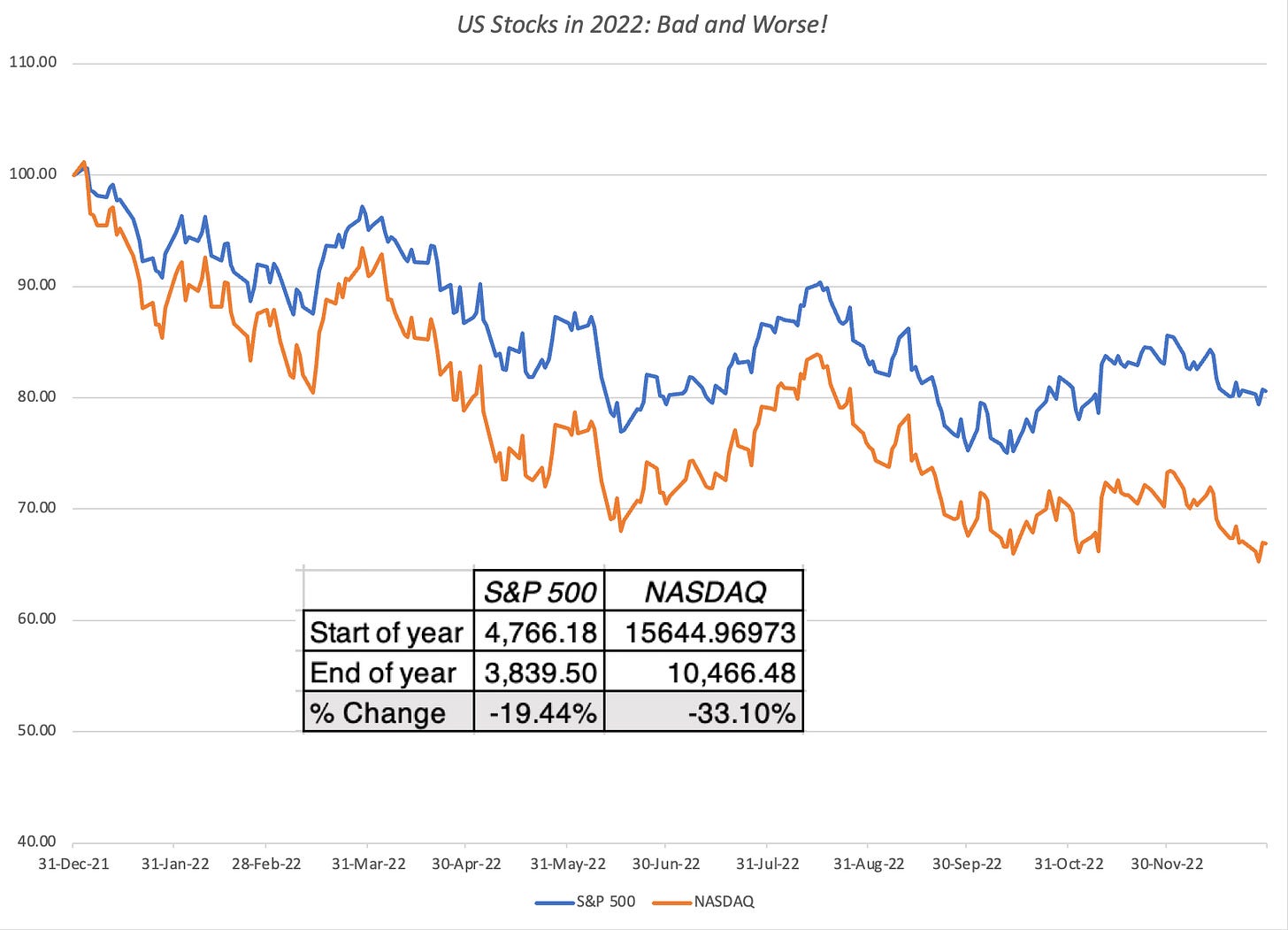

In my second data update post from the start of this year, I looked at US equities in 2022, with the S&P 500 down almost 20% during the year and the NASDAQ, overweighted in technology, feeling even more pain, down about a third, during the year.

Looking across company groupings, returns on stocks in 2022 flipped the script on the market performance over much of the prior decade, with the winners from that decade (tech, young companies, growth companies) singled out for the worst punishment during the year.

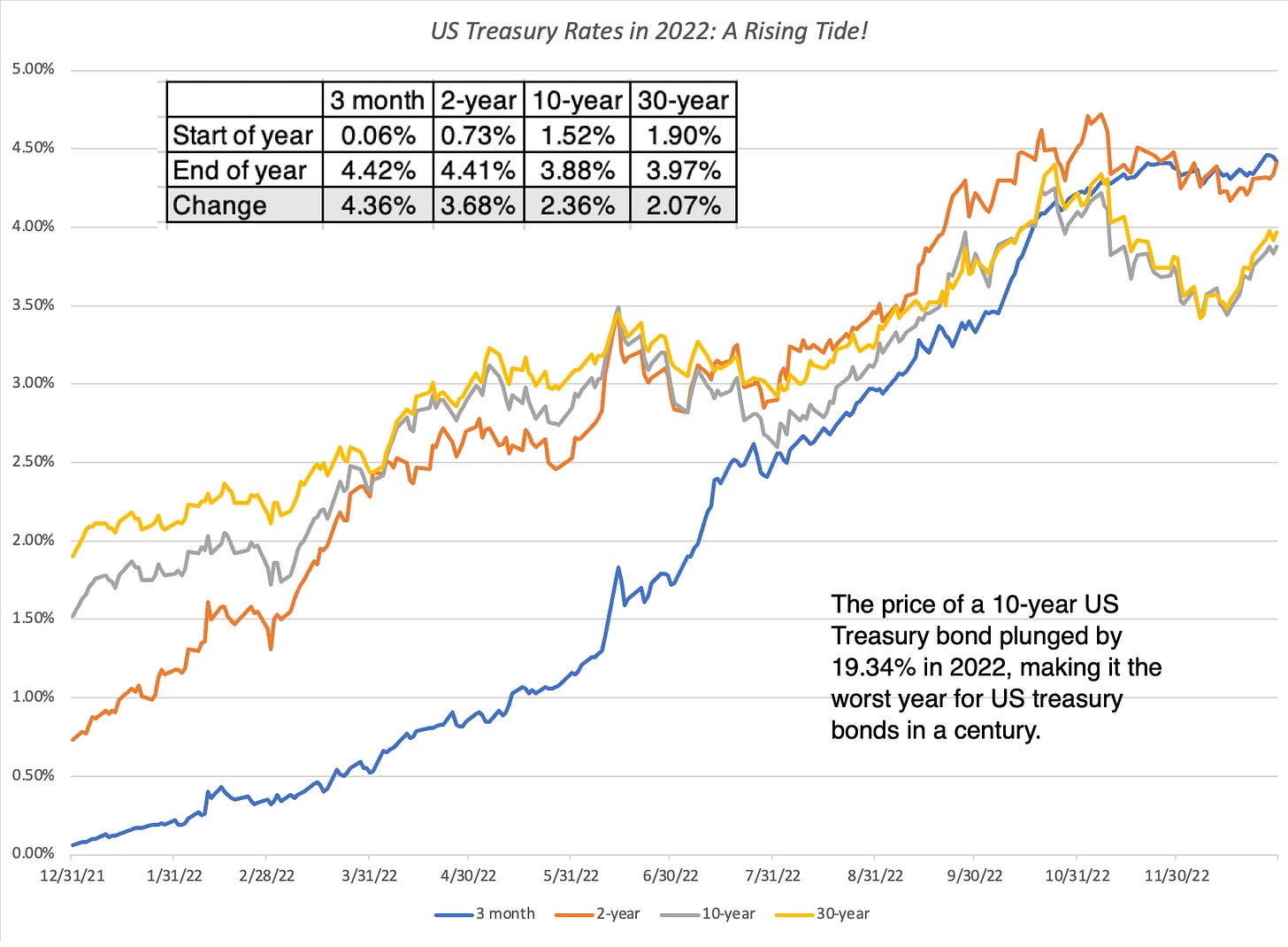

While stocks had a bad year (the eighth worst in the last century), the bond market had an even worse one. In my third post at the start of 2023, I looked at US treasuries, the long-touted haven of safety for investors. In 2022, they were in the eye on the storm, with the ten-year US treasury bond depreciating in price by more than 19% during the year, the worst year for US treasury returns in a century.

The decline in bond prices was driven by surging interest rates, with short term treasuries rising far more than longer term treasuries, and the yield curve inverted towards the end of the year.

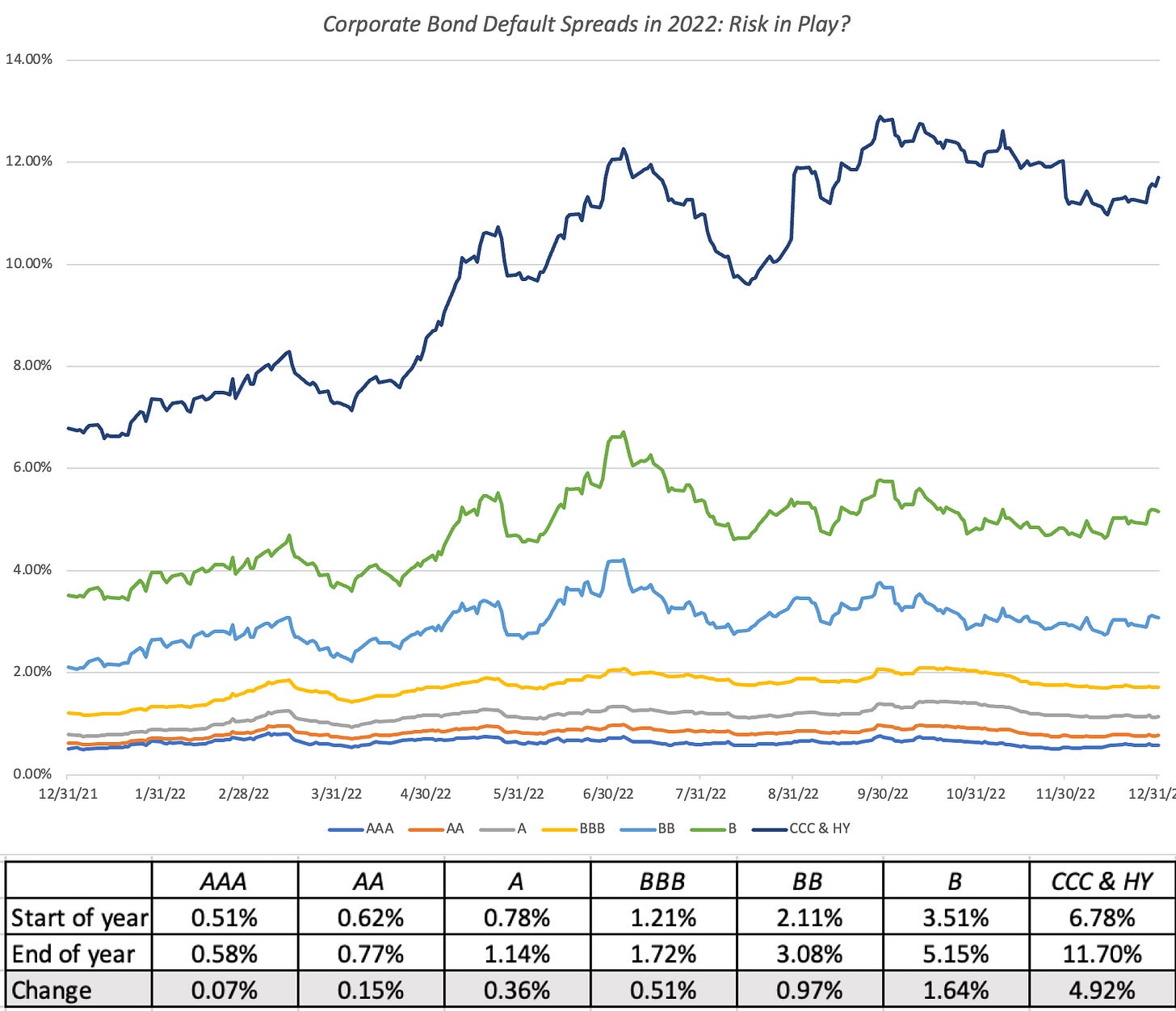

The rise in US treasury rates spilled over into the corporate bond market, causing corporate bond yields to rise. Exacerbating the pain, corporate default spreads rose during the course of 2022:

While default spreads rose across ratings classes, the rise was much more pronounced for the lowest ratings classes, part of a bigger story about risk capital that spilled across markets and asset classes. After a decade of easy access, translating into low risk premiums and default spreads, accompanied by a surge in IPOs and start-ups funded by venture capital, risk capital moved to the sidelines in 2022.

In sum, investors were shell shocked at the start of 2023, and there seemed to be little reason to expect the coming year to be any different. That pessimism was not restricted to market outlooks. Inflation dominated the headlines and there was widespread consensus among economists that a recession was imminent, with the only questions being about how severe it would be and when it would start.

The Market (and Economy) Surprises: The First Half of 2023

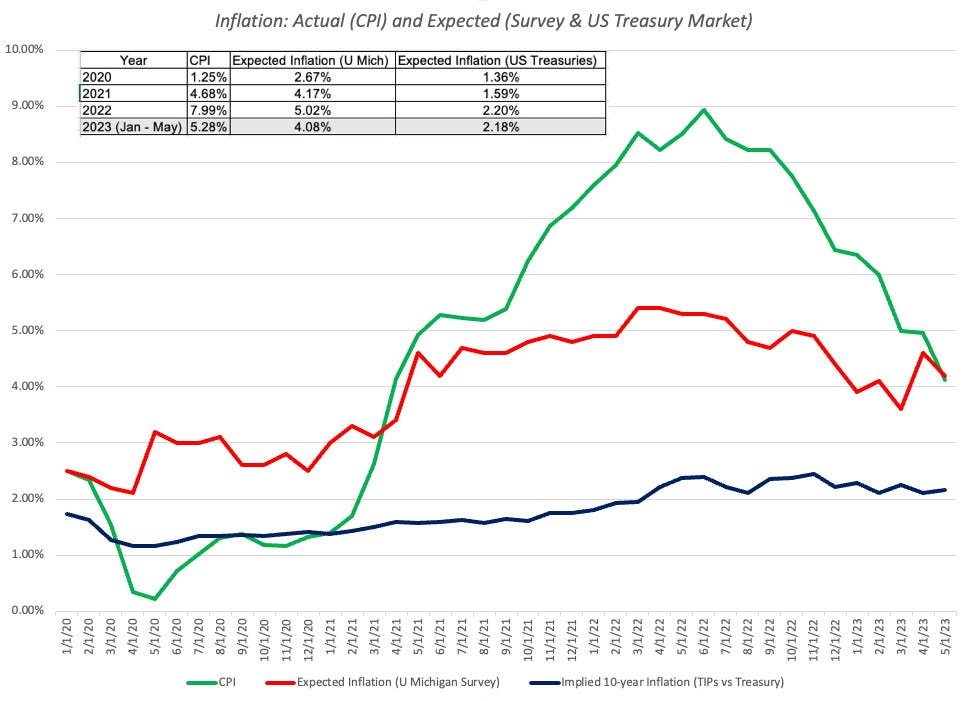

Halfway through 2023, I think it is safe to say that markets have surprised investors and economists again, this year. The combination of high inflation and a recession that was on the bingo cards of some economists at the start of 2023 did not manifest, with inflation declining sooner than most expected during the year:

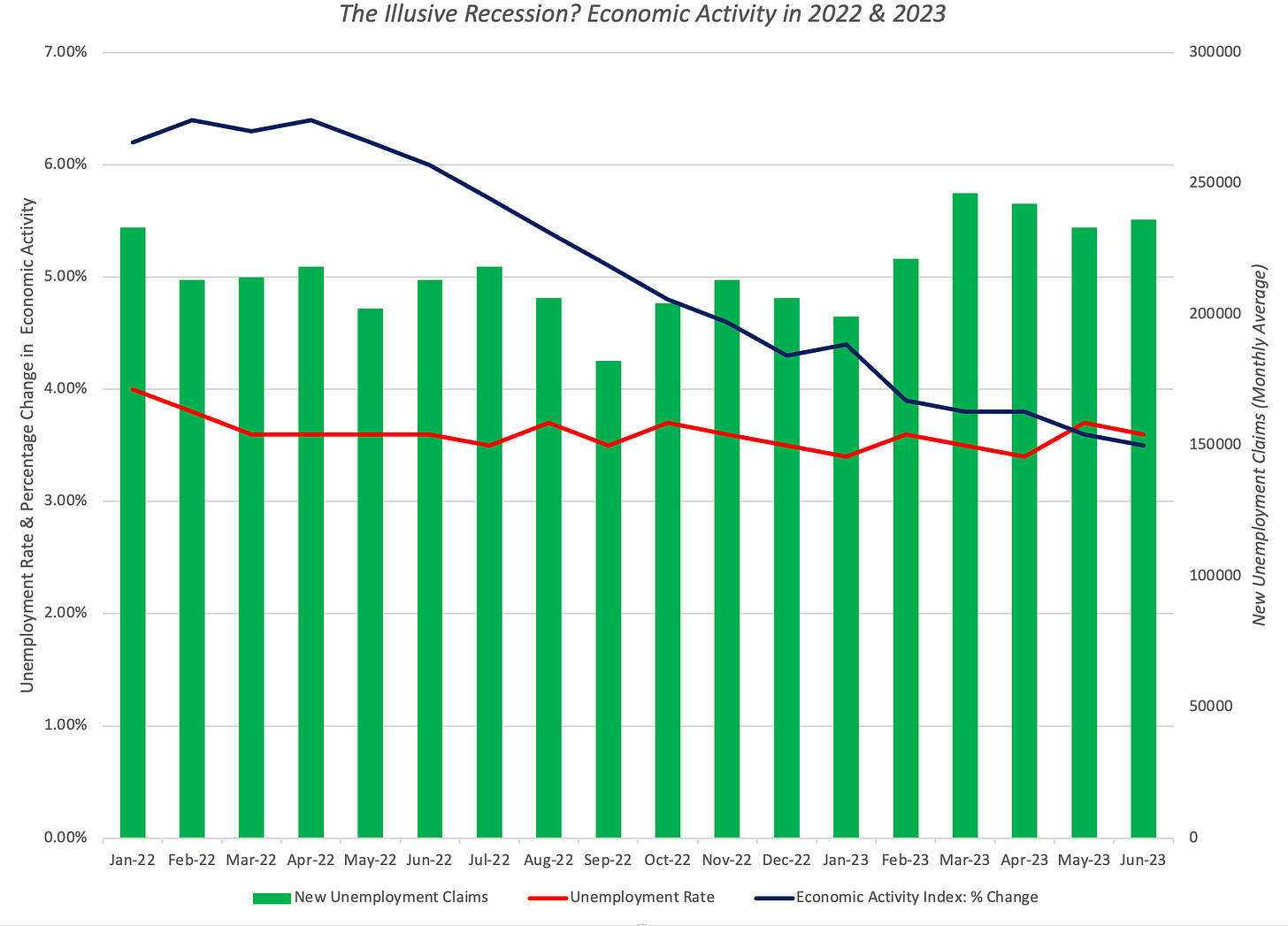

It is true that the drop in inflation was anticipated by some economists, but most of them also expected that decline to come from a rapidly slowing economy, i.e., a recession and to be Fed-driven. That has not happened either, as employment numbers have stayed strong, housing prices have (at least up till now) absorbed the blows from higher mortgage rates and the economy has continued to grow.

It is true that economic activity has leveled off and housing prices have declined a little, relative to a year ago, but given the rise in rates in 2022, those changes are mild. If anything, the economy seems to have settled into a stable pattern, albeit at the high levels that it reached in the second half of 2021. I know that the game is not done, and the long-promised pain may still arrive in the second half of the year, but for the moment, at least, markets have found some respite.

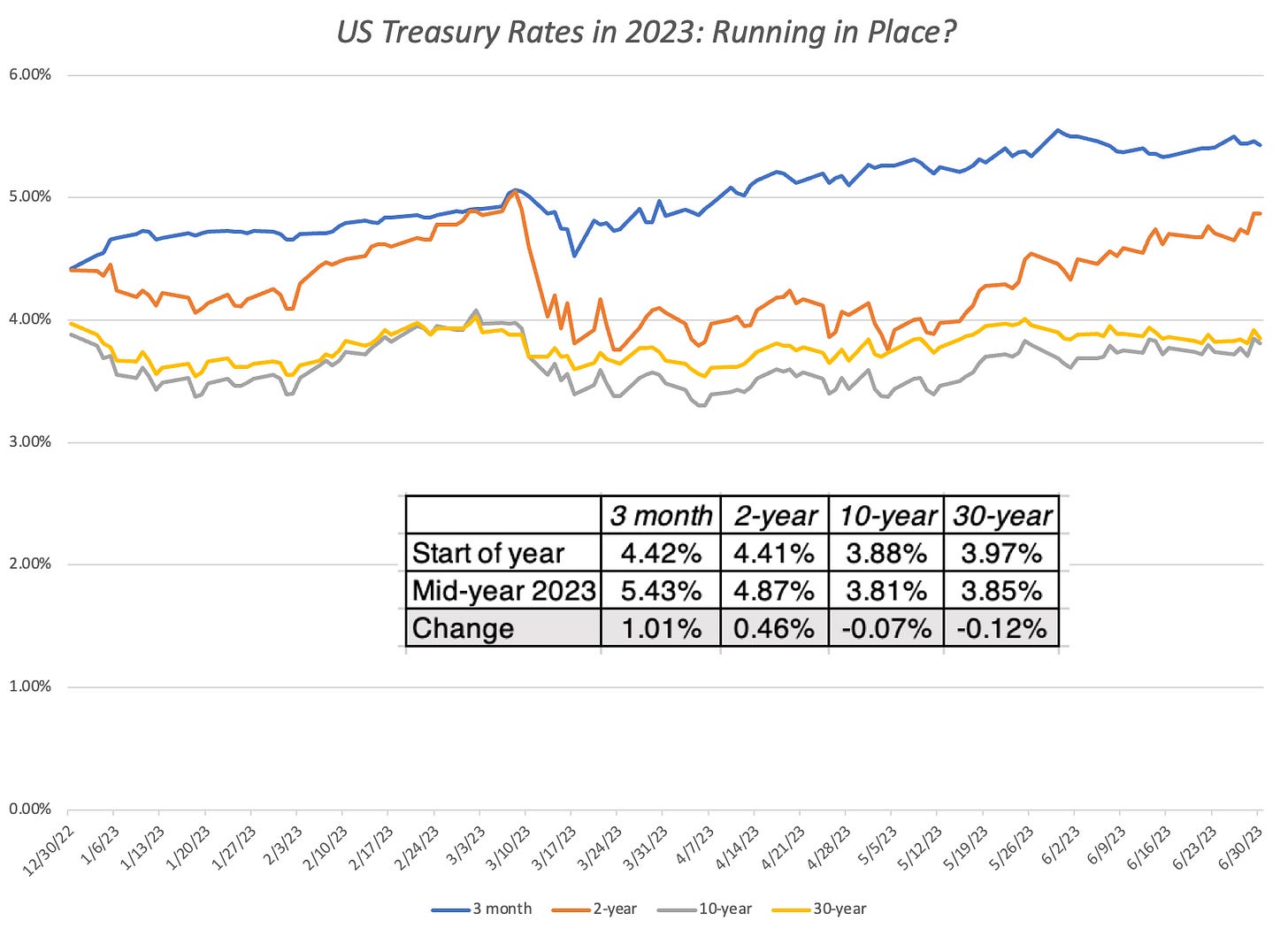

During the course of 2023, the Fed was at the center of most economic storylines hero to some and villain to many others, with every utterance from Jerome Powell and other Fed officials parsed for signals about future actions. That said, it is worth noting that there is very little of consequence in the economy or the market, in 2023, that you can attribute to Fed activity. The Fed has raised the Fed Funds rate multiple times this year, but those rate increases have clearly done nothing to slow the economy down and inflation has stabilized, not because of the Fed but in spit of it. I know that there are many who still like to believe that the Fed sets interest rates, but here is what market interest rates (in the form of US treasury rates) have done during 2023:

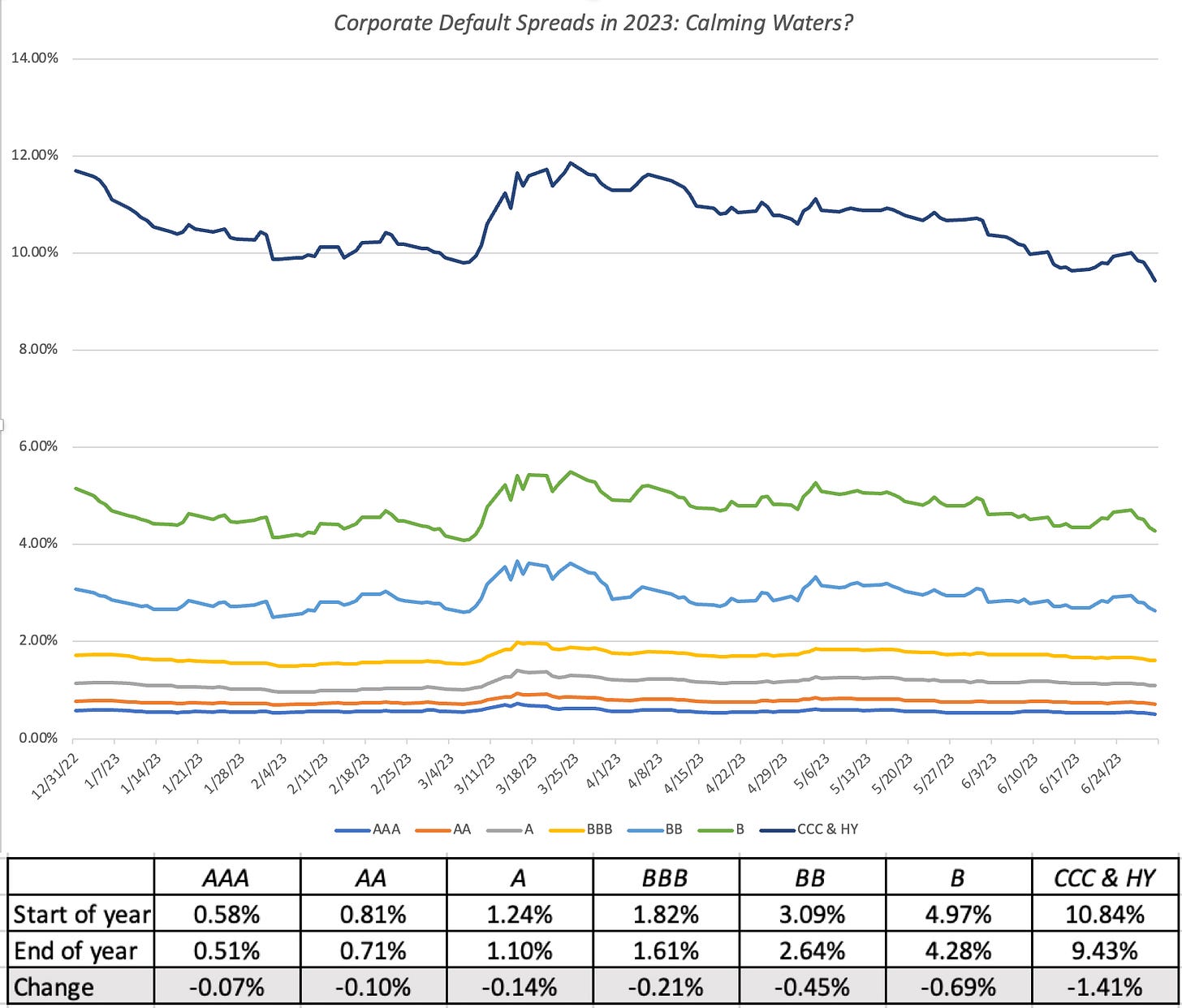

If there is a Fed effect on interest rates, it is almost entirely on the very short end of the spectrum, and not on longer term rates; the ten-year and thirty-year treasury bond rates have declined during the year. That does not surprise me, since I have never bought into the “Fed did it” theme, and have written multiple posts about why it is inflation and economic growth that drive interest rates, not central banks. As inflation has dropped and the economy has kept its footing, the corporate bond market has benefited from default spreads declining, as fears subside:

As in 2022, the change in default spreads is greatest at the lowest ratings, with the key difference being that spreads are declining in 2023, rather than increasing, though the spreads still remain significantly higher than they were at the start of 2022.

Stock Markets Perk Up: The First Half of 2023

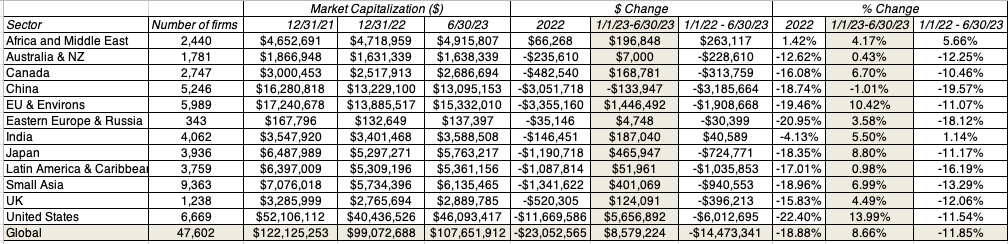

I noted that risk capital retreated from markets in 2022, with negative consequences for risky asset classes. To the extent that some of that risk capital is coming back into the markets, equity markets have benefited, with benefits skewing more towards the companies and markets that were punished the most in 2022. To understand the equity comeback in 2023, I start by looking at the increase in market capitalizations, in US $ terms, across the world in the first six months of the year, with the change in market capitalizations in 2022 to provide perspective:

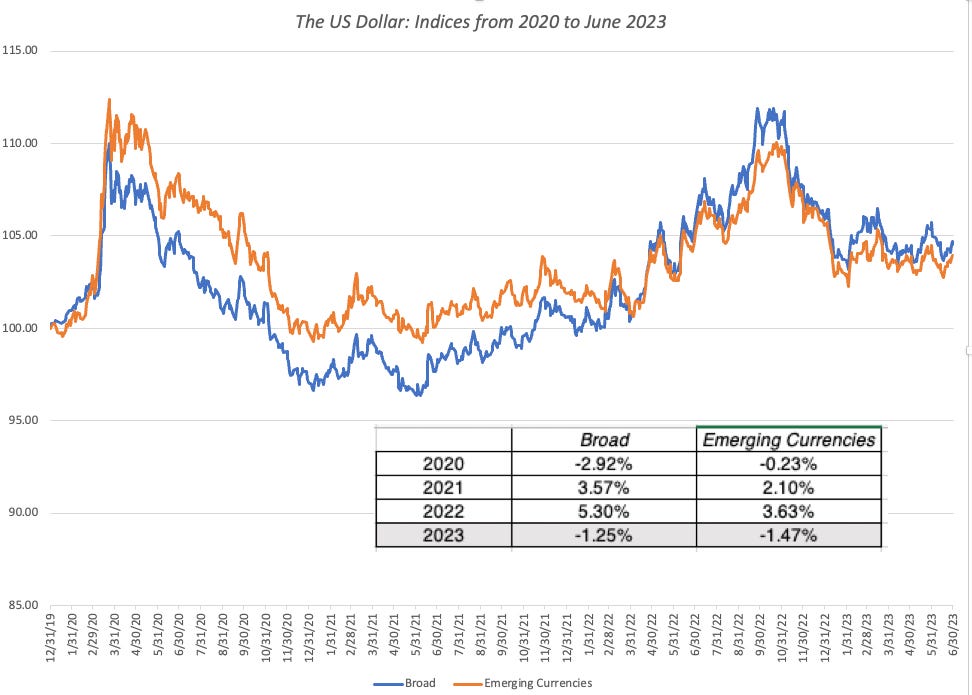

In US dollar terms, global equities have reclaimed $8.6 trillion in market value in the first six months in the year, but the severity of last year's decline has still left them $14.4 trillion below their values from the start of 2022. Looking across regions, US equities have performed the best in the first six months of 2023, adding almost 14% ($5.6 trillion) to market capitalizations, regaining almost half of the value lost in last year's rout. In US dollar terms, China was the worst performing region of the world, with equity values down 1.01% in the first six months on 2023, adding to the 18.7% that was lost last year. The two best performing parts of the world in 2022, Africa and India, performed moderately well in the first half of 2023. In US dollar terms, Latin America was flat in the first half of 2023, though there were a couple of Latin American markets that delivered stellar returns in local currency terms, albeit with high inflation eating away at these returns. It is currency rate changes that explains that contrast between local currency and dollar returns, and in the graph below, I look at the US dollar's performance broadly (against other currencies) as well as against emerging market currencies , between 2020 and 2023;

After strengthening in 2022, the US dollar has weakened against most currencies in 2023, albeit only mildly.

US Equities in 2023: Into the Weeds!

The bulk of the surge in global equities in 2023 has come from US stocks, but there are many investors in US stocks who are looking at their portfolio performance this year, and wondering why they don't seem to be sharing in the upside. In this section, I will start by looking with an overall assessment of US equities (levels and equity risk premiums) before delving into the details of the winners and losers this year.

Stocks and the Equity Risk Premium

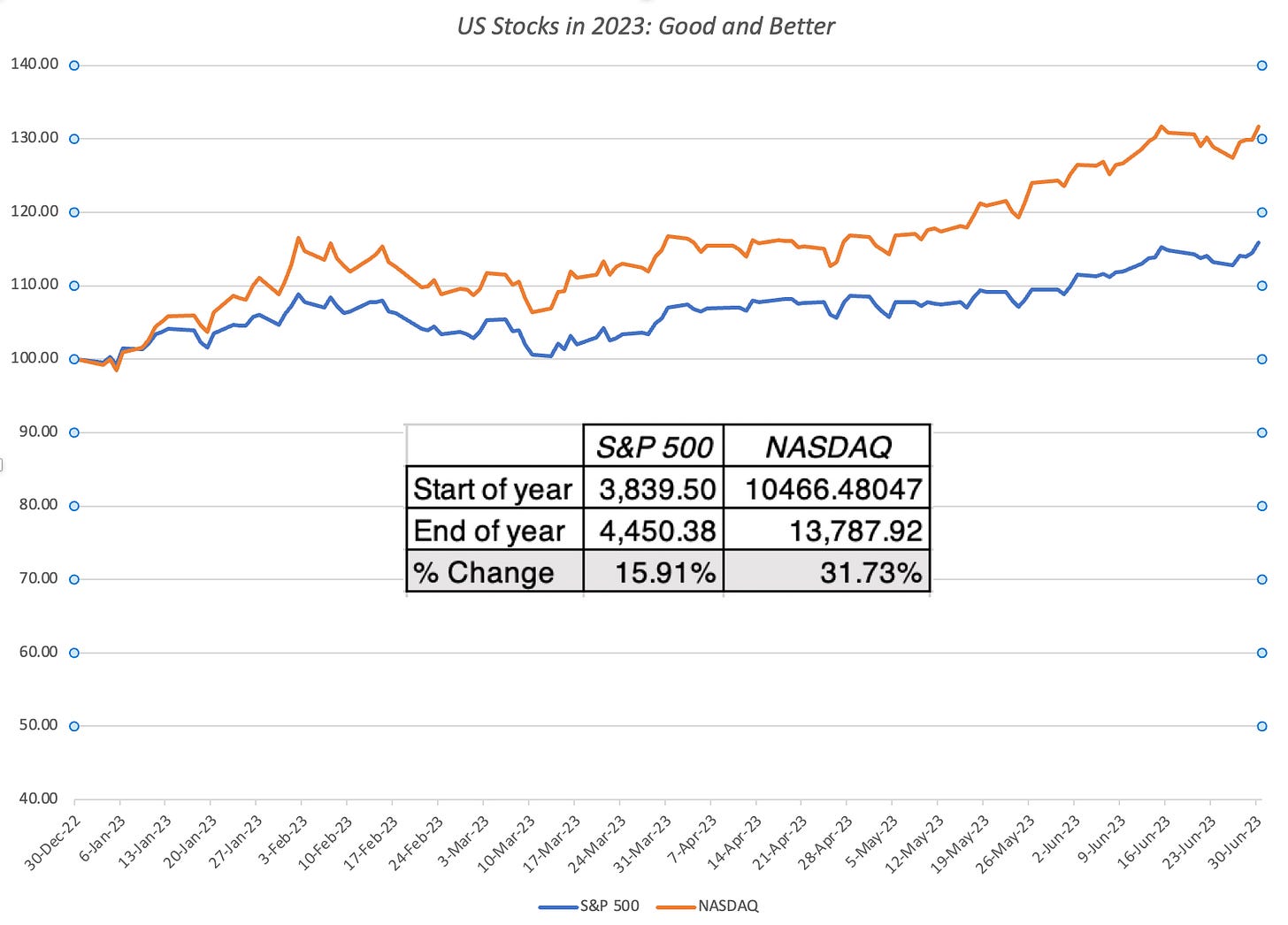

I start my assessment of US equities by looking at the performance of the S&P 500 and the NASDAQ during the first half of this year:

As you can see, why the S&P has had a strong first half of 2023, increasing 15.91%, the NASDAQ has delivered almost twice that return, with its tech focus. One reason for the rise in stock prices, at least in the aggregate, has been a dampening of worries of out-of-control inflation or a deep recession, and this drop in fear can be seen in the equity risk premium, the price of risk in the equity market. In the figure below, I have graphed my estimates of expected returns on stocks and implied equity risk premiums through 2022 and the first six months of 2023:

After a year for the record books, in 2022, when the expected return on stocks (the cost of equity) increased from 5.75% to 9.82%, the largest one-year increase in that number in history, we have had not just a more subdued year in 2023, but one where the expected return has come back down to 8.81%. In the process, the implied equity risk premium, which peaked at 5.94% on January 1, 2023, is back down to 5% at the start of July 2023. Even after that drop, equity risk premiums are still at roughly the average value since 2008, and significantly higher than the average since 1960. If the essence of a bubble is that equity risk premiums become "too low", the numbers, at least for the moment, don't seem to signaling a bubble (unlike years like 1999, when the equity risk premium dropped to 2%).

Sector and Industry

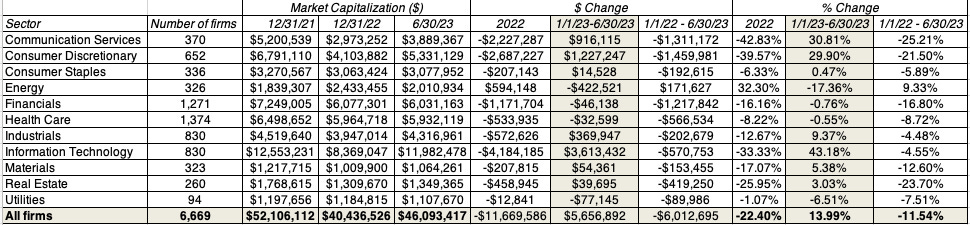

The divergence between the S&P 500 and the NASDAQ's performance this year provides clues as to which sectors have benefited the most this year, as risk has receded. In the table below, I break all US equities into sectors and report on performance, in 2022 and in the first half of 2023:

As you can see, four of the twelve sectors have had negative returns in 2023, with energy stocks down more than 17% this year. The biggest winner, and this should come as no surprise, has been technology, with a return of 43% in 2023, and almost entirely recovering its losses in 2022. Financials, handicapped by the bank runs at SVB and First Republic, have been flat for the year, as has been real estate. Communication services and consumer discretionary have had a strong first half of 2023, but remain more than 20% below their levels at the star of 2022.

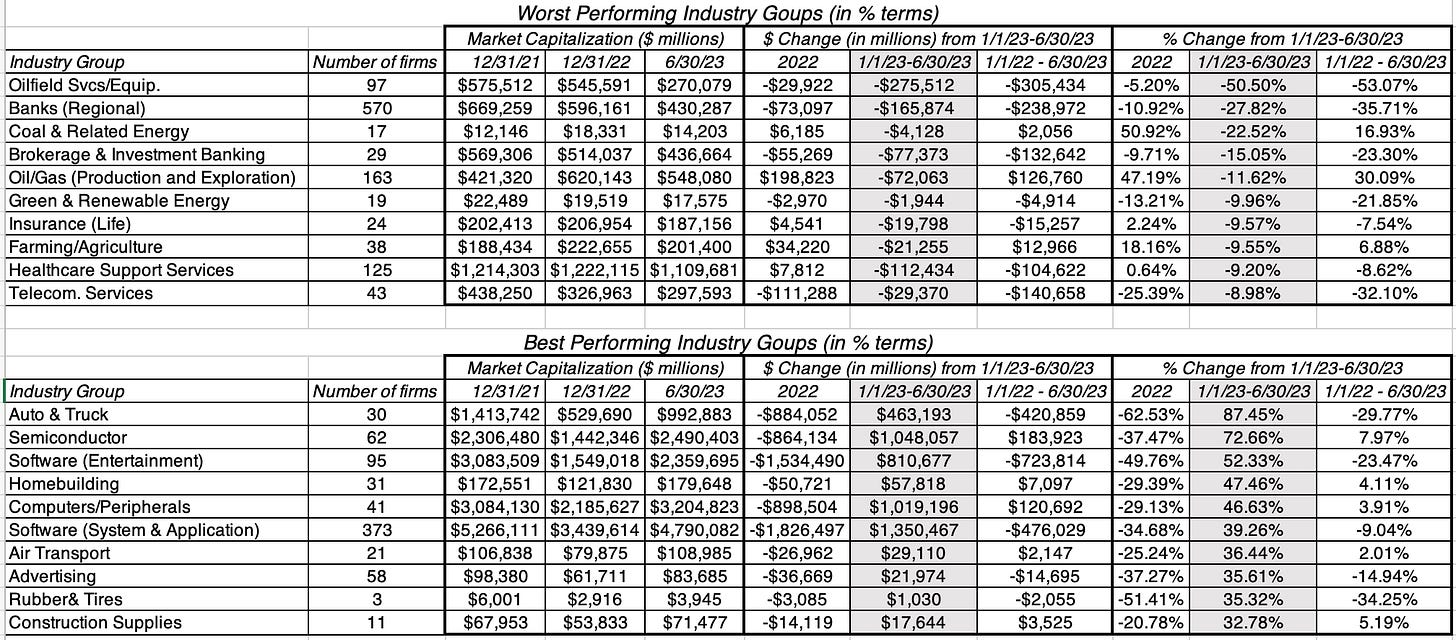

Breaking sectors down into industry-level details, we can identify the biggest winners and losers, among industries. In the table below, I list the ten worst performing and best performing industry groups, based purely on market capitalization change in the first half of 2023:

Download market performance in 2023, by industry

The worst performing industry groups are in financial services and energy, with oilfield services companies being the worst impacted. The best performing industry group is auto & truck, but those results are skewed upwards, with one big winner (Tesla) accounting for a large portion of the increase in market capitalization in the sector. There are several technology groups that are on the winner list, not just in terms of percentage increases, but also in absolute value changes, with semiconductors, computers/peripherals and software all adding more than a trillion dollars in market capitalization apiece.

Market Capitalization and Profitability

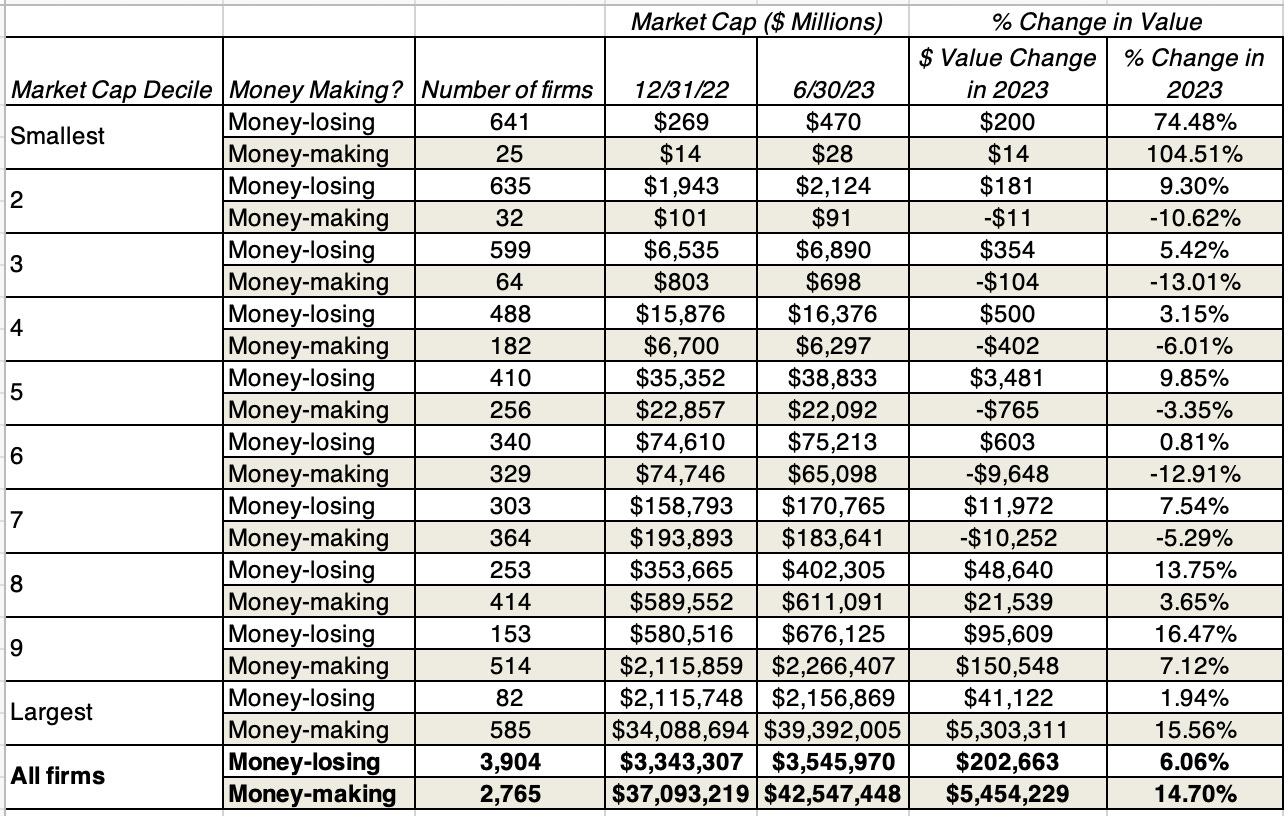

The first six months of the year have also seen concentrated gains in a larger companies and this can be seen in the table below, where I break companies down based upon their market capitalizations at the start of 2023 into deciles, and then break the stocks down in each decile into money-making and money-losing companies, based upon net income in 2022:

Again, the numbers tell a story, with the money-making companies in the largest market cap decile accounting for almost all of the gain in market cap for all US equities; the market capitalization of these large money-making companies increased by $5.3 trillion in the first six months of 2023, 97.2% of the $5.45 trillion increase in value for all US equities.

Value and Growth

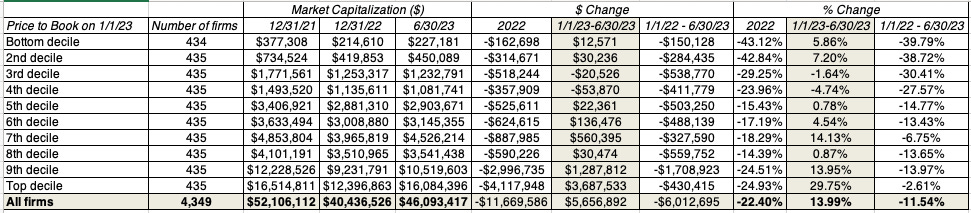

Over the last decade, I have written many posts about how old-time value investing, with its focus low PE and low price to book stocks, has lagged growth investing, with high growth stocks that trade at higher multiples of earnings and book value delivering much higher returns than old-time value stocks (low PE ratios, high dividend yields etc.). In 2022, old-time value investors felt vindicated, as the damage that year was inflicted on the highest growth companies, especially in technology. That celebration has not lasted long, though, since in 2023, we saw a return to a familiar pattern from the last decade, with the highest price to book stocks earning significantly higher returns than the stocks with the lowest price to book ratios:

As you can see from the chart, almost all of the value increase in US equities has come from the top two deciles of stocks, in terms of price to book ratios. Looking at value and growth go back and forth between the winning and losing columns in 2023, I believe that this is a pattern that will continue to play out for the rest of the decade, with no decisive winner.

An Assessment

I know that one of the critiques of this market rise is that it has been uneven, but almost all market recoveries are uneven, with some groupings of companies always doing better than others. That said, there are lessons to be learned from looking at the winners and the losers in the first half of 2023 market sweepstakes:

Big tech: There is no doubt that this market has been largely elevated not just by tech companies, but by a subset of large tech companies. Seven companies (Apple, Microsoft, NVIDIA, Amazon, Tesla, Meta and Alphabet) have seen their collective market capitalization increase by $4.14 trillion in the first half of 2023, accounting for almost 80% of the overall increase in equity values at all 6669 publicly traded US equities. If these stocks level off or drop, the market will have trouble finding substitutes to keep the market pushing higher, simply because of the size of the hole that will need to be filled.

With a profitability skew: While this does seem like a reversion to the tech boom that drove markets prior to 2022, the market seems to be more inclined to rewarding money-making tech companies, at the expense of money-losers. If risk capital is coming back in 2023, it is being more selective about where it is directing its money, and it is therefore not surprising that IPOs, venture capital and high yield bond issuances have remained mired in 2022 (low) levels.

And an economic twist: One reason that these big and money-making tech companies may be seeing the return of investor money is that they have navigated the inflation storm relatively unscathed and some have emerged more disciplined, from the experience. The two best cases in point are Meta and Google, both of which have not only reduced payrolls but also seem to have shifted their narrative from a relentless pursuit of growth to one of profitability.

It is true that as market rallies lengthen, they draw in more stocks into their orbit, and it is possible that the market rally will broaden over the course of the year. That said, this has been a decade of unpredictability, starting with the first quarter of 2020, where COVID ravaged stocks, and I don't think it makes much sense to take charts from 2008 or 2001 or earlier and extrapolating from those.

The Rest of the Year: What's coming?

The market mood is buoyant, as investors seem to be convinced that we have dodged the bullet, with inflation cooling and a soft landing for the economy. The lesson that I have learned not just from the first six months of 2023, but from market performance over the last three years, has been that macro forecasting is pointless, and that trying to time markets is foolhardy. If I were to make guesses about what the rest of the year will bring, here are my thoughts:

On inflation, the good news on inflation in the first half of the year should not obscure the reality that the inflation rate, at 3% in June, still remains higher than the Fed-targeted value (of 2%). That last stretch getting inflation down from 3% to below 2% will be trench warfare, and we will be exposed to macro shocks (from energy prices or regional unrest) that can create inflationary shocks.

On the economy, notwithstanding good employment numbers, there are signs that the economy is cooling and it is again entirely possible that this turns into a slow-motion recession, as real estate (especially commercial) succumbs to higher interest rates and consumers start retrenching.

On interest rates, I do think that hoping and praying that rates will go back to 2% or lower is a pipe dream, as long as inflation stays at 3% or higher. In short, with or without the Fed, long term treasury rates have found a steady state at 3.5% to 4%, and companies and investors will have to learn to live with those rates. I have never attached much significance to the yield curve inversion as a predictor of economic growth, but that inversion is unlikely to go away soon, as near term inflation remains higher than long term expectations.

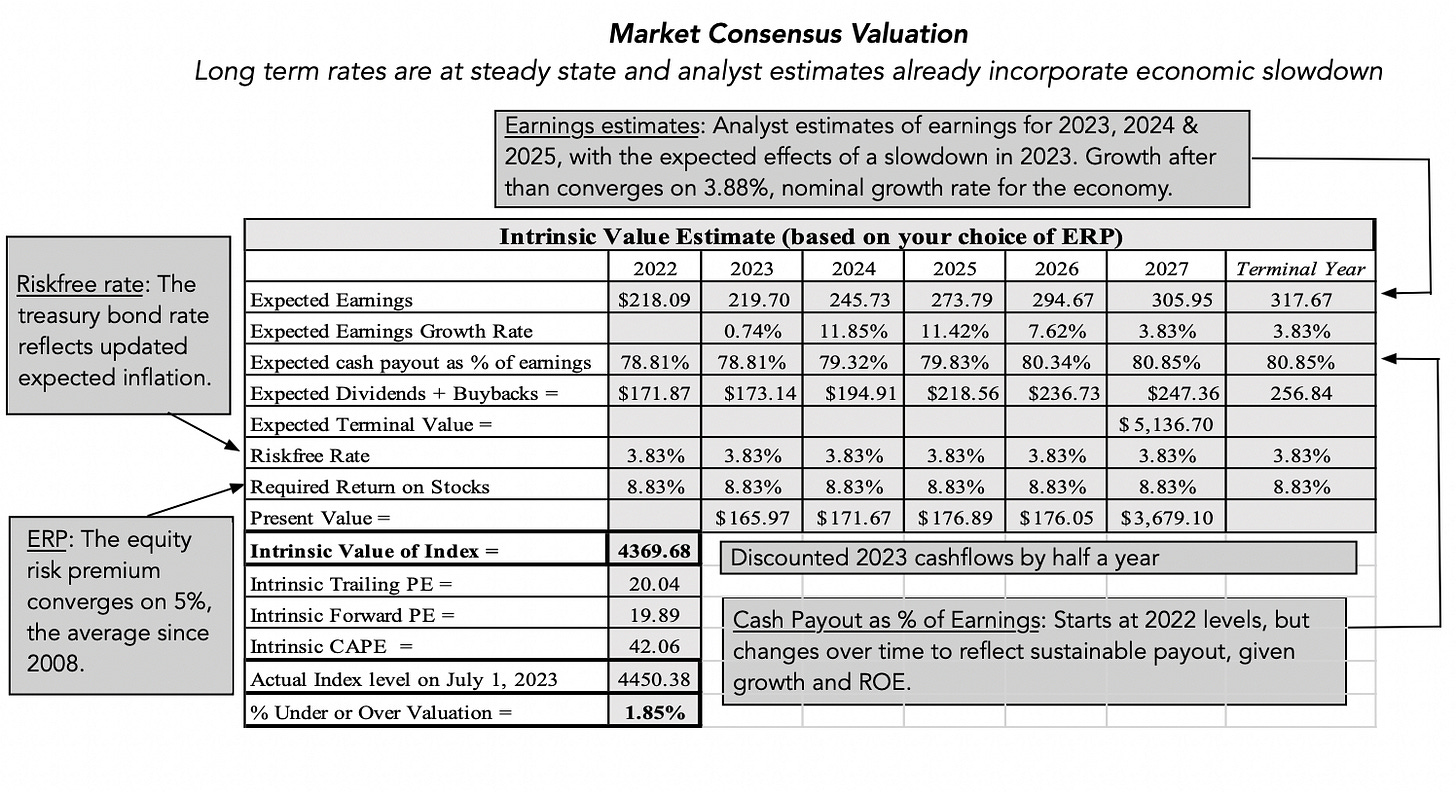

On equities, the one certainty is that there will be uncertainties, and it is unlikely that the market will repeat its success in the second half of 2023. I did value the S&P 500 at the start of the year, and and argued that it was close to fairly valued then. Updating this valuation to reflect updated perspectives on both dimensions, as well as an index price that is about 16% higher, here is what I see:

Download spreadsheet with valuation

Note that I have used the analyst projections of earnings for the index for 2023 to 2025, and adjusted the cash payout over time to reflect reinvestment needed to sustain growth in the long term (set to 3.88%, after 2027). After the run up in stock prices in the first six months, stocks look fairly valued, given estimated earnings and cash flows, and assuming that long term rates have found their steady state. (Unlike market strategies who provide target levels for the index, an intrinsic value delivers a value for the index today; to get an estimate of what translates into as a target level of the index, you can apply the cost of equity as the expected return factor to get index levels in future time periods.)

It goes without saying, but I will say it anyway, that the economy may still go into a recession, analysts may be over estimating earnings and inflation may make a come back (pushing up long term rates). If you have concerns on those fronts, your investing should reflect those worries, but your returns will be only as good as your macro forecasting abilities. Mine are not that good, and it is why I steer away from grandiose statements about equities being in a bubble or a bargain. While uncertainties abound, there is one thing I am certain about. I will be wrong on almost every single one of these forecasts, and there is little that I can or want to do about that. That is why I demand an equity risk premium in the first place, and all I can do is hope that it large enough to cover those uncertainties.

A Time for Humility

If the greatest sin in investing is arrogance, markets exist to bring us back to earth and teach us humility. The first half of 2023 was a reminder that no matter who you are as an analyst, and how well thought through your investment thesis is, the market has other plans. As you listen to market gurus spin tales about markets, sometimes based upon historical data and compelling charts, it is worth remembering that forecasting where the entire market is going is, by itself, an act of hubris. In the spirit of humility, I would suggest that if you were a winner in the first half of this year, recognize that much of that can be attributed to luck, and what the market gives, it can take away. By the same token, if you were a loser over the course of the last six months, regret should not lead you to try to load up on the winners over that period. That ship has sailed, and who knows? Your loser portfolio may be well positioned to take advantage of whatever is coming in the next six months.

YouTube Video

Data Spreadsheets

Valuation Spreadsheets

Excellent work. Thanks! Especially appreciate your honest humility!

As a private investor, I wish all stock market analysis would be like this one! Thank you!