Meatless Future or Vegan Delusions? The Beyond Meat Valuation

In a big year for initial public offerings (IPOs), with Uber, Lyft, Pinterest and Zoom, to name just a few, already having gone public and more companies waiting in the wings, it is ironic that it is not a tech company, but a food company, Beyond Meat, that has managed to deliver the most dazzling post-IPO performance of any of the listings. As the stock increased seven-fold, investors who were able to get into the stock at the offering price have been enriched, but those who jumped on the bandwagon later have also reaped extraordinary returns. The speed and magnitude of the stock price rise has left many wondering whether investors have over reached and whether a correction is around the corner.

The Meatless Meat Company!

The Company: Let's take a look at what Beyond Meat's products are and the market opening it is exploiting, before diving into a story and valuation for the company. The company, headquartered in Southern California, and founded in 2009, makes makes plant-based (pea protein) products that mimic burgers and ground meat in taste, texture and aroma. In the prospectus that it filed leading up to its IPO, the company argues that its production process is revolutionary and new, and is responsible for its capacity to replicate animal-based meats.

The Competitors: While Beyond Meat is a leader right now in the specialized sub-category of meatless meats, it faces a formidable competitor in Impossible Foods, another young start-up producing its own plant-based versions of meat-like products. Since it is very likely, especially after Beyond Meat's explosive market debut, that Impossible Foods will be going public soon, it is inevitable that there will be comparisons between the two companies. While I have done my own taste test, taste is in the mouth of the beholder, and this article perhaps has the most even-handed comparison of the two companies' products. Both companies have also adopted similar strategies of enlisting fast-food companies as product adopters, with Impossible Foods showing up on Burger King (Impossible Whopper) and White Castle menus, and Beyond Meat countering with TGI Friday's, Carl's Jr. and Red Robin. Other companies are taking note, including companies like Amy's Kitchen, a long standing producer of organic and vegan offerings, and companies like Tyson Foods and Perdue that derive the bulk of their revenues from meat, but see opportunity in this new market.

The Drivers: Both Beyond Meat and Impossible Foods have been helped by a shift away from meat to meatless alternatives, and that trend has been driven by three factors:

Health: While the research on the health consequences of eating meat continues, it has become part of conventional wisdom that meat-based diets (and red meat in particular) are associated with a greater risk of cardiovascular disease and cancer. This link provides a fairly balanced account of whether this belief is true, but for better or worse, it has led some meat eaters to cut back and sometimes stop consuming meat.

Environment: As climate change and environmental concerns rise to the top of concerns for some, they are feeling the pressure to shift away from meat, in general, and beef, in particular, because of its environmental footprint. I am not an environmental scold, but I don't think that there is any debate that meat-based diets puts a greater pressure on the environment

Taste: Until recently, shifting away from a meat-based diet also meant giving up the taste and texture of meat, since most meat substitutes did not come close. As companies like Beyond Meat and Impossible Foods are showing, plant-based alternatives are getting better at mimicking real meat, and for those who are attached to the texture and taste of meat, that is making a difference in their diet decisions.

None of these three factors are likely to fade away. In fact, I think that we can safely assume that they will only get stronger over time, accelerating the shift from meat to meatless alternatives.

Market Sizing

All of the talk about the shift to vegan and vegetarian diets can sometimes obscure two basic facts about this market and its underlying trends:

The meatless meat market is still small, relative to the overall meat market: In 2018, the meatless meat market had sales of $1-$5 billion, depending on how broadly you define meatless markets and the geographies that you look at. Defined as meatless meats, i.e., the products that Beyond Meat and Impossible Foods offer, it is closer to the lower end of the range, but inclusive of other meat alternatives (tofu, tempeh etc.) is at the upper end. No matter which end of the range you go with, it is small relative to the overall meat market that is in excess of $250 billion, just in the US, and closer to a trillion, if you expand it globally, in 2018. In fact, while the meat market has seen slow growth in the US and Europe, with a shift from beef to chicken, the global meat market has been growing, as increasing affluence in Asia, in general, and China, in particular, has increased meat consumption, Depending on your perspective on Beyond Meats, that can be bad news or good news, since it can be taken by detractors as a sign that the overall market for meatless meats is not very big and by optimists that there is plenty of room to grow.

It is still a niche market: Meatless meat products have made their deepest inroads in urban and affluent populations and its allure is greatest with former meat-eaters rather than lifelong vegetarians, who don't crave either the taste or texture of meat. The plus is that this market has significant buying power, but the minus is that urban, well-to-do millennials can eat only so much.

The big question that we face is in estimating how much the shift towards vegan and vegetarian diets will continue, driven by health reasons or environmental concern (or guilt). There is also a question of whether some governments may accelerate the shift away from meat-based diets, with policies and subsidies. Given this uncertainty, it is not surprising that the forecasts for the size of the meatless meat market vary widely across forecasters. While they all agree that the market will grow, they disagree about the end number, with forecasts for 2023 ranging from $5 billion at the low end to $8 billion at the other extreme. Beyond Meat, in its prospectus, uses the expansion of non-dairy milk(soy, flax, almond mild) in the milk market as its basis, to estimate the market for meatless meat to be $35 billion in the long term.

Beyond Meat: Story and Valuation

History: At the time of its public offering, Beyond Meat had all of the characteristics of a young company, not much separated from its start up days, with revenues of $87.9 million, operating losses of $26.5 million and a common equity of -$121.8 million. Its first earnings report, delivered to a rapturous market response, reported a tripling of revenues and a narrowing of operating losses, but even with it incorporated, the company remains a small, money losing company.

The Story: To value young companies, I first have to put my optimist hat on, and with it firmly in place, my story for Beyond Meat is that it is catching the front end of a significant shift towards vegan and vegetarian-based diets. The key parts of my story are below:

Total market for meatless meats will grow significantly: I see the total market for meatless meats growing from just over $1 billion in 2018 to $12 billion by 2028. While that is less than the $35 billion that Beyond Meat's back-of-the-envelope estimate delivers, it is closer to the upper end of the range of forecasts that you have for this market.

With Beyond Meat capturing a significant market share: As the market grows, the number of players will increase, but I see Beyond Meats capturing a 25% market share of this market, building on its early entry into the market and brand name recognition, partly from its fast food connections.

While delivering operating profits similar to the large US food processing companies: Over the next five years, I see pre-tax operating margins improving towards the 13.22% that US food processing business delivered in 2018, built largely on economies of scale and pricing power.

And reinvesting a lot less, in delivering that growth: While Beyond Meat generates about a dollar in revenue per dollar in invested capital right now, I will assume that it will be able to use technology as its ally to invest more efficiently in the future. Specifically, I will assume that the company will generate $3 in revenue for every dollar in invested capital, about double what the typical US food processing company is able to generate.

Is there risk in this investment? Absolutely, and you may be surprised that my cost of capital is only 7.46%, but that reflects my assessment of risk in this investment, as a going concern and as part of a diversified portfolio. As a money-losing company that will require about $500 million in capital over the next four years to deliver on its potential, there remains a significant chance of failure, and I estimate the probability of failure to be 15%.

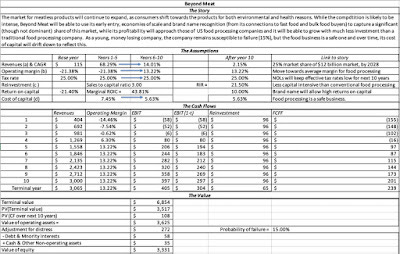

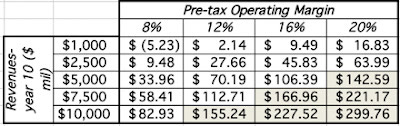

The Valuation: With the story in place, the valuation follows and the picture below captures the ingredients of value:

With my story, which I believe reflects an upbeat story for the company, the value that I obtain for its equity is $3.3 billion, yielding a value per share of about $47. At the end of June 10, when I completed my valuation, the stock price was close to $170, well above my estimated value. What the stock dropped almost $41 on June 11 to $127/share, it still remained over valued.

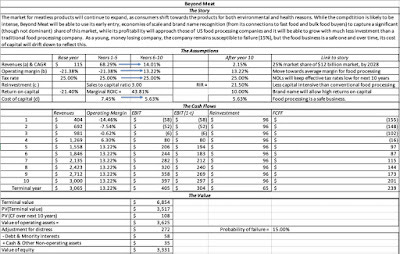

What if? As with any young company, the value of Beyond Meat is driven almost entirely by the story you tell about the company, and in this case, that story revolves around two key inputs. The first is the revenue that you believe the company can generate, once mature, and that reflects how big you think the market for meatless meats will get and Beyond Meat's market share of the market. The second is its profitability at that point, which is a function of how much pricing power you believe the company will have. While I have assumed that Beyond Meat will deliver about $3 billion in revenues in 2028, with an operating margin of 13.22%, your story for the company can lead you to very different estimates for one or both numbers:

The shaded cells represent break even points, where you could justify buying Beyond Meat at the price ($127) it was trading at on June 11, 2019. Put differently, if your story for the meatless meat market and Beyond Meat's place in it leads you to revenues of $5 billion or higher with an operating margin of 20%, you should be a value investor in the company.

Macro Bets and Micro Value

As you can see from the what-if analysis on Beyond Meat's value, the value that you obtain for Beyond Meat is determined mostly by how large you believe that market for meatless meats will end up being. In fact, there are some investors whose primary reason for investing in Beyond Meat is as a bet on a macro trend towards vegan and vegetarian diets. That said, it is worth remembering that investors don't get pay offs from making the right macro bets, but from the micro vehicles (individual investments) that they use as proxies for those bets. To get the pay off from a correct macro call, there are two additional assessments that investors have to make:

Industry structure: A growing market may not translate into high value businesses, if it is crowded and intensely competitive. That market will deliver high revenue growth, but with low or no profitability, and no pathway to sustainable profits and value added. In contrast, a growing market where there are significant barriers to entry and a few big winners can result in high-value companies with large market share and unscalable moats.

Winners and Losers: Assuming that there is potential for value creation in a market, investors have to pick the companies that are most likely to win in that market. That is difficult to do, when you are looking at young companies in a young market, but there is no way around making that judgment. In a post from 2015, I argued that in big (or potentially big) markets, you can expect companies to be collectively over valued early in the game.

In my Beyond Meat valuation, I have implicitly made assumptions about both these components, by first allowing operating margins to converge on those of large food processing companies and then making Beyond Meat one of the winners in the meatless meat market, by giving it a 25% market share. My defense of these assumptions is simple. I believe that the meatless meat market will evolve like the broader food business, with a few big players dominating, with similar competitive advantages including brand name, economies of scale and access to distribution systems. I also believe that Beyond Meat and Impossible Foods, as front runners in this market, will use their access to capital to scale up quickly. Their use of fast food chains feeds into this strategy, with bulk sales increasing revenues quickly, allowing for economies of scale, and name-brand offerings (Impossible Whopper at Burger Kind, Beyond Famous Star burger at Carl's Jr.) helping improve brand name recognition. I will undoubtedly have to revisit these assumptions as the market evolves and some of you may disagree with me strongly on one or both assumptions. If so, please do download the spreadsheet and make your best judgments to derive your value for the company.

A Trading Play

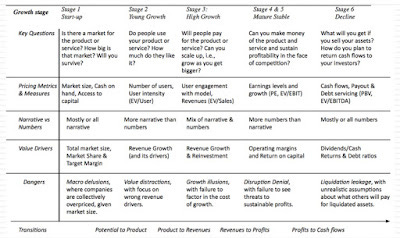

Early in a company's life, it is the pricing game that dominates and it is futile to use fundamentals to try to explain a stock price or day-to-day changes. This table, from one of my presentations on corporate life cycles, illustrates how investors and trades view companies as they move through the life cycle.

For a young company like Beyond Meat, making the transition from start-up to young growth, it is all pricing all the time, with stories about market size driving the pricing,. This trading phenomenon is exacerbated by the fact that it is one of the few pure plays on a macro trend, i.e., a shift in diets away from meat to plant-based options. That leads me to two conclusions. The first is an unexceptional one and it is that you will see wide swings in the stock price on a day to day basis, for little or no reason. That is a feature of priced stocks, not a bug, as mood and momentum shift for no perceptible reasons. The second is that selling short on a stock like this one (small, with a small float) is a dangerous game, since you are unlikely to have time as your ally, and while you may be right in the long term, you may bankrupt yourself before you are vindicated.

YouTube Video

Links

Past Posts