As inflation has taken center stage, markets have gone into retreat globally, and across asset classes. In 2022, as bond rates have risen, stock prices have fallen, and crypto has imploded, even true believers are questioning what the bottom for markets might be, and when we will get there. While it is easy to call the market movement in 2022 a correction and to argue that it is overdue, it is facile, and it fails to address the question of why it is happening now, and whether the correction is overdone or has more to go. In this post, I will argue that almost everything that we are observing in markets, across asset classes, can be explained by a pull back on risk capital, and that understanding the magnitude of the pull back, and putting in historical perspective, is key to gauging what is coming next.

Risk Capital: What is it?

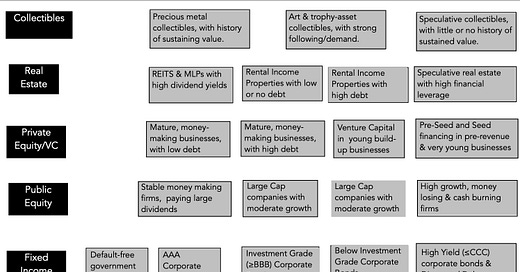

To put risk capital in perspective, it is best to start with a definition of risk that is comprehensive and all-inclusive, and that is to think of risk as a combination of danger (downside) and opportunity (upside) and to consider how investments vary in terms of exposure to both. In every asset class, there is a range of investment choices, with some being safer (or even guaranteed) and others being riskier.

Risk capital is the portion of capital that is invested in the riskiest segments of each market and safety capital is that portion that finds its way to the safest segments in each market.

While risk and safety capital approach the market from opposite ends in the risk spectrum, one (safety capital) being driven by fear and the other (risk capital), by greed, they need to not only co-exist, but be in balance, for the market to be healthy. When to two are not in balance, these imbalances can have profound and often unhealthy effects not just of markets, but also on the overall economy. At the extremes, when risk capital is absent and everyone seeks safety, the economy and markets will atrophy, as businesses and investors will stay away from risky ventures, and when risk capital is too easy and accessible, risky asset prices will soar, and the economy will see too much growth in its riskiest segments, often at the expense of more stable (and still necessary) businesses.

Risk Capital's Ebbs and Flows

It is a common misconception that the risk-takers supply risk capital (risk takers) and that the investors who invest for safety draw from different investor pools, and that these pools remain unchanged over time. While investor risk aversion clearly does play a role in whether investors are drawn to invest in risk or safety capital, it obscures two realities:

Variation within an investor's portfolio: Many investors, including even the most risk averse, may and often do set aside a portion of their portfolios for riskier investments, drawn by the higher expected returns on those investments. For some investors, this set aside will be the portion that they can afford to lose, without affecting their life styles in any material way. For others, it can be the portion of their capital with the longest time horizon (pension fund savings or 401Ks, if you are a young investor, for example), where they believe that any losses on risk capital can be made up over time. For still others, it is that segment of their portfolios that they treat las long shot gambles, hoping for a disproportionately large payoff, if they are lucky. The amount that is put into the risk capital portion will vary with investor risk aversion, with more risk averse investors putting less or even nothing into the riskiest assets, and less risk averse investors putting in more.

Variation across time: The amount that investors are willing to put into risk capital, or conversely redirect to safety capital, will change over time, with several factors playing a role in determining whether risk capital will be plentiful or scarce. The first is market momentum, since more money will be put into the riskiest asset classes, when markets are rising, because investors who benefit from these rising markets will have more capital that they are willing to risk. The second is the the health and stability of the economy, since investors with secure jobs and rising paychecks are more willing to take risks.

There are two macro factors that will come into play, and both are in play in markets today. The first is the return that can be earned on guaranteed investments, i.e., US treasury bills and bonds, for instance, if you are a investor in US dollar, since it is a measure of what someone who takes no or very low risk can expect to earn. When treasury rates are low or close to zero, refusing to take risk will result in returns that are very low or close to zero as well, thus inducing investors to expose themselves to more risk than they would have taken in higher interest rate regimes. The second is inflation, which reduces the nominal return you make on all your investments, and the effects of rising inflation on risk capital are complex. As expected inflation rises, you are likely to see higher interest rates, and as we noted above, that may induce investors to cut back on risk taking and focus on earning enough to cover the ravages of inflation. As uncertainty about inflation rises, you will see reallocation of investment across asset classes, with real assets gaining when unexpected inflation is positive (actual inflation is higher than expected), and financial assets benefiting when unexpected inflation is negative (actual inflation is less than expected).

And Consequences

If you are wondering why you should care about risk capital's ebbs and flows, it is because you will feel its effects in almost everything you do in investing and business.

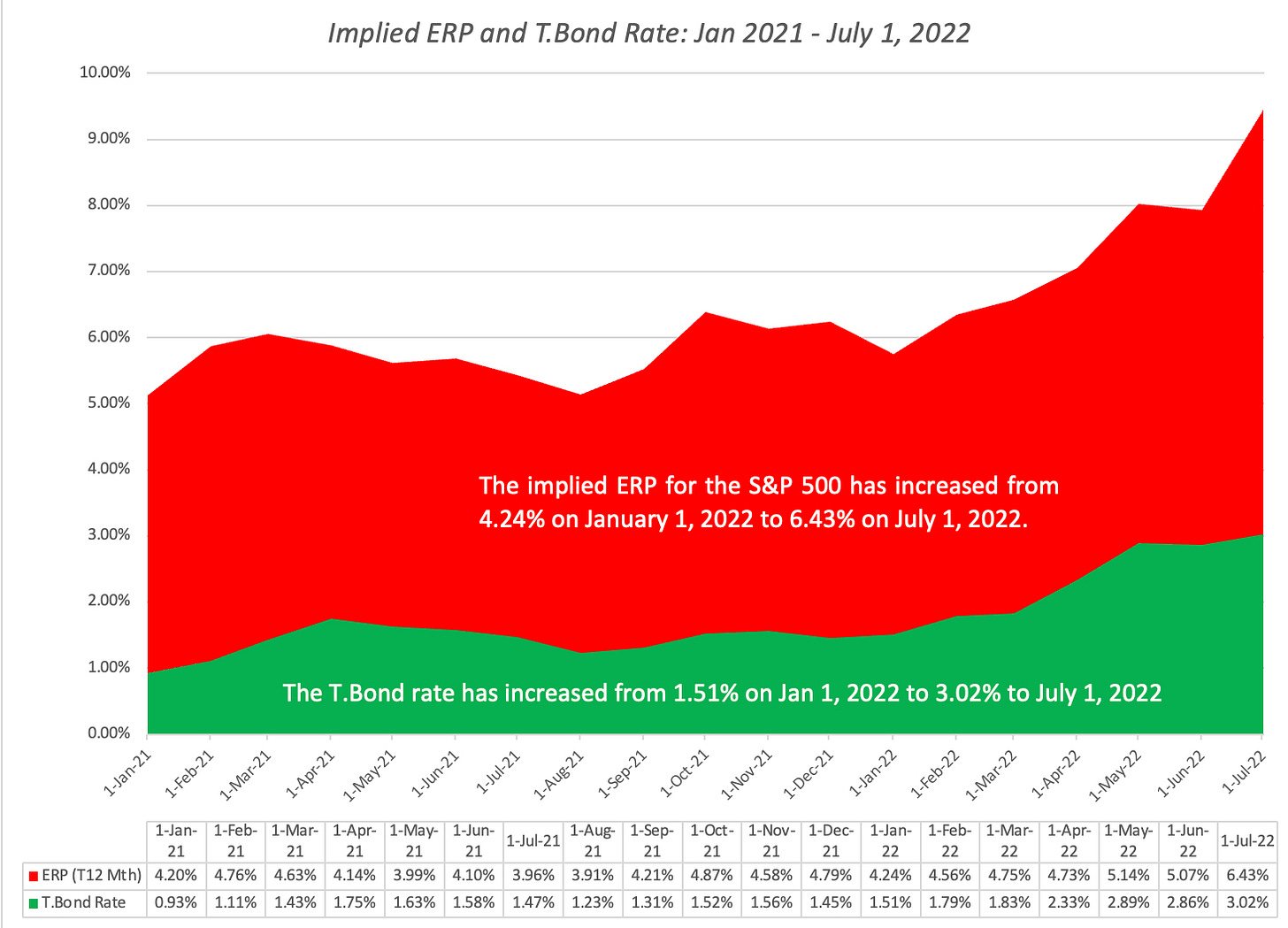

Risk Premiums: The risk premiums that you observe in every risky asset market are a function of how much risk capital there is in play, with risk premiums going up when risk capital becomes scarcer and down, when risk capital is more plentiful. In the bond and loan market, access to risk capital will determine default spreads on bonds, with lower rated bonds feeling the pain more intensely when risk capital is withdrawn or moves to the side lines. Not only will default spreads widen more for lower-rated bonds, but there will be less bond issuances by riskier companies. In the equity market, the equity risk premium is the price of risk, and its movements will track shifts in risk capital, increasing as risk capital becomes scarcer.

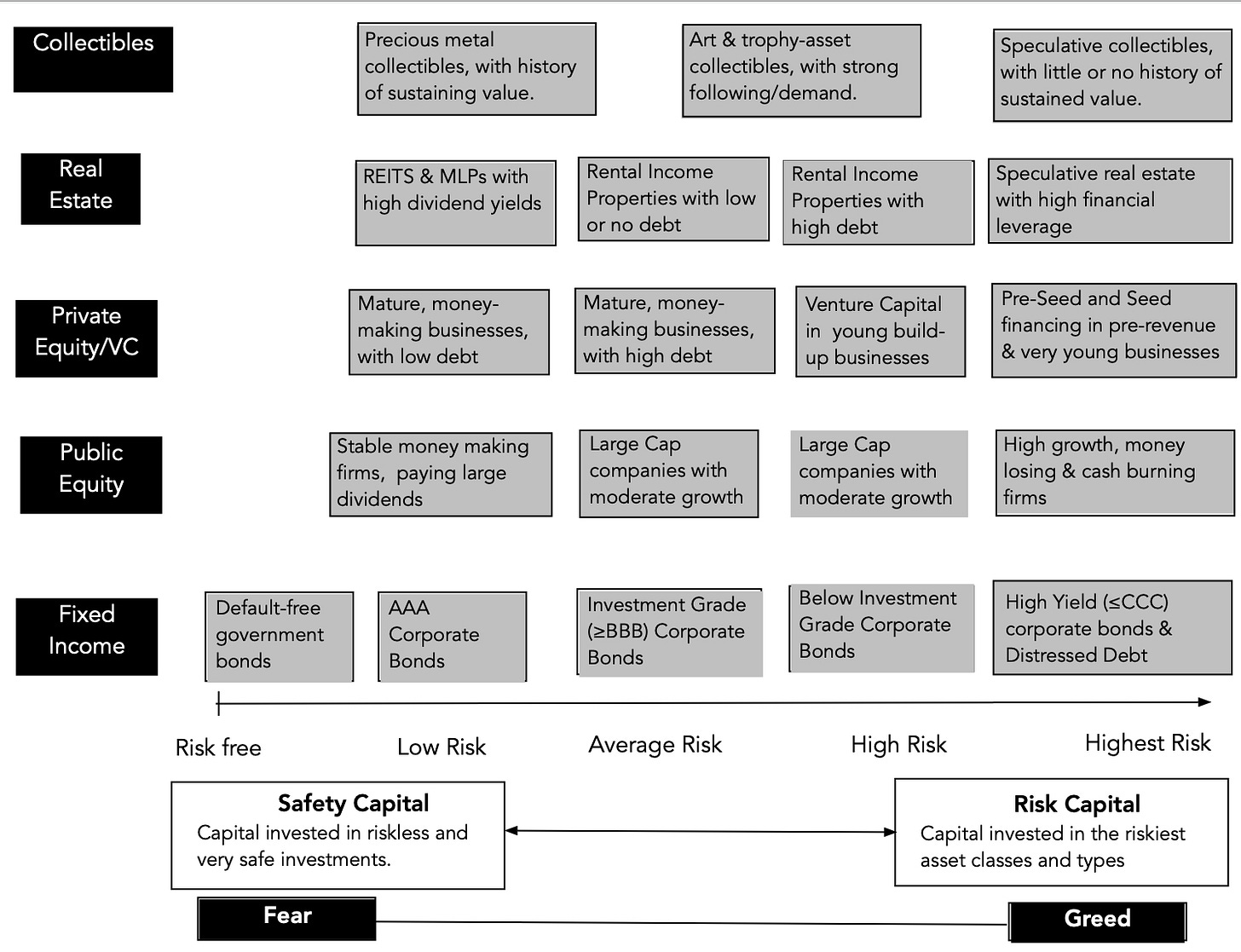

Price and Value Gaps: As those of you who read this blog know well, I draw a contrast between value and price, with the former driven by fundamentals (cash flows, growth and risk) and the latter by mood, momentum and liquidity. The value and price processes can yield different numbers for the same company, and the two numbers can diverge for long periods, with convergence not guaranteed but likely over long periods.

I argue that investors play the value game, buying investments when the price is less than the value and hoping for convergence, and that traders play the pricing game, buying and selling on market momentum, rather than fundamentals. At the risk of generalizing, safety capital, with its focus on earnings and cash flows now, is more likely to focus on fundamentals, and play the investor game, whereas risk capital, drawn by the need to make high returns quickly, is more likely to play the trading game. Thus, when risk capital is plentiful, you are more likely to see the pricing game overwhelm the value game, with prices often rising well above value, and more so for the riskiest segments of every asset class. A pull back in risk capital is often the catalyst for corrections, where price not only converges back on value, but often overshoots in the other direction (creating under valuations). It behooves both investors and traders to therefore track movements in risk capital, since it is will determine when long term bets on value will pay off for the former, and the timing of entry into and exit from markets for the latter.

Corporate Life Cycle: The ebbs and flows of risk capital have consequences for all businesses, but the effects will vary widely across companies, depending on where they are in the life cycle. Using another one of my favorite structures, the corporate life cycle, you can see the consequences of expanding and shrinking risk capital, through the lens of free cash flows (and how they vary across the life cycle).

Early in the corporate life cycle, young companies have negative free cash flows, driven by losses on operations and investments for future growth, making them dependent on risk capital for survival and growth. As companies mature, their cash flows first become self sustaining first, as operating cash flows cover investments, and then turn large and positive, making them not only less dependent on risk capital for survival but also more valued in an environment where safety capital is dominant. Put simply, as risk capital becomes scarcer, young companies, especially those that are money-losing and with negative cash flows, will see bigger pricing markdowns and more failures than more mature companies.

Risk Capital: Historical Perspective

How do you track the availability and access to risk capital over time? There are three proxies that I will use, and while each has its limitations, read together, they can provide a fuller measure of the ebbs and flows of risk capital. The first is funds invested by venture capitalists, with a breakdown further into types, from pre-seed and seed financing to very young companies to capital provided to more young companies with more established business models, as a prelude to exit (acquisition or IPO). The second is the trend line in initial public offerings (number and value raised), since companies are more likely to go public and be able to raise more capital in issue proceeds, when risk capital is plentiful. The third is original bond issuances by the riskiest companies (below investment grade and high yield), since these issuances are more likely to have a friendly reception when risk capital is easily available than when it is not.

Let’s start with venture capital, the typical source of capital for start ups and young companies for decades in the United States, and more recently, in the rest of the world. In the graph below, I trace out total venture capital raised, by year, between 1995 and 2021, in the US:

Source: NVCA Yearbooks

The dot-com boom in the 1990s created a surge in venture capital raised and invested, with venture capital raised peaking at more than $100 billion in 2000, before collapsing as the that bubble burst. The 2008 banking and market crisis caused a drop of almost 50% in 2009, and it took the market almost five years to return to pre-crisis levels. In the just-concluded decade, from 2011 to 2020, the amount raised and invested by venture capitalists has soared, and almost doubled again in 2021, from 2020 levels, with venture capital raised in 2021 reaching an all-time high of $131 billion, surpassing the 2000 dot-com boom levels, albeit in nominal terms. Along the way, exits from past venture capital investments, either in IPOs or in M&A, have become more lucrative for the most successful companies, with 43 exits that exceeded a billion (the unicorn status) in 2021.

If success in venture capital comes from exiting investments at a higher pricing, initial public offerings represent the most lucrative route, and tracking the number of initial public offerings over time provides a window on the ebbs and flows of risk capital, over long periods. Using data made public by Jay Ritter on IPOs, I track the number of IPO and dollar proceeds from offerings in the graph below from 1980 to 2021:

Source: Jay Ritter

As you can see, IPOs go through hot periods (when issuances surge) and cold ones (when there are relatively few listed), with much of the last decade representing hot periods and 2000/01 and 2008/09 representing periods when there were hardly any offerings. While the number of IPOs in 2021 is still below the peak dot-com years, the proceeds from IPOs has surged to an all-time high during the year.

In the final graph, I look at corporate bond offerings, broken down into investment grade and high yield, by year, from 1996 to 2021:

Source: SIFMA

Here again, you see a familiar pattern, with the percentage of high-yield bond issuances tracking the availability of risk capital. As with IPOs, you see big dips in 2000-01and 2008-09, reflecting market corrections and crises, and a period of easy access to risk capital in the last decade. Again, the percentage of corporate bond issuances hit an all-time high in 2021, representing more than a quarter of all bond issuances. In sum, all three proxies for risk capital show the same patterns over time, pulling back and surging during the same time periods, and with all three proxies, it is clear that 2021 was a boom year.

An Update

The last two and a half years may not represent much time on a historical scale, but the period has packed in enough surprises to make it feel like we have aged a decade. We started 2020 with a pandemic that altered our personal, work and financial lives, and in 2022, at least in North America and Europe, we have seen inflation reach levels that we have not seen for decades. Looking at the 30 months through the lens of risk capital can help us understand not only the journey that markets have gone through to get where they are today, but also perhaps decipher where they may go next. In the graph below, I look at venture capital, IPOs and high yield bond issuances over the last two and a half years:

The first thing to note is that there was a pullback on all three measures in the first quarter of 2020, as COVID put economies into deep freeze and rolled markets. The big story, related to COVID, is that risk capital not only did not stay on the side lines for long but came surging back to levels that exceeded pre-COVID numbers, with all three measures hitting all-time highs in 2021. In a post in late 2020, I argued that it was the resilience of risk capital that explained why markets recovered so quickly that year, even as the global economy struggled, that year, and pointed to three explanatory factors. The first was the perception that the COVID shut-down was temporary, and that economies would come back quickly, once the immediate threat from the virus passed. The second was the decline in interest rates across the globe, with rates in developed market currencies (US $, Euro, Japanese Yen etc.) moving towards zero, increasing the costs of staying on the sidelines. The third was a change in investor composition, with a shift from institutional to individual investor market leadership, and increased globalization.

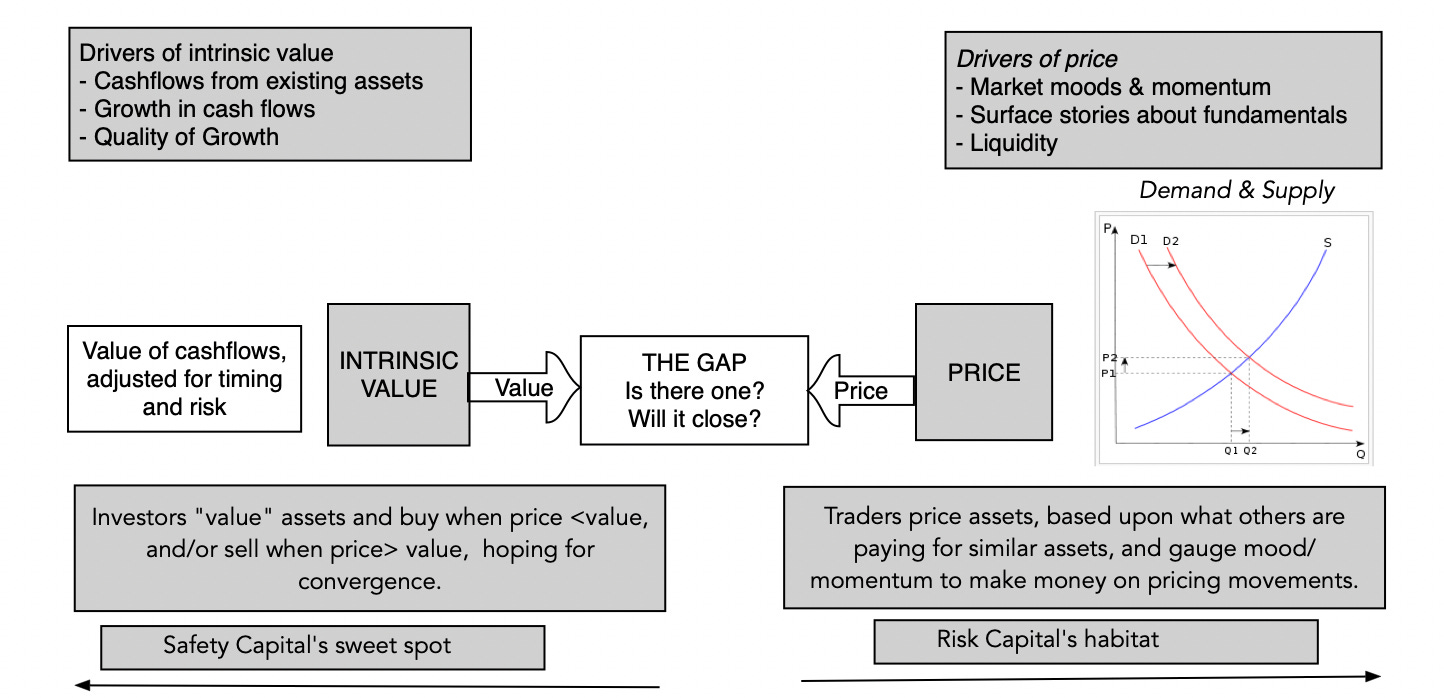

The first half of 2022 has been a trying period for markets, and as inflation has risen, it is having an effect on the availability of and access to risk capital. There has been a pullback in all three proxies for risk capital, albeit smaller in venture capital, than in IPOs and in high-yield bond issuances in the first few months of 2022. That pullback has had its consequences, with equity risk premiums rising around the world. In the graph below, I have updated the equity risk premium for the S&P 500 through the start of July 2022:

The chart reveals how unsettling this year has been for equity investors, in the United States. Not only has the implied ERP surged to 6.43% on June 23, 2022, from 4.24% on January 1, 2022, but stocks are now being priced to earn 9.45% annually, up from the 5.75% at the start of the year. (The jump in ERP may be over stated, since the forward earnings estimates for the index, from analysts, does not seem to be showing any upcoming pain from an expected recession. )

As inflation and recession fears have mounted, equity markets are down significantly around the world, but the drop in pricing has been greatest in the riskiest segments of the market. In the table below, I look at the price change in the first six months of 2022 for global stocks, broken down by quintiles, into net profit margin and revenue growth classes:

Source for raw data: S&P Cap IQ

Note that high growth, negative earnings companies have fared much worse, in general, during the 2022 downturn, than more mature, money-making companies. The fear factor that is tilting the balance back to safety capital from risk capital has also had clear consequences in the speculative collectibles space, with cryptos bearing the brunt of the punishment. Finally, there are markdowns coming to private company holdings, both in the hands of venture capitalists, and public market investors (including mutual funds that have been drawn into this space and public companies like Softbank).

The big question that we all face, as we look towards the second half of the year, is whether the pullback in risk capital is temporary, as it was in 2020, or whether it is more long term, as it was after the dot-com bust in 2000 and the market crisis in 2008. If it is the former, there is hope of not just a recovery, but a strong rebound in risky asset prices, and if it is the latter, stocks may stabilize, but the riskiest assets will see depressed prices for much longer. I don't have a crystal ball or any special macro forecasting abilities, but if I had to guess, it would be that it is the latter. Unlike a virus, where a vaccine may provide at least the semblance of a quick cure (real or imagined), inflation, once unleashed, has no quick fix. Moreover, now that inflation has reared its head, neither central banks nor governments can provide the boosts that they were able to in 2020 and may even have to take actions that make things worse, rather than better, for risk capital. Finally, at the risk of sounding callous, I do think that a return of fear and a longer term pullback in risk capital is healthy for markets and the economy, since risk capital providers, spoiled by a decade or more of easy returns, have become lazy and sloppy in their pricing and trading decisions, and have, in the process, skewed capital allocation in the economy. If a long-term slowdown is in the cards, it is almost certain that the investment strategies that delivered high returns in the last decade will no longer work in this new environment, and that old lessons, dismissed as outdated just a few years go, may need to be relearned.

YouTube Video

Given all of the above, its strange to see the riskiest of sectors, biotech, creeping towards a repair over this past month. Pharma is an obvious safe harbour where pricing power can offset much of your inflationary woes, but biotech, particualrly given the absolute muck that has gone public these past three years from the crossover cartel, should still be in the doghouse surely?