Stream On: An IPO Valuation of Spotify!

In the last few weeks, we have seen two high profile unicorns file for initial public offerings. The first out of the gate was Dropbox, a storage solution for a world where gigabyte files are the rule rather than the exception, with a filing on February 23. Following close after, on February 28, Spotify, positioning itself as the music streaming analog to Netflix, filed its prospectus. With it's larger potential market capitalization and unusual IPO structure, Spotify has attracted more attention than Dropbox, and I would like to focus this post on it.

Spotify: The Back Story

Spotify was founded in 2008 in Sweden, by Daniel Ek and Martin Lorentzon, as a music streaming service. The timing was opportune, since the company caught and contributed to a shift in the music business, as users have moved away from paying for physical (records, CDs) to digital, as evidenced in the graph below:

Source: IFPI

Note that not only has the move towards streaming, in proportional terms, been dramatic, but disruption has come with pain for the music business, with a drop in aggregate revenues from $24 billion in 1999 to about $16 billion in 2016. In a bright spot, revenues have started rising again in 2016 and 2017, and it is possible that the business will rediscover itself, with a new digital model. Spotify was not the first one in the business, being preceded by both Pandora and Soundcloud, but its success is testimonial to the proposition that the spoils seldom go to the first movers in any business disruption.

The Spotify business model is a simple one. Listeners can subscribe to a free version, with limited customization features (playlists, stations etc.) and online ads. Alternatively, they can subscribe to a premium version of the service, paying a monthly fee, in return for a plethora of customization options, and no ads. The company's standard service cost $9.99/month in the United States in 2018, with a family membership, where up to six family members living at the same address, can share a family service for $14.99/month, while preserving individualized playlists and stations. Prices vary globally, ranging from a high of $16.94 in the UK (for standard service) to much lower prices in Eastern Europe and Latin America. (You can check out the variations in this fascinating link that reports the prices across the world for Spotify, in dollar terms.) Spotify pays for its music content, based upon how often a song is streamed, but the rates vary depending on whether it is on the free or premium service and where in the world, creating some complexity in how it is computed. To get a sense of where Spotify stands right now and how it got there, I looked the prospectus, with the intent of catching broad trend lines. I came up with the following:

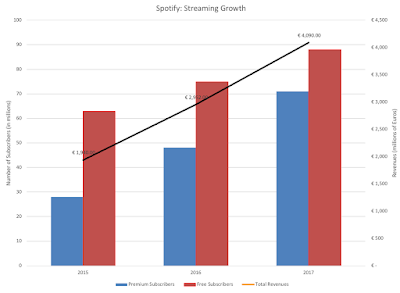

Explosive Growth: Spotify is coming off a growth burst, especially since 2015, in both number of users and revenues, as can be seen in the graph below. Revenues have increased from 1.94 billion Euros to 4.09 billion Euros, reflecting both a growth in subscribers from 91 million to 159 million, and a change in the composition, with premium members climbing from about 31% of total subscribers in 2015 to 45% of subscribers in 2017.

Source: Spotify Prospectus

Subscription Revenue dominates Ad Revenue: Spotify's focus on improving its premium subscriptions is explained easiest by looking at the breakdown of revenues each year, where subscription revenues have accounted for 90% of revenues each year from 2015 to 2017. The one discordant note is that average revenue per premium subscriber has dropped over the same period 7.06 Euros/month to 5.24 Euros/month, a change that the company ascribes to family memberships, but a problematic trend nevertheless:

Source: Spotify Prospectus

Content Costs are coming down: While Spotify insists that it is not scaling back payouts to music labels and artists, the company has been able to lower its content costs as a percent of revenues each year from 88.7% of revenues in 2015 to 79.2% of revenues in 2017. In fact, Spotify has conveyed to investors that its intent is to earn gross margins of 30%-35%, implying that it sees content costs dropping to 65%-70% of revenues. There is an inherent tension here between what Spotify has to convince its investors it can do and what it tells the music industry it is doing and the tension will only intensify, after the company goes public.

Source: Spotify Prospectus

Other costs are trending up: There are three other buckets of cost at Spotify -R&D, Selling & Marketing and G&A- and these costs are not only growing but eating up larger proportion of revenues. If there are economies of scale, as you would expect in most businesses, they are not manifesting themselves in the numbers yet. The collective load of these expenses are creating operating losses, and while margins have become less negative, it is primarily through the content cost controls.

Source: Spotify Prospectus

At this stage of its story, Spotify is a growth company with lots of potential (no irony intended) but lots of rough spots to work out.

The Spotify IPOI have posted ahead of IPOs for many companies in the last decade, ranging from Facebook to Twitter to Alibaba to Snap, but Spotify's IPO is different for two reasons:

No Banks: In a typical IPO, the issuing company seeks out an investment bank, which not only sets an offering price (backed up by a guarantee) but also creates a syndicate with other banks to market the IPO, in roadshows and private client pitches. The Spotify IPO will dispense with the bankers and go directly to the market, letting demand and supply set the price on the opening day.

Cashing Out: In most IPOs, the cash that comes in on the offering, from the shares that are bought by the public, is kept in the company, either to retire existing financing that is not advantageous to the firm, or to cover future investment needs. Spotify is aiming to raise about $1 billion from its offering, but none of it will go to company. Instead, existing equity investors in the company will be receiving the cash in return for their holdings.

As a potential investor, I am less concerned about the "no banker" part of the IPO than I am by the "cash out:" part of the transaction:

No bankers, no problem: I think that the banking role in IPOs is overstated, especially for a company as high profile as Spotify. Bankers don't value IPOs; they price them, usually with fairly crude pricing metrics, though they often reverse engineer DCFs to back up their pricing. Their guarantee on the offering price is significantly diluted in value by the fact that they set offering prices 10% to 15% below what they think the market will bear, and their marketing efforts are more useful in gauging demand than in selling the securities. From an investor perspective, there is little that I learn from road shows that I could not have learned from reading the prospectus, and there is almost as much disinformation as information meted out as part of the marketing.

Control or Growth: I find it odd that a company like Spotify, growing at high rates and losing money while doing so, would turn away a billion in cash that could be used to cover its growth needs for the near future. The cashing out of existing owners sends two negative signals. The first is that they (equity investors who cash out) do not feel that staying on as investors in the company, as a publicly traded entity, is worth it. Since they have access to data that I don't, I would like to know what they see in the company's future. The second is that the structure of the share offering, with voting and non-voting shares, indicates a consolidation of control with the founders, and the offering may provide an opportunity to get rid of dissenting voices.

My Spotify ValuationIn keeping with my view that you need a story to provide a framework for you valuation inputs, and especially so for young companies, I constructed a story for Spotify with the following elements:

Continued (but Slower) Revenue Growth: Spotify's success in scaling up over the last three years also sets the stage for a slowing down of growth in the future, with competition for Apple Music (backed by Apple's deep pockets) contributing to the trend. A combination of increases in subscriber numbers and a leveling off and even a mild increase in subscription per member will translate into a revenue growth of 25% a year for the next five years, scaling down to much lower growth in the years after. Since I am projecting revenues for Spotify in 10 years that are larger than the reported global music business revenues today, implicit in this story is the assumption that the music business overall has turned the corner and that aggregate revenues will not only continue to post increases like they did in 2016 and 2017, but that streaming will be the savior of the music business, allowing it expand its reach into emerging markets and pick up more paying customers.

With Reduced Content Costs: Spotify's entire value proposition rests on improved operating margins and a large portion of the improvement has to come from continuing to reduce content costs as a percent of revenues. Since Spotify pays for its content based upon song streams, those savings have to come from either paying less per stream (which is going to and should create push back from labels and artists) or finding ways to create economies of scale on this cost component. In it's defense, Spotify can point to its track record from 2015 to 2017 in reducing content costs. I assume that they can reduce content costs to 70% of revenues, while finding a way to keep artists and labels happy. That is not going to be an easy balance to maintain, especially with the top artists, as evidenced by Taylor Swift's and Jay-Z's decisions to pull their music from Spotify. (I have been told that they have reversed their decisions, but this fight is ongoing.)

And Economies of Scale on Other Costs: Of the three other costs, the marketing expenses are the ones most likely to scale down as growth declines, but for Spotify to deliver solid operating margins, it also has to bring R&D costs and G&A costs under control. I may be over optimistic on this front, but here is what my projected values yield for my target operating margin (ten years from now):

With Limited Capital Investments: Spotify's business model is built for scaling, with little need for capital reinvestment, except for R&D. Consequently, I assume that small capital investments can generate large revenues, using a sales to capital ratio of 4.00 (putting it at the 90th percentile of global companies) to estimate reinvestment.

Manageable Operating Risk but Significant Failure Risk: Spotify's subscription based model and low turnover rate among subscribers does lend some stability to revenues, though adding more subscribers and going for growth is a riskier proposition. Overall, allowing for their business mix (90% entertainment, 10% advertising) and their global mix of revenues yields a cost of capital of 9.24%, at the 80th percentile of global companies; the firm is planning to convert much of its debt into equity at the time of the IPO, giving it a equity dominated capital structure. However, the company is still young, losing money and faces deep pocketed competition, suggesting that failure is a very real possibility. I assume a 20% chance of failure, with failure translating into selling the company to the highest bidder at half of its going concern value.

Loose Ends: To estimate equity value in common shares, I add the cash balance of the company of 1.5 billion Euros and a cross holding in Tencent Music (valued at 910 million Euros), ignore the proceeds from the IPO because of the cash-out structure and net out the value of 20.82 million options/warrants outstanding, with an average strike price of 42.56 Euros per share. Dividing the equity value of 16.5 billion Euros by 177.17 million shares (including restricted shares) yields a value per share of 93.40 Euros per share or $115.31. The shares that you will be buying will be non-voting, implying a discount on this number, though how much you discount it will depend on how much you like and trust the company's founders.

The entire picture, with the story embedded in it, is shown below. You can also download the spreadsheet here. (The base year numbers in the prospectus were all in Euros, but all of the valuation inputs (growth, cost of capital) are in US dollars, making it a US dollar valuation. In hindsight, I should have restated the base year numbers in US dollars. While it would not have changed the valuation, it would have reduced currency confusion. Alternatively, I could have valued the company entirely in Euros, with lower growth rates and costs of capital, and arrived at Euro valuation that yield roughly similar results):

It goes without saying, but I will say it anyway, that I made lots of assumptions to get to my value and that you may (and should) disagree with me or some or even all of these assumptions. You are welcome to download the spreadsheet that contains my valuation of Spotify and make it your own.

Bottom Line

There are three elements missing in this post. First, I have argued in my prior IPO posts that what happens after initial public offerings is more of a pricing game than a value game. To those of you who want to play that game, I don't think that this post is going to be very helpful. In my next post, I will look at how best to price Spotify, why you will hear pessimists about the company talk a lot about Pandora and optimists about Netflix. Second, there is the argument that top down valuations, like the one in this post, are ill equipped to value user or subscriber based companies. I will also use the user-based model that I introduced last year to value an Uber rider and an Amazon Prime member to value a Spotify subscriber. Finally, there is the lurking question of what Spotify is learning about its subscriber music tastes and how that data can be used to not only modify its offerings but perhaps create content that is more closely tailored to these tastes. That too has to wait for the next post.

YouTube

Data Links