The Power of Expectations: Nvidia's Earnings Report and Market Reaction!

The essence of a surprise

Last Wednesday (August 28), the market waited with bated breath for Nvidia’s earning call, scheduled for after the market closed. That call, at first sight, contained exceptionally good news, with revenues and earnings coming in at stratospheric levels, and above expectations, but the stock fell in the aftermath, down 8% in Thursday’s trading. That drop of more than $200 billion in market capitalization in response to what looked like good news, at least on the surface, puzzled market observers, though, as is their wont, they had found a reason by day end. This dance between companies and investors, playing out in expected and actual earnings, is a feature of every earnings season, especially so in the United States, and it has always fascinated me. In this post, I will use the Nvidia earnings release to examine what news, if any, is contained in earnings reports, and how traders and investors use that news to reframe their thinking about stocks.

Earnings Reports: The Components

When I was first exposed to financial markets in a classroom, I was taught about information being delivered to markets, where that information is processed and converted into prices. I was fascinated by the process, an interplay of accounting, finance and psychology, and it was the subject of my doctoral thesis, on how distortions in information delivery (delays, lies, mistakes) affects stock returns. In the real world, that fascination has led me to pay attention to earnings reports, which while overplayed, remain the primary mechanism for companies to convey information about their performance and prospects to markets.

The Timing

Publicly traded companies have had disclosure requirements for much of their existence, but those requirements have become formalized and more extensive over time, partly in response to investor demands for more information and partly to even the playing field between institutional and individual investors. In the aftermath of the great depression, the Securities Exchange Commission was created as part of the Securities Exchange Act, in 1934, and that act also required any company issuing securities under that act, i.e., all publicly traded firms, make annual filings (10Ks) and quarterly filings (10Qs), that would be accessible to investors.

The act also specifies that these filings be made in a timely manner, with a 1946 stipulation the annual filings being made within 90 days of the fiscal year-end, and the quarterly reports within 45 calendar days of the quarter-end. With technology speeding up the filing process, a 2002 rule changed those requirements to 60 days, for annual reports, and 40 days for quarterly reports, for companies with market capitalizations exceeding $700 million. While there are some companies that test out these limits, most companies file well within these deadlines, often within a couple of weeks of the year or quarter ending, and many of them file their reports on about the same date every year.

If you couple the timing regularity in company filings with the fact that almost 65% of listed companies have fiscal years that coincide with calendar years, it should come as no surprise that earnings reports tend to get bunched up at certain times of the year (mid-January, mid-April, mid-July and mid-October), creating “earnings seasons”. That said, there are quite a few companies, many of them high-profile, that preserve quirky fiscal years, and since Nvidia’s earnings report triggered this post, it is worth noting that Nvidia has a fiscal year that ends on January 31 of each year, with quarters ending on April 30, July 31 and October 31. In fact, the Nvidia earnings report on August 28 covered the second quarter of this fiscal year (which is Nvidia's 2025 fiscal year).

The Expectations Game

While corporate earnings reports are delivered once a quarter, the work of anticipating what you expect these reports to contain, especially in terms of earnings per share, starts almost immediately after the previous earnings report is delivered. In fact, a significant portion of sell side equity research is dedicated to this activity, with revisions made to the expected earnings, as you get closer and closer to the next earnings report. In making their earnings judgments and revisions, analysts draw on many sources, including:

The company’s history/news: With the standard caveat that the past does not guarantee future results, analysts consider a company’s historical trend lines in forecasting revenues and earnings. This can be augmented with other information that is released by the company during the course of the quarter.

Peer group reporting: To the extent that the company’s peer group is affected by common factors, it is natural to consider the positive or negative the operating results from other companies in the group, that may have reported earnings ahead of your company.

Other analysts’ estimates: Much as analysts claim to be independent thinkers, it is human nature to be affected by what others in the group are doing. Thus, an upward revision in earnings by one analyst, especially an influential one, can lead to revisions upwards on the part of other analysts.

Macro news: While macroeconomic news (about the economy, inflation or currency exchange rates) cuts across the market, in terms of impact, some companies are more exposed to macroeconomic factors than others, and analysts will have to revisit earnings estimates in light of new information.

The earnings expectations for individual companies, from sell side equity research analysts are publicly accessible, giving us a window on trend lines.

Nvidia is one of the most widely followed companies in the world, and most of the seventy plus analysts who publicly follow the firm play the estimation game, leading into the earnings reports. Ahead of the most recent second quarter earnings report, the analyst consensus was that the company would report revenues of $28.42 billion for the quarter, and fully diluted earnings per share of 64 cents; in the 30 days leading into the report, the earnings estimates had drifted up mildly (about 0.1%), with the delay in the Blackwell (NVidia’s new AI chip) talked about but not expected to affect revenue growth near term. It is worth noting that not all analysts tracking the stock forecast every metric, and that there was disagreement among them, which is also captured in the range on the estimates; on earnings per share, for instance, the estimates ranged from 60 to 68 cents, and on revenues, from $26 to $30 billion.

The pre-game show is not restricted to analysts and investors, and markets partake in the expectations game in two ways.

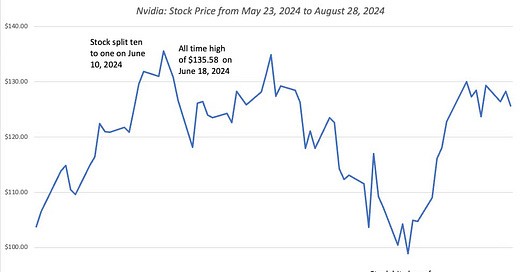

Stock prices adjust up or down, as earnings expectations are revised upwards or downwards, in the weeks leading up to the earnings report. Nvidia, which traded at $104 on May 23rd, right after the company reported its results for the first quarter of 2024, had its ups and down during the quarter, hitting an all-time high of $135.58 on June 18, 2024, and a low of $92.06, on August 5, before ending at $125.61 on August 28, just ahead of the earnings report:

During that period, the company also split its shares, ten to one, on June 10, a week ahead of reaching its highs.

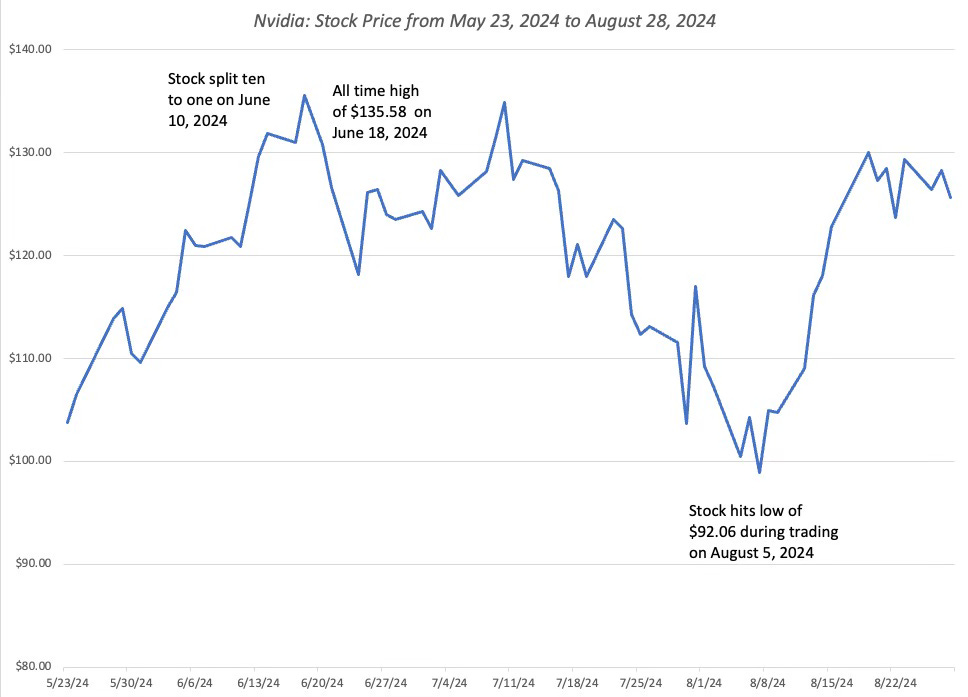

Stock volatility can also changes, depending upon disagreements among analysts about expected earnings, and the expected market reaction to earnings surprises. That effect is visible not only in observed stock price volatility, but also in the options market, as implied volatility. For Nvidia, there was clearly much more disagreement among investors about the contents of the second quarter earnings report, with implied volatility spiking in the weeks ahead of the report:

Source; Fintel

While volatility tends to increase just ahead of earnings reports, the surge in volatility ahead of the second quarter earnings for Nvidia was unusually large, a reflection of the disagreement among investors about how the earnings report would play out in the market. Put simply, even before Nvidia reported earnings on August 28, markets were indicating more unease about both the contents of the report and the market reaction to the report, than they were with prior earnings releases.

The Event

Given the lead-in to earnings reports, what exactly do they contain as news? The SEC strictures that companies disclose both annual and quarterly results have been buffered by accounting requirements on what those disclosures should contain. In the United States, at least, quarterly reports contain almost all of the relevant information that is included in annual reports, and both have suffered from the disclosure bloat that I called attention to in my post on disclosure diarrhea. Nvidia’s second quarter earnings report, weighing in at 80 pages, was shorter than its annual report, which ran 96 pages, and both are less bloated than the filings of other large market-cap companies.

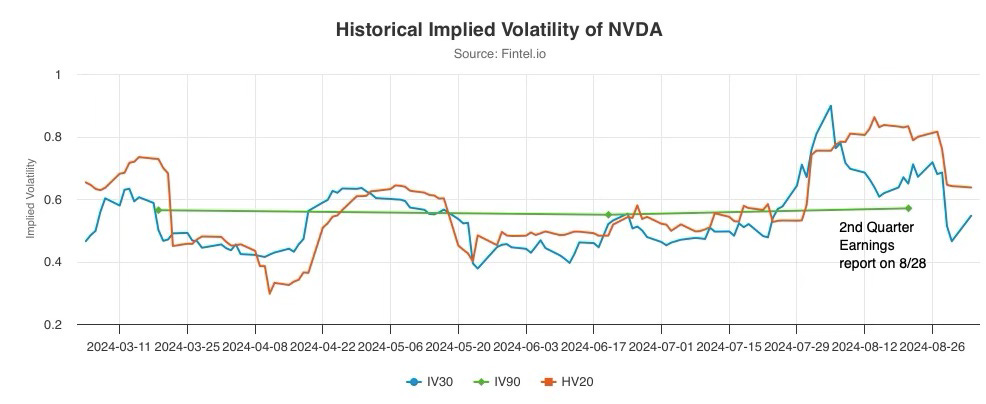

The centerpieces of the earnings report, not surprisingly, are the financial statements, as operating numbers are compared to expectations, and Nvidia’s second quarter numbers, at least at first sight, are dazzling:

The company’s astonishing run of the last few years continues, as its revenues, powered by AI chip sales, more than doubled over the same quarter last year, and profit margins came in at stratospheric levels. The problem, though, is that the company's performance over the last three quarters, in particular, have created expectations that no company can meet. While it is just one quarter, there are clear signs of more slowing to come, as scaling will continue to push revenue growth down, the unit economics will be pressured as chip manufacturers (TSMC) push for a larger slice and operating margins will decrease, as competition increases.

Over the last two decades, companies have supplemented the financial reports with guidance on key metrics, particularly revenues, margins and earnings, in future quarters. That guidance has two objectives, with the first directed at investors, with the intent of providing information, and the second at analysts, to frame expectations for the next quarter. As a company that has played the expectations game well, it should come as no surprise that Nvidia provided guidance for future quarters in its second quarter report, and here too, there were reminders that comparisons would get more challenging in future quarters, as they predicted that revenue growth rates would come back to earth, and that margins would, at best, level off or perhaps even decline.

Finally, in an overlooked news story, Nvidia announced that it would had authorized $50 billion in buybacks, over an unspecified time frame. While that cash return is not surprising for a company that has became a profit machine, it is at odds with the story that some investors were pricing into the stock of a company with almost unlimited growth opportunities in an immense new market (AI). Just as Meta and Alphabet’s dividend initiations signaled that they were approaching middle age, Nvidia’s buyback announcement may be signaling that the company is entering a new phase in the life cycle, intentionally or by accident.

The Scoring

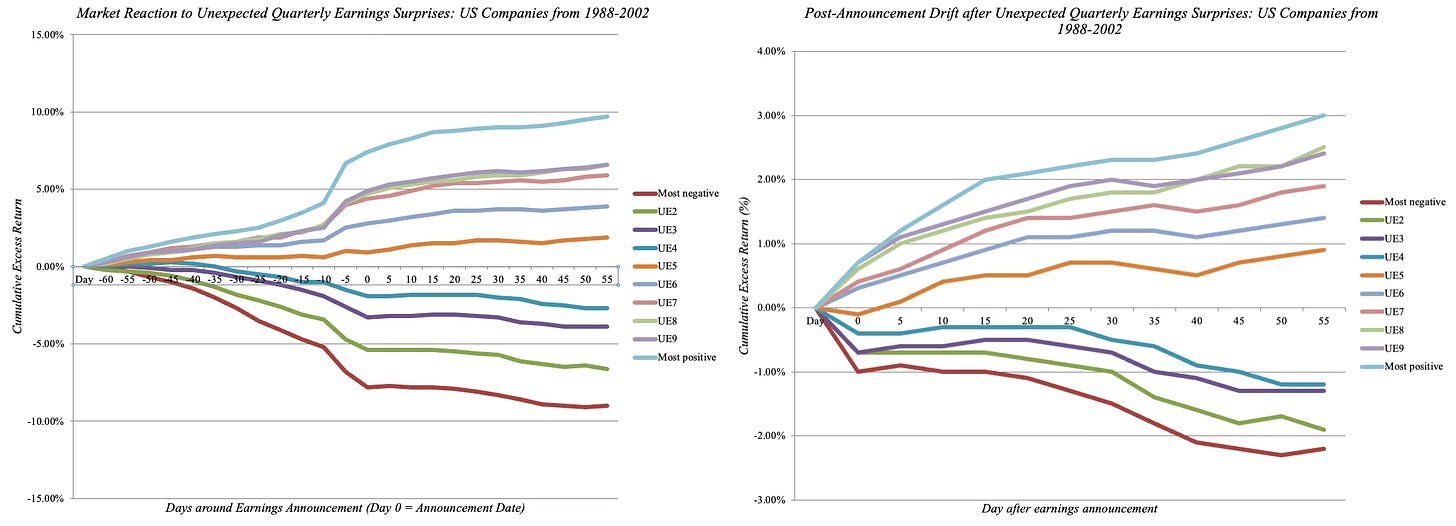

The final piece of the earning release story, and the one that gets the most news attention, is the market reaction to the earnings reports. There is evidence in market history that earnings reports affect stock prices, with the direction of the effect depending on how actual earnings measure up to expectations. While there have been dozens of academic papers that focus on market reactions to earnings reports, their findings can be captured in a composite graph that classifies earnings reports into deciles, based upon the earnings surprise, defined as the difference between actual and predicted earnings:

As you can see, positive surprises cause stock prices to increase, whereas negative surprises lead to price drops, on the announcement date, but there is drift both before and after surprises in the same direction. The former (prices drifting up before positive and down before negative surprises) is consistent with the notion that information about earnings surprises leaks to markets in the days before the report, but the latter (prices continuing to drift up after positive or down after negative surprises) indicates a slow-learning market that can perhaps be exploited to earn excess returns. Breaking down the findings on earnings reports, there seems to be evidence that the that the earnings surprise effect has moderated over time, perhaps because there are more pathways for information to get to markets.

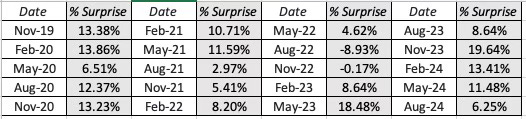

Nvidia is not only one of the most widely followed and talked about stocks in the market, but one that has learned to play the expectations game well, insofar as it seems to find a way to beat them consistently, as can be seen in the following table, which looks at their earnings surprises over the last 5 years:

Nvidia Earnings Surprise (%)

Barring two quarters in 2022, Nvidia has managed to beat expectations on earnings per share every quarter for the last five years. There are two interpretations of these results, and there is truth in both of them. The first is that Nvidia, as with many other technology companies, has enough discretion in both its expenditures (especially in R&D) and in its revenue recognition, that it can use it to beat what analysts expect. The second is that the speed with which the demand for AI chips has grown has surprised everyone in the space (company, analysts, investors) and that the results reflect the undershooting on forecasts.

Focusing specifically on the 2025 second quarter, Nvidia beat analyst expectations, delivering earnings per share of 68 cents (above the 64 cents forecast) and revenues of $30 billion (again higher than the $28.4 billion forecast), but the percentage by which it beat expectations was smaller than in the most recent quarters. That may sound like nitpicking, but the expectations game is an insidious one, where investors move the goal posts constantly, and more so, if you have been successful in the past. On August 28, after the earnings report, Nvidia saw share prices drop by 8% and not only did that loss persist through the next trading day, the stock has continued to lose ground, and was trading at $106 at the start of trading on September 6, 2028.

Earnings Reports: Reading the Tea Leaves

So what do you learn from earnings reports that may cause you to reassess what a stock is worth? The answer will depend upon whether you consider yourself more of a trader or primarily an investor. If that distinction is lost on you, I will start this section by drawing the contrast between the two approaches, and what each approach is looking for in an earnings report.

Value versus Price

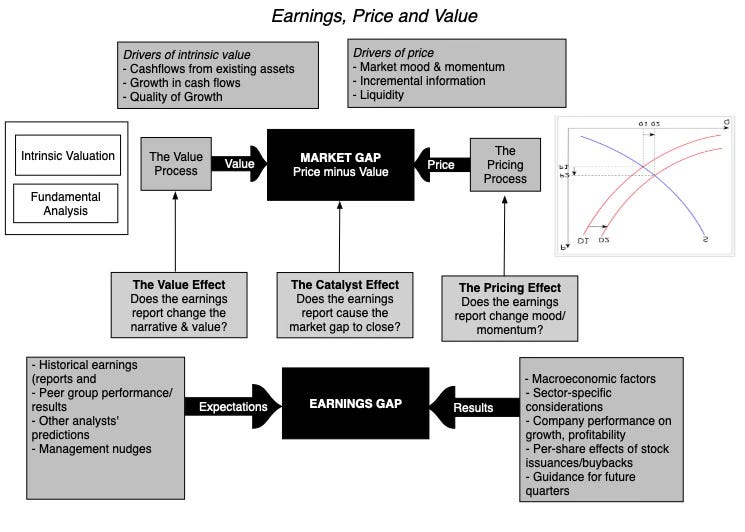

At the risk of revisiting a theme that I have used many times before, there are key differences in philosophy and approach between valuing an asset and pricing it.

The value of an asset is determined by its fundamentals – cash flows, growth and risk, and we attempt to estimate that value by bringing in these fundamentals into a construct like discounted cash flow valuation or a DCF. Looking past the modeling and the numbers, though, the value of a business ultimately comes from the story you tell about that business, and how that story plays out in the valuation inputs.

The price of an asset is set by demand and supply, and while fundamentals play a role, five decades of behavioral finance has also taught us that momentum and mood have a much greater effect in pricing, and that the most effective approach to pricing an asset is to find out what others are paying for similar assets. Thus, determining how much to pay for a stock by using a PE ratio derived from looking its peer group is pricing the stock, not valuing it.

The difference between investing and trading stems from this distinction between value and price. Investing is about valuing an asset, buying it at a price less than value and hoping that the gap will close, whereas trading is almost entirely a pricing game, buying at a low price and selling at a higher one, taking advantage of momentum or mood shifts. Given the very different perspectives the two groups bring to markets, it should come as no surprise that what traders look for in an earnings report is very different from what investors see in that same earnings report.

Earnings Reports: The Trading Read

If prices are driven by mood and momentum, it should come as no surprise that what traders are looking for in an earnings report are clues about how whether the prevailing mood and momentum will prevail or shift. It follows that traders tend to focus on the earnings per share surprises, since its centrality to the report makes it more likely to be a momentum-driver. In addition, traders are also swayed more by the theater around how earnings news gets delivered, as evidenced, for instance, by the negative reaction to a recent earnings report from Tesla, where Elon Musk sounded downbeat, during the earnings call. Finally, there is a significant feedback loop, in pricing, where the initial reaction to an earnings report, either online or in the after market, can affect subsequent reaction. As a trader, you may learn more about how an earnings report will play out by watching social media and market reaction to it than by poring over the financial statements.

For Nvidia, the second quarter report contained good news, if good is defined as beating expectations, but the earnings beat was lower than in prior quarters. Coupled with sober guidance and a concern the stock had gone up too much and too fast, as its market cap had increased from less than half a trillion to three trillion over the course of two years, the stage was set for a mood and momentum shift, and the trading since the earnings release indicates that it has happened. Note, though, that this does not mean that something else could not cause the momentum to shift back, but before you, as an Nvidia manager or shareholder, are tempted to complain about the vagaries of momentum, recognize that for much of the last two years, no stock has benefited more from momentum than Nvidia.

The Investing Read

For investors, the takeaways from earnings reports should be very different. If value comes from key value inputs (revenues growth, profitability, reinvestment and risk), and these value inputs themselves come from your company narrative, as an investor, you are looking at the earnings reports to see if there is information in them that would change your core narrative for the company. Thus, an earnings report can have a significant effect on value, if it significantly changes the growth, profitability or risk parts of your company’s story, even though the company’s bottom line (earnings per share) might have come in at expectations. Here are a few examples:

A company reporting revenue growth, small or even negligible for the moment, but coming from a geography or product that has large market potential, can see its value jump as a consequence. In 2012, I reassessed the value of Facebook upwards, a few months after it had gone public and seen its stock price collapse, because its first earnings report, while disappointing in terms of the bottom line, contained indications that the company was starting to succeed in getting its platform working on smart phones, a historical weak spot for the firm.

You can also have a company reporting higher than expected revenue growth accompanied by lower than anticipated profit margins, suggesting a changing business model, and thus a changed story and valuation. Earlier this year, I valued Tesla, and argued that their lower margins, while bad news standing alone, was good news if your story for Tesla was that it would emerge as a mass market automobile company, capable of selling more cars than Volkswagen and Toyota. Since the only pathway to that story is with lower-priced cars, the Tesla strategy of cutting prices was in line with that story, albeit at the expense of profit margins.

A company reporting regulatory or legal actions directed against it, that make its business model more costly or more risky to operate, even though its current numbers (revenues, earnings etc.) are unscathed (so far).

In short, if you are an investor, the most interesting components of the report are not in the proverbial bottom line, i.e., whether earnings per share came in below or above expectations, but in the details. Finally, as investors, you may be interested in how earnings reports change market mood, usually a trading focus, because that mood change can operate as a catalyst that causes the price-value gap to close, enriching you in the process.

The figure below summarizes this section, by first contrasting the value and pricing processes, and then looking at how earnings releases can have different meanings to different market participants.

As in other aspects of the market, it should therefore come as no surprise that the same earnings report can have different consequences for different market participants, and it is also possible that what is good news for one group (traders) may be bad news for another group (investors).

Nvidia: Earnings and Value

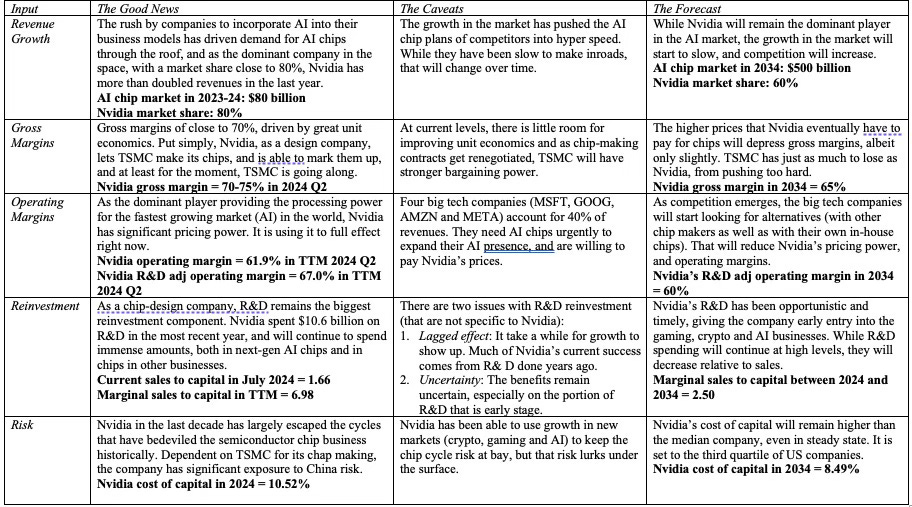

My trading skills are limited, and that I am incapable of playing the momentum game with any success. Consequently, I am not qualified to weigh in on the debate on whether the momentum shift on Nvidia is temporary or long term, but I will use the Nvidia second quarter earnings report as an opportunity to revisit my Nvidia story and to deliver a September 2024 valuation for the company. My intrinsic valuation models are parsimonious, built around revenue growth, profit margins and reinvestment, and I used the second quarter earnings report to review my story (and inputs) on each one:

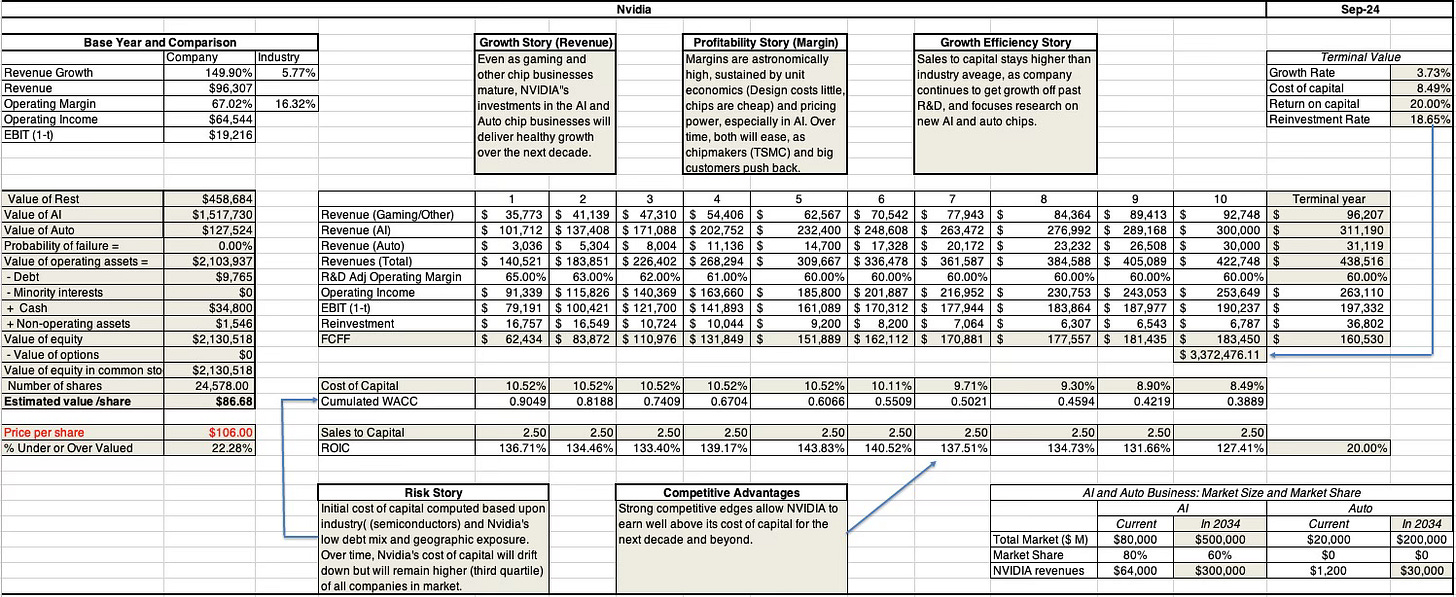

Nvidia: Valuation Inputs (Sept 2024)

With these input changes in place, I revalued Nvidia at the start of September 2024, breaking its revenues, earnings and cash flows down into three businesses: an AI chip business that remains its central growth opportunity, and one in which it has a significant lead on the competition, an auto chip business where it is a small player in a small game, but one where there is potential coming from demand for more powerful chips in cars, and the rest, including its existing business in crypto and gaming, where growth and margins are solid, but unlikely to move dramatically. While traders may be disappointed with Nvidia’s earnings release, and wish it could keep its current pace going, I think it is both unrealistic and dangerous to expect it to do so. In fact, one reason that my story for Nvidia has become more expansive, relative to my assessment in Jun3e 2023, is that the speed with which AI architecture is being put in place is allowing the total market to grow at a rate far faster than I had forecast last year. In short, relative to where I was about a year ago, the last four earnings reports from the company indicate that the company can scale up more than I thought it could, has higher and more sustainable margins than I predicted and is perhaps less exposed to the cycles that the chip business has historically been victimized by. With those changes in place, my value per share for Nvidia in is about $87, still about 22% below the stock price of $106 that the stock was trading at on September 5, 2024, a significant difference but one that is far smaller than the divergence that I noted last year.

As always, the normal caveats apply. The first is that I value companies for myself, and while my valuations drive my decisions to buy or sell stocks, they should not determine your choices. That is why my Nvidia valuation spreadsheet is available not just for download, but for modification, to allow you to tell your own story for Nvidia, yielding a different value and decision. The second is that this is a tool for investors, not traders, and if you are playing the trading game, you will have to reframe the analysis and think in terms of mood and momentum. Looking back, I am at peace with the decision made in the summer of 2023 to shed half my Nvidia shares, and hold on to half. While I left money on the table, with the half that I sold, I have been richly compensated for holding on to the other half. I am going to count that as a win and move on!

YouTube Video

Links

My best read of the day and it was about my favorite stock, Nvidia. Thank you!

I am not a big fan of DCF analysis - too many assumptions upon assumptions that usually distort the conclusions. In this case, if I were to wait for $87 before buying NVDA, I could be waiting for a while.

On top of that, today, NVDA is the most traded stock in the world (it used to be TSLA). About $40-50B of NVDA is traded daily. as per Factset. As per VandaTrack, $260B has flowed into NVDA related ETFs, including 2x and 3x levered ETFs. I dont have NVDA specific 0DTE options data...that is another trading related factor distorting price movements.

Suffice to say, pricing NVDA using traditional methods...in today's markets...is a challenge and could be misleading for investors.

Thank you again for your writings. I love reading them because I learn something new every time. Your previous work on valuing TSLA was another master class.

Cheers!

Thank you!