I was planning to finish my last two data updates for 2024, but decided to take a break and look at the seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) which carried the market in 2023. While I will use the "Magnificent Seven" moniker attached by these companies by investors and the media, my preference would have been to call them the Seven Samurai. After all, like their namesakes in that legendary Kurosawa movie, who saved a village and its inhabitants from destruction, these seven stocks saved investors from having back-to-back disastrous years in the stock market.

The What?

It is worth remembering that the Magnificent Seven (Mag Seven) had their beginnings in the FANG (Facebook, Amazon, Netflix and Google) stocks, in the middle of the last decade, which morphed into the FANGAM (with the addition of Apple and Microsoft to the group) and then to the Mag Seven, with the removal of Netflix from the mix, and the addition of Tesla and Nvidia to the group. There is clearly hindsight bias in play here, since bringing in the best performing stocks of a period into a group can always create groups that have supernormal historical returns. That bias notwithstanding, these seven companies have been extraordinary investments, not just in 2023, but over the last decade, and there are lessons that we can learn from looking at the past.

First, let's look at the performance of these seven stocks in 2023, when their collective market capitalization increased by a staggering $5.1 trillion during the course of the year. In a group of standout stocks, Nvidia and Meta were the best performers, with the former more than and the later almost tripling in value over the period. In terms of dollar value added, Microsoft and Apple each added a trillion dollars to their market capitalizations, during the year.

To understand how much these stocks meant for overall market performance, recognize that these seven companies accounted for more than 50% of the increase in market capitalization of the the entire US equity market (which included 6658 listed companies in 2023). With them, US equities had price appreciation of 23.25% for the year, but without them, the year would have been an average one, with returns on 12.6%.

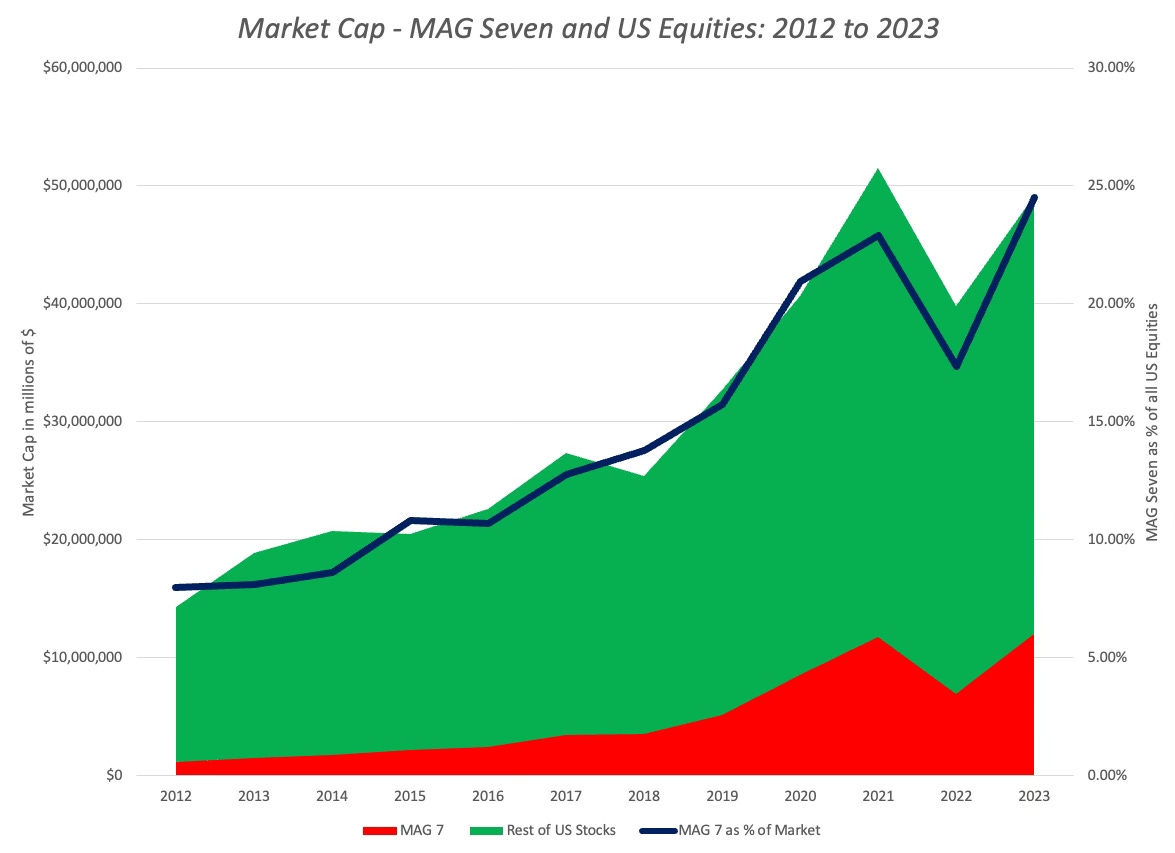

While these seven stocks had an exceptional year in 2023, their outperformance stretches back for a much longer period. In the graph below, I look at the cumulated market capitalization of the Mag Seven stocks, and the market capitalization of all of the remaining US stocks from 2012 to 2023:

Over the eleven-year period, the cumulative market capitalization of the seven companies has risen from $1.1 trillion in 2012 to $12 trillion in 2023, rising from 7.97% of overall US market cap in 2012 to 24.51% of overall market cap at the end of 2023. To put these numbers in perspective, the Mag Seven companies now have a market capitalization larger than that of all listed stocks in China, the second largest market in the world in market capitalization terms.

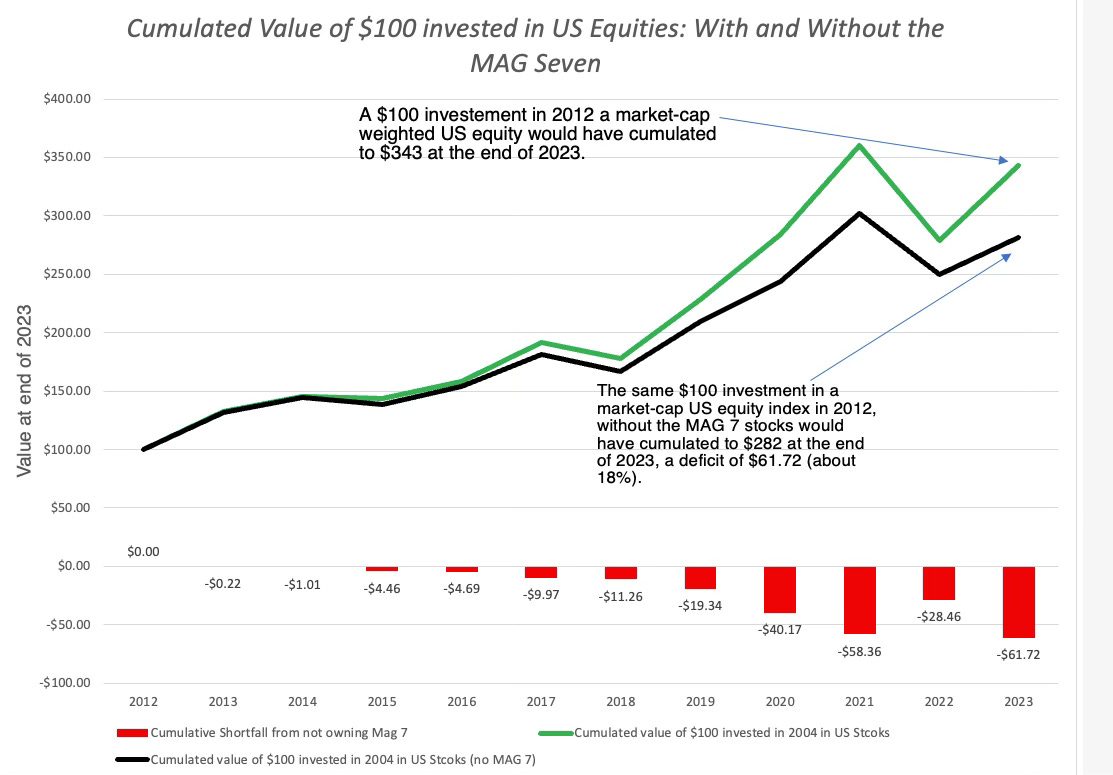

Another way to see how much owning or not owning these stocks meant for investors, I estimated the cumulated value of $100 invested in December 2012 in a market-cap weighted index of US stocks at the end of 2023, first in US equities , and then in US equities, without the Mag Seven stocks:

It is striking that removing seven stocks from a portfolio of 6658 US stocks, investing between 2012 and 2023, creates a 17.97% shortfall in the end value. In effect, this would suggest that any portfolio that did not include any of these seven stocks during the last decade would have faced a very steep, perhaps even insurmountable, climb to beat the market. That may go a long way in explaining why both value and small cap premium have essentially disappeared over this period.

In all of the breathless coverage of the Mag Seven (and FANG and FANGAM) before it, there seems to be the implicit belief that their market dominance is unprecedented, but it is not. In fact, equity markets have almost always owed their success to their biggest winners, and Henrik Bessimbinder highlighted this reality by documenting that of the $47 trillion in increase in market capitalization between 1926 and 2019, five companies accounted for 22% of the increase in market value. I will wager that at the end of the next decade, looking back, we will find that a few companies accounted for the bulk of the rise in market capitalization during the decade, and another acronym will be created.

The Why?

When stocks soar as much as the Mag Seven stocks have in recent years, they evoke two responses. One is obviously regret on the part of those who did not partake in the rise, or sold too soon. The other is skepticism, and a sense that a correction is overdue, leading to what I call knee-jerk contrarianism, where your argument that these stocks are over priced is that they have gone up too much in the past. With these stocks, in particular, that reaction would have been costly over much of the last decade, since other than in 2022, these stocks have found ways to deliver positive surprises. In this section, we will look at the plausible explanations for the Mag Seven outperformance in 2023, starting with a correction/momentum story, where 2023 just represented a reversal of the losses in 2022, moving on to a profitability narrative, where the market performance of these companies can be related to superior profitability and operating performance, and concluding with an examination of whether the top-heavy performance (where a few large companies account for the bulk of market performance can explained by winner-take-all economics,

1. Correction/Momentum Story: One explanation for the Mag Seven's market performance in 2023 is that they were coming off a catastrophic year in 2022, where they collectively lost $4.8 trillion in market cap, and that 2023 represented a correction back to a level only slightly above the value at the end of 2021. There is some truth to this statement, but to see whether it alone can explain the Mag Seven 2023 performance, I broke all US stocks into deciles, based upon 2022 stock price performance, with the bottom decile including the stocks that went down the most in 2022 and the top decile the stocks that went up the most in 2022, and looked at returns in 2023:

As you can see in the first comparison, the worst performing stocks in 2022 saw their market capitalizations increase by 35% in 2023, while the best performing stocks saw little change in market capitalization. Since all of the MAG 7 stocks fell into the bottom decile, I compared the performance of those stocks against the rest of the stocks in that decile, and th difference is start. While Mag Seven stocks saw their market capitalizations increase by 74%, the rest of the stocks in the bottom decile had only a 19% increase in market cap. In short, a portion of the Mag Seven stock performance in 2023 can be explained by a correction story, aided and abetted by strong momentum, but it is not the whole story.

2. Operating Performance/Profitability Narrative: While it is easy to attribute rising stock prices entirely to mood and momentum, the truth is that momentum has its roots in truth. Put differently, there are some good business reasons why the Mag Seven dominated markets in 2023:

Pricing power and Economic Resilience: Coming into 2023, market and the Mag Seven stocks were battered, down sharply in 2022, largely because of rising inflation and concerns about an economic downturn. There were real concerns about whether the big tech companies that had dominated markets for the prior decade had pricing power and how well they would weather a recession. During the course of 2023, the Mag Seven set those fears to rest at least for the moment on both dimensions, increasing prices (with the exception of Tesla) on their products/services and delivering growth. In fact, if you are a Netflix subscriber or Amazon Prime member (and I would be surprised if any reader has neither, indicating their ubiquity), you saw prices increase on both services, and my guess is that you did not cancel your subscription/membership. With Alphabet and Meta, which make their money on online advertising, the rates for that advertising, measures in costs per click, rose through much of the year, and as an active Apple customer, I can guarantee that Apple has been passing through inflation into their prices all year.

Money Machines: The pricing power and product demand resilience exhibited by these companies have manifested as strong earnings for the companies. In fact, both Alphabet and Meta have laid off thousands of employees, without denting revenues, and their profits in 2023 reflect the cost savings:

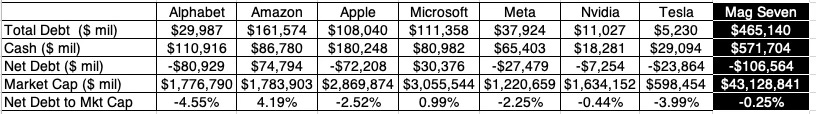

Safety Buffers: As interest rates, for both governments and corporates, has risen sharply over the last two years, it is prudent for investors to worry about companies with large debt burdens, since old debt on the books, at low rates, will have to get refinanced at higher rates. With the Mag Seven, those concerns are on the back burner, because these companies have debt loads so low that they are almost non-existent. In fact, six of the seven firms in the Mag Seven grouping have cash balances that exceed their debt loads, giving them negative net debt levels.

Put simply, there are good business reasons for why the seven companies in the Mag Seven have been elevated to superstar status.

3. Winner take all economics: It is undeniable that as the global economy has shifted away from its manufacturing base in the last century to a technology base, it has unleashed more "winner-take-all (or most" dynamics in many industries. In advertising, which was a splintered business where even the biggest players (newspapers, broadcasting companies) commanded small market shares of the overall market, Alphabet and Meta have acquired dominant market shares of online advertising, driven by easy scaling and network benefits (where advertising flows to the platforms with the most customers). Over the last two decades, Amazon has set in motion similar dynamics in retail and Microsoft's stranglehold on application and business software has been in existence even longer. In fact, it is the two newcomers into this group, Nvidia and Tesla, where questions remain about what the end game will look like, in terms of market share. Historically, neither the chip nor car businesses have been winner-take-all businesses, but investors are clearly pricing in the possibility that the changing economics of AI chips and electric cars could alter these businesses.

This may seem like a cop out, but I think all three factors contributed to the success of the Mag Seven stocks in 2023. There was clearly a bounce back effect, as these firms recovered from a savage beatdown in 2022, but that bounce back occurred only because they were able to deliver strong profits and solid cash flows. And looking across the decade, I don't think it is debatable that investors have not only bought into the dominant player story (coming from the winner-take-all economics), but have also anointed these seven companies as leaders in the race to dominance in each of their businesses.

The What Next?

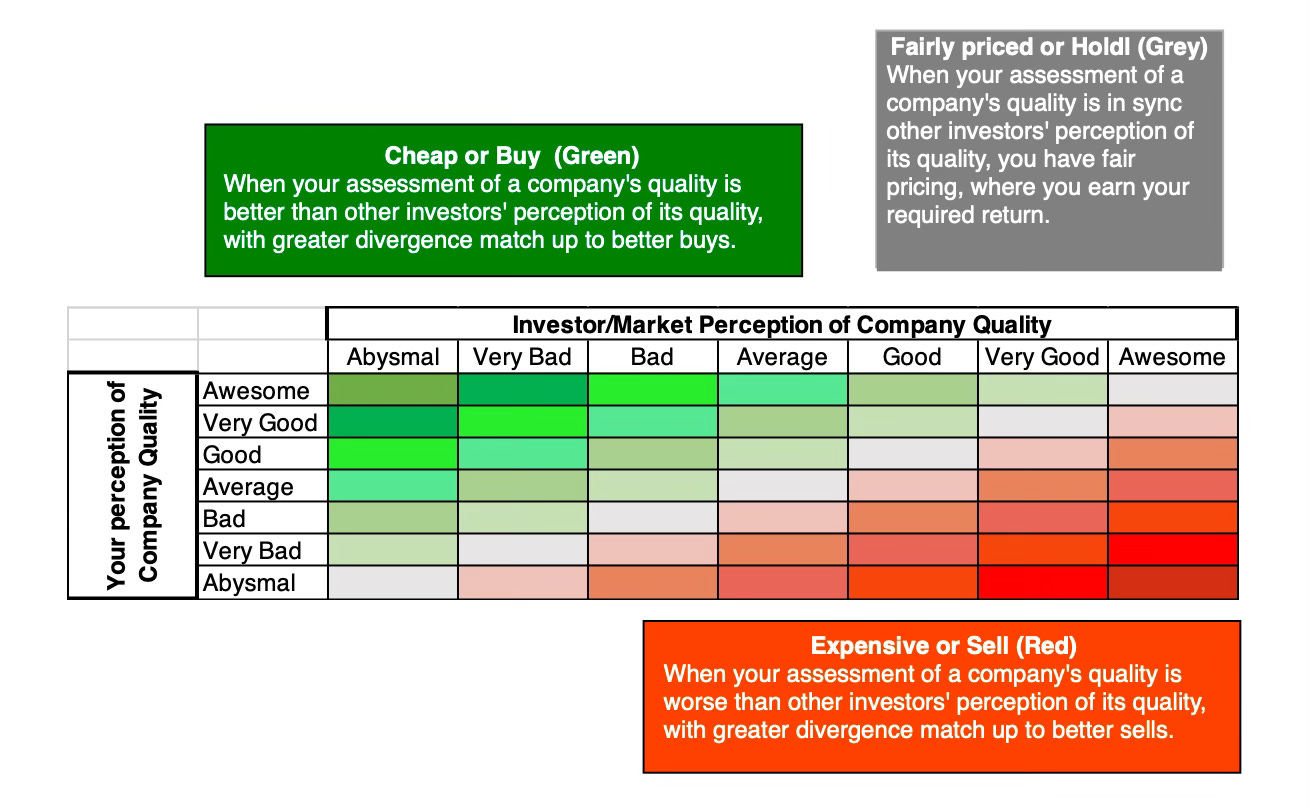

At the risk of stating the obvious, investing is always about the future, and a company's past market history, no matter how glorious, has little or no effect on whether it is a good investment today. I have long argued that investors need to separate what they think about the quality of a company (great, good or awful) from its quality as an investment (cheap or expensive). In fact, investing is about finding mismatches between what you think of a company and what investors have already priced in:

I think that most of you will agree that the seven companies in the Mag Seven all qualify as very good to awesome, as businesses, and the last section provides backing, but the question that remains is whether our perceptions are shared by other investors, and already priced in.

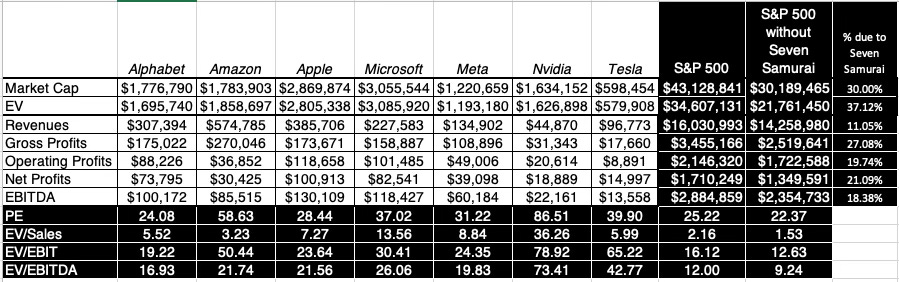

The tool that most investors use in making this assessment is pricing, and specifically, pricing multiples. In the table below, I compute pricing metrics for the Mag Seven, and compare them to that of the S&P 500:

Trailing 12-month operating metrics used

On every pricing metric, the Mag Seven stocks trade at a premium over the rest of the stocks in the S&P 500, and therein lies the weakest link in pricing. That premium can be justified by pointing to higher growth and margins at the Mag Seven stocks, but that is followed by a great deal of hand waving, since how much of a premium is up for grabs. Concocting growth-adjusted pricing multiples like PEG ratios is one solution, but the PEG ratio is an absolutely abysmal measuring of pricing, making assumptions about PE and growth that are untenable. The pricing game becomes even more unstable, when analysts replace current with forward earnings, with bias entering at every step.

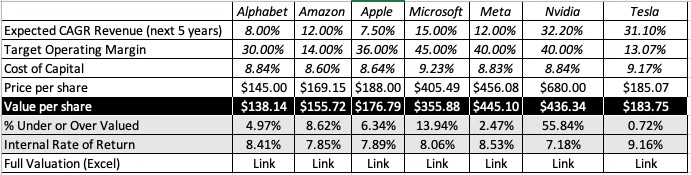

I know that some of you don't buy into intrinsic valuation and note quite correctly that there are lots of assumptions that you have to make about growth, profitability and risk to arrive at a value and that no matter how hard you try, you will be wrong. I agree, but I remain a believer that intrinsic valuation is the only tool that you have for assessing whether the market is incorporating what I see in a company (awful to awesome). I have valued every company in the Mag Seven multiple times over the last decade, and based my judgments on investing in these companies on a comparison of my value estimates and price. With the operating numbers (revenues, earnings) coming in for the 2023 calendar year, I have updated my valuations, and here are my summary estimates

* NVidia and Tesla were valued as the sum of the valuations of their different businesses. The growth and margins reported are for the consolidated company.

First, while all of the companies in the Mag Seven have values that exceed their prices, Tesla and Meta look close to fairly valued, at current prices, Alphabet, Apple and Amazon are within striking distance of value, and Microsoft and Nvidia look over valued, with the latter especially so. It may be coincidence, but these are the two companies that have benefited most directly from the AI buzz, and my findings of over valuation may just reflect my lack of imagination on how big AI can get as a business. Just to be clear, though, I have built in substantial value from AI in my valuation of Nvidia, and given Microsoft significantly higher growth because of it, but it is plausible that I have not done enough. If intrinsic value is not your cup of tea, you can look at the internal rates of return that you would earn on these companies, at current market prices, and with my expected cash flows. For perspective, the median cost of capital for a US company at the start of 2024 was 8.60%, and while only Tesla delivers an expected return higher than that number, the test, with the exception of Nvidia, are close.

I own all seven of these companies, which may strike you as contradictory, but with the exception of Tesla that I bought just last week, my acquisitions of the other seven companies occurred well in the past, and reflected my judgments that they were undervalued (at the time). To the question of whether I should be selling, which would be consistent with my current assessment that these stocks are overvalued, I hesitate for three reasons: The first is that my assessments of value come with error, and for at least five of the companies, the price is well within my range of value. The second is that I will have to pay a capital gains tax that will amount to close to 30%, with state taxes included. The third is psychological, since selling everything or nothing would leave me with regrets either way. Last summer, when I valued Nvidia in this post, I found it over valued at a price of $450, and sold half my holdings, choosing to hold the other half. Now that the price has hit $680, I plan to repeat that process, and sell half of my remaining holdings.

Conclusion

As I noted at the start of this post, the benefit of hindsight allows us to pick the biggest winners in the market, bundle them together in a group and then argue that the market would be lost without them. That is true, but it is neither original nor unique to this market. The Mag Seven stocks have had a great run, but their pricing now reflects, in my view, the fact that they are great companies, with business models that deliver growth, at scale, with profitability. If you have never owned any of these companies, your portfolio will reflect that choice, and jumping on to the bandwagon now will not bring back lost gains. You should bide your time, since in my experience, even the very best companies deliver disappointments, and that markets over react to these disappointments, simply because expectations have been set so high. It is at those times that you will find that the price is right!

YouTube Video

Intrinsic Valuations

This is just great stuff , many thanks .

Fantastic read and very useful now, almost a year later, when considering the Deepseek AI story.